Navigating the crypto landscape can often feel like wading through a sea of acronyms and slang. Terms like HODL, FOMO, and DeFi have become part of the lingo, making the world of crypto sometimes appear like a secret society with its own secret language. In such a scenario, you might have come across the term ‘crypto whales’ and wondered, “What are whales in crypto?” In this article, we’ll demystify this term and shed light on its relevance in the digital currency world.

Before we dive in, let me introduce myself. My name is Zifa. Over two years ago, I immersed myself in the dynamic and often exhilarating world of cryptocurrencies. I’ve reported on the highs and lows, the pioneering technologies, and the influential personalities shaping this industry. Today, we’re taking a step back to focus on the basics. Whether you’re new to crypto or simply looking to brush up on your knowledge, this article aims to provide a clear and comprehensive understanding of the key players in the crypto world: the whales.

Table of Contents

- What Are Crypto Whales, Exactly?

- What are the whales buying in crypto?

- How Much Crypto Makes You a Whale?

- What Happens When a Whale Buys Crypto?

- What is a cryptocurrency whale pump?

- How Do You Identify Crypto Whales?

- What is crypto whale tracking?

- Who Is the Biggest Whale in Crypto?

- What are the other known crypto whales?

- The Impact of Whales: Do Whales Control the Crypto Market?

- Are crypto whales good or bad?

- What is wash trading?

- Crypto Whales: Final Thoughts

What Are Crypto Whales, Exactly?

A crypto whale refers to an individual or entity that holds a significant amount of cryptocurrency, such as Bitcoin or Ethereum, in their digital wallets. The term “whale” was derived from traditional financial markets, where a whale represents an investor or trader with substantial holdings, capable of influencing market movements due to the size of their transactions.

In the context of the crypto market, whales play a pivotal role. Their crypto holdings provide them with a considerable amount of power to impact price movements. When a whale buys or sells a large number of coins, it can cause powerful fluctuations in the market and potentially influence the trading decisions of other investors.

What are the whales buying in crypto?

Crypto whales — individuals or entities with significant cryptocurrency holdings — impact the crypto market to a great extent. Curiously, what these whales invest in can offer valuable insights into their strategies. Typically, their diverse portfolios encompass established cryptocurrencies like Bitcoin and Ethereum, known for their relative stability. They also show interest in other coins with growth potential, particularly those linked to emerging blockchain projects and technologies.

Investment strategies among whales are not uniform: they can vary quite a lot, contingent on their risk appetite and the prevailing market conditions. Some might lean toward long-term investments, choosing to hold their positions through the market’s ups and downs. Others might engage in short-term trading, capitalizing on market volatility and price movements to accumulate more assets.

