Crypto markets move fast. Prices can sit still for days, then explode in minutes. These sharp moves are called breakouts, and spotting them early is one of the most valuable skills a crypto trader can learn.

The good news is that you don’t need advanced math or complex trading systems. With the right crypto breakout indicators, even beginners can learn to recognize when a big move might be coming.

In this guide, you’ll learn what a crypto breakout is, how to spot one, which technical indicators work best, and how to combine them into simple, effective strategies.

Table of Contents

What Is a Crypto Breakout?

A crypto breakout is a market situation when the price of an asset moves outside the range common for it.

The two most important terms you need to know are the ones between which this range forms—support and resistance levels.

- Support: a price level where demand exceeds supply (buying pressure), which stops the price from falling further.

- Resistance: a price level where supply exceeds demand (selling pressure), which prevents the price from rising.

When price breaks above resistance, it’s called a bullish breakout.

When price breaks below support, that’s a bearish breakout.

Breakouts are important because they often mark the start of a new trend. Instead of slow, sideways movement, the market suddenly gains momentum. Traders look for breakouts to enter positions early, before the biggest part of the move happens.

In crypto, breakouts are especially common due to high volatility, continuous trading, and fast, strong emotional reactions from retail traders.

Learn more about bullish and bearish market cycles.

How to Spot a Potential Breakout

Before using indicators, it helps to understand price structure. Breakouts don’t happen randomly. They usually follow clear visual clues on the chart.

How to Get Free Crypto

Simple tricks to build a profitable portfolio at zero cost

Support and Resistance Levels Explained

Support and resistance are the foundation of breakout trading. Support is a price zone where buyers step in. Its opposite is resistance, a price zone where sellers take control. These levels form because traders keep track of prices. If Bitcoin has failed at $40,000 several times before, many traders will expect resistance there again.

A breakout becomes more likely when:

- Price tests the same level multiple times.

- The range gets tighter.

- Buyers or sellers become more aggressive.

The more times a level is tested, the more meaningful a breakout becomes when it finally happens.

Chart Patterns That Signal Breakouts (Triangles, Flags, Rectangles)

The price history of every cryptocurrency is available publicly. And there are certain chart patterns that are known to signal upcoming breakouts.

You can learn how to read cryptocurrency charts in our dedicated article.

Triangles

A triangle pattern is a chart shape that forms when price moves into a tightening range. It shows buyers and sellers reaching a balance before a big move. Triangles often appear before breakouts and can signal trend continuation or reversal, depending on the direction of the breakout. There are three main types of triangle patterns.

- Ascending triangle (a flat top with rising lows) usually signals a bullish breakout as buyers push prices higher.

- Descending triangle (a flat bottom with falling highs) often points to a bearish breakout as selling pressure increases.

- Symmetrical triangle (when both highs and lows converge) shows market indecision and can break out in either direction, often following the previous trend.

Typical signs of a triangle pattern include price making higher lows and lower highs, as well as volatility shrinking over time. A breakout usually happens near the end of the triangle.

Flags

A flag pattern is a chart shape that appears after a strong price move, followed by a short pause before the trend continues. It shows the market taking a brief break while buyers or sellers regroup. Flags are usually a sign of trend continuation, not reversal, and can be bullish or bearish depending on the direction of the initial move.

- A bullish flag forms after a sharp upward move, with price drifting slightly downward or sideways in a tight channel before breaking higher.

- A bearish flag appears after a strong drop, followed by a small upward or sideways consolidation before price continues lower.

Flag patterns often look like small rectangles or channels. Volume is usually high during the first move and lower during consolidation, then increases again on the breakout.

Rectangles

A rectangle pattern is a chart shape that forms when price moves sideways between clear horizontal support and resistance levels. It shows a pause in the market, where buyers and sellers are evenly matched and no clear trend is in control. Rectangles often appear during periods of consolidation and usually end with a breakout.

- The top of the rectangle acts as resistance, where selling pressure stops price from moving higher.

