In a space built on volatility, USDT is the calm eye of the storm. Whether you’re holding, trading, or bridging value between chains, Tether is likely involved. But what is USDT currency, and how did it become one of the most used tools in crypto? Here’s what you need to know before you can rely on it yourself.

Table of Contents

What Is Tether?

Tether is a type of stablecoin—a digital token designed to stay equal in value to a traditional fiat currency, in this case, the US dollar. That means one USDT should always be worth one dollar.

Tether first launched in 2014 under the name Realcoin, then rebranded and issued its first tokens on the Bitcoin blockchain using the Omni Layer Protocol. The company behind it, Tether Limited, was co-founded by current Tether CEO Reeve Collins.

Their most popular coin is USD₮, pegged to the US dollar, but Tether also supports:

- MXN₮, pegged to the Mexican peso, launched May 2022

- CNH₮, tied to the offshore Chinese yuan, launched September 2019

- XAU₮ (aka XAUT), each backed by one troy ounce of physical gold stored in Swiss vaults

Today, USDT is available on multiple blockchains incuding Liquid Network, Ethereum, EOS, Algorand, Cosmos, Tron, and plays a central role in the crypto space, acting as a digital dollar in day-to-day crypto transactions.

How USDT Works and Stays Stable

USDT stays stable through a simple system. When users deposit fiat currency into Tether Holdings Limited, the company issues an equal number of tokens. These USDT tokens are backed by Tether’s reserves, which include cash equivalents, corporate bonds, treasury bills, and other financial instruments.

When tokens are redeemed, they’re destroyed—reducing supply. This mint-and-burn system helps keep the Tether price close to $1.

To reduce risk, Tether minimizes exposure to risky assets like secured loans and has shifted toward safer holdings. In recent years, Tether announced expanded transparency efforts, including quarterly reserve reports. Still, the system isn’t trustless: it relies on confidence that enough dollar reserves exist to back every token.

Unlike algorithmic stablecoins, Tether doesn’t use smart contracts to manage stability. Instead, it’s backed through centralized reserve control—a model that prioritizes speed, simplicity, and resilience in times of market volatility.

What Gives Tether (USDT) Value?

USDT holds its value because it’s designed to be redeemable for real dollars. The system relies on market confidence that every token can be exchanged for money held in reserve.

While Tether doesn’t offer full audits, it publishes quarterly breakdowns showing holdings in short-term assets like corporate bonds and liquidity tools. Tether has moved away from risky positions after regulatory pressure and now leans heavily on US government debt. This shift has helped reduce doubt over the token’s ability to maintain its peg—even when the crypto market gets volatile.