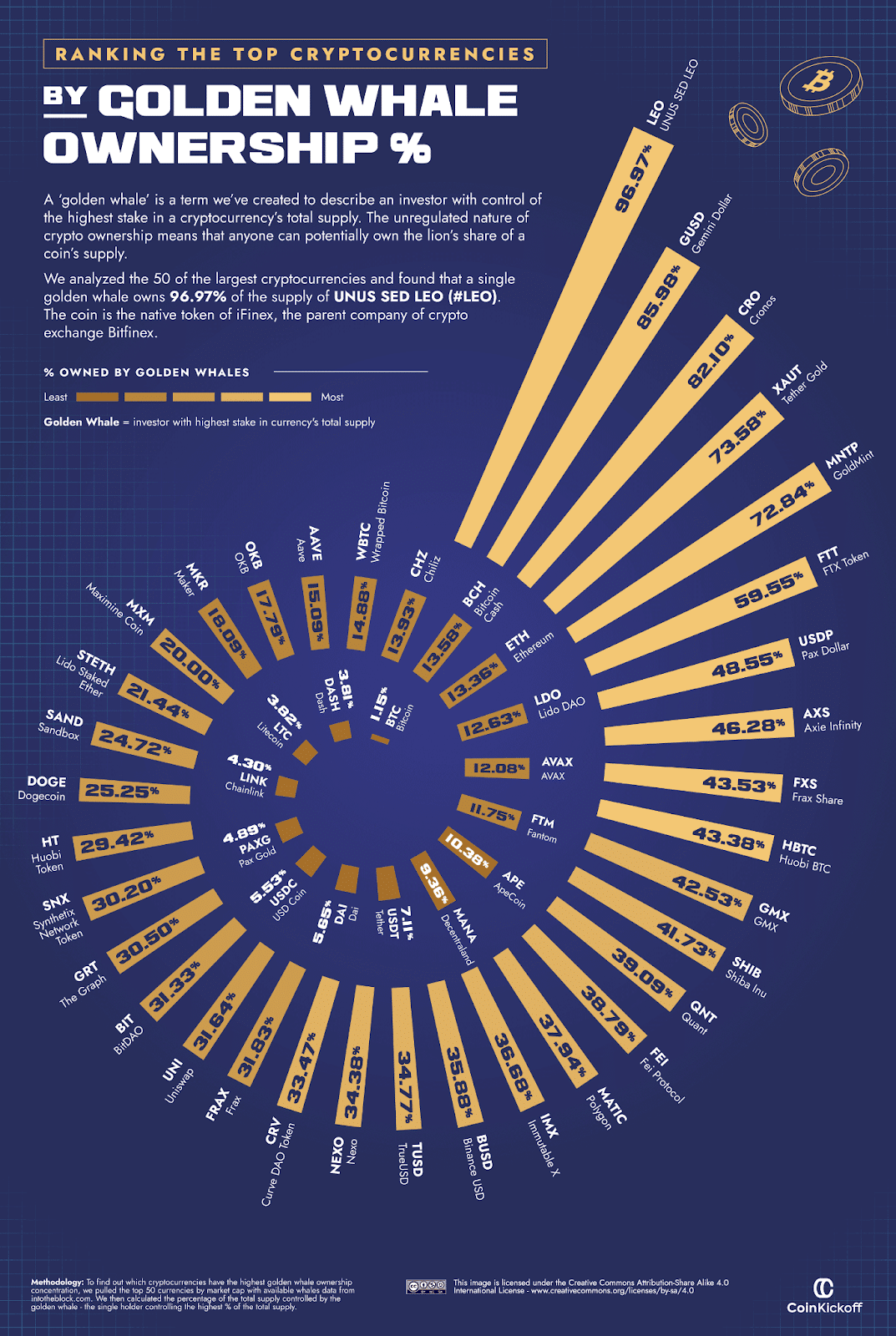

Recent research by Coin Kickoff, using data from blockchain analytics platform intotheblock.com, provides some intriguing insights into whale activity. It has been revealed that whales control over half of a coin’s stock in 36 out of the 50 largest cryptocurrencies by market cap. This means they wield a significant influence over the direction of these currencies.

One particularly striking finding is that a single individual owns a staggering 96.97% of UNUS SED LEO stock. This represents the highest proportion of a single cryptocurrency owned by one entity. At the opposite end of the spectrum, Chainlink, identified by its ticker symbol LINK, shows the highest quantity of whale ownership among the bigger pool of whales. The coin’s total stock is spread across 20 investors, meaning these whales control 56% of it.

Are you finding this article informative and insightful? Don’t miss out on more just like it! Subscribe to Changelly’s newsletter right away. Click the subscribe button now and let Changelly guide you through the intriguing maze of digital currencies!

How Much Crypto Makes You a Whale?

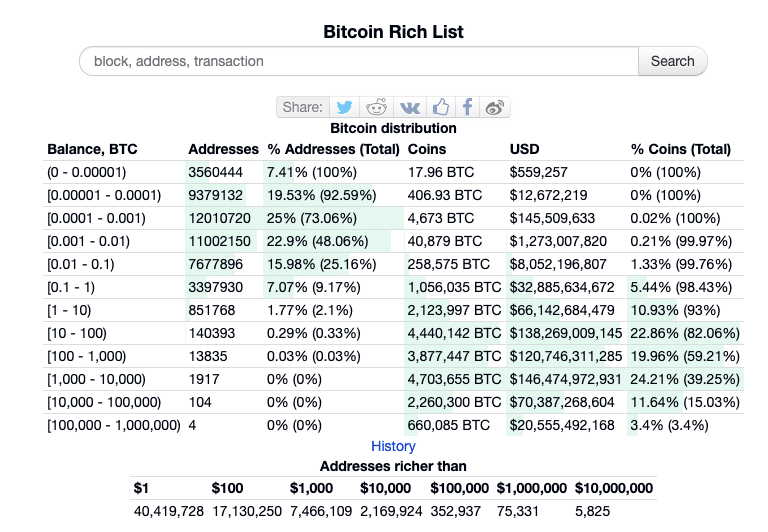

The definition of a “crypto whale” is not explicitly tied to a specific amount of crypto but largely dependent on the quantity of a particular asset owned by an individual or an entity. That being said, while there isn’t an exact number, a generally accepted threshold in the crypto community to be considered a whale is ownership of around $10 million worth of a particular cryptocurrency. However, the specifics can vary greatly depending on the coin’s price and the overall market capitalization.

In essence, being a cryptocurrency whale is more about the share of the total supply of a given cryptocurrency that one owns, rather than the sheer dollar value. For instance, owning a thousand Bitcoins would make one a prominent Bitcoin whale due to the limited supply of 21 million coins. Yet, possessing a thousand coins of a lesser-known cryptocurrency with a larger supply may not grant you the status of the whale.

