Leveraged yield farming is one of the most talked-about strategies in decentralized finance (DeFi). It promises bigger returns by letting farmers borrow extra capital and put it to work in liquidity pools. But higher yields also come with higher risks. Liquidations, interest costs, and protocol failures can wipe out gains fast. Understanding how it works, when it makes sense, and what to watch out for is essential before diving in.

Table of Contents

What Is Leveraged Yield Farming?

Leveraged yield farming is an advanced strategy in decentralized finance (DeFi) where investors borrow additional assets to increase the size of their farming position. By using leverage, a farmer can deposit more liquidity into pools than they could with their own funds alone, which amplifies both potential rewards and risks.

At its core, leveraged yield farming combines two DeFi tools: yield farming (earning rewards by providing liquidity to decentralized exchanges or lending protocols) and borrowing/lending mechanisms. The leverage comes from taking on debt in order to put more capital to work.

Read more: What Is Crypto Lending?

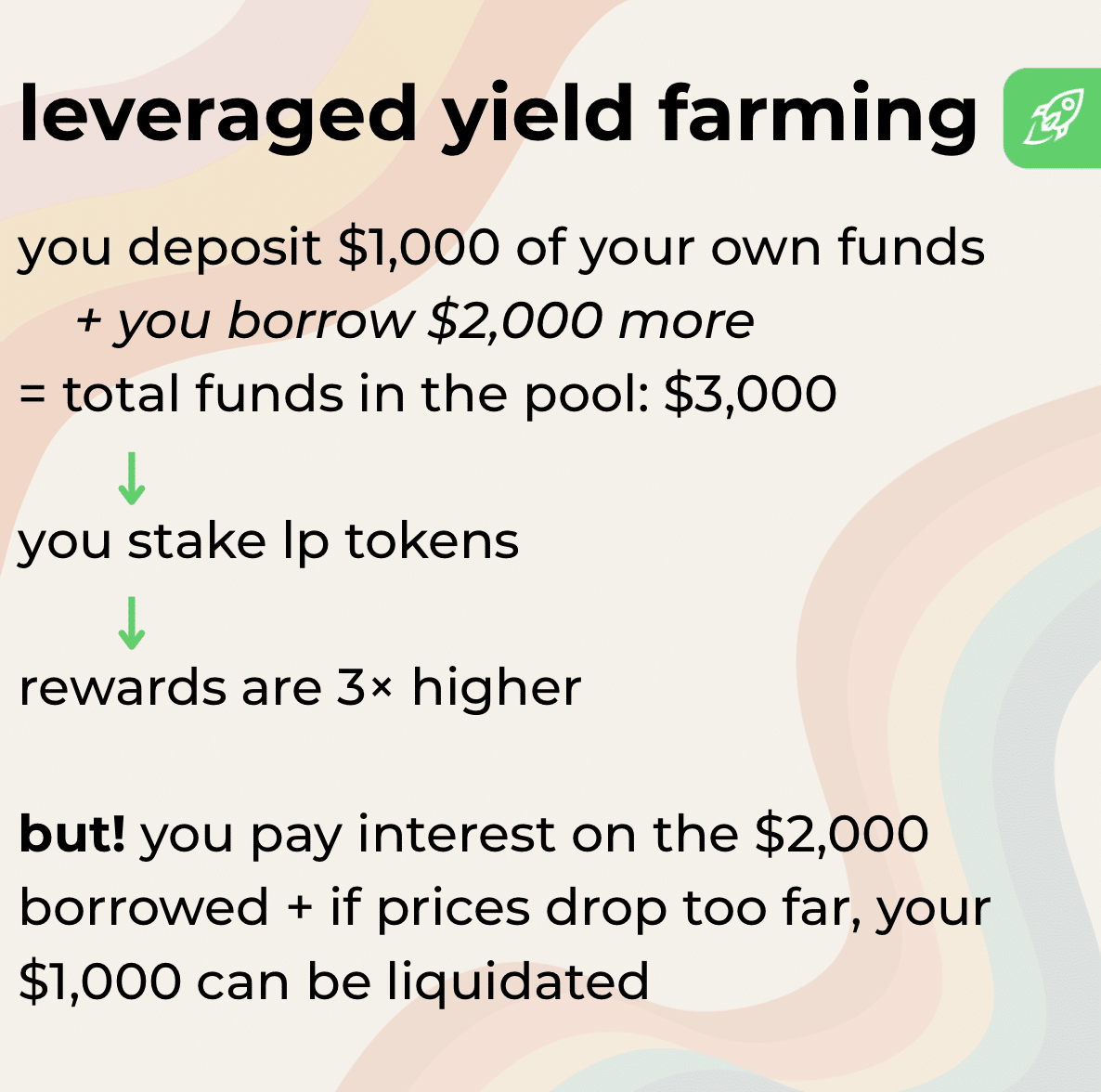

An easy-to-understand analogy is margin trading in traditional finance. Imagine you have $1,000 to invest, but you borrow another $2,000 to make a $3,000 trade. If the investment goes well, your gains are multiplied. If it goes poorly, your losses pile up faster, and you still owe the borrowed money. Leveraged yield farming works the same way: only instead of trading, you’re using the borrowed funds to farm yields.

This strategy is attractive to users who want to maximize returns on their crypto holdings without adding new capital. However, because it involves borrowing, leveraged yield farming is far riskier than normal yield farming or staking, making risk management essential.

What Does ‘Leveraged’ Mean in DeFi?

In decentralized finance, leverage means borrowing additional assets to increase the size of your position beyond what you actually own. It allows a user to put more money to work than they hold in their wallet.

For example, if you deposit $500 worth of tokens and borrow another $1,000 through a DeFi lending protocol, you’re now farming or investing with $1,500. That extra borrowed capital is your leverage. Leverage is usually expressed as a ratio, such as 2x, 3x, or 5x. A 2x position means half your capital is borrowed, while a 5x position means most of it is. The higher the leverage, the greater your exposure, both in terms of potential returns and risks.

In practice, this makes leveraged yield farming more powerful but also more dangerous. If prices move against you or borrowing costs rise, your position can be liquidated, wiping out your deposit.

Read more: Leveraged Trading in Crypto