Tether’s History and Key Milestones

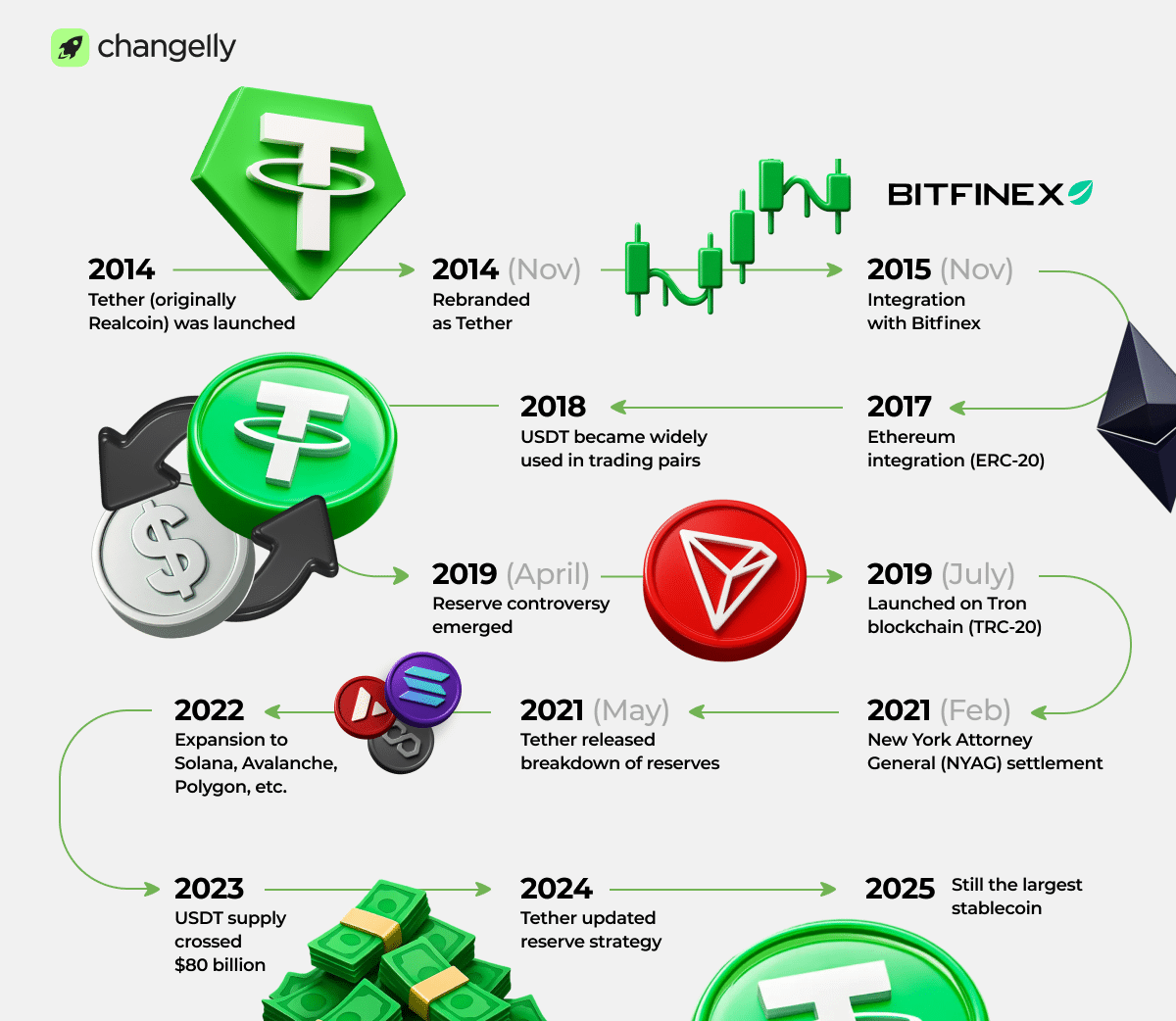

| Year | Milestone | What Happened | Why It Matters |

| 2014 | Tether (originally Realcoin) was launched | Founded by Brock Pierce, Reeve Collins, and Craig Sellars | Introduced the concept of a stablecoin: a crypto asset backed 1:1 by a real-world currency |

| 2014 (Nov) | Rebranded as Tether | Realcoin changed its name to “Tether” | Helped distinguish the project from being just another altcoin |

| 2015 | Integration with Bitfinex | Bitfinex became the first major exchange to support USDT | Provided a gateway to widespread trading and liquidity |

| 2017 | Ethereum integration (ERC-20) | Tether became available on the Ethereum blockchain | Faster, cheaper transactions and broader DeFi integration |

| 2018 | USDT became widely used in trading pairs | Most crypto exchanges adopted USDT/BTC and USDT/ETH pairs | Cemented Tether as a primary unit of account in crypto trading |

| 2019 (April) | Reserve controversy emerged | Tether admitted not all USDT was backed 1:1 by cash | Sparked ongoing debate about transparency and trust |

| 2019 (July) | Launched on Tron blockchain (TRC-20) | USDT began operating on another fast and low-fee network | Increased speed and accessibility for users, especially in Asia |

| 2021 (Feb) | New York Attorney General (NYAG) settlement | Tether and Bitfinex paid $18.5 million to settle case over misused reserves | Provided legal clarity but also highlighted concerns over accountability |

| 2021 (May) | Tether released breakdown of reserves | First public disclosure showed mix of assets backing USDT | Transparency step, but raised questions over commercial paper holdings |

| 2022 | Expansion to Solana, Avalanche, Polygon, etc. | Tether went multi-chain | Improved utility across different blockchain ecosystems |

| 2023 | USDT supply crossed $80 billion | Market cap grew rapidly, despite regulatory pressure | Showed continued dominance as a stablecoin even amid competition |

| 2024 | Tether updated reserve strategy | Reduced reliance on commercial paper, increased holdings in T-bills | Aimed at improving investor confidence and transparency |

| 2025 | Still the largest stablecoin | Despite competition from USDC, DAI, and others | Shows resilience and market preference for USDT’s liquidity and reach |

What Makes Tether (USDT) Unique?

Tether stands out as one of the most widely-adopted stablecoins in the world. It was the first stablecoin to gain global traction and remains essential in the blockchain ecosystem.

What makes it unique is its deep liquidity, fast settlement, and availability across multiple blockchain networks. Traders rely on Tether to move funds quickly without converting back into traditional currency, especially in volatile conditions. It’s widely used in cross-border payments and has become a go-to option in countries with limited banking access. Tether also supports a wide range of digital currencies, making it a versatile tool for crypto portfolios. Its integration into leading payment processors further extend its reach.

