Bitcoin Cash (BCH) was created to make Bitcoin faster and cheaper for everyday use. It was the result of a major split within the Bitcoin community, driven by disagreements over fees, transaction times, scalability, and other issues. While Bitcoin evolved into a store-of-value asset, Bitcoin Cash was focused on payments. In this guide, you’ll learn what Bitcoin Cash is and how it’s used.

Table of Contents

What Is Bitcoin Cash (BCH)?

Bitcoin Cash is an altcoin and a fork of Bitcoin. It was launched in 2017 as a direct response to scalability issues on the Bitcoin network. Later, during a hard fork in 2018, Bitcoin Cash went through another split, which resulted in a new currency called Bitcoin Satoshi Vision (BSV). The two separate cryptocurrencies now work independently from Bitcoin.

Bitcoin Cash runs on its own blockchain, uses its own consensus mechanism, and has a separate community of users, miners, and developers. Its ticker symbol is BCH, and it functions as a peer-to-peer payment system designed for low-cost, fast transactions. BCH can be mined by users with GPU or ASIC miners but just like with Bitcoin, large pools and companies dominate the space.

Infographic showing Bitcoin Cash key technical features, including 32MB blocks for higher transaction throughput, low fees for everyday payments, faster confirmations with reduced congestion, and a proof-of-work SHA-256 security model similar to Bitcoin

How BCH Differs From Bitcoin in One Sentence

Bitcoin is a scarce store of long-term value, while Bitcoin Cash functions more like money for everyday transactions.