How Leveraged Yield Farming Works (Step-by-Step)

Leveraged yield farming follows a clear sequence.

Supplying Your Funds

You begin by depositing your own crypto into a leveraged yield farming platform. This is your initial capital and also acts as collateral for any borrowing you do later. The more you supply, the more you can borrow.

Borrowing More Tokens

After supplying funds, you borrow additional assets: usually stablecoins or the pair needed for a liquidity pool. The platform uses your deposit as collateral, and you agree to pay interest on the borrowed amount. This borrowing is what creates leverage.

Creating Liquidity Pool (LP) Tokens

With both your own and borrowed tokens, you add liquidity to a decentralized exchange (DEX) pool. In return, you receive LP tokens that represent your share of the pool. These LP tokens are what generate farming rewards, typically paid in the DEX’s native token or other incentives.

Read more: What Are Liquidity Pools?

Earning Higher Returns Through Staking

Finally, you stake the LP tokens in a farming contract. Because your position is larger thanks to leverage, your rewards are higher than they would be with only your own funds. However, you must account for the interest on borrowed tokens and the risk of liquidation if markets move against your position.

Leveraged Yield Farming vs. Normal Yield Farming vs. Staking

In DeFi, users have multiple ways to grow their investments: staking, normal yield farming, and leveraged yield farming. Each method offers different levels of reward, complexity, and risk.

| Staking | Normal Yield Farming | Leveraged Yield Farming | |

| What It Is | Locking tokens in a network to secure it and earn rewards | Providing token pairs to a liquidity pool and earning fees/rewards | Using your funds plus borrowed assets to farm with a larger position |

| Risk Level | Low | Medium | High |

| Borrowing | None | None | Yes |

| Returns | Steady, predictable | Variable, higher than staking | Potentially much higher, but unstable |

| Impermanent Loss | None | Possible | Greater impact due to leverage |

| Complexity | Simple | Moderate | Advanced, requires active management |

Why People Use Leveraged Yield Farming

Leveraged yield farming has become popular because it gives farmers advantages that normal yield farming or staking can’t offer. By combining lending, borrowing, and liquidity provision on decentralized platforms, users can achieve greater capital efficiency and unlock new ways of growing their investments. Lenders earn interest, borrowers get extra funds to expand their positions, and the platform connects them through smart contracts that work automatically.

However, that’s not all there is to it. Let’s take a look at some of the reasons why investors might want to go for this type of investing instead of others.