How Many USDT Coins Are in Circulation?

As of June 2025, approximately 154.76B Tether tokens are in circulation.

Tether’s circulating supply adjusts with market demand. Every time someone deposits real dollars, Tether mints new tokens. When tokens are redeemed, they’re destroyed. This mint-and-burn process ensures the supply reflects real-world demand. During bull markets, supply can rise quickly; in downturns, it contracts. This elasticity is essential to Tether’s role as a liquid dollar proxy.

You can track the current token count on platforms like CoinMarketCap or Tether’s own dashboard.

How Is Tether (USDT) Secured?

Tether’s security involves two main layers: blockchain-level protection and reserve-level trust.

On-chain, USDT functions as a token on established networks like Ethereum, Tron, and Bitcoin’s Omni Layer. This means that transactions rely on the underlying blockchain technology for security, making it encrypted, irreversible, and publicly verifiable. Like any crypto asset, USDT stored in wallets is protected by private keys that only the user controls.

At the company level, Tether is managed by Tether Ltd, which is responsible for issuing and redeeming Tether tokens. The company claims that all tokens in circulation are backed by reserves. However, the lack of full, independent audits has raised concerns. We will touch on that in a section below.

Tether also works with law enforcement and payment processors to freeze addresses linked to illegal activity, helping reduce risk in the broader crypto economy.

While its blockchain-level security is strong, the token’s overall safety still depends on trust in Tether’s management and disclosures. Without compliance with Generally Accepted Auditing Standards, users must weigh convenience against transparency when choosing Tether for storage or transfers.

Use Cases for USDT

USDT has become one of the most useful tools in cryptocurrency markets, with applications across trading, DeFi, and global payments.

Trading without exiting to fiat

USDT allows traders to sell volatile assets without converting them into traditional currency. This helps avoid banking delays and fees while staying in the crypto ecosystem. By moving into a stable asset like Tether, traders maintain capital on-chain and are ready to re-enter when market conditions improve.

Avoiding volatility in bear markets

During downturns, many investors convert holdings to USDT to preserve value. That gives them a reliable hedge against price volatility, especially when major cryptocurrencies suddenly drop. Tether’s predictable value makes it a preferred safe zone in uncertain conditions.

Moving money between exchanges quickly

USDT is supported on nearly every crypto exchange, allowing funds to be transferred instantly between platforms. This speed is vital for arbitrage strategies or reacting to fast-changing markets. It also helps reduce reliance on slow or costly fiat rails.

Use in decentralized finance (DeFi)

Tether is widely used in lending, liquidity pools, and staking across DeFi protocols. Users can earn yield or borrow against their holdings without worrying about fluctuating asset prices. Unlike some volatile digital currencies, USDT brings stability to these on-chain operations.

International transfers and remittances

For users in countries with limited banking access, USDT offers fast and affordable cross-border transfers. It’s become especially popular in Latin America and Southeast Asia, where it bypasses currency restrictions and enables seamless global payments in stable dollar value.

Benefits of Tether

Price stability

USDT is pegged to the US dollar, providing a consistent value of around $1. This stable value helps users avoid the unpredictable swings that plague most cryptocurrencies. It’s especially useful for those who want to hold or send digital money without risk.

High liquidity and market acceptance

As of June 2025, Tether had a market cap of nearly $155 billion, making it the third-largest cryptocurrency overall. It dominates stablecoin trading with over 65% of the market share, meaning users can easily enter or exit positions with minimal slippage.

Fast, low-cost transfers across borders

USDT can be sent around the world in minutes, often for just a few cents in fees. This makes it a superior alternative to bank wires or services like Western Union. It’s also used by payment processors in emerging markets to enable real-time merchant settlements.

Supports various blockchains

Tether runs on Ethereum, Tron, Solana, Liquid Network, and more. This multi-chain approach allows USDT to integrate into almost every major blockchain network, from centralized exchanges to DeFi apps. It also improves transaction speed and cost by letting users choose the chain that fits best.

Criticisms

Lack of full audits

Tether has never published an independent audit under Generally Accepted Auditing Standards. Instead, it provides attestations—brief snapshots from accounting firms. This lack of transparency raises doubts about whether every USDT is truly backed 1:1 by dollar reserves.

Legal actions and regulatory scrutiny

In 2021, the New York Attorney General revealed that Tether had misrepresented its backing and secretly loaned funds to cover an $850 million loss at Bitfinex. Tether agreed to an $18.5 million settlement and was barred from operating in New York. Though no wrongdoing was admitted, the case seriously damaged trust.