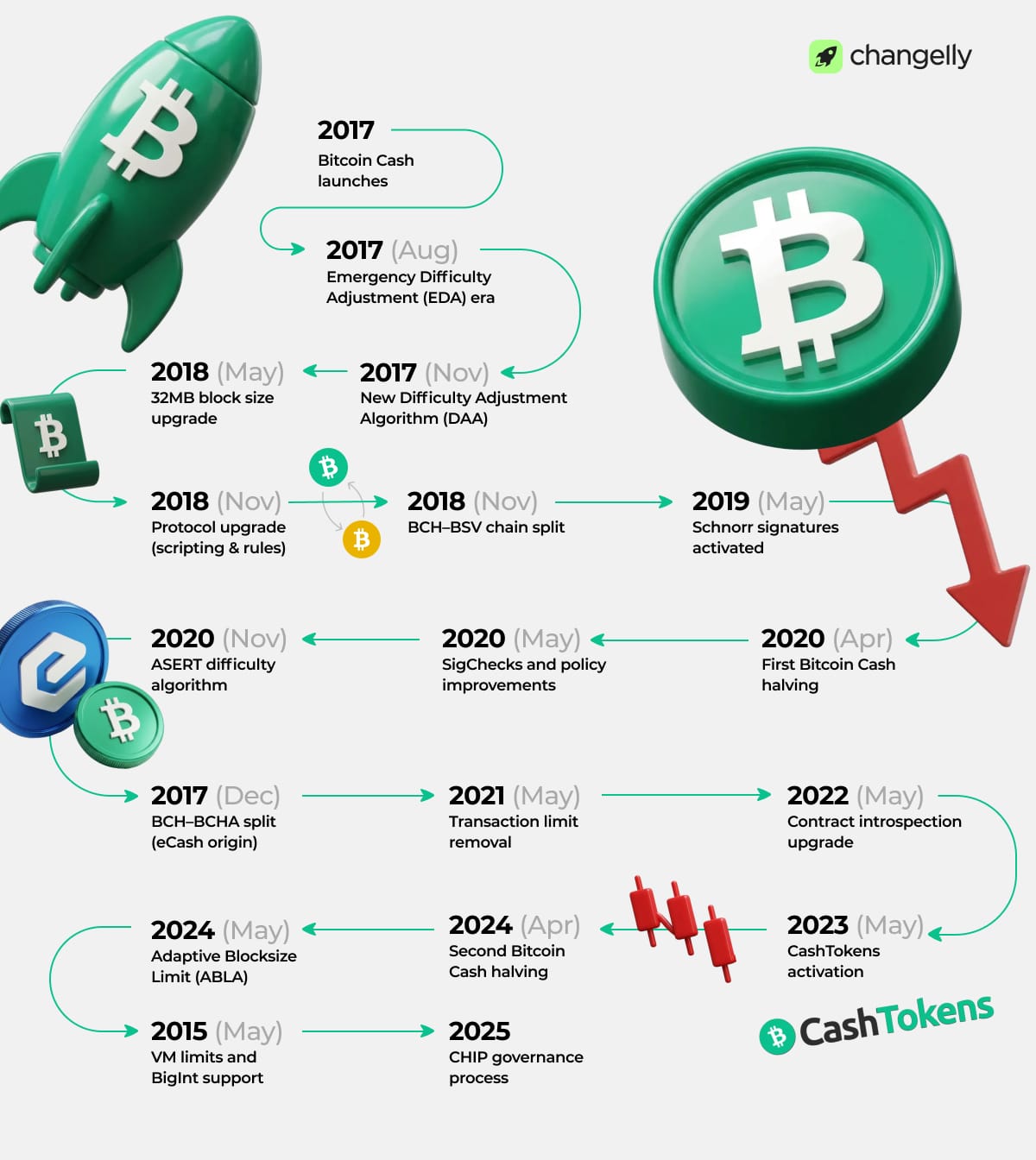

Bitcoin Cash (BCH) Development Milestones

Why Bitcoin Cash Was Created: The 2017 Bitcoin Fork

The more Bitcoin adoption rose around the globe, the more its network struggled to keep up. With an increasing number of transactions, blocks filled up faster, which led to users competing for space. A direct result of this was higher transaction fees. Confirmation also took more time, and the system became overwhelmingly expensive for smaller payments.

Bitcoin was launched as digital cash but it quickly became too slow and expensive for those who wanted to use it frequently.

How to Get Free Crypto

Simple tricks to build a profitable portfolio at zero cost

The Scalability Problem Bitcoin Faced: High Fees, Slow Speeds

The block size limit was one of the biggest issues in the Bitcoin debate.

- Bitcoin had a maximum block size of 1MB

- Bitcoin Cash increased the maximum block size to 32MB

By increasing block size, the Bitcoin Cash blockchain could process more transactions per block and up to 116 transactions per second, allowing it to lower fees compared to BTC. This change was meant to restore the original vision of Bitcoin becoming a digital payment coin.

The Bitcoin Cash Hard Fork: Block 478,559

The Bitcoin community split into two groups:

- One group wanted to keep blocks small and rely on second-layer solutions

- The other wanted larger blocks to scale the network directly

Developers proposed multiple solutions, but consensus couldn’t be reached. This disagreement eventually led to a hard fork on August 1, 2017, at block 478,559. All Bitcoin holders at that time automatically received an equal amount of BCH. This was the creation of a new currency.

The Philosophical Difference: Digital Gold vs. Peer-to-Peer Cash

Bitcoin eventually turned into the cryptocurrency we know today, often called “digital gold”—an asset people invest in and hold long-term. Bitcoin Cash, on the contrary, doubled down on being peer-to-peer electronic cash—in other words, a coin meant to be spent, not hoarded.

This difference still defines both networks today.

How Bitcoin Cash Works

Bitcoin Cash works similarly to Bitcoin. It also uses a public blockchain and interacts with digital wallets. However, there are important changes that improve scalability and cost. For example, Bitcoin Cash can handle over 100 transactions per second, while confirmations usually occur within seconds to minutes.

How BCH Achieves Security

Bitcoin Cash uses proof-of-work (PoW) as its consensus mechanism, relying on miners to validate transactions and secure the network.

What Miners Do

In the Bitcoin Cash network, miners:

- Collect transactions

- Bundle them into a block

- Compete to add that block to the blockchain

- Receive rewards for their work

This process keeps the Bitcoin Cash blockchain decentralized and secure.

SHA-256 and Why BCH Uses It

SHA-256 is a cryptographic hashing algorithm used to secure both the Bitcoin and Bitcoin Cash blockchains. It turns transaction data into a fixed-length string of numbers and letters. That string can’t easily be altered. SHA-256 is used by miners to validate transactions and create new blocks—they compete to solve cryptographic puzzles, and the first to succeed adds a new block to the blockchain. This process keeps the network secure and prevents double-spending.

