Table of Contents

- Bitcoin Overview

- Bitcoin (BTC) Technical Overview

- Bitcoin Profit Calculator

- Bitcoin (BTC) Price Prediction For Today, Tomorrow and Next 30 Days

- Bitcoin Prediction Table

- Bitcoin Historical

- Bitcoin Price Prediction 2024

- BTC Price Forecast for April 2024

- May 2024: Bitcoin Price Forecast

- BTC Price Forecast for June 2024

- July 2024: Bitcoin Price Forecast

- BTC Price Forecast for August 2024

- September 2024: Bitcoin Price Forecast

- BTC Price Forecast for October 2024

- November 2024: Bitcoin Price Forecast

- BTC Price Forecast for December 2024

- Bitcoin Price Prediction 2025

- Bitcoin Price Prediction 2026

- Bitcoin Price Prediction 2027

- Bitcoin Price Prediction 2028

- Bitcoin Price Prediction 2029

- Bitcoin Price Prediction 2030

- Bitcoin Price Prediction 2031

- Bitcoin Price Prediction 2032

- Bitcoin Price Prediction 2033

- Bitcoin Price Prediction 2040

- Bitcoin Price Prediction 2050

- What Is Bitcoin (BTC)?

- What Affects the Value of Bitcoin?

- History of Bitcoin

- Will Bitcoin Go Back Up?

- Bitcoin Price Predictions by Experts

- The Bearish Scenario

- Is Bitcoin a Good Investment?

- Bitcoin vs Fiat Currencies

- Is it too late to buy Bitcoin?

- FAQ

- Is Bitcoin a good investment?

- Can Bitcoin rise?

- How much will Bitcoin be worth 2025?

- How much will Bitcoin be worth 2030?

- Will Bitcoin ever hit $100K?

- Will Bitcoin go back down to $10K?

- How high can Bitcoin go in 10 years?

- Why can there only ever be 21 million Bitcoins?

- Is Bitcoin a safe long-term investment?

- What happened to Bitcoin’s price?

Bitcoin Overview

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2024 | $83,001.70 | $85,601.44 | $97,517.25 |

| 2025 | $122,154.78 | $125,577.44 | $144,533.55 |

| 2026 | $177,945.20 | $184,224.58 | $211,424.86 |

| 2027 | $263,695.63 | $272,906.71 | $312,342.76 |

| 2028 | $390,634.93 | $404,280.57 | $469,336.06 |

| 2029 | $561,515.84 | $581,729.82 | $687,327.26 |

| 2030 | $813,719.62 | $836,987.29 | $988,657.12 |

| 2031 | $1,222,364.75 | $1,264,214.57 | $1,422,536.73 |

| 2032 | $1,750,882.89 | $1,801,450.84 | $2,133,236.66 |

| 2033 | $2,476,675.31 | $2,566,748.30 | $3,009,208.05 |

| 2040 | $3,875,790.38 | $4,106,797.28 | $4,440,474.91 |

| 2050 | $4,645,814.37 | $4,953,825.57 | $5,107,829.17 |

- Our real-time BTC to USD price update shows the current Bitcoin price as $64,351.4 USD.

- Our most recent Bitcoin price forecast indicates that its value will increase by 12.11% and reach $72,126 by April 26, 2024.

- Our technical indicators signal about the Neutral Bullish 59% market sentiment on Bitcoin, while the Fear & Greed Index is displaying a score of 72 (Greed).

- Over the last 30 days, Bitcoin has had 17/30 (57%) green days and 3.98% price volatility.

Bitcoin (BTC) Technical Overview

When discussing future trading opportunities of digital assets, it is essential to pay attention to market sentiments.Bitcoin Profit Calculator

