Litecoin might not always be in the spotlight, but it’s one of the oldest and most trusted cryptocurrencies in the world. While Bitcoin is often seen as “digital gold,” Litecoin has earned a similar nickname: “digital silver.” All thanks to its speed, low fees, and usability. In this guide, we’ll break down what Litecoin is, how it works, why it matters in today’s crypto ecosystem, and whether it might be the right digital currency for you. Let’s explore how a cryptocurrency created by a former Google engineer grew into a global network with millions of users worldwide.

Table of Contents

What Is Litecoin?

Litecoin (LTC) is a fork of Bitcoin’s source code, an altcoin created in October 2011 by Charlie Lee, who wanted a faster, cheaper, and more accessible version of Bitcoin. It runs on a decentralized peer-to-peer network powered by blockchain technology, where computers connect directly without a central server. This means no bank or central authority controls the system.

The goal was to create a digital currency for instant, low-cost payments. A currency that’s secure and easy for you to use, wherever you are. Litecoin achieves this by confirming blocks faster than Bitcoin and typically keeping transaction fees low, while adoption continues to grow.

Learn More About Blockchain Forks.

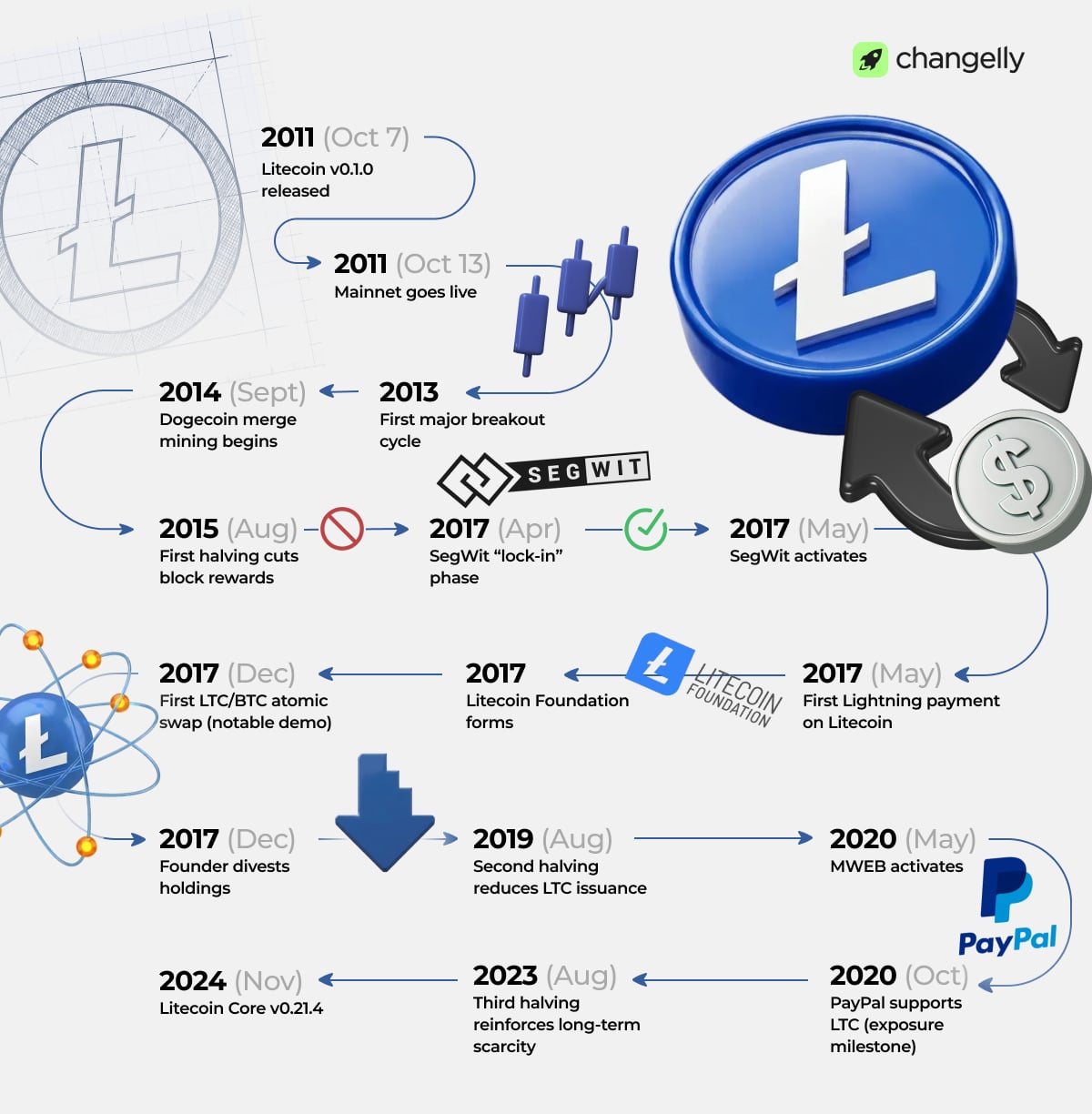

Litecoin (LTC) Development Milestones

Why People Call Litecoin “Digital Silver”

Bitcoin is often viewed as a store of value, while Litecoin is often described as “silver to Bitcoin’s gold”—a lighter, more flexible version built for everyday transfers. Here’s why the nickname stuck:

- Faster transactions: Litecoin confirms a new block every 2.5 minutes, compared to Bitcoin’s ~10 minutes. This enables instant, smoother everyday use.

- Lower fees: Litecoin is known for consistently low transaction fees, making it ideal for small payments.

- Broader everyday utility: While Bitcoin often acts like a long-term investment, Litecoin aims to be practical money you can send, spend, and trade easily.

Litecoin keeps the strong foundation of the Bitcoin blockchain but adapts it for speed and efficiency, exactly what the name “digital silver” suggests.

How Litecoin Works: Technology & Architecture

Litecoin runs on the Litecoin blockchain, a decentralized network maintained by thousands of nodes—computers that store blockchain data, verify transactions, and enforce the rules worldwide. Here’s what makes Litecoin work:

1. Proof-of-Work (PoW) Mining

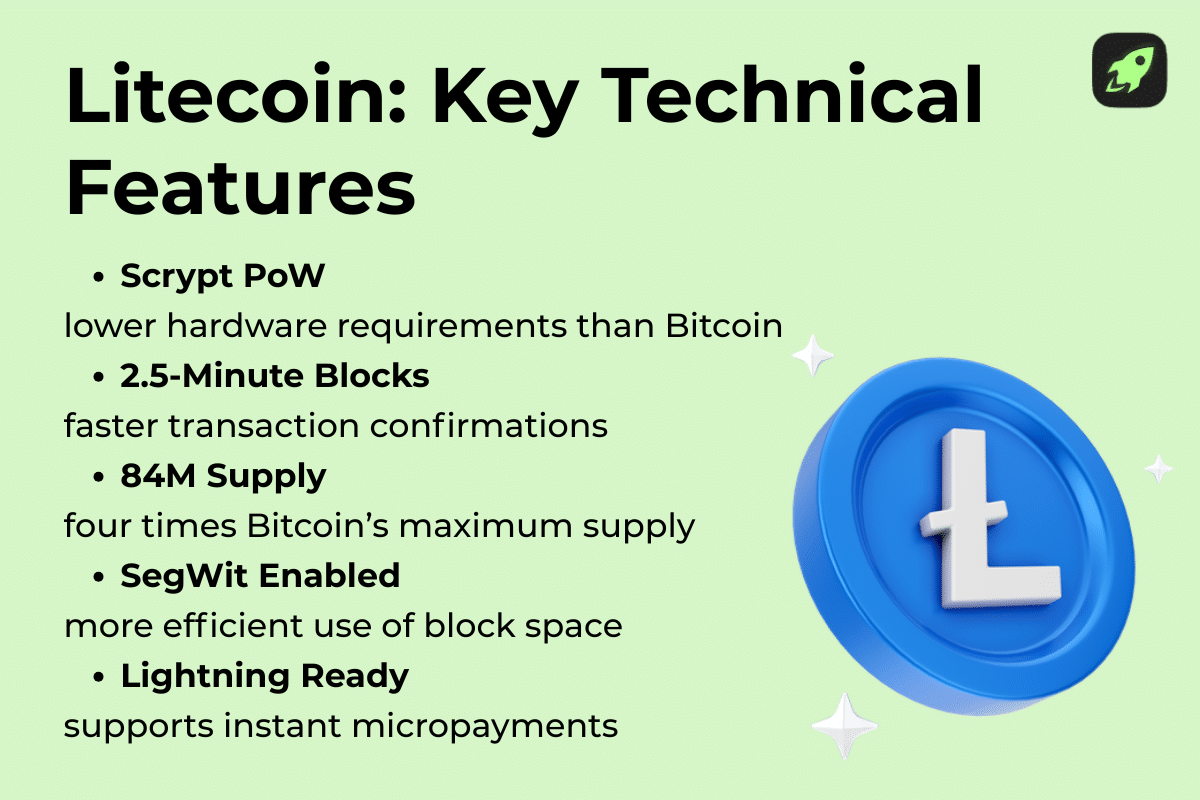

Litecoin uses the proof-of-work algorithm, just like Bitcoin. Proof-of-work means miners use computational power to validate transactions and add new blocks to the chain. However, it uses a different hashing algorithm called scrypt, which was designed to make mining more accessible than Bitcoin’s early mining environment. This can help spread out mining power and support decentralization.

2. Faster Block Times

A 2.5-minute block time means quicker confirmations and faster transaction settlement, one of the features that makes Litecoin stand out.

3. MimbleWimble Extension Blocks (MWEB)

MimbleWimble Extension Blocks (MWEB) add an optional privacy feature to Litecoin using extension blocks alongside the main chain. MWEB lets users optionally hide transaction amounts while keeping the base network secure, which makes it more efficient and more private.

4. Strong Network Security

The Litecoin network is protected by miners and full nodes that validate blocks and enforce the rules.

How to Get Free Crypto

Simple tricks to build a profitable portfolio at zero cost

Why does LTC have value?

Litecoin’s value comes from several factors:

- Utility: You can choose it for fast, cheap, and borderless transactions.

- Scarcity: Litecoin has a maximum supply of 84 million coins.

- Security: Its proof-of-work system and global mining network make it secure.

- Community: Litecoin has a passionate community and long history in the crypto world.

- Adoption: Many services, merchants, and exchanges support Litecoin, including BitPay.

- Stability: As one of the oldest cryptocurrencies, it has earned user trust.

Litecoin behaves like money but without banks, giving you more control over your assets.

Litecoin Tokenomics — Max Supply, Block Rewards & Halving Events

Litecoin’s tokenomics closely resemble Bitcoin’s:

- Maximum supply: 84 million LTC.

- Block reward: The reward you receive for validating a new block.

- Halving cycle: After every 840,000 blocks, the block reward is cut in half in a halving event.

Halving events are an essential part of Litecoin’s emission schedule. They help to reduce new supply entering the market. Over time, this helps to support long-term value and mirrors how Bitcoin manages inflation.

