There are several different types of orders in trading, but the main two every investor should know are the market order and the stop-loss order.

The former allows traders to buy or sell stocks or crypto at the current market price. Stop-loss orders are a little bit more complicated than that; thanks to them, experienced traders can follow a more sophisticated trading strategy.

Table of Contents

What Is a Stop-Loss Order?

A stop-loss order allows users to buy or sell stocks at a stop price. Essentially, it lets traders set a certain price at which an asset will be bought or sold once this level becomes the current market price. It can be regarded as a delayed market order that will come into effect only once the trigger price is reached.

Please note that a stop-loss order is very unlikely to be executed at the stop price. Your order will be carried out at the next available market price, which can be lower (or higher) than the stop price you’ve entered.

Stop-Loss Order Example

Imagine you want to buy one Bitcoin; however, its price is currently volatile (well, when is it not volatile), so you use a stop-loss order to minimize your risk of paying more than you were planning to. Bitcoin’s current market price is $60K, but you think that’s too high and expect it to decline sometime later that day. So, you set a stop-loss order at $59.9K.

BTC does indeed come down to that specified price level later in the day, and at that point, your order becomes a market order. It immediately gets executed at the market price of $59.85K.

However, it could also happen that the market price immediately rises after reaching the specified stop price. In that case, it is possible that your order will be executed at $59.95K, or even potentially $60K. However, that happens quite rarely, and the deviation in price is usually pretty minimal.

Understanding Stop-Loss Orders

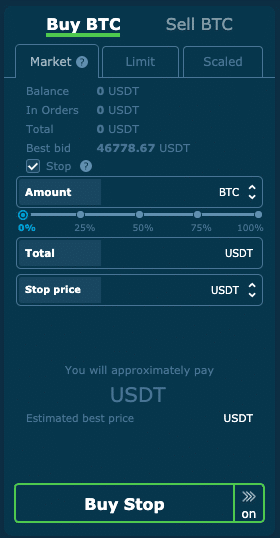

Here’s an example of how the trading terminal looks when you try to set up a stop-loss order.

Here, the stop price is the trigger price at which the exchange will purchase your chosen amount of BTC at the prevailing market price.

As you can see, a stop-loss order is essentially a market order with an additional step. However, you can also place a limit order with a stop price.

Stop-Limit Order

If you Google “stop-loss order,” then chances are, you will come across the term “stop-limit order.” Despite seemingly being very similar, these two have one key difference.

In addition to a stop price, a stop-limit order also has a limit price. Therefore, once crypto or stock price reaches the trigger, your order won’t be executed at the market price — instead, a normal limit order will be placed.

Although it may seem safer, it comes with a huge drawback: stop-limit orders don’t always get executed. If the asset’s price moves too sharply, it can go below/above the specified limit price, essentially blocking the order from going through. It can be either a benefit or a disadvantage depending on your trading strategy and the market you’re trading in.

Advantages of a Stop-Loss Order

Stop-loss orders have two main advantages:

- They will be executed immediately and are highly unlikely not to go through, allowing you to reap profits while minimizing losses without having to keep a close eye on the market. Stop-loss orders will only fail to go through at a price similar to your stop price if they are triggered right before the market closes or there’s too little liquidity.

- They won’t be executed until the asset reaches the stop price, ensuring that your trade will go through in necessary market conditions.

Stop-loss orders act as a sort of insurance for traders, making sure their losses never go above a specified point.

Purposes of Stop-Loss Orders

The main purpose of stop-loss orders is, well, to stop you from incurring any losses. They are especially useful in a fast-moving market where it can be quite difficult to catch the right moment to execute your trades.

Stop-loss orders are also often used to establish new positions at price levels that the trader believes the asset is going to be at in the future. For example, if you think that Bitcoin might reach $50K by the end of the week, you can set a stop-loss order at that specific price level. Then, if it indeed does rise, you will get a profit, and if it doesn’t, you will just cancel your order without losing anything.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.