Important Update

The Digitex Futures launch has been postponed, and this price projection is no longer relevant. The launch date remains unknown at the moment.

What is Digitex Futures Exchange?

Digitex Futures is the first non-custodial (i.e. you control your private keys) cryptocurrency futures exchange with no fees, going live 30th of April 2019. It has a token-based revenue model like Binance. Let’s dive in Digitex Futures review and DGTX token price predictions right away.

The Digitex Futures CEO is Adam Todd, a former pit trader of the LIFFE, a London-based futures & options exchange. He is also a founder of Racingtraders.co.uk trading community and a developer of BetTrader software, a trading tool that makes betting much faster.

Digitex Futures ICO

Digitex (DGTX) Token sale was held at Seychelles on 15th January 2018. The demand was so high that it took only 1 day to sell all the tokens allocated for ICO.

ICO Start & End day: Jan 15, 2018

Price at Token Sale: USD $0.01

Raised in US dollars: $5,200,000

Tokens sold: 700 Million DGTX Tokens (70% of total supply)

DGTX Token & Digitex Futures Exchange Value

- Zero-Fee futures trading of Bitcoin, Ethereum & Litecoin against USD

- Account balances are held on an Ethereum-based smart contract

- Non-custodial meaning that your private keys are not controlled by the exchange

- Large Tick Sizes to equalize the chances of traders and high-frequency trading bots (a problem with tick sizes on crypto exchanges is well-described here)

- DGTX Token is governed by all token holders

- Token price is linked to the demand for DGTX token among traders who wish to work on Digitex Futures Exchange

- High Leverage (exact numbers are unknown)

- Privacy-focused

Futures contract is a great tool for hedging risks associated with crypto market volatility. For example, you would like to make sure, that even if Bitcoin price will go down you’ll be able to seize your profits by creating a short order. Digitex Futures exchange makes it possible by hedging your bitcoins against DGTX token.

The price of DGTX could rise or drop during your futures contract period. To manage this risk, Digitex Futures exchange provides the option of pegging your position in DGTX coins against ETH and BTC by utilizing corresponding smart contracts (for BTC it’s a smart contract created in RBTCs, learn more about BTC smart contracts here). However, you have to deposit a subsequent amount of ether or bitcoin to be able to do so.

Basic Information on DGTX Token

DGTX token is built on Ethereum blockchain, the token sale is finished. Link to the Digitex token whitepaper. By the way, the idea and some basic features of DGTX look very similar to the Bittrain whitepaper. We don’t know if there is a connection between projects, but that’s interesting.

| Supply & Allocation | 1,000,000,000 DGTX total supply 65% – Token Sale (ICO) 20% – Digitex Market Makers 10% – Team 5% – Referrals (Bounty & Loyalty program) |

| Token Standard | ERC-223 (2nd generation of ERC-20) |

| Token Type | Utility |

| Smart Contract Address | link to smart-contract on etherscan.io |

| Current Market Cap. | $87,809,799.05 (source: coinmarketcap.com) |

Notice that 20% of DGTX went to Digitex market makers (i.e. trading bots) to provide liquidity on the exchange, i.e. creating bid/offer orders with algorithmic trading strategies. 10% of DGTX will provide the team with funds for development over the following 3 years.

Crypto Futures Exchanges Comparison

Cryptocurrency futures trading isn’t something new, there are several major exchanges with high volumes, including Binance, Bitmex, Kraken, CME Group, Deribit, Okex and Bakkt that already have such a derivative.

The main difference between these exchanges and Digitex Futures is fees for deposits, withdrawals and trading fees. Digitex won’t charge any fees at all, they will cover all operational costs by mining (“minting”) new DGTX coins.

Therefore Digitex Futures is a safe harbor for short-term traders willing to make a profit out of small price fluctuations. These traders could bring more liquidity to the whole cryptocurrency market as they make trades much more frequently.

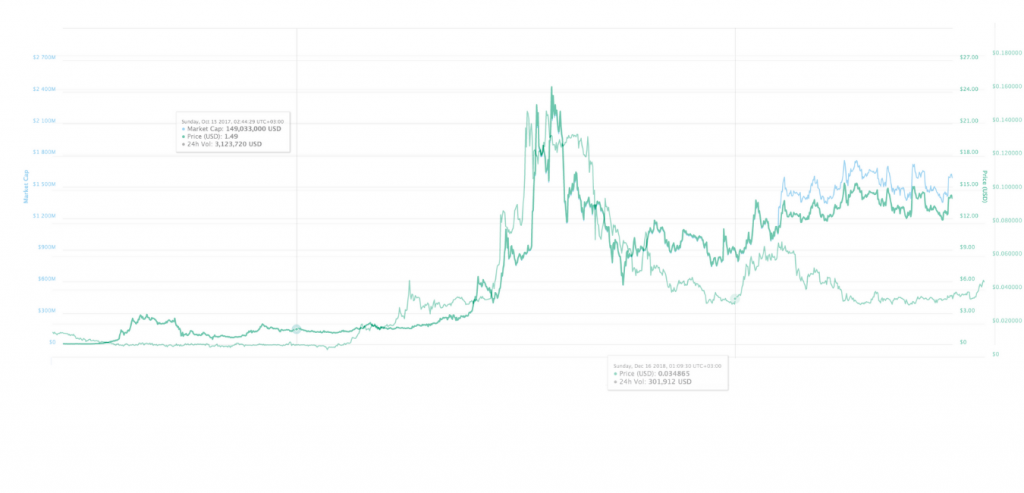

The ICO campaign, initial token price of $0.01 and the chosen revenue-model make Digitex Futures look very similar to BNB token at its early days. So let’s take a look at the BNB coin price history at the start.