Litecoin vs Bitcoin

Although Litecoin was inspired by Bitcoin, there are clear differences:

| Feature | Bitcoin | Litecoin |

| Block time | ~10 minutes | ~2.5 minutes |

| Max supply | 21 million | 84 million |

| Algorithm | SHA-256 | Scrypt |

| Purpose | Store of value | Everyday use |

With all the similarities, Litecoin isn’t trying to replace Bitcoin. Instead, while Bitcoin anchors itself as a long-term asset, Litecoin is a convenient alternative that can also maintain value.

Litecoin’s Key Features

Litecoin is fairly unique. It stands out from many other cryptocurrencies thanks to a set of features:

- Fast confirmation times (2.5-minute blocks).

- Low transaction fees, great for everyday transactions.

- Scrypt mining, making it more accessible.

- Strong security through proof-of-work.

- MWEB privacy upgrade for optional confidentiality.

- High liquidity, with broad exchange support.

- Long history of reliability—one of the oldest crypto networks still running, which is reflected in its block height.

All these elements show how and why Litecoin can withstand the competition with newer blockchains.

Who Runs Litecoin? Miners, Full Nodes, Litecoin Core & the Foundation

Litecoin is not controlled by any single company. Instead, its network is supported by several independent groups working together, including an open-source community, and developers around the world.

Litecoin miners validate transactions and secure the blockchain. But they’re not the only important players in the network. Full nodes form the backbone of the system: they store the entire blockchain history, verify every block and transaction independently, and enforce the consensus rules. Full nodes make sure the network stays honest and consistent—even if miners or other participants try to cheat. They don’t create new blocks like miners do, but they approve what is valid and what isn’t.

The Litecoin Core developers handle software updates and ongoing improvements, ensuring the system runs smoothly.

Meanwhile, the Litecoin Foundation, a nonprofit organization, supports education, adoption, and development, but it does not control the network. This decentralized structure helps keep Litecoin neutral and transparent.