What Happens When a Whale Buys Crypto?

Easy to guess that whales, with their hefty crypto ownership, can shape the market, influencing trends and causing volatility. Their buying activity often triggers notable price shifts, fostering artificial demand for a specific coin and raising its price. This domino effect entices other traders, escalating the price further. Conversely, a whale’s major sell-off can spark a sharp price drop, inciting panic selling and market downturns.

The ability of whales to manipulate the crypto space can’t be understated. Their strategic trading can mislead smaller traders and create artificial market trends. This manipulation can yield market irregularities, distorting price fluctuations and potentially undermining market confidence and stability.

The actions of whales can overshadow smaller traders and retail investors. Their large-scale trades can make market trend prediction challenging for smaller participants, possibly leading to substantial losses when trading against whale-induced price moves.

Regulatory concerns arise from the whales’ influence on the market. Their ability to manipulate trends and prices raises the risk of market abuse and fraud. Regulators keenly monitor whale activity to maintain fairness and transparency. Striking a balance between market freedom and investor protection is pivotal in nurturing a healthy, sustainable crypto ecosystem, one where whales prefer to engage actively.

What is a cryptocurrency whale pump?

A Whale Pump denotes the strategic price manipulation of a specific cryptocurrency by crypto whales. Using their sizable stakes, they spur a sudden increase in demand for a specific coin, artificially escalating its price.

Whales manipulate crypto through varied Whale Pump strategies, such as simultaneous or staggered large-volume purchases, inducing a buying frenzy. This activity creates a price rally, stirring FOMO (fear of missing out) among traders.

The effect of a Whale Pump on the market is powerful, inciting excitement and optimism among retail investors as they observe the price surge. However, the subsequent sell-off by the whale typically triggers a sharp price decline, causing huge losses for peak buyers and inciting panic selling.

Notable instances of Whale Pumps include the 2017 Bitcoin bull run, propelled by Bitcoin whales, which saw prices touching nearly $20,000. Another example is the Dogecoin pump instigated by the Reddit group WallStreetBets in 2021. Such events underscore why crypto whales matter — their actions have tangible impacts on market trends and values.

How Do You Identify Crypto Whales?

Spotting a Crypto Whale can be extremely important for traders navigating the volatile crypto markets. Whales have the capacity to induce significant price shifts, influencing market trends. By recognizing indicators of whale activity, traders can gain insights into potential market manipulations, helping them make informed decisions.

What is crypto whale tracking?

Crypto whale tracking is the process of monitoring large transactions in the crypto world. Tracking tools help identify whale wallets and observe their blockchain activities. Users can utilize blockchain explorers and on-chain analysis services for this purpose, gaining insights into whale movements, transactions, and holdings.

Blockchain explorers provide a transparent view into the blockchain network, assisting in the identification of whale wallets through the analysis of large transactions. On-chain analysis services, using sophisticated algorithms and data analysis techniques, offer a deeper understanding of whale activities by tracking transaction history, address balances, and more.

Crypto whale tracking offers valuable insights for investors, helping them understand market trends and predict price movements, especially when whales sell. Monitoring these sales can reveal whales’ sentiment and behavior, which is vital in navigating the unpredictable crypto market. Hence, tracking crypto whales through these services is essential for investors to enhance their market understanding and decision-making process.

Who Is the Biggest Whale in Crypto?

Identifying the biggest whale in the crypto world can be challenging due to the pseudonymous nature of blockchain transactions. However, as per available data, the largest Bitcoin whale is often considered to be the Bitcoin address that holds the highest amount of the cryptocurrency. This is believed to be a wallet address associated with Satoshi Nakamoto, the pseudonymous creator(s) of Bitcoin. The wallet is said to hold approximately one million Bitcoins, which would be worth billions of dollars at current prices. However, it’s worth noting that these Bitcoins haven’t been moved for many years, suggesting that they might never be used.

Another notable Bitcoin whale is the wallet address for the cold storage of Bitfinex, a prominent cryptocurrency exchange. This wallet consistently holds a huge amount of Bitcoin, given the size and volume of transactions on the Bitfinex platform. However, it’s important to remember that these holdings represent the assets of many individuals trading on the exchange, rather than a single entity. As such, while this wallet is a ‘whale’ in terms of holdings, it doesn’t represent a single influential actor in the crypto world.

What are the other known crypto whales?

Crypto whales, those with a large portion of digital assets, are known for shaping market trends. Notable Bitcoin whales include:

- Michael J. Saylor: The MicroStrategy CEO is recognized for his bullish Bitcoin stance and his firm’s sizable investments in this cryptocurrency.