- The bottom of the rectangle acts as support, where buying interest prevents further declines.

Price moves back and forth inside this “box” until momentum builds. The pattern is complete when price breaks above resistance or below support, often starting a new trend. Some traders trade inside the range, while others wait for the breakout for confirmation.

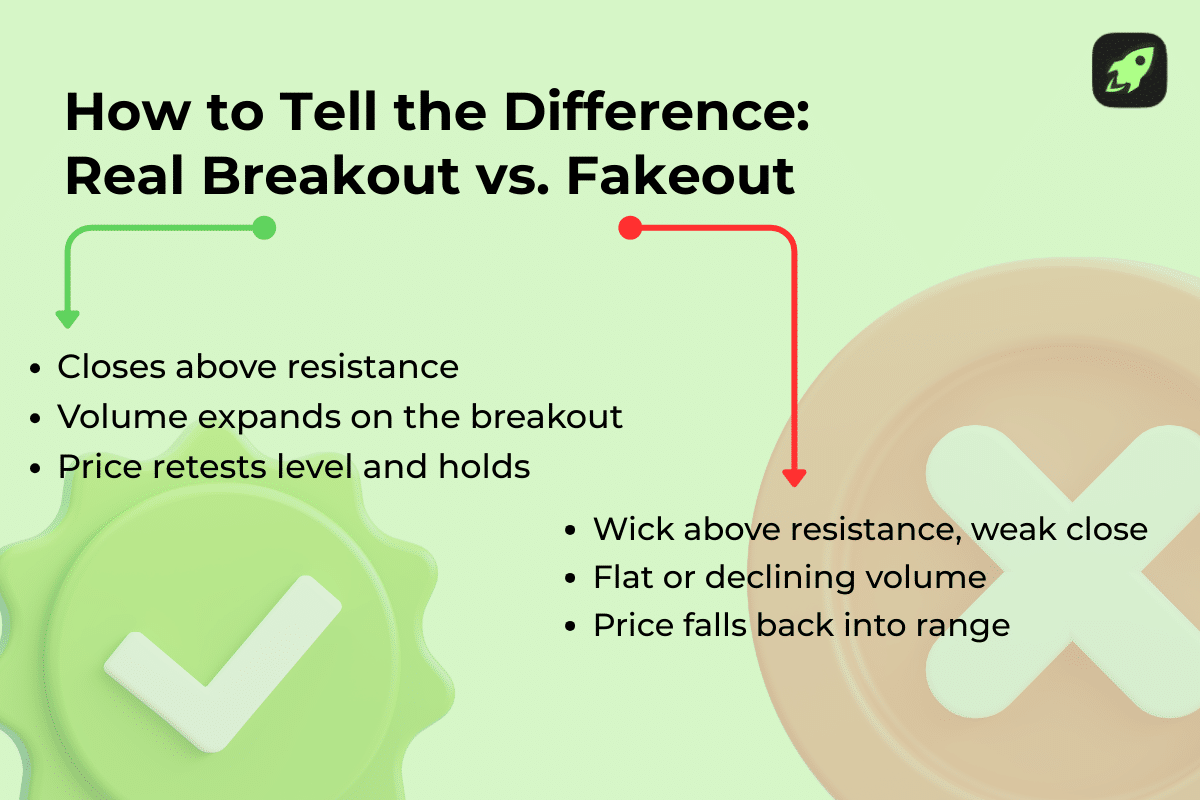

Breakout Volume

The breakout volume is the amount of trading activity that happens when price breaks above resistance or below support. Volume is one of the most important breakout confirmations. It’s easy to assess, since a true breakout usually comes with both rising volume and strong participation from traders, while low-volume breakouts often fail as they lack conviction. If price breaks resistance but volume stays flat, it often points to a false breakout—one that leads to the price moving back to its previous range. Always check volume before trusting the move.

Best Technical Indicators for Crypto Breakouts

Now it’s time to take a look at the most reliable technical signs of a crypto breakout. These tools help confirm what price action is already suggesting.

