Fully decentralizedcrypto exchange

Get the best token prices from 100+ decentralized exchanges.

24/7 live support

Our dedicated support team is available around the clock to offer you personalised assistance.

Best market rates

Through partnerships with over 20 crypto trading platforms, we strive to find the most competitive rates for your transactions.

Speedy transactions

With an average transaction speed of 5–40 minutes, we ensure you can swiftly take advantage of market opportunities.

Secure funds handling

We do not store cryptocurrencies: instead, they are sent directly to your wallet after the exchange for the utmost security.

Popular crypto

for 24hTop gainers

for 24hTop losers

for 24hSubscribe for crypto updates

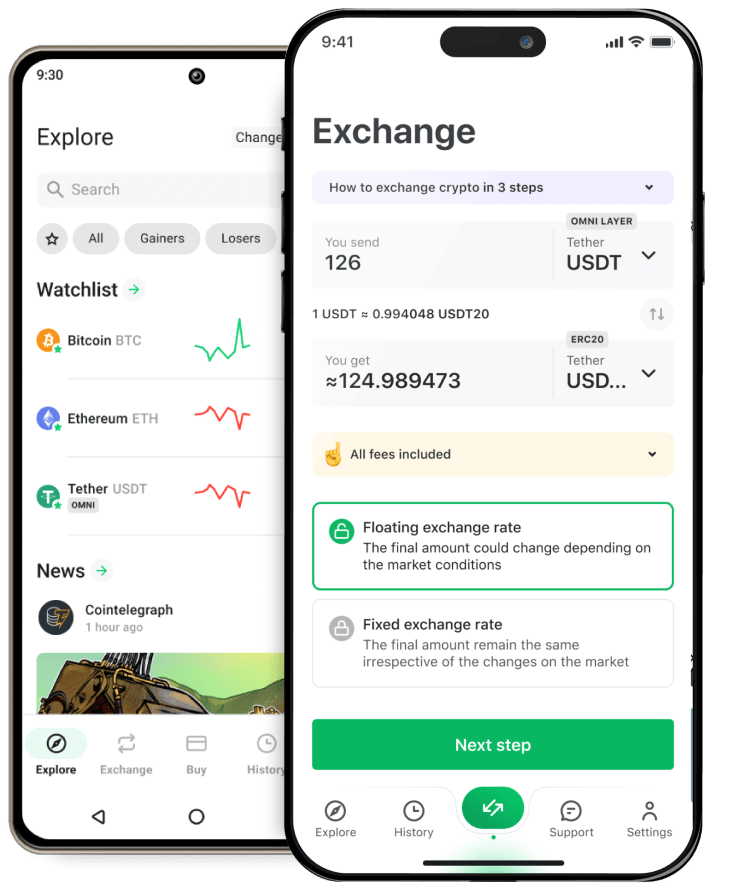

Exclusive benefits of the Changelly app

Get better rates in the app and enjoy an exclusive discount on your very first crypto exchange transaction. Don’t settle for less when you can maximize your returns with us!

This offer does not apply for users based in UK

How to swap DeFi tokens on Changelly

Create a wallet

Create a MetaMask wallet or any other wallet of your choice supported by WalletConnect. If you already have a DeFi wallet, just skip this step.

Get native currency

Top up your wallet with enough native cryptocurrency to cover network fees, then select the blockchain and the token pair you would like to swap.

Approve transaction

Send transaction approval to the blockchain. You will have to repeat this step once for each new token you wish to trade. If you’re trading native cryptocurrencies such as Ethereum or BNB, you can skip this step.

Make а swap

Confirm the transaction in your wallet and wait for it to be completed. That’s it! Your tokens will now be securely stored in your wallet, ready for you to sell or use as you please.

Helpful guides

![personal-dex-page.helpful-section.guides.first[0]](/static/main-pages/new-assets/help-section/dex-guides-1.png)

![personal-dex-page.helpful-section.guides.second[0]](/static/main-pages/new-assets/help-section/dex-guides-2.png)

![personal-dex-page.helpful-section.guides.third[0]](/static/main-pages/new-assets/help-section/dex-guides-3.png)

![personal-dex-page.helpful-section.guides.fourth[0]](/static/main-pages/new-assets/help-section/dex-guides-4.png)

![personal-dex-page.helpful-section.guides.fifth[0]](/static/main-pages/new-assets/help-section/dex-guides-5.png)

![personal-dex-page.helpful-section.guides.sixth[0]](/static/main-pages/new-assets/help-section/dex-guides-6.png)

Changelly FAQ

What is the difference between decentralized (DEX) and centralized (CEX) exchanges?

Decentralized exchanges (DEXs) eliminate the need for intermediaries, enabling you to trade cryptocurrencies securely and with complete control over your assets. DEXs operate on the basis of smart contracts, offering a wide range of over 3600 DeFi exotic tokens for exchange. However, these tokens can only be traded within their specific networks, such as Ethereum or Binance Smart Chain (BSC).

On the other hand, centralized exchanges (CEXs) offer access to great liquidity, allowing for the exchange of over 500 cryptocurrencies across 140+ blockchains and providing a seamless cross-chain exchange experience.

Why are exchanges available only within one network?

Currently, integration on our platform works only with decentralized exchanges (DEXs), which allows exchanges only within one network (for example, Ethereum). Soon, we will integrate decentralized cross-chain bridges that will enable exchanges through different blockchain networks as well.

Why is it necessary to allow the use of tokens?

To exchange ERC20 or BEP20 tokens, it's important to first complete the "approving" transaction. This step grants permission for our smart contract to access and utilize your tokens during the swap process. This is a standard procedure in DeFi protocols and once the approval is made for a specific token type, it will remain valid for future exchanges. Please note that this doesn’t apply to native cryptocurrencies like Ethereum or BNB.

Where can I get cryptocurrency to use DeFi Swap?

If you wish to exchange a cryptocurrency based on one network for a cryptocurrency based on another, you can do so in the Exchange section. Alternatively, for cryptocurrency purchases, visit the platform's Buy section, where you can obtain various cryptocurrencies using fiat currency.

Are there any restrictions or limitations on swaps?

On DeFi Swap, there are no restrictions on the minimum or maximum exchange amounts. All exchange rules are defined and executed through a smart contract, ensuring a secure and seamless exchange experience. If your transaction is successful, you'll receive the exchanged tokens promptly. However, if for any reason the transaction can't be executed,your original tokens will be returned to you without loss, minus a small network fee for the transaction attempt.