-

BitcoinBTC

-

EthereumETH

-

BNBBNB

-

XRPXRP

-

CardanoADA

-

DogecoinDOGE

-

SolanaSOL

-

PolkadotDOT

-

TRONTRX

-

LitecoinLTC

-

Shiba InuSHIB

-

AvalancheAVAX

-

ChainlinkLINK

-

UNUS SED LEOLEO

-

CosmosATOM

-

UniswapUNI

-

MoneroXMR

-

OKBOKB

-

Ethereum ClassicETC

-

ToncoinTON

-

StellarXLM

-

KaspaKAS

-

Internet ComputerICP

-

Bitcoin CashBCH

-

FilecoinFIL

-

CronosCRO

-

Lido DAOLDO

-

NEAR ProtocolNEAR

-

MantleMNT

-

AlgorandALGO

-

InjectiveINJ

-

The GraphGRT

-

EOSEOS

-

The SandboxSAND

-

RenderRNDR

-

Rocket PoolRPL

-

BitDAOBIT

-

StacksSTX

-

dogwifhatWIF

-

DecentralandMANA

-

TezosXTZ

-

StarknetSTRK

-

ChilizCHZ

-

SynthetixSNX

-

Bitcoin SVBSV

-

NeoNEO

-

PepePEPE

-

KlaytnKLAY

-

PAX GoldPAXG

-

ZcashZEC

-

BonkBONK

-

GMXGMX

-

XDC NetworkXDC

-

Terra ClassicLUNC

-

BeamBEAM

-

OptimismOP

-

eCashXEC

-

ConfluxCFX

-

IOTAMIOTA

-

Huobi TokenHT

-

DashDASH

-

EthenaENA

-

Frax ShareFXS

-

DymensionDYM

-

KavaKAVA

-

LoopringLRC

-

ZilliqaZIL

-

Oasis NetworkROSE

-

PancakeSwapCAKE

-

NexoNEXO

-

dYdX (ethDYDX)ETHDYDX

-

Convex FinanceCVX

-

Enjin CoinENJ

-

GasGAS

-

FlareFLR

-

AstarASTR

-

Basic Attention TokenBAT

-

OsmosisOSMO

-

ORDIORDI

-

Manta NetworkMANTA

-

NEMXEM

-

Akash NetworkAKT

-

Tether GoldXAUt

-

HoloHOT

-

CoreCORE

-

AltlayerALT

-

CompoundCOMP

-

ThresholdT

-

SingularityNETAGIX

-

RavencoinRVN

-

DecredDCR

-

SKALESKL

-

ICONICX

-

Bitcoin GoldBTG

-

UMAUMA

-

IoTeXIOTX

-

MX TOKENMX

-

HarmonyONE

-

GalaGALA

-

Decentralized SocialDESO

-

HeliumHNT

-

SiacoinSC

-

0x ProtocolZRX

-

PendlePENDLE

-

OntologyONT

-

WavesWAVES

-

Mask NetworkMASK

-

Reserve RightsRSR

-

Ethereum Name ServiceENS

-

OriginTrailTRAC

-

Alchemy PayACH

-

BiconomyBICO

-

JOEJOE

-

AmpAMP

-

StorjSTORJ

-

AragonANT

-

DigiByteDGB

-

DAO MakerDAO

-

LivepeerLPT

-

Dogelon MarsELON

-

BalancerBAL

-

LiskLSK

-

HorizenZEN

-

PowerledgerPOWR

-

HEXHEX

-

FTX TokenFTT

-

Baby Doge CoinBabyDoge

-

PolymathPOLY

-

FINSCHIAFNSA

-

TelcoinTEL

-

Omni NetworkOMNI

-

NanoXNO

-

ArkARK

-

CivicCVC

-

XaiXAI

-

LCXLCX

-

SteemSTEEM

-

NumeraireNMR

-

DentDENT

-

Ribbon FinanceRBN

-

RadworksRAD

-

MyroMYRO

-

AlephiumALPH

-

VeThor TokenVTHO

-

RenREN

-

WINkLinkWIN

-

AugurREP

-

NeutronNTRN

-

HELLO LabsHELLO

-

Spell TokenSPELL

-

Hooked ProtocolHOOK

-

Pirate ChainARRR

-

SuperVerseSUPER

-

GoldfinchGFI

-

StormXSTMX

-

MOBOXMBOX

-

MANTRAOM

-

Origin ProtocolOGN

-

ElectroneumETN

-

KomodoKMD

-

VergeXVG

-

SingularityDAOSDAO

-

MonaCoinMONA

-

MultichainMULTI

-

Wirex TokenWXT

-

ChainGPTCGPT

-

Circuits of ValueCOVAL

-

PropchainPROPC

-

CoreumCOREUM

-

TABOO TOKENTABOO

-

QuantstampQSP

-

Hoge FinanceHOGE

-

GoChainGO

-

MintlayerML

-

CrypteriumCRPT

-

EnergiNRG

-

Bitcoin Standard Hashrate TokenBTCST

-

ArivaARV

-

GorillaGORILLA

-

MithrilMITH

-

XCarnivalXCV

-

NeblioNEBL

-

KickTokenKICK

-

AionAION

-

MytheriaMYRA

-

XEN CryptoXEN

-

EGOEGO

-

Dmail NetworkDMAIL

-

Nerd BotNERD

-

Magic SquareSQR

-

FarcanaFAR

-

NosanaNOS

-

PengPENG

-

Velodrome FinanceVELO

-

Forward ProtocolFORWARD

-

DragonCoinDRAGON

-

PatexPATEX

-

Bull TokenBULL

-

Chuck NorrisCHUCK

-

EveryworldEVERY

-

VelarVELAR

-

EeseeESE

-

HugeWinHUGE

-

CYBONKCYBONK

-

GUMMYGUMMY

-

ApeWifHatAPEWIFHAT

-

mfercoin$mfer

-

BookOfPussyCatsBOCA

-

HumpHUMP

-

The SimpsonsDONUTS

-

Wormhole (IOU)W

-

SpeedySPEEDY

-

Kishu InuKISHU

-

JupiterJUP

-

BombcryptoBCOIN

-

ImmutableDARA

Bitcoin (BTC) Price Prediction For Today, Tomorrow and Next 30 Days

| Date | Price | Change |

|---|---|---|

| April 25, 2024 | $64,886 | 0.86% |

| April 26, 2024 | $68,505 | 6.48% |

| April 27, 2024 | $72,126 | 12.11% |

| April 28, 2024 | $73,143 | 13.69% |

| April 29, 2024 | $73,629 | 14.45% |

| April 30, 2024 | $74,286 | 15.47% |

| May 01, 2024 | $75,030 | 16.62% |

| May 02, 2024 | $75,691 | 17.65% |

| May 03, 2024 | $76,264 | 18.54% |

| May 04, 2024 | $76,831 | 19.42% |

| May 05, 2024 | $77,384 | 20.28% |

| May 06, 2024 | $77,838 | 20.99% |

| May 07, 2024 | $77,747 | 20.85% |

| May 08, 2024 | $77,656 | 20.71% |

| May 09, 2024 | $76,317 | 18.62% |

| May 10, 2024 | $74,955 | 16.51% |

| May 11, 2024 | $74,260 | 15.43% |

| May 12, 2024 | $73,719 | 14.59% |

| May 13, 2024 | $73,741 | 14.62% |

| May 14, 2024 | $74,074 | 15.14% |

| May 15, 2024 | $75,932 | 18.03% |

| May 16, 2024 | $79,484 | 23.55% |

| May 17, 2024 | $82,359 | 28.02% |

| May 18, 2024 | $83,679 | 30.07% |

| May 19, 2024 | $84,842 | 31.88% |

| May 20, 2024 | $84,990 | 32.11% |

| May 21, 2024 | $85,139 | 32.34% |

| May 22, 2024 | $84,826 | 31.85% |

| May 23, 2024 | $84,497 | 31.34% |

| May 24, 2024 | $84,348 | 31.11% |

Bitcoin Prediction Table

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

|---|---|---|---|---|

| April | $64,886 | $69,586 | $74,286 |

12.5%

|

| May | $73,719 | $80,458.03 | $87,197.05 |

32.1%

|

| June | $63,037.32 | $72,391.31 | $81,745.29 |

23.8%

|

| July | $63,938.18 | $67,432.97 | $70,927.75 |

7.4%

|

