Compound crypto is a decentralized financial protocol based on the Ethereum ecosystem. The Compound platform’s main goal is to create an environment for crypto lenders and borrowers, where the former could make their digital money work, and the latter gain access to loans without worrying about third party regulators. It is a transparent and secure network that operates on smart contracts.

Let’s see what this behemoth of the DeFi market has to offer. We’ll review the underlying principles of Compound, its use cases and basic features, talk about COMP cryptocurrency and the team of developers behind the platform, and see how the Compound Finance platform affects the crypto community.

Table of Contents

What Is Compound Platform

The Compound platform is an ecosystem where users can lend and borrow crypto assets without any intermediary. Lenders are investors who want their coins to generate more value. They give loans to borrowers and get interest for it. Lenders don’t interact with borrowers directly, though. They give their crypto assets into a liquidity pool.

Liquidity pool is a series of smart contracts that help to match borrowers with available loans, a completely decentralized and transparent network. Any user with enough technical expertise can check the open-source code of these smart contracts.

Smart contracts serve yet another vital purpose: they determine the interest rates the lenders get, using sophisticated algorithms that monitor the world’s crypto supply and demand around the clock.

In order to borrow money in the Compound ecosystem, you have to put up a collateral – a particular amount of coins above Combound’s threshold.

At the time of writing, Compound works with the following altcoins: Ethereum (ETH), Basic Attention Token (BAT), Sai (Legacy DAI), Tether (USDT), Augur (REP), USD Coin (USDC), Wrapped Bitcoin (WBTC), and 0x (ZRX). Compound is built on Ethereum blockchain and uses its smart contracts technology.

Compound Features and Use Cases

The Compound network can be seen as an alternative to traditional financial instruments platforms. However, the mechanics of how Compound works differs.

First of all, there is no ID verification. It is hard to imagine a bank granting a loan to an unidentified person, right? This is precisely why many crypto enthusiasts say that DeFi is the path for a more open, accessible, and fair global financial system. Compound doesn’t carry out any KYC checks: no need for identity and sustainability verification or risk assessment.

There is no lower limit neither for lending nor for borrowing in the Compound ecosystem. There are also no terms or penalties, you can pay back whenever you want. Locked assets can be withdrawn at any time. As for the interest, lenders get their rewards every 15 seconds or so, each time a new Ethereum block is generated.

Compound users have to make sure their collateral’s value doesn’t go below the established limit (relative to their loan). If it drops below the minimum, the borrower is automatically liquidated, and their collateral is sold in order to secure the repayment of the loan. But even in that case, any member of the Compound community may repay up to 50% of their debt, getting a proportional amount of the borrower’s collateral with a 5% discount.

Compound is primarily used to earn interest money by storing crypto assets on the platform. You will find more information about the Compound’s technical features in its whitepaper.

Compound cTokens

cTokens are internal Compound coins that represent the amount of crypto that a user deposited in the Compound protocol. They are ERC-20 standard tokens compatible with Ethereum.

When a lender puts a certain amount of crypto into the Compound system, they get a cToken in return. The tokens are proof of the deposit and generate interest automatically. For instance, if you lock in 100 ETH, you get 100 cETH from the network.

Compound Team

Compound Labs, the development team behind the Compound platform, is headquartered in San Francisco. The company’s CEO is Robert Leshner, a brilliant economist, financial analyst, and experienced startup founder.

Geoffrey Hayes is a CTO; application and strategy leads are Torrey Atcitty and Calvin Liu, respectively. There are four senior engineers in the team – Antonina Norair, Zachary Skolnik, Jared Flatow, and Coburn Berry.

Compound (COMP) Cryptocurrency

Compound (COMP) is the native cryptocurrency of the network, which you can not mine. The only way to get COMP is from the platform’s development team. The supply of this coin is limited to 10 000 000 COMP.

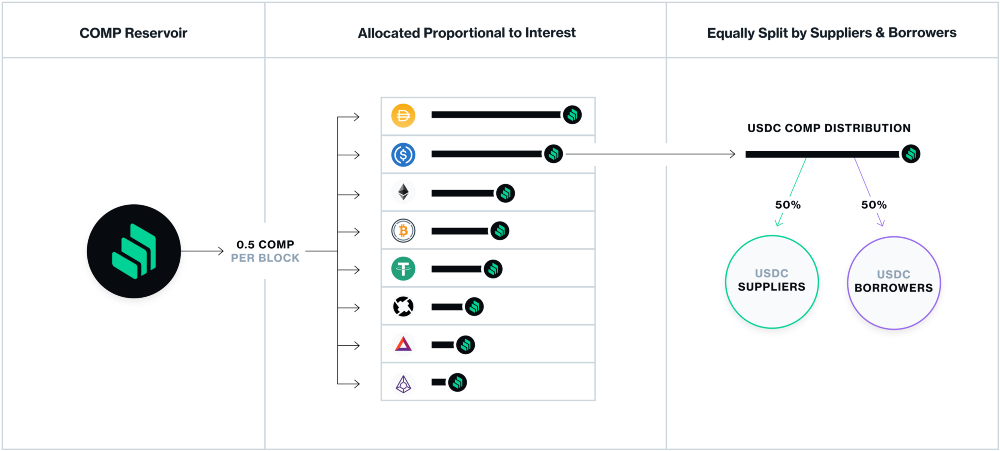

Every day 2880 COMP are distributed among the protocol users in proportion to the number of transactions with a particular coin, lenders and borrowers getting half and half. As soon as a user earns 0,001 COMP, the reward is transferred to their account.

COMP tokens also enable community governance. Every time an important decision on the platform’s future has to be made, there is a vote. Compound users who have more than 100 000 COMP can propose their own ideas, which are then voted for by the entire community of COMP-holders. If, after a three-day voting period, the idea gets more than 400 000 votes, it goes to Timelock smart contract and can be implemented in two days.

Where to Store COMP Token

Compound cryptocurrency can be stored in Coinbase and Web3 Metamask wallets. As it is an ERC-20 standard token, it is compatible with other wallets that use this standard, but you’d have to add it to the list of coins manually.

Compound Review – Summary

Compound is a decentralized finance platform that enables users to lend and borrow crypto. Lenders earn on interest; borrowers can get loans quickly and anonymously. The two don’t interact directly – the investors lock their crypto up into a liquidity pool, and the borrowers are matched with the assets they want to loan from the pool. The liquidity pool is a network of smart contracts that make all the transactions happen.

No ID verification is needed to use the platform, and no special terms or penalties apply to borrowers, except for the established minimum limit of the collateral. Lenders can withdraw money at any time. While their crypto is in the pool, they get the interest every time an Ethereum block is created (approx every 15 seconds). The interest rate is defined by complicated algorithms that work through smart contracts. They monitor the crypto market at all times.

There is a team of developers behind the Compound Finance platform; their headquarters is located in San Francisco. Robert Leshner is the company’s CEO, Geoffrey Hayes – the CTO.

COMP, a native coin of the Compound network, is traded on most popular exchanges. It is also used as a governance token, enabling the Compound community to make collective decisions about the ecosystem’s future.

About Changelly

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.