How to Get Free Crypto

Simple tricks to build a profitable portfolio at zero cost

Questions around reserve backing and redemption policies

Also in 2021, the Commodity Futures Trading Commission found that Tether Holdings Limited had fully backed USDT with real assets only 27.6% of the time between 2016 and 2018. This raised concerns over how much of the reserves were actually held in cash or equivalents, and whether large-scale redemptions would be honored.

Risks of centralization in stablecoins

Unlike algorithmic stablecoins or decentralized assets, Tether is fully managed by a single company. This creates a central point of failure.

This level of control also includes the ability to freeze funds, which, while helpful for blocking fraud, raises issues for privacy-focused users and undermines the decentralized ideals of the broader crypto market.

Tether vs. Other Stablecoins

USDT vs. USDC: Trust, Reserves, and Transparency

Tether and USD Coin (USDC) are the two largest fiat-backed stablecoins, but they differ in approach.

Tether has greater reach and liquidity, while USDC is more transparent. Tether claims each token is backed by a mix of cash, cash equivalents, and short-term securities. However, it has never published a full audit.

USDC, issued by Circle, undergoes regular attestation by top US accounting firms and discloses exact reserve compositions monthly. This has earned it stronger regulatory confidence, especially in the US. Still, USDT’s massive market capitalization makes it the most widely used stablecoin globally.

Continue reading: USDT vs. USDC.

USDT vs. DAI: Centralized vs Decentralized

DAI takes a completely different path. It’s not backed by fiat but by overcollateralized crypto assets managed by smart contracts and governed by the MakerDAO protocol. That makes it decentralized in theory, but in practice, much of DAI’s collateral is USDC—adding indirect exposure to centralized assets.

USDT, meanwhile, is managed entirely by Tether and backed by reserves off-chain, making it more centralized but often more liquid.

The trade-off here is control versus convenience: DAI offers transparency through code, while Tether offers speed and integration through centralized issuance. Both serve different user needs in the stablecoin landscape.

Should you hold money in Tether?

Holding USDT is simple and flexible—great for short-term use. It’s what many traders turn to when they want to dodge volatility, move funds fast, or join DeFi platforms without cashing out to a bank. As one of the most liquid digital assets, it’s perfect for reacting quickly to the market.

But it’s not built for long-term savings. USDT is centralized and still hasn’t released a full audit of its reserves. If you value speed and wide compatibility, it does the job well. If you care more about transparency or decentralization, coins like USDC or DAI might be a better fit.

Ultimately, Tether works best as a stable payment method, hedge, or liquidity tool—used tactically, not as your primary store of wealth.