| August | $55,497.72 | $69,749.11 | $84,000.49 |

27.2%

|

| September | $75,086.60 | $82,262.85 | $89,439.10 |

35.5%

|

| October | $44,786.01 | $65,880.08 | $86,974.15 |

31.7%

|

| November | $39,980.41 | $54,131.65 | $68,282.88 |

3.4%

|

| December | $45,100.14 | $47,314.41 | $49,528.67 |

-25%

|

| All Time | $58,447.93 | $67,689.60 | $76,931.26 |

16.5%

|

Bitcoin Historical

According to the latest data gathered, the current price of Bitcoin is $$66,364.25, and BTC is presently ranked No. 1 in the entire crypto ecosystem. The circulation supply of Bitcoin is $1,306,679,037,543.86, with a market cap of 19,689,503 BTC.

In the past 24 hours, the crypto has increased by $99.55 in its current value.

For the last 7 days, BTC has been in a good upward trend, thus increasing by 5.41%. Bitcoin has shown very strong potential lately, and this could be a good opportunity to dig right in and invest.

During the last month, the price of BTC has increased by 0.84%, adding a colossal average amount of $557.46 to its current value. This sudden growth means that the coin can become a solid asset now if it continues to grow.

Bitcoin Price Prediction 2024

According to the technical analysis of Bitcoin prices expected in 2024, the minimum cost of Bitcoin will be $$39,980.41. The maximum level that the BTC price can reach is $$64,709.76. The average trading price is expected around $$89,439.10.

BTC Price Forecast for April 2024

Based on the price fluctuations of Bitcoin at the beginning of 2023, crypto experts expect the average BTC rate of $$69,586 in April 2024. Its minimum and maximum prices can be expected at $$64,886 and at $$74,286, respectively.

May 2024: Bitcoin Price Forecast

Cryptocurrency experts are ready to announce their forecast for the BTC price in May 2024. The minimum trading cost might be $$73,719, while the maximum might reach $$87,197.05 during this month. On average, it is expected that the value of Bitcoin might be around $$80,458.03.

BTC Price Forecast for June 2024

Crypto analysts have checked the price fluctuations of Bitcoin in 2023 and in previous years, so the average BTC rate they predict might be around $$72,391.31 in June 2024. It can drop to $$63,037.32 as a minimum. The maximum value might be $$81,745.29.

July 2024: Bitcoin Price Forecast

In the middle of the year 2023, the BTC price will be traded at $$67,432.97 on average. July 2024 might also witness an increase in the Bitcoin value to $$70,927.75. It is assumed that the price will not drop lower than $$63,938.18 in July 2024.

BTC Price Forecast for August 2024

Crypto experts have analyzed Bitcoin prices in 2023, so they are ready to provide their estimated trading average for August 2024 — $$69,749.11. The lowest and peak BTC rates might be $$55,497.72 and $$84,000.49.

September 2024: Bitcoin Price Forecast

Crypto analysts expect that at the end of summer 2023, the BTC price will be around $$82,262.85. In September 2024, the Bitcoin cost may drop to a minimum of $$75,086.60. The expected peak value might be $$89,439.10 in September 2024.

BTC Price Forecast for October 2024

Having analyzed Bitcoin prices, cryptocurrency experts expect that the BTC rate might reach a maximum of $$86,974.15 in October 2024. It might, however, drop to $$44,786.01. For October 2024, the forecasted average of Bitcoin is nearly $$65,880.08.

November 2024: Bitcoin Price Forecast

In the middle of autumn 2023, the Bitcoin cost will be traded at the average level of $$54,131.65. Crypto analysts expect that in November 2024, the BTC price might fluctuate between $$39,980.41 and $$68,282.88.

BTC Price Forecast for December 2024

Market experts expect that in December 2024, the Bitcoin value will not drop below a minimum of $$45,100.14. The maximum peak expected this month is $$49,528.67. The estimated average trading value will be at the level of $$47,314.41.

Bitcoin Price Prediction 2025

After the analysis of the prices of Bitcoin in previous years, it is assumed that in 2025, the minimum price of Bitcoin will be around $$118,755. The maximum expected BTC price may be around $$142,086. On average, the trading price might be $$122,185 in 2025.

| Month | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| January 2025 | $46,544.96 | $92,167.93 | $71,157.78 |

| February 2025 | $53,109.51 | $94,896.75 | $77,605.80 |

| March 2025 | $59,674.06 | $97,625.58 | $84,053.82 |

| April 2025 | $66,238.61 | $100,354.40 | $90,501.84 |

| May 2025 | $72,803.16 | $103,083.23 | $96,949.86 |

| June 2025 | $79,367.71 | $105,812.05 | $103,397.88 |

| July 2025 | $85,932.25 | $108,540.88 | $109,845.90 |

| August 2025 | $92,496.80 | $111,269.70 | $116,293.92 |

| September 2025 | $99,061.35 | $113,998.53 | $122,741.94 |

| October 2025 | $105,625.90 | $116,727.35 | $129,189.96 |

| November 2025 | $112,190.45 | $119,456.18 | $135,637.98 |

| December 2025 | $118,755 | $122,185 | $142,086 |

Bitcoin Price Prediction 2026

Based on the technical analysis by cryptocurrency experts regarding the prices of Bitcoin, in 2026, BTC is expected to have the following minimum and maximum prices: about $$174,376 and $$202,880, respectively. The average expected trading cost is $$179,262.