As you can see, the DGTX price correlates with BNB in the first 5 months, despite the fact that Binance coin price was influenced by the overall bull trend in the cryptocurrency market. The subsequent growth of the DGTX should be dictated by the launch of the platform itself and the stability of its operation. Time will tell.

Influencers Opinion

Here are some tweets from crypto enthusiasts about DGTX.

DGTX Future Price Assumptions from Whitepaper

In his study, reflected in the official Digitex Futures Whitepaper, Adam Todd made several assumptions about the demand for DGTX tokens in relation to the number of traders of the future stock exchange.

According to his assumptions, there are several possible price movement scenarios. He admits that his projections are simplified and do not take into account many factors, especially such as sentiment in the cryptocurrency market.

Adam Todd’s DGTX price projections

| # of traders | 1,000 | 5,000 | 10,000 | 50,000 |

| Jan 2018 Price | $0.01 | $0.01 | $0.01 | $0.01 |

| Jan 2021 Price | $0.02 | $0.05 | $0.09 | $0.43 |

These price predictions are based on the expectations that there will be 2% of whales, 10% of medium traders and 88% of smaller ones. Each member of these groups should buy DGTX tokens worth at least $150000, $15000, $1500 accordingly.

Inflation projections

| January 2021 | 1 DGTX = $0.02 | 1 DGTX = $0.05 | 1 DGTX = $0.09 | 1 DGTX = $0.43 |

| 12 Month Costs | $1M | $2M | $5M | $10M |

| Tokens Issued | $1M / $0.02 equalling 50M DGTX $ | $2M / $0.05 equalling 40M DGTX | $5M / $0.09 equalling 55.6M DGTX | 10M / $0.43 equalling 23.3M DGTX |

| Percentage of Total Supply | +5% | +4% | +5.5% | +2.3% |

What will happen when DGTX reaches its maximum supply of 1,000M tokens?

In this case, all DGTX holders will be able to propose the amount of new tokens to be minted meaning that the emission is completely in the hands of the community. Think of it as a DAO, decentralized autonomous organization.

First token emission after the initial one is planned on Q1 of 2021.

First Look at Digitex Futures Interface

Conclusion & DGTX Price Forecast?

The idea of trustless cryptocurrency futures exchange with NO FEES is great by design and fundamentally it brings a lot of hype. A huge number of people are waiting for the launch of the platform (only the Telegram channel has about 72,000 subscribers at the time of this writing).

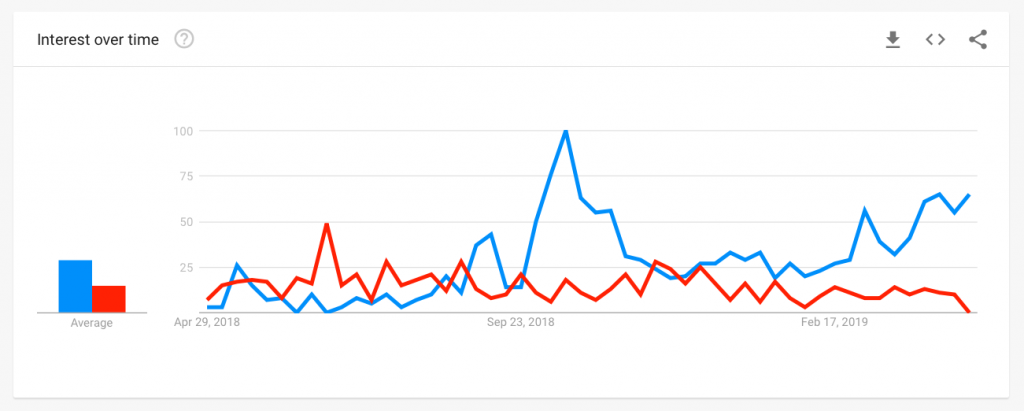

According to Google Trends, the demand for DGTX is close to the demand for Bitcoin Futures. A good sign to buy and HODL!

My personal prediction for DGTX is a price range of $5-15 USD by the end of 2020 year. Their marketing efforts are great, let’s hope their tokenized revenue model and a technological stack of futures platform will show us the same!

P.S. Just to make more hype, the ROI of DGTX is almost 700% since ICO.

Disclaimer: This article should not be considered as offering trading recommendations. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. While price analysis is a useful tool, it should not be considered predictive for the future performance of any investment vehicle.

Any investor should research multiple viewpoints and be familiar with all local regulations before committing to an investment. Website personnel and the author of this article may have holdings in the above mentioned cryptocurrencies.

Predicting a marketcap of somewhere between litecoin’s and ethereum’s marketcap by EOY? Really? Lol.

Also, yes initially 20% of digitex was kept back for market makers but the team took half of that back to sell in a “treasury”. So only 10% now allocated for market making across all the different markets that have been announced since whitepaper, including but not limited to; bitcoin, ethereum, litecoin, gold, silver (commodities) apple (stocks) etc etc. So not really going to be as liquid as originally made out in whitepaper (20% for only 3 markets)

now what ? predictions still same after no product in May 2019? This is an ico that collected money just because of an idea which exists in traditional market for more than 100 years. Come on , 1. have an idea 2. collect money 3. give it to third party for development 4. promise big to investors 5. nothing to show after 1 year 6. fire third party 7. hire another third party for development (possibly repeat from step 5) …

See the updated information on the top of the article.

Thanks, it is very informative

Some genuinely tremendous work on behalf of the owner of this web site, dead outstanding content.