The blockchain world runs on code that never stops improving. When developers change that code, a fork happens. Some updates are small and compatible—others divide entire communities. Learning the basics of a soft fork vs. hard fork shows you how these updates affect coins, transactions, and even prices. Let’s unpack what forks are, why they happen, and what they mean for you as a crypto user.

Table of Contents

Why Blockchain Forks Matter

A blockchain fork matters because it changes the rules that keep a blockchain network running. Every fork—soft or hard—affects how transactions are verified, who follows the blockchain protocol, and what features users get next. For investors, a fork can create new coins or shift a project’s value. For developers, it’s a way to fix flaws or improve performance. Forks show how decentralized systems evolve—not by force, but through community decisions that shape the future of crypto.

Read more: What Is a Blockchain Fork?

Soft Forks Explained

A soft fork is a change to a blockchain protocol that stays compatible with older versions of the network. Think of it like a system update that still works with your old apps. In a soft fork, new rules are added, but they don’t break the old ones. That’s why it’s called backward compatible—nodes that don’t upgrade can still validate new blocks, as long as they follow the tightened rules.

Soft forks help developers improve blockchains without splitting them into separate chains. They usually update block validation, add new rules, or limit what’s allowed inside a block. This keeps the network unified, since upgraded and non-upgraded nodes can still talk to each other.

How Soft Forks Are Implemented

A common way to activate these upgrades is through user-activated soft forks (UASF). In this case, network validators and users coordinate to signal support for the change. Once enough miners or nodes accept it, the fork becomes part of the blockchain network.

Benefits and Potential Drawbacks

Soft forks are often used for security patches, performance boosts, or adding smart features to improve the original Bitcoin blockchain and similar networks. They’re safer and easier to coordinate than hard forks because they don’t create a new chain.

Still, soft forks rely on consensus. If too few participants follow the new rules, the network risks temporary chaos or stalled transactions. Successful forks depend on trust, coordination, and clear communication across the community.

Soft Fork Examples

One of the best-known soft forks on the Bitcoin network was Segregated Witness (SegWit), introduced in 2017 through a Bitcoin Improvement Proposal. It changed how data blocks store signatures, freeing space for more transactions in the same block without raising the block size limit. This upgrade improved scalability and reduced transaction malleability, a long-standing issue in Bitcoin’s design.

SegWit was a user-activated soft fork, supported by most miners and exchanges. It showed that the community could upgrade the blockchain protocol through coordination rather than division. New blocks followed stricter validation rules but stayed backward compatible, keeping the network unified.

Since then, other blockchains have used similar updates to add new features or improve efficiency without creating separate chains. Soft forks remain a vital way for blockchain developers to evolve systems while protecting users’ funds and transaction history.

Hard Forks Explained

A hard fork is a major update to a blockchain’s underlying protocol that breaks compatibility with older versions. Unlike a soft fork, it introduces new rules that old nodes can’t understand. Once the fork activates, nodes that don’t upgrade are left behind on the old blockchain, following different validation rules.

How Hard Forks Are Implemented

Hard forks create a permanent split in the blockchain network. When this happens, one chain follows the new version, and the other continues under old conditions. Both remain valid from a technical standpoint, but they no longer recognize each other’s blocks. This can result in two separate networks, each running its own transaction history.

Developers often launch hard forks to add new features, fix critical bugs, or address issues like block size and scalability. Some forks are planned, while others—called accidental hard forks—occur when nodes disagree on updates or block validation timing.

A hard fork requires community coordination because everyone must upgrade simultaneously. If the blockchain projects involved can’t agree, a chain split forms and users must choose which side to support. That’s how entirely new cryptocurrencies like Bitcoin Cash first appeared.

Benefits and Potential Drawbacks

Hard forks carry risks but also opportunity. They let blockchain developers experiment with radical improvements without disrupting the original system. Whether you’re a miner, investor, or trader, understanding hard forks helps you prepare for network upgrades, potential coin duplication, and shifts in token value.

Hard Fork Examples

Bitcoin Cash and Its Variants

The Bitcoin Cash hard fork is one of the clearest examples of a major blockchain split. It began when developers and miners on the Bitcoin network disagreed over transaction capacity. Supporters pushed to raise the block size limit to an eight MB block size, enabling more transactions per block, while others argued it would weaken decentralization. The result was Bitcoin Cash, a separate blockchain that prioritized speed over conservatism.

Later, Bitcoin SV and Bitcoin Cash ABC emerged, each proposing different block sizes and governance models. These versions share roots with Bitcoin Core, the original client for the Bitcoin protocol, but follow their own paths and have their own communities. Together, Bitcoin Cash, SV, and ABC paved the way for numerous other Bitcoin forks, each born from the same drive to push limits and test new ideas.

Ethereum and Ethereum Classic

It wasn’t just Bitcoin that went through high-profile splits. In 2016, the Ethereum network divided after a major smart contract exploit known as The DAO hack. Developers chose to roll back stolen funds, creating a new version of the chain—Ethereum—while purists who opposed the rollback continued as Ethereum Classic. The event showed how values like immutability and trust can redefine a blockchain’s direction.