| Month | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| January 2026 | $123,390.08 | $126,941.42 | $147,152.17 |

| February 2026 | $128,025.17 | $131,697.83 | $152,218.33 |

| March 2026 | $132,660.25 | $136,454.25 | $157,284.50 |

| April 2026 | $137,295.33 | $141,210.67 | $162,350.67 |

| May 2026 | $141,930.42 | $145,967.08 | $167,416.83 |

| June 2026 | $146,565.50 | $150,723.50 | $172,483 |

| July 2026 | $151,200.58 | $155,479.92 | $177,549.17 |

| August 2026 | $155,835.67 | $160,236.33 | $182,615.33 |

| September 2026 | $160,470.75 | $164,992.75 | $187,681.50 |

| October 2026 | $165,105.83 | $169,749.17 | $192,747.67 |

| November 2026 | $169,740.92 | $174,505.58 | $197,813.83 |

| December 2026 | $174,376 | $179,262 | $202,880 |

Bitcoin Price Prediction 2027

The experts in the field of cryptocurrency have analyzed the prices of Bitcoin and their fluctuations during the previous years. It is assumed that in 2027, the minimum BTC price might drop to $$248,295, while its maximum can reach $$298,850. On average, the trading cost will be around $$255,465.

| Month | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| January 2027 | $180,535.92 | $185,612.25 | $210,877.50 |

| February 2027 | $186,695.83 | $191,962.50 | $218,875 |

| March 2027 | $192,855.75 | $198,312.75 | $226,872.50 |

| April 2027 | $199,015.67 | $204,663 | $234,870 |

| May 2027 | $205,175.58 | $211,013.25 | $242,867.50 |

| June 2027 | $211,335.50 | $217,363.50 | $250,865 |

| July 2027 | $217,495.42 | $223,713.75 | $258,862.50 |

| August 2027 | $223,655.33 | $230,064 | $266,860 |

| September 2027 | $229,815.25 | $236,414.25 | $274,857.50 |

| October 2027 | $235,975.17 | $242,764.50 | $282,855 |

| November 2027 | $242,135.08 | $249,114.75 | $290,852.50 |

| December 2027 | $248,295 | $255,465 | $298,850 |

Bitcoin Price Prediction 2028

Based on the analysis of the costs of Bitcoin by crypto experts, the following maximum and minimum BTC prices are expected in 2028: $$430,664 and $$361,017. On average, it will be traded at $$371,235.

| Month | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| January 2028 | $257,688.50 | $265,112.50 | $309,834.50 |

| February 2028 | $267,082 | $274,760 | $320,819 |

| March 2028 | $276,475.50 | $284,407.50 | $331,803.50 |

| April 2028 | $285,869 | $294,055 | $342,788 |

| May 2028 | $295,262.50 | $303,702.50 | $353,772.50 |

| June 2028 | $304,656 | $313,350 | $364,757 |

| July 2028 | $314,049.50 | $322,997.50 | $375,741.50 |

| August 2028 | $323,443 | $332,645 | $386,726 |

| September 2028 | $332,836.50 | $342,292.50 | $397,710.50 |

| October 2028 | $342,230 | $351,940 | $408,695 |

| November 2028 | $351,623.50 | $361,587.50 | $419,679.50 |

| December 2028 | $361,017 | $371,235 | $430,664 |

Bitcoin Price Prediction 2029

Crypto experts are constantly analyzing the fluctuations of Bitcoin. Based on their predictions, the estimated average BTC price will be around $$549,995. It might drop to a minimum of $$535,145, but it still might reach $$626,526 throughout 2029.

| Month | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| January 2029 | $375,527.67 | $386,131.67 | $446,985.83 |

| February 2029 | $390,038.33 | $401,028.33 | $463,307.67 |

| March 2029 | $404,549 | $415,925 | $479,629.50 |

| April 2029 | $419,059.67 | $430,821.67 | $495,951.33 |

| May 2029 | $433,570.33 | $445,718.33 | $512,273.17 |

| June 2029 | $448,081 | $460,615 | $528,595 |

| July 2029 | $462,591.67 | $475,511.67 | $544,916.83 |

| August 2029 | $477,102.33 | $490,408.33 | $561,238.67 |

| September 2029 | $491,613 | $505,305 | $577,560.50 |

| October 2029 | $506,123.67 | $520,201.67 | $593,882.33 |

| November 2029 | $520,634.33 | $535,098.33 | $610,204.17 |

| December 2029 | $535,145 | $549,995 | $626,526 |

Bitcoin Price Prediction 2030

Every year, cryptocurrency experts prepare forecasts for the price of Bitcoin. It is estimated that BTC will be traded between $$754,110 and $$912,127 in 2030. Its average cost is expected at around $$776,109 during the year.

| Month | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| January 2030 | $553,392.08 | $568,837.83 | $650,326.08 |

| February 2030 | $571,639.17 | $587,680.67 | $674,126.17 |

| March 2030 | $589,886.25 | $606,523.50 | $697,926.25 |

| April 2030 | $608,133.33 | $625,366.33 | $721,726.33 |

| May 2030 | $626,380.42 | $644,209.17 | $745,526.42 |

| June 2030 | $644,627.50 | $663,052 | $769,326.50 |

| July 2030 | $662,874.58 | $681,894.83 | $793,126.58 |

| August 2030 | $681,121.67 | $700,737.67 | $816,926.67 |

| September 2030 | $699,368.75 | $719,580.50 | $840,726.75 |

| October 2030 | $717,615.83 | $738,423.33 | $864,526.83 |

| November 2030 | $735,862.92 | $757,266.17 | $888,326.92 |

| December 2030 | $754,110 | $776,109 | $912,127 |

Bitcoin Price Prediction 2031

Cryptocurrency analysts are ready to announce their estimations of the Bitcoin’s price. The year 2031 will be determined by the maximum BTC price of $$1,324,089. However, its rate might drop to around $$1,096,457. So, the expected average trading price is $$1,127,502.