Is Litecoin Safe?

Yes, Litecoin is widely considered secure, and for several reasons. It relies on proven proof-of-work security, similar to Bitcoin, and has a long history of working without major network failures. A global network of miners and nodes helps protect the system, and a dedicated developer community regularly updates and improves the software. While you have to remember that no cryptocurrency is entirely risk-free, consider that a decentralized network with such a long and trusted track record, has to be acknowledged as safe by industry standards.

Litecoin Use Cases

Litecoin’s design makes it ideal for different goals, among them:

- Everyday payments. It’s quick and cheap for routine spending.

- Online purchases. It’s easy to use with merchants that accept crypto.

- Remittances and global transfers. Litecoin is faster and cheaper than many traditional services.

- Trading on exchanges. LTC is widely supported and highly liquid.

- Merchant services. Low fees make it attractive for businesses.

- Storing value. Litecoin is affordable to move and hold.

- Peer-to-peer payments. It’s simple for sending money directly to anyone, anywhere.

Because it enables fast, low-cost transactions worldwide, Litecoin is a practical digital currency for everyday use. It is accepted by a surprisingly wide range of businesses—from luxury brands to everyday services. According to Cryptwerk, in 2025, over 4,000 different companies offer Litecoin as a payment method.

For example, you can use LTC to buy cars, yachts, and even private jet flights through companies like Camper & Nicholsons, Exclusive Automotive Group, and LunaJets. Big names in tech and retail, including Newegg and PacSun, also support Litecoin payments. Many charities such as the Against Malaria Foundation and the Electronic Frontier Foundation accept LTC donations, and premium watchmakers like Hublot, Urwerk, and Ace Jewelers let customers shop with Litecoin too.

How to Buy Your First Litecoin

Litecoin wouldn’t be as popular if it weren’t easy to buy. On Changelly, you can purchase Litecoin with a bank card, Apple Pay, Google Pay, PayPal, or another cryptocurrency. Here’s how you can do that:

- Head to the Changelly website or mobile app.

- Create an account.

- Choose your preferred payment method.

- Search for Litecoin (LTC) and complete the trade.

- Store your LTC in a secure wallet (hardware or software).

Always double-check fees, security settings, and withdrawal options before making a purchase. There are other platforms where you can buy Litecoin, but always research an exchange before you use it.

Risks & Limitations — Volatility, Regulations & Competition

Just like any other crypto, Litecoin faces certain risks. They’re not as prominent as with newer or less popular coins, yet there are things to watch out for:

- Price volatility, like all crypto assets.

- Regulatory uncertainty in different regions.

- Competition from newer blockchains offering smart contracts and advanced features.

- Dependence on mining, which can make it less energy-efficient than proof-of-stake systems.

Crypto investments always carry risk, so evaluate carefully and never spend more than you can afford to lose.

Is Litecoin Right for You?

Litecoin may be a good fit if you’re looking for a fast and inexpensive digital currency on a reliable, time-tested network. It works well as a complementary asset to Bitcoin, since it offers a secure way to send and receive money globally, and it benefits from strong community support. However, it might not be the best choice if you’re specifically interested in advanced smart-contract ecosystems or staking rewards.

What Is the Future of Litecoin?

Litecoin has experienced a varied and eventful market history. Since its launch, it quickly became one of the top three cryptocurrencies by market capitalization and has generally moved in line with broader market cycles. The asset reached an all-time high of $386.45 in May 2021, a milestone that still stands as a key reference point in its price history.

Like many longstanding cryptocurrencies, LTC has seen both bullish surges and extended corrections since that peak. But Litecoin’s relevance comes from its utility, not just its market performance. The network has processed over 300 million transactions over the years, making it one of the most widely used blockchains for everyday payments thanks to its speed and low fees.

Institutional interest is also growing, with reports that Luxxfolio holds 20,000 LTC and that MEI Pharma has allocated $100 million to a Litecoin treasury.

Check out the Litecoin price prediction to get a clearer outlook on Litecoin’s future.

Final Thoughts

Litecoin may be one of the oldest cryptocurrencies, but its mission still resonates today: simple, fast, low-cost digital payments for anyone in the world. Whether you see it as “digital silver,” a cheaper version of Bitcoin, or simply a dependable crypto network, Litecoin remains a solid part of the blockchain ecosystem with millions of users and a bright future ahead.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.