Why Do Hard Forks Happen?

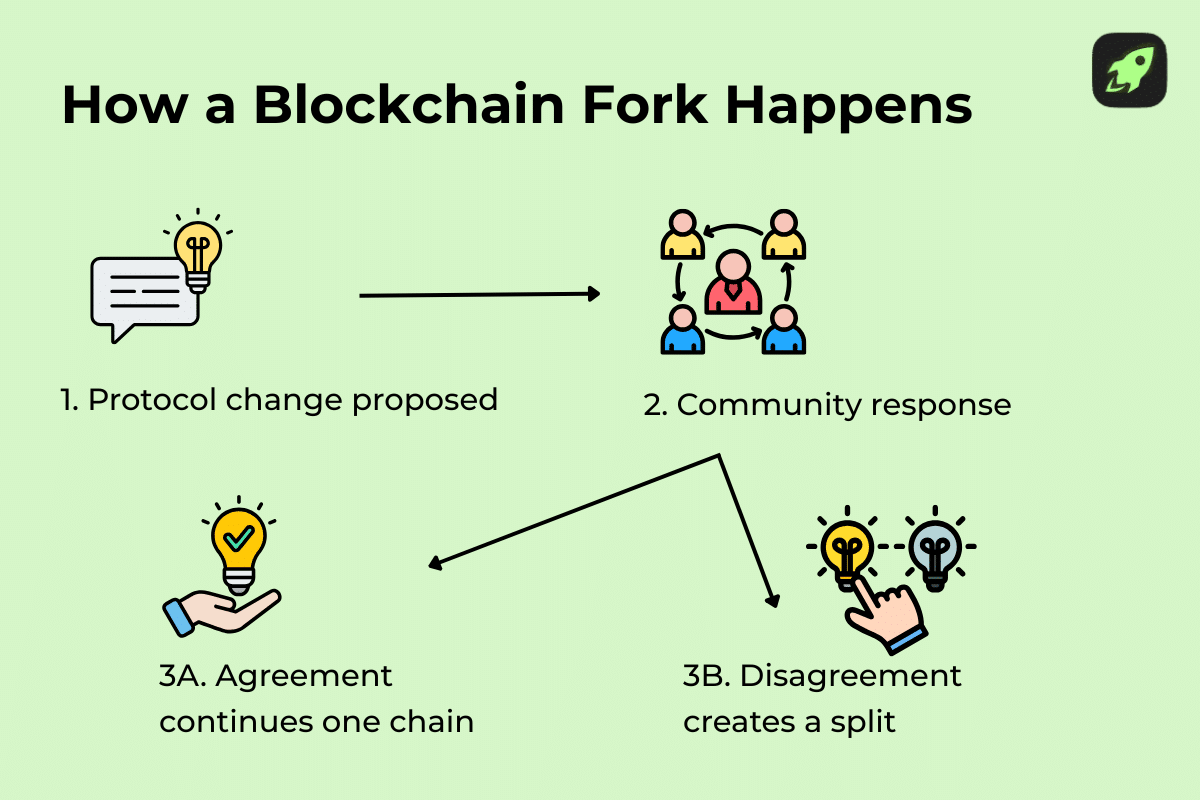

Hard forks happen when a community can’t reach consensus on the network’s direction. Sometimes it’s about scaling, other times about ideology or governance. When blockchain developers propose new rules or code changes, everyone must agree to update. If they don’t, the original blockchain splits, and both sides start validating different blocks.

A fork formation can also occur after bugs, hacks, or incidents of stolen funds that require a new chain to fix mistakes or roll back damage. In these cases, the community chooses which main blockchain to support, and the other becomes the old blockchain with fewer users and miners.

Whether they’re planned or accidental hard forks, these events reflect how decentralized systems handle disagreement. They show that there’s no central authority—just people, code, and coordination. That freedom keeps blockchain innovation alive, even when unity breaks.

How to Get Free Crypto

Simple tricks to build a profitable portfolio at zero cost

Soft Fork vs. Hard Fork: A Detailed Comparison

You’ll often hear people confuse hard and soft forks, but they work very differently. A soft fork updates rules while staying compatible with older versions. A hard fork rewrites them and breaks compatibility. Both shape how blockchain projects evolve and how communities react to change.

These changes can lead to blockchain splits, where two versions of the same network move in different directions. A soft fork usually avoids that by enforcing new limits without dividing users. But when developers can’t agree, the network can break into a forked network—one side following old rules, the other moving forward.

Here’s a side-by-side look at the key differences between the two.