| Month | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| January 2031 | $782,638.92 | $805,391.75 | $946,457.17 |

| February 2031 | $811,167.83 | $834,674.50 | $980,787.33 |

| March 2031 | $839,696.75 | $863,957.25 | $1,015,117.50 |

| April 2031 | $868,225.67 | $893,240 | $1,049,447.67 |

| May 2031 | $896,754.58 | $922,522.75 | $1,083,777.83 |

| June 2031 | $925,283.50 | $951,805.50 | $1,118,108 |

| July 2031 | $953,812.42 | $981,088.25 | $1,152,438.17 |

| August 2031 | $982,341.33 | $1,010,371 | $1,186,768.33 |

| September 2031 | $1,010,870.25 | $1,039,653.75 | $1,221,098.50 |

| October 2031 | $1,039,399.17 | $1,068,936.50 | $1,255,428.67 |

| November 2031 | $1,067,928.08 | $1,098,219.25 | $1,289,758.83 |

| December 2031 | $1,096,457 | $1,127,502 | $1,324,089 |

Bitcoin Price Prediction 2032

After years of analysis of the Bitcoin price, crypto experts are ready to provide their BTC cost estimation for 2032. It will be traded for at least $$1,577,446, with the possible maximum peaks at $$1,906,149. Therefore, on average, you can expect the BTC price to be around $$1,622,547 in 2032.

| Month | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| January 2032 | $1,136,539.42 | $1,168,755.75 | $1,372,594 |

| February 2032 | $1,176,621.83 | $1,210,009.50 | $1,421,099 |

| March 2032 | $1,216,704.25 | $1,251,263.25 | $1,469,604 |

| April 2032 | $1,256,786.67 | $1,292,517 | $1,518,109 |

| May 2032 | $1,296,869.08 | $1,333,770.75 | $1,566,614 |

| June 2032 | $1,336,951.50 | $1,375,024.50 | $1,615,119 |

| July 2032 | $1,377,033.92 | $1,416,278.25 | $1,663,624 |

| August 2032 | $1,417,116.33 | $1,457,532 | $1,712,129 |

| September 2032 | $1,457,198.75 | $1,498,785.75 | $1,760,634 |

| October 2032 | $1,497,281.17 | $1,540,039.50 | $1,809,139 |

| November 2032 | $1,537,363.58 | $1,581,293.25 | $1,857,644 |

| December 2032 | $1,577,446 | $1,622,547 | $1,906,149 |

Bitcoin Price Prediction 2033

Cryptocurrency analysts are ready to announce their estimations of the Bitcoin’s price. The year 2033 will be determined by the maximum BTC price of $$2,787,136. However, its rate might drop to around $$2,417,673. So, the expected average trading price is $$2,498,801.

| Month | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| January 2033 | $1,647,464.92 | $1,695,568.17 | $1,979,564.58 |

| February 2033 | $1,717,483.83 | $1,768,589.33 | $2,052,980.17 |

| March 2033 | $1,787,502.75 | $1,841,610.50 | $2,126,395.75 |

| April 2033 | $1,857,521.67 | $1,914,631.67 | $2,199,811.33 |

| May 2033 | $1,927,540.58 | $1,987,652.83 | $2,273,226.92 |

| June 2033 | $1,997,559.50 | $2,060,674 | $2,346,642.50 |

| July 2033 | $2,067,578.42 | $2,133,695.17 | $2,420,058.08 |

| August 2033 | $2,137,597.33 | $2,206,716.33 | $2,493,473.67 |

| September 2033 | $2,207,616.25 | $2,279,737.50 | $2,566,889.25 |

| October 2033 | $2,277,635.17 | $2,352,758.67 | $2,640,304.83 |

| November 2033 | $2,347,654.08 | $2,425,779.83 | $2,713,720.42 |

| December 2033 | $2,417,673 | $2,498,801 | $2,787,136 |

Bitcoin Price Prediction 2040

According to the technical analysis of Bitcoin prices expected in 2040, the minimum cost of Bitcoin will be $$3,773,189. The maximum level that the BTC price can reach is $$4,123,022. The average trading price is expected around $$3,898,129.

| Month | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| January 2040 | $2,530,632.67 | $2,615,411.67 | $2,898,459.83 |

| February 2040 | $2,643,592.33 | $2,732,022.33 | $3,009,783.67 |

| March 2040 | $2,756,552 | $2,848,633 | $3,121,107.50 |

| April 2040 | $2,869,511.67 | $2,965,243.67 | $3,232,431.33 |

| May 2040 | $2,982,471.33 | $3,081,854.33 | $3,343,755.17 |

| June 2040 | $3,095,431 | $3,198,465 | $3,455,079 |

| July 2040 | $3,208,390.67 | $3,315,075.67 | $3,566,402.83 |

| August 2040 | $3,321,350.33 | $3,431,686.33 | $3,677,726.67 |

| September 2040 | $3,434,310 | $3,548,297 | $3,789,050.50 |

| October 2040 | $3,547,269.67 | $3,664,907.67 | $3,900,374.33 |

| November 2040 | $3,660,229.33 | $3,781,518.33 | $4,011,698.17 |

| December 2040 | $3,773,189 | $3,898,129 | $4,123,022 |

Bitcoin Price Prediction 2050

After the analysis of the prices of Bitcoin in previous years, it is assumed that in 2050, the minimum price of Bitcoin will be around $$4,872,662. The maximum expected BTC price may be around $$5,222,494. On average, the trading price might be $$5,022,590 in 2050.

| Month | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| January 2050 | $3,864,811.75 | $3,991,834.08 | $4,214,644.67 |

| February 2050 | $3,956,434.50 | $4,085,539.17 | $4,306,267.33 |

| March 2050 | $4,048,057.25 | $4,179,244.25 | $4,397,890 |

| April 2050 | $4,139,680 | $4,272,949.33 | $4,489,512.67 |

| May 2050 | $4,231,302.75 | $4,366,654.42 | $4,581,135.33 |

| June 2050 | $4,322,925.50 | $4,460,359.50 | $4,672,758 |

| July 2050 | $4,414,548.25 | $4,554,064.58 | $4,764,380.67 |

| August 2050 | $4,506,171 | $4,647,769.67 | $4,856,003.33 |

| September 2050 | $4,597,793.75 | $4,741,474.75 | $4,947,626 |

| October 2050 | $4,689,416.50 | $4,835,179.83 | $5,039,248.67 |

| November 2050 | $4,781,039.25 | $4,928,884.92 | $5,130,871.33 |

| December 2050 | $4,872,662 | $5,022,590 | $5,222,494 |

What Is Bitcoin (BTC)?