1. Moving Averages

Moving averages smooth out price data and show the overall trend. They help you understand whether the market is generally moving up, down, or sideways.

Common types:

- Simple Moving Average (SMA)

An SMA calculates the average price over a set number of periods. Every price is given equal weight, so it reacts more slowly to sudden price changes. It’s useful for spotting long-term trends. - Exponential Moving Average (EMA)

An EMA also averages prices, but it gives more weight to recent data. This makes it react faster to price changes, which is helpful for identifying short-term trends and potential breakouts.

EMAs are measured in units of time (periods of 9, 12, 20, 26, 50, 100, and 200—days, hours, or minutes). A faster EMA reacts quickly to price changes because it uses a shorter time period. Examples include the 9 EMA or 20 EMA. A slower EMA moves more smoothly because it uses a longer time frame. It reacts more slowly to price changes and helps show the overall trend. Common examples are the 50 EMA and 200 EMA.

How they help with breakouts:

- When price moves above an important moving average, it can signal that buyers are taking control.

- When a faster EMA crosses above a slower EMA, it often hints that a breakout may be coming.

- Moving averages can act like moving support or resistance levels where price often reacts.

- Commonly used levels include the 20 EMA, 50 EMA, and 200 EMA, which many traders watch closely.

2. Bollinger Bands

Bollinger Bands are a popular technical indicator that helps traders measure market volatility, which simply means how much the price is moving up and down. When the market is calm, volatility is low. When price starts moving fast, volatility is high.

Bollinger Bands are made up of three lines:

- The middle line, which is a moving average. A moving average smooths price data to show the general direction of the trend.

- The upper band, which sits above the average and shows when price is relatively high.

- The lower band, which sits below the average and shows when price is relatively low.

When the bands tighten, it means price movement has slowed and volatility is low. This phase is called a Bollinger Band squeeze. Squeezes often happen before a breakout, when price suddenly starts moving strongly in one direction.

Common breakout signals include price closing outside the bands, bands expanding after being tight, and higher trading volume, which confirms that many traders are participating. Bollinger Band squeezes are especially useful in crypto, where sharp price moves happen often.

Read more: Bollinger Bands and How to Use Them in Crypto Trading

3. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a popular indicator that helps traders understand momentum, or how strong a price move is. It works on a scale from 0 to 100, making it easy to read even for beginners.

Traditionally, RSI is interpreted like this:

- Above 70 means the asset may be overbought, which means price has gone up very fast and could slow down or pull back.

- Below 30 means the asset may be oversold, which means price has dropped quickly and could bounce upward.

When trading breakouts, RSI is used in a slightly different way. Instead of looking for overbought or oversold levels, traders focus on momentum strength.

Key breakout-focused RSI signals include:

- RSI breaking above 50, which often shows bullish momentum is building.

- RSI holding above 40 during consolidation, meaning buyers are staying in control even while price moves sideways.

- RSI divergence, which happens when RSI moves in a different direction than price and can signal a breakout is coming.

Overall, RSI helps confirm whether a breakout has real momentum behind it. Learn more about RSI in our dedicated guide.

4. MACD (Moving Average Convergence Divergence)

MACD, short for Moving Average Convergence Divergence, is an indicator that helps traders see both momentum (i.e. how strong a move is) and trend direction (whether price is moving up or down). It is built from moving averages, which means it reacts to changes in price over time.

MACD has three main components:

- The MACD line, the main line that shows changes in momentum.

- The signal line, a smoother line that helps spot trend shifts.

- The histogram, bars that show the distance between the MACD line and the signal line, making momentum easier to see.

For breakouts, traders look for a few key signals:

- A bullish MACD crossover, when the MACD line crosses above the signal line near resistance, suggesting upward momentum.

- The histogram expanding after consolidation, which shows momentum increasing after a quiet period.

- MACD crossing above the zero line, meaning the trend is shifting from bearish to bullish.

MACD works best when combined with price structure, such as support, resistance, or chart patterns, to confirm real breakouts.