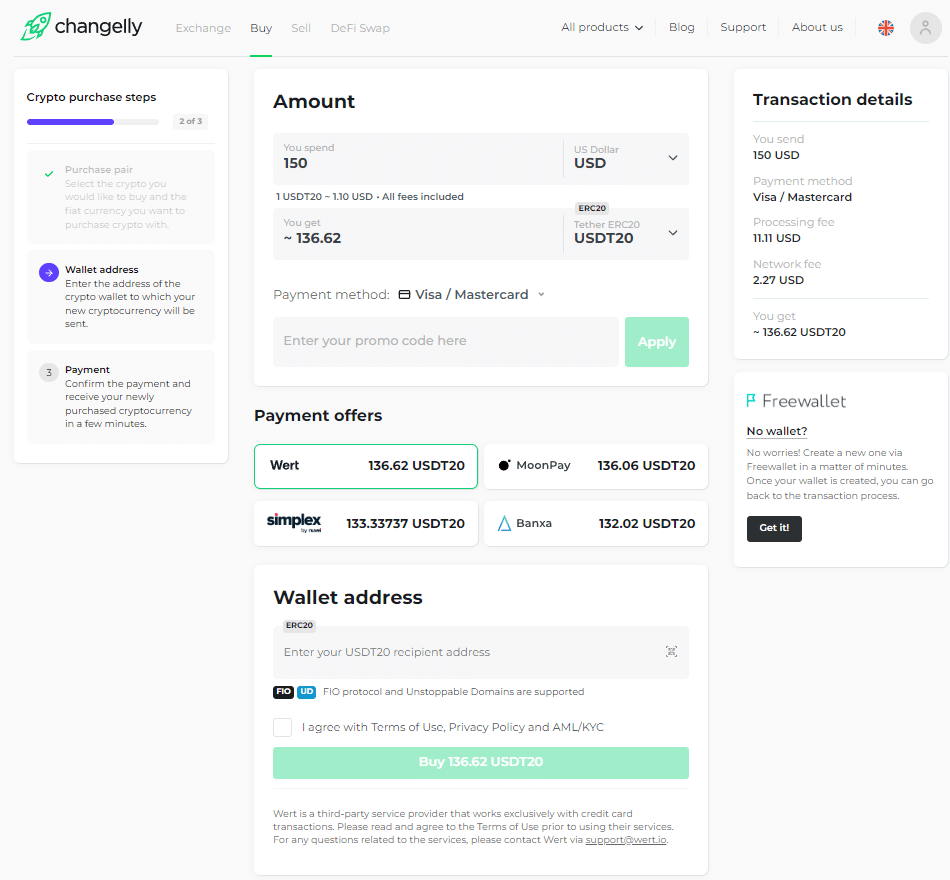

How to Buy Tether?

You can buy Tether quickly and easily on Changelly—no trading experience needed. Just choose USDT, pick your preferred payment method, and complete the purchase in minutes. We support a wide range of fiat currencies, so you can buy from almost anywhere using your local currency.

Final Words

Tether is one of modern crypto’s foundational tools—used globally for trading, transfers, and DeFi. It’s the first choice for millions thanks to its stability and reach, but it’s not without its concerns. While its peg has held so far, transparency around reserves remains debated. But if you need fast liquidity, cross-border movement, or a stable dollar alternative on-chain, USDT is hard to beat. Just use it wisely, stay informed, and remember: in crypto, trust is earned, not assumed.

FAQ

Is each USDT really backed by 1 US dollar?

That’s the idea—but the reality is more complex. The Tether stablecoin is meant to be backed 1:1 by dollar reserves, but it hasn’t always been the case.

In 2021, Tether reported that its holdings included cash, commercial papers, and other assets—not just dollars.

As of September 2024, only about 0.5% was held as cash or deposits; over 80% of the reserves were in US Treasury bills, backed by repos and money market funds. Another ~17% comes from assets like corporate bonds, precious metals, Bitcoin, and secured loans.

While Tether now holds more US T-bills and fewer risky instruments, it still hasn’t published a full audit. So, while it’s backed most of the time, it still relies on trust in Tether’s internal reporting, not external verification.

Even some users on Reddit have expressed concern over this lack of transparency, launching their own investigations into the company’s financial practices. One such thread, “Tether is shady—but is it a scam?”, explores potential red flags and seeks clarity from the community.

Can the price of USDT ever drop below $1?

Yes, but usually only briefly. USDT is designed to hold its peg through Tether’s reserves, but in rare moments of stress, like the TerraUSD collapse in 2022, for example, it dipped as low as $0.95. Still, it quickly bounced back. Because USDT is widely used and deeply liquid, even large redemptions don’t often break the peg. Its value holds as long as users believe they can redeem it for dollars or near-dollar equivalents. If confidence falters, that’s when the price could temporarily slip.

Is Tether safe to use for beginners?

Tether is generally safe for beginners—if it’s used correctly. It’s a stablecoin with a long track record, and it’s supported by nearly every crypto wallet and exchange.

That said, users should understand the risks: Tether is centralized, and its reserves haven’t been fully audited. If you’re using USDT for short-term trades, transfers, or stable storage between assets, it’s a convenient option. Just don’t treat it like a savings account—and always double-check the blockchain network when sending it.

Why is USDT on different blockchains like Ethereum or Tron?

Having USDT on multiple chains improves accessibility and lets users choose the network that best fits their needs. It also makes it easier to move funds between platforms without relying on centralized exchanges or costly fiat rails.

Tether started on the Bitcoin network using Omni Layer, but now it’s available on many blockchains to meet user demand for faster and cheaper transactions. Ethereum offers high security and DeFi access, while Tron is favored for speed and low fees.

Is USDT the same as USD?

No, they’re not the same. USDT—also called Tether coins—are digital representations of dollars held by a private company. They’re meant to mimic USD in value, but they aren’t issued by the US government or backed by it. You can use USDT to trade, send money, or access DeFi, but it doesn’t carry the same guarantees as actual dollars in a bank. It’s like a tokenized dollar for the crypto world—useful, but not risk-free.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

Nice overview

Hope this one don’t de-pegs itself lol

I use USDT all the time for transfers! Can 100% recommend

Why is USDC said to be more trustworthy after their depeg?

Tether is the future of digital money. All my friends and familily already use it one way or another.

I’m not into crypto as much anymore but stablecoins look promising. Thanks guys!