Bitcoin, Bitcoin… Is there anything new to say about this cryptocurrency at this point? Even people who have zero interest in the industry have heard its name. As the number one cryptocurrency, it enjoys unimaginably high prices (up to $60K), a lot of attention, and, of course, much scrutiny.

Bitcoin, alongside the rest of the cryptocurrency market, is known for its ability to overcome any challenges and have strong comebacks despite everyone writing it off. Various financial experts have been predicting that the Bitcoin bubble will pop “in the near future” every month without fail for the past eight or so years. And yet, the coin still remains on top, and BTC investors enjoy high profits, patiently waiting for yet another meteoric BTC price rise.

However, the crypto industry is rapidly changing, and some crypto enthusiasts are starting to doubt whether Bitcoin is still worth investing in.

Please note that this is our long-term Bitcoin price prediction. This article does not constitute financial advice, and we are not investment advisors.

Bitcoin is the first cryptocurrency that was created back in 2009. It is a decentralized digital currency that uses blockchain technology to facilitate trustless peer-to-peer transactions. BTC has the proof-of-work consensus mechanism, which means it relies on Bitcoin miners to secure its network.

In recent years, Bitcoin has been one of the most popular assets for investment: not only can it be extremely profitable due to the high volatility of the cryptocurrency market, but it is also very easy to invest in. All one needs to get Bitcoin is an Internet connection.

What Affects the Value of Bitcoin?

There are a lot of different factors that can affect the price of Bitcoin. Unlike most altcoins, its price movements do not depend as heavily on the rest of the crypto market and usually ends up being the one to set the trend. However, BTC is still responsive to the general factors that affect all markets like rising interest rates or huge crypto news, especially ones that either concern the industry as a whole or other big coins like Ethereum or Shiba Inu.

Bitcoin’s price also gets affected by non-crypto news — a great example of that would be its price action in the spring of 2020. That’s why you should keep an eye on stock forecasts if you want to have a better understanding of the current Bitcoin price. Another news sector that those who invested in Bitcoin or are planning to do so should look out for is ecology.

Just like any other asset, Bitcoin gets affected by news related to it, be it about Bitcoin itself, crypto exchanges, or blockchain technology. Crypto prices usually go up when there is a piece of news related to mass adoption, new technological breakthroughs, and so on. On the other hand, any uncertainty can cause its value to plummet.

Source: zipmex.com

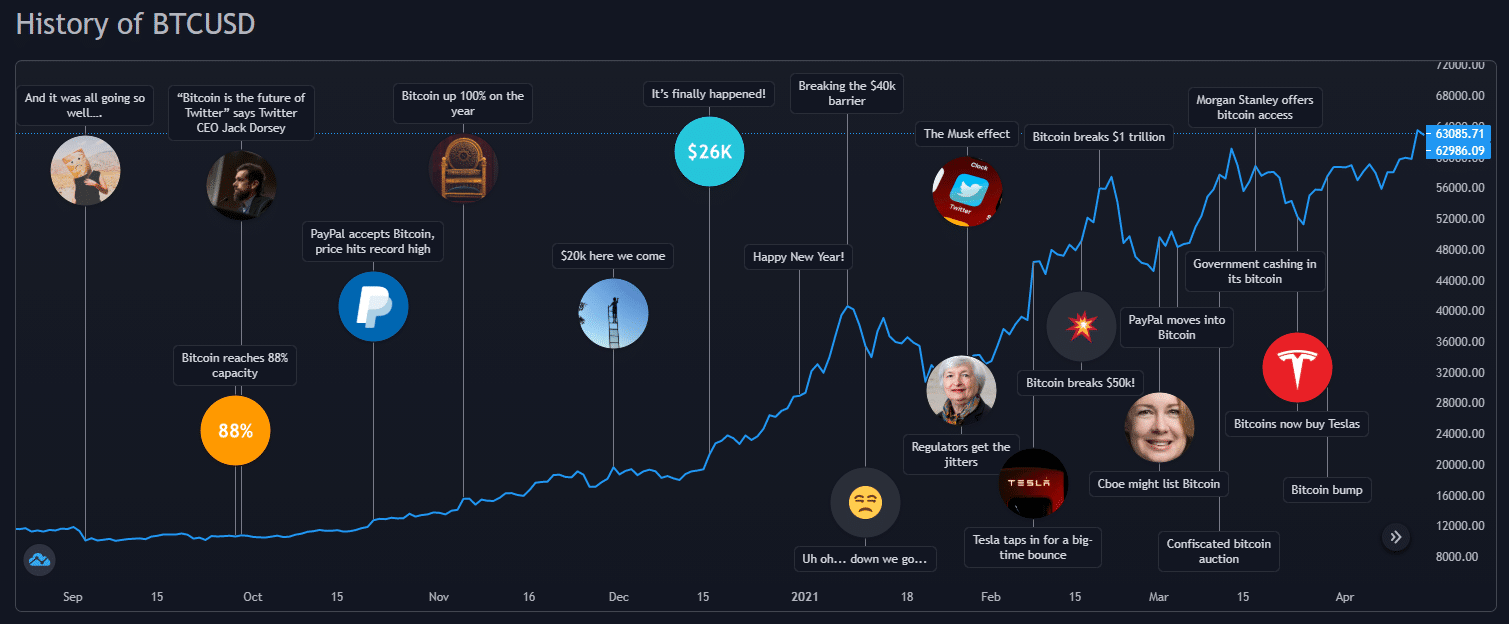

History of Bitcoin

Bitcoin’s price history is known to most crypto enthusiasts. From being ultimately nearly worthless, this coin has grown to become one of the biggest assets in the world. At its height, Bitcoin’s market cap was even higher than that of several established businesses.