Block Rewards & Halving

Miners on the Bitcoin Cash network earn newly issued BCH coins, plus fees. The issuance schedule includes halving events that reduce rewards over time, capping total supply at 21 million coins—just like Bitcoin.

Learn more about Bitcoin Halving.

Uses of Bitcoin Cash

Bitcoin Cash is mainly used for payments. Its common use cases include:

- Paying for goods and services

- Sending money globally with low cost

- Peer-to-peer transfers

- Everyday transactions where fees matter

Bitcoin Cash (BCH) is accepted by a wide range of merchants and services. You can use it on online marketplaces like Gamivo, travel platforms like Destinia, and electronics stores such as Trezor. Payment services like eGifter and NOWPayments also support BCH, allowing users to buy gift cards for major brands like Uber Eats, Amazon, and Home Depot, while platforms such as PayPal and Binance Pay enable BCH transactions and transfers. Low fees are what makes Bitcoin Cash practical and widely accepted.

Bitcoin Cash Pros and Cons

Bitcoin Cash certainly has a set of advantages for users, but that doesn’t mean there are no concerns. Below is a more detailed list of pros and cons of BCH.

| Benefits of Bitcoin Cash | Limitations and Risks of Bitcoin Cash |

| Low fees (often under $0.01) | Smaller market cap, fewer users, and less liquidity than BTC |

| Fast confirmation times | Competition from BTC, Lightning Network, Stablecoins, L2s |

| Straightforward payment UX | Regulatory and market uncertainty |

| Strong alignment with Satoshi’s original “cash” vision | Volatility |

| Small network, susceptible to attacks |

How to Buy Your First Bitcoin Cash?

You can buy Bitcoin Cash on Changelly using a bank card, Apple Pay, Google Pay, PayPal, or another cryptocurrency. Here’s step-by-step instructions on how to do it:

- Open the Changelly website or mobile app.

- Create an account (not necessary, but it’s recommended)

- Enter your wallet address

- Choose any of the available payment methods.

- Search for Bitcoin Cash (BCH) and complete the transaction.

Before making a purchase, always check fees, security settings, and withdrawal options. If you’re planning to hold your BCH, make sure to keep it in a secure cold wallet, or in a hot wallet for active trading. You can also buy Bitcoin Cash on other platforms, but make sure to research an exchange before you use it.

Final Thoughts

Bitcoin Cash owes its existence to the Bitcoin community disagreeing on scaling. Regardless, BCH has carved out a clear role as digital cash on its own. It faces strong competition and market volatility, yet remains a working payment system with low fees and fast transactions.

Whether Bitcoin Cash has a strong future depends on adoption, developer activity, and user demand. For beginners exploring cryptocurrency beyond holding assets, BCH offers a practical look at how blockchain-based money can work in the real world.

FAQ

Is Bitcoin Cash the same as Bitcoin?

No. Bitcoin Cash (BCH) and Bitcoin (BTC) are separate cryptocurrencies. They share the same history up to 2017, after which they split and now run on different blockchains with different rules.

Why is BCH cheaper than BTC?

BCH is cheaper mainly because market demand is lower. Bitcoin is seen as “digital gold,” while Bitcoin Cash focuses more on payments. Lower demand usually means a lower price, even if the technology works well.

Did BCH replace my BTC during the fork?

No. When Bitcoin Cash forked from Bitcoin in 2017, BTC holders received an equal amount of BCH, but their BTC stayed unchanged. You ended up with both coins.

Can BCH be used for everyday payments?

Yes. Bitcoin Cash was designed for fast, low-cost transactions, making it suitable for everyday payments like shopping, transfers, and online purchases.

Can BCH do smart contracts? (CashTokens explained simply)

Yes, in a limited way. Bitcoin Cash has built-in support for smart contracts through protocols like the Simple Ledger Protocol (SLP) and upgrades like CashTokens. CashTokens allow Bitcoin Cash to create tokens and simple, smart contract–like features such as NFTs and programmable payments without complex code.

Is Bitcoin Cash Safe?

Bitcoin Cash uses proof-of-work and SHA-256, the same security model as Bitcoin. The network is secure, but like all cryptocurrencies, its price can be volatile.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.