- Barry Silbert: Digital Currency Group (DCG) has invested in multiple crypto projects, establishing its founder CEO as a big fish in the crypto ocean.

- The Winklevoss twins: Co-founders of Gemini, these twins are applauded for their early Bitcoin investment and pushing for cryptocurrency adoption.

- Michael Edward Novogratz: The Galaxy Digital CEO and former hedge fund manager is optimistic about cryptocurrencies and blockchain technology.

- Tim Draper: A venture capitalist known for successful investments in blockchain startups, Draper maintains a positive view on Bitcoin and digital currencies.

These are some of the biggest crypto whales whose trades and strategies influence the crypto market greatly. Their impact on price fluctuations and overall market sentiment is considerable. Further information about Bitcoin whales can be found in this article of mine.

The Impact of Whales: Do Whales Control the Crypto Market?

Crypto whales can substantially impact the digital currency market. Their considerable trading volumes andl capital can influence liquidity, volatility, and investor sentiment.

Whales can sway the market through their trading decisions. For instance, huge sell-offs can create a ripple effect on liquidity. If a whale executes a large sell order, it can reduce market liquidity, making it difficult for smaller investors to execute trades at preferred prices. This lack of liquidity can increase market volatility, resulting in swift price changes.

Additionally, whales can manipulate prices. They might spark market-wide sell-offs by executing large-scale trades strategically, inducing panic among retail investors and driving prices down. On the other hand, they can also cause short squeezes where their buying pressure forces short-sellers to cover their positions, leading to a rapid price surge.

There are notable examples of such whale activity. The notorious Silk Road whale — a big Bitcoin holder — triggered major price swings when their wallet transactions were linked to the dark web marketplace’s confiscation. The 2017 flash crash is another case where a whale’s large sell order on the GDAX exchange led to a swift price drop.

I cannot stress enough the importance of whale watching. Tools like blockchain explorers and whale tracking platforms like Whale Alert allow investors to track large transactions. By grasping the actions and intentions of these major market players, investors can better predict price movements and adjust their strategies accordingly.

Are crypto whales good or bad?

Crypto whales, or individuals and entities with substantial crypto holdings, play a complex role in the digital currency market. On the downside, these whales can manipulate crypto prices by strategically buying or selling large volumes, causing artificial market trends. Such maneuvers can lead to market irregularities and volatility, making it challenging for the broader crypto community — particularly for smaller traders — to predict and navigate the market.

On the flip side, crypto whales can also contribute positively to the market dynamics. By holding a significant portion of specific cryptocurrencies out of circulation, they create scarcity, potentially driving up demand and the coin’s value. Moreover, by capitalizing on market volatility, they can stimulate activity and growth within the market. Thus, while crypto whales can indeed be a source of manipulation and unpredictability, they also can serve as key market movers, offering both challenges and opportunities to the crypto community.

What is wash trading?

Wash trading is a deceptive crypto market practice where individuals or entities artificially create trading activity by repeatedly buying and selling the same asset. This strategy, used to manipulate prices, creates a false impression of market interest.

Whales can easily engage in wash trading to influence prices. By executing a series of trades between themselves, they create the illusion of massive trading activity, attracting other investors to join in. This can lead to an increase in demand and ultimately drive up the price of the asset.

The purpose of wash trading is to deceive other market participants into thinking there is genuine interest and demand for a particular cryptocurrency. This false impression can entice retail investors and traders to enter the market or make trading decisions based on misleading information. This manipulation can lead to artificially inflated prices or even a market bubble.

Regulators and exchanges are taking measures to detect and prevent wash trading, as it undermines the integrity of the market. Improved surveillance systems and stricter regulations aim to identify and penalize individuals or entities involved in these deceptive practices.

Investors need to be cautious of wash trading and use reliable sources of information to make informed trading decisions. Understanding the potential manipulation by whales and staying updated on market trends can help mitigate the risks associated with wash trading.

Crypto Whales: Final Thoughts

Relying on my expertise, it’s clear that whale activity in the cryptocurrency market can both stabilize and disrupt it. Whale watching is vital, but it is not the sole factor in decision-making.

I advocate that profound research on tokens and crypto assets is key to mitigating the risk of whale manipulations. Understanding a cryptocurrency’s fundamental value safeguards against artificial price swings instigated by whales. A focus on the underlying technology and long-term prospects paves the way for sustainable investments.

Though tools like Whale Alert provide insight into whale activity, remember that these may not fully capture the market picture due to tactics like wash trading.

In conclusion, consider whale activity as part of your crypto investing strategy, but also focus on crypto fundamentals and comprehensive research. This balance allows for effective market navigation and reduces the risks associated with whale manipulation.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.