Let’s take a brief look at the Bitcoin price chart.

Upon looking at this chart, one thing that immediately becomes apparent is that Bitcoin’s price cycles keep on shortening. Additionally, despite the coin regularly losing value, the average value of Bitcoin keeps increasing. This shows a positive trend for the future.

“Will Bitcoin go back up?” is an evergreen question in the crypto market. The truth is, no matter how hard we study BTC price history and trends, we would not be able to predict this accurately. However, we can still consider these factors as well as today’s Bitcoin news to make a tentative prediction.

Bitcoin’s crypto market cap is still the highest in the industry, and it still has the most recognition. Its circulating supply is slowly approaching its total supply but there’s still a long way to go till we reach a point where there will be no new Bitcoins released.

Overall, Bitcoin price history shows us that there’s still room for this asset to grow even if there is a bear market.

Please note that this does not constitute investment advice.

Will Bitcoin Go Back Up?

The future trajectory of Bitcoin’s price, influenced by various macroeconomic factors and key events, is a subject of widespread interest in the cryptocurrency industry.

The anticipated reduction in interest rates by the US Federal Reserve is expected to ease pressure on the cryptocurrency market, potentially fostering widespread adoption of Bitcoin. Additionally, prospective legislation in the US aiming for clearer crypto investment regulations might reduce investor uncertainty. This, coupled with Bitcoin’s current status as a regulated commodity in the US, could encourage institutional adoption, attracting new investors to the cryptocurrency.

Another significant event is the Bitcoin block reward halving scheduled for 2024, historically associated with a surge in Bitcoin’s price and indicative of bullish momentum. This event is eagerly awaited, as it has previously signaled the start of a bullish market trend. Bitcoin’s robust performance, highlighted by a record-breaking transaction volume and a strong hash rate, has further reinforced investor confidence and positively impacted its market value.

Despite these positive developments, the long-term viability of the crypto market faces scrutiny. The increasing introduction of crypto-related products and services contrasts with the skepticism of experts, driven by stringent global regulations and public apprehension about new technologies, often attributed to misunderstanding or fear.

Bitcoin is a digital currency, straightforward and unambiguous in its essence. However, its slow adaptability and reliance on an environmentally unfriendly proof-of-work (PoW) consensus algorithm could challenge its attractiveness as an investment compared to more diverse cryptocurrency ecosystems.

In light of these dynamics, the question remains: Can Bitcoin recover and reclaim its previous highs? Its history of resilience suggests the potential for rebound. All that said, we stand with the analysts who believe in the nearing rise of BTC. Now, let’s take a look at what numbers BTC is predicted to hit in a short time.

Bitcoin Price Predictions by Experts

The approval of the Bitcoin exchange-traded fund (ETF) marks an important milestone in mainstreaming Bitcoin investments, potentially expanding its investor base, especially among institutions. Despite Bitcoin trading below $45,000 post-approval, investor sentiment is generally bullish, suggesting an optimistic outlook for future price increases.

Anthony Scaramucci of SkyBridge Capital predicts a $100,000 peak within a year, drawing parallels to the 2004 spot gold ETF approval and highlighting the historical price action of such assets. Technopedia forecasts a high of $98,000 in 2024, with an early low of around $21,500 and an average of $65,000, indicating potential price appreciation.

MicroStrategy’s Michael Saylor anticipates a “supply shock” from the Bitcoin halving, reducing miner-available BTC, which could fuel bullish price action. Tim Draper of Draper Associates speculates about a rise to $250,000 by July. Figures like Marshall Beard of Gemini and Paolo Ardoino of Tether expect a retest of the $69,000 high.

Tom Lee of Fundstrat Global Advisors sees a potential rise to $150,000 short-term, with long-term potential at $500,000, influenced by changing monetary policy and market dynamics. Ark Invest’s Cathie Wood has an even more ambitious projection of $600,000 in her base case and $1.5 million by 2030 in her bull case, reflecting a strong belief in Bitcoin’s potential for much growth.

Digital Coin Price predicts a gradual increase to nearly $140K in three years, with an average price of $90,733 in 2024, $99,421.76 in 2025, and $153,537.15 in 2026.

However, more conservative forecasts, like Wallet Investor, suggest a potential drop to $10,000, demonstrating the diversity of opinions in the market.

These bullish predictions are underpinned by Bitcoin’s finite supply and independence from external economic factors. Its growing acceptance and technological advancements, despite the evolving regulatory landscapes, bolster its investment appeal.

The Bearish Scenario

At the time of writing, the cryptocurrency industry largely maintains a positive view on Bitcoin, making it challenging to find notable bearish projections. However, two primary concerns could negatively influence Bitcoin’s price.

Firstly, Bitcoin’s substantial energy consumption continues to draw criticism, posing a potential threat to its market value. Secondly, the evolving regulatory landscape, particularly concerning anti-money laundering (AML) and Know Your Customer (KYC) laws, presents significant challenges that trouble investors.

If Bitcoin’s price crashes, then the values of other cryptocurrencies are likely to follow suit.

Is Bitcoin a Good Investment?

No matter if it’s in a down- or uptrend, Bitcoin is almost always predicted to keep rising in the future. So, it can be a good investment. However, please DYOR and carefully consider the risks before investing in BTC or any other cryptocurrency.

Our Bitcoin price prediction is rather conservative and does not take into account any random media hype or unexpected regulations that may happen in the near future — these factors are too unpredictable. However, if you’re considering investing in Bitcoin, you need to make sure you’re ready for its price to fluctuate wildly.

Bitcoin is less risky than other cryptocurrencies, but it is still fairly unstable and unpredictable in comparison to traditional investment avenues like the stock market.

Bitcoin vs Fiat Currencies

Compared to cryptocurrencies, fiat currencies are a comparatively low-risk investment, especially ones like the US dollar. However, they can still definitely be considered risky assets.