Boosting Passive Income

This reason doesn’t need an introduction. With both their own assets and borrowed tokens, farmers can stake larger amounts in liquidity pools. This increases the yield they earn compared to standard yield farming, making it attractive for those focused on maximizing passive income.

Farming Stablecoins With Higher APY

Stablecoins are often paired in liquidity pools because they reduce the risk of impermanent loss compared to volatile tokens. By leveraging stablecoin pairs, farmers can generate higher APY while keeping their investment exposure more predictable within the crypto market.

Getting More Out of Your Capital

One of the main advantages of leveraged farming is capital efficiency. Instead of simply staking funds or holding assets idle, borrowing allows users to put more liquidity into LP tokens and earn rewards from yield farming projects across multiple blockchain ecosystems. The same initial investment is leveraged into a larger farming yield, improving overall returns.

Accessing Advanced DeFi Strategies

Leveraged yield farming also introduces more sophisticated strategies in decentralized finance. Some protocols allow looping: borrowing, reinvesting, and compounding positions. Others integrate swaps, governance, and staking within a single ecosystem.

These strategies give experienced farmers tools to optimize liquidity provision, diversify across farming pools, and align with top leveraged platforms on Layer 1 and Layer 2 blockchains.

Read more: What Is Layer 2 in Crypto? Blockchain Layers Explained

Is Leveraged Yield Farming Safe?

Leveraged yield farming offers higher rewards but adds extra risks compared to normal yield farming or staking. Various platforms and top leveraged protocols on Layer 1 blockchains provide tools to reinvest rewards and manage LP token positions across blockchain ecosystems, but they cannot fully solve risks like impermanent loss, price swings, or smart contract failures.

The key is treating leveraged farming as a calculated risk: research the platform, understand how borrowing and liquidation work, and decide if the potential future returns justify the exposure.

Read more: Crypto Risk Management Strategies

Learn how to spot scams and protect your crypto with our free checklist.

Main Risks of Leveraged Yield Farming

As we have already mentioned, this type of yield farming can amplify rewards, but it also magnifies risks. Borrowing, price swings, and protocol vulnerabilities all add layers of exposure that farmers need to understand before committing funds.

- Liquidation risk. If the price of tokens in your liquidity pool drops too far, the value of your collateral may no longer cover what you borrowed. The platform can liquidate your position, causing you to lose part or all of your funds.

- Impermanent loss. Token price changes inside a liquidity pool can reduce your returns compared to simply holding the assets. With leverage, this loss is amplified.

- Smart contract hacks. DeFi relies on code. Vulnerabilities in smart contracts can be exploited, leading to stolen funds or drained liquidity pools.

- Interest costs outweigh profits. Borrowing isn’t free. If borrowing rates increase or farming rewards drop, your profits can turn negative.

- Platform failure or rug pulls. Some platforms may shut down, be abandoned, or turn out to be malicious, leaving lenders and farmers with no way to recover funds.

- Liquidity crunches. In extreme market conditions, it may be hard to exit a farming pool or swap LP tokens back into assets without heavy slippage.

- Governance risks. Protocols governed by token holders may change rules, reward rates, or fees in ways that hurt existing farmers.

- Cross-chain risks. Leveraged yield farming on blockchain ecosystems that use bridges can expose farmers to additional vulnerabilities, including bridge hacks or failures.

Popular Platforms for Leveraged Yield Farming

Several DeFi platforms specialize in leveraged yield farming, each offering different features, blockchain ecosystems, and token incentives. Here are some of the most notable:

- Kamino Finance (Solana). Borrow against your deposits and “multiply” into larger LP positions on Solana DEX pools. Positions auto-compound and use a built-in risk engine with clear health metrics and liquidation thresholds.

- Extra Finance (Optimism / Superchain; Base). Dedicated leveraged-farming pools with isolated risk per market. You supply collateral, borrow the pair token, create LP, and farm—while the app tracks health factors and debt ratios.

- Juice Finance (Blast L2). Cross-margin leverage for Blast-native LPs. One account manages multiple positions, letting you borrow (e.g., ETH or stablecoins), build LPs, and farm while the system monitors portfolio-level risk.

- Gearbox Protocol (Ethereum). Open a “credit account” to deploy leverage across external protocols (e.g., Curve, Convex, Uniswap, Pendle). It’s composable: you borrow once, then route that leverage into supported LP and farming strategies under whitelisted integrations.