Learn more: How to Use MACD in Crypto Trading

5. Volume Indicators

Volume indicators help traders understand how strong a price move really is by looking beyond price alone. While basic volume shows how much of an asset is traded, volume indicators add extra context and make trends easier to spot.

Two popular volume indicators are:

- On-Balance Volume (OBV), a running total that adds volume on up days and subtracts it on down days. It helps show whether buyers or sellers are in control.

- Volume Moving Averages, which smooth out volume data over time, making it easier to see when trading activity is unusually high or low.

For breakout trading, watch for these signals:

- OBV rising while price moves sideways, which suggests quiet buying, also called accumulation.

- Volume increasing before resistance breaks, showing growing interest before a big move.

- Volume spikes at the breakout, confirming that many traders support the move.

Volume indicators often reveal hidden accumulation before price moves.

6. Stochastic Oscillator and StochRSI

These indicators focus on momentum, which means how fast and how strong the price is moving. They also help identify overbought and oversold conditions and compare the current price to its recent range to show when momentum is building or fading.

They are useful for:

- Timing breakout entries, helping you enter closer to the start of a move.

- Spotting momentum shifts during consolidation, when price moves sideways.

Breakout-friendly signals include:

- Stochastic crossing upward from low levels, suggesting buyers are stepping in.

- StochRSI breaking above 0.5, showing momentum turning bullish.

- Momentum increasing before price escapes the range, often a breakout warning.

These indicators work best when combined with trend indicators like moving averages.

Top 3 Breakout Indicator Combos for Crypto

Single indicators can be misleading. Combining tools reduces false signals and improves accuracy. Here are three useful breakout indicator combinations.

Example 1: EMA + RSI + Volume

- EMA shows trend direction.

- RSI confirms momentum.

- Volume confirms participation.

Bullish Setup

- Price above key EMA.

- RSI above 50 and rising.

- Volume increases on resistance break.

This combo is simple, clear, and effective for trending markets.

Example 2: Bollinger Bands + MACD

- Bollinger Bands identify volatility squeezes.

- MACD confirms momentum shifts.

Bullish Setup

- Bands tighten significantly.

- MACD bullish crossover.

- Price closes above upper band.

This strategy is ideal for spotting explosive moves after quiet periods.

Example 3: Triangle Pattern + OBV

- Triangle pattern defines structure.

- OBV reveals accumulation or distribution.

Bullish Setup

- Ascending or symmetrical triangle.

- OBV rising before breakout.

- Price breaks resistance with volume.

This combo helps avoid fake breakouts and improves confidence.

Final Thoughts

Crypto breakouts offer some of the best trading opportunities—but only if you know how to spot them. The most important lesson is this: breakouts are about confirmation, not prediction. Price action comes first. Indicators help confirm what the market is already showing.

Start simple by learning support and resistance, watching volume, and using 2–3 indicators you understand well. Over time, you’ll recognize breakout setups faster and avoid common mistakes like chasing false moves.

FAQ

Can I use breakout indicators on smaller altcoins or are they better for Bitcoin and Ethereum?

You can use breakout indicators on altcoins too, but be careful. Smaller altcoins are more volatile and easier to manipulate, which means more false breakouts. Breakout strategies work best on coins with good liquidity and trading volume, like Bitcoin, Ethereum, and large-cap altcoins.

What’s a good win rate or success rate for breakout strategies in crypto?

A realistic win rate is usually 40–60%. Breakout trading focuses more on risk–reward than being right every time. A few strong winning trades can outweigh several small losses.

Do breakout strategies still work in bear markets, or are they mostly for bull runs?

They work in both, but differently. In bull markets, upside breakouts are more common. In bear markets, downside breakouts (breakdowns) happen more often. You must trade in the direction of the overall trend.

Should I always use stop-losses with breakout trades?

Yes. Always use a stop-loss. Breakouts fail often, and a stop-loss protects your capital. It turns a bad trade into a stumble rather than a fall.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.