Comparison Table: Soft Fork vs. Hard Fork

| Aspect | Soft Fork | Hard Fork |

| Definition | A change that’s backward compatible and keeps old nodes connected. | A full rule rewrite that’s not compatible with older versions. |

| Consensus Requirement | Works when most miners or validators follow the new rules. | Requires everyone to upgrade to the latest version to stay in sync. |

| Network Split | Stays within one chain unless coordination fails. | Causes a permanent split with two independent chains processing data blocks differently. |

| Upgrade Process | Activated gradually, often through miner or node signaling. | Activated all at once, more like upgrading an operating system. |

| Risk of Errors | Usually low, but accidental hard forks occur if nodes misread new rules. | Higher risk, since even small timing errors or two miners finding blocks at nearly the same time can lead to instability. |

| Creation of New Coins | No new coins are created. | Often creates new assets on a decentralized network, like Bitcoin and Bitcoin Cash. |

| Coordination Complexity | Easier to organize since old nodes can still validate. | Harder to organize as it requires total alignment across the entire ecosystem. |

| Community Impact | Keeps the ecosystem united under shared rules. | Can divide communities, creating blockchain forks and competing blockchain projects. |

Understanding the Trade-Off

Soft forks are like gentle updates that keep everyone on the same page. They keep security tight and community alignment strong. But their flexibility ends when big rule changes are needed.

Hard forks, on the other hand, rewrite the rulebook. They spark innovation but also invite disagreement and risk fragmentation. Accidental hard forks and disputed upgrades remind everyone that coordination matters just as much as code.

Whether a fork succeeds depends on timing, transparency, and communication. In the end, both types drive blockchain progress. Crypto would stagnate without them, but with them, it keeps evolving, one upgrade at a time.

How Do Disagreements in the Community Affect Whether a Fork Stays “Soft”?

Most forks start as minor updates to a blockchain’s underlying protocol, with simple changes to improve performance, fees, or security. But as soon as developers, miners, or users disagree on those changes, things can escalate quickly. When consensus breaks, what begins as a soft fork can turn into a contentious hard fork.

This kind of split creates friction and even produces a new blockchain with its own rules, coins, and community. It’s how some of the most famous network divisions have happened in crypto history.

Disagreements show the strength of decentralization. In a blockchain, no central authority decides what’s “right.” The code and community together determine which version survives. That freedom to choose keeps blockchains adaptable, even if it sometimes means going separate ways.

Final Words

Forks are how blockchain technology evolves. From early Bitcoin forks to modern upgrades, each one shows how open collaboration drives innovation. They fix bugs, add features, and let communities decide the future of their networks. Whether a fork is soft or hard, it protects a blockchain’s censorship resistance, keeping control in users’ hands. In crypto, every disagreement sparks progress, and often, lasting change.

FAQ

Is a soft fork not backward compatible?

No, it’s the opposite. Every soft fork is designed to be backward compatible, meaning older nodes can still interact with upgraded ones. Soft forks attempt to tighten existing rules, not replace them. This allows developers to improve the network without splitting it. If coordination succeeds, users won’t even notice the change, as transactions continue seamlessly across upgraded and non-upgraded nodes.

Is a hard fork good or bad?

Both, depending on why it happens. Hard forks can unlock innovation but also risk division. Comparing hard forks and soft ones shows the trade-off: Soft forks preserve unity, while hard forks enable bigger leaps forward. A well-planned hard fork can fix long-standing issues or expand features. But when coordination fails, it can split the network and confuse users until one version gains support.

Do forks mean the project failed or is in trouble?

No, not at all. Forks often mean progress, not failure. The Bitcoin Cash fork, for instance, emerged from a debate about transaction size, not collapse. Developers used it to experiment with scalability on a different chain. Forks allow communities to test ideas without shutting down the original network, proving that disagreement can drive innovation, not destruction, in the crypto world.

Can forks be used to fix bugs or security issues in a blockchain?

Yes, absolutely. Forks are sometimes deployed as emergency patches to correct errors or recover stolen funds. For example, Bitcoin Gold and Bitcoin Diamond were both launched to improve mining fairness and enhance security. Such upgrades show how flexible blockchain systems are—developers can apply fixes, strengthen defenses, and restore trust without rebuilding the entire network from scratch.

Is one type of fork better or safer than the other?

There’s no universal answer. Both types have strengths and risks. A soft fork adds improvements without breaking the old rules, while a hard fork introduces a new version of the network. Soft forks keep users aligned and reduce disruption, but they’re limited in scope. Hard forks enable faster innovation but risk fragmentation. Safety depends on coordination, clear rules, and how well the community executes the upgrade.

Why do some forks create entirely new cryptocurrencies?

When consensus breaks, one side may launch a new blockchain. That’s what happened with the Bitcoin Cash blockchain, which started as an offshoot of Bitcoin after developers disagreed on block size. Once a new chain gains enough support, it becomes its own cryptocurrency with unique rules, tokens, and community. These splits preserve choice and experimentation across the crypto ecosystem.

Who decides whether a blockchain should fork?

In decentralized systems, no single person makes that call. Developers propose updates to the blockchain protocol, miners vote with their hash power, and users show support by running upgraded nodes. When enough participants agree, the fork activates. It’s democracy in code form, where consensus decides the outcome. That’s what makes blockchain governance both powerful and unpredictable.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.