Institutional investors have tentatively started putting their trust in Bitcoin and other cryptocurrencies. Nevertheless, digital assets definitely do not have the same relevancy as fiat money like the euro or the US dollar — at least, not yet.

Bitcoin is a higher risk, higher reward investment alternative to fiat money and other asset classes that gains additional value if you believe in its worth as a currency of the future.

Is it too late to buy Bitcoin?

History shows that it’s never too late to buy Bitcoin. The Bitcoin price today is still lower than its ATH, which means it may rise and go for a full-scale bull run again in the future.

FAQ

Is Bitcoin a good investment?

The forecast for Bitcoin price is quite positive. It is expected that BTC price might meet a bull trend in the nearest future. We kindly remind you to always do your own research before investing in any asset.

To maximize investment potential, one should regularly monitor their wallet Bitcoin balance and transaction history for accuracy and signs of unauthorized activity.

Can Bitcoin rise?

In a five-year plan perspective, the cryptocurrency could probably rise up to $143,779.60. Due to price fluctuations on the market, please always do your research before investing money in any project, network, asset, etc.

How much will Bitcoin be worth 2025?

The Bitcoin network is developing rapidly. BTC price forecast for 2025 is rather positive. The BTC average price is expected to reach minimum and maximum prices of $67,625.22 and $83,868.30 respectively.

How much will Bitcoin be worth 2030?

BTC is provided with suitable environment to reach new heights in terms of price. BTC price prediction is quite positive. Business analysts predict that BTC might reach the maximum price of $505,014.84 by 2030.

Will Bitcoin ever hit $100K?

Considering the fact that Bitcoin’s price has already doubled its value several times in the past, it is possible. However, it would require another market-wide price surge and at least one trip to the moon.

Will Bitcoin go back down to $10K?

It is possible. After all, the cryptocurrency market is incredibly volatile, and the question of crypto regulation remains uncertain.

How high can Bitcoin go in 10 years?

In 10 years, Bitcoin can reach $100K or even hit $200K. As long as there are no threats to it in terms of competition and regulation, its finite supply and growing popularity should ensure that it keeps on reaching new price highs.

Why can there only ever be 21 million Bitcoins?

The simple answer to this question is “because it was designed that way.” Well, but why can’t this limit be extended? Among other things, BTC’s finite supply acts as a deflationary measure and is one of the reasons why Bitcoin’s price is as high as it is. As for why this exact figure was chosen, there are a few theories about it. One states that it’s because the total value of all physical money in the world when BTC was developed was equal to $21 trillion. As a result, if Bitcoin had been then to completely replace fiat, 1 BTC would have been worth $1M, and one satoshi — $0.01.

Is Bitcoin a safe long-term investment?

Bitcoin is a relatively safe investment compared to other cryptocurrencies. However, it is still a high-risk, high-reward type of asset and should not be seen as a reliable long-term store of value.

What happened to Bitcoin’s price?

Bitcoin hasn’t been able to reach its previous highs lately, but it might be slowly starting to bounce back.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

Oh my goodness! Incredible article dude! Many

thanks, However I am experiencing issues with your RSS. I don’t know the reason why I am unable to subscribe to it.

Is there anybody having identical RSS problems?

Anybody who knows the solution will you kindly

respond? Thanx!!

Hi Barney,

Should be easy, just add our home page or category with “/feed/” at the end of an URL to you RSS reader, like that:

https://changelly.com/blog/feed/

https://changelly.com/blog/category/price-predictions/feed/

Thanks for subscribing!

Hi, i didnt get the chart of bitcoin…that chart said to me that bitcoin can down to 6.5K$ or 7K$

but the people say that bitcoin will grow up to 20k$ end of 2020 !!!!!!!!!!!

Can anybody help me about chart and bitcoin price in future????

thanks

today bitcoin is 8201$

Well, John McAfee says Bitcoin’s price is going to be 2 million in USD in 2020. Lots of BTC holders are trying to speculate on the price, that’s understandable. Just do your research, and don’t put all your money in Bitcoin or anything else. There many other profitable ways to earn.

For sure, a block reward decrease will affect the price of Bitcoin in 2020. My expectations – before halving, the price will drop for like 20%, and then it will rally up to all-time high 1-3 months after the halving.

John McAfee will have a very small snack when it comes time to pay his debt.

Thanks for your bitcoin price prediction! I actually doubt there can be such a huge drop down when I watch the current bitcoin price dynamics. However, the bitcoin price may fall, this is true.

So 2017 and 2018 had the perfect effect for the jovial of Btc returns and 2019 surfaced safely from the loss of profit. Then 2020 will hinge where it matter and release the question at hand . the traders and demand have been supporting I read this report. Thank you.

People who’re saying that BTC will hit $100k and more are totally gone mad. Of course, Bitcoin price after halving may skyrocket but such jump seems pretty impossible for me now. The most possible scenario is that Bitcoin price will increase steadily like LongForecast says.

I guess bitcoin price will pump in 2020 after the halving than slightly will go down and be calm till 2022-23. We should be ready, so hodl

Thanks for the detailed stats but I see no point such far-reaching bitcoin price predictions cause it is hard to say what the industry will look like even after several very next years…

According to Bitcoin price history, the father of crypto will continually go up, but of course, it’ll still be a wavy process. I have no doubt ’bout btc price rise…while the last bitcoin isn’t mined people will invest… after that the end of supply and apocalypses)))

Bitcoin has already moved passed 10K and then retraced to 9,800 or so. Now, where does it go? 20k by December 2020?

Bitcoin, for some reason, has ceased to inspire confidence. It has become a completely useless centralized cryptocurrency that can be regulated by anyone. It is better to pay attention to promising cryptocurrencies like Crypton, which cannot be regulated

According to this prediction of the future of Bitcoin, which is more profitable to invest in digital currencies, gold or real estate?

Your predictions have been incredibly helpful to me!

I highly recommend the service

nice services though..

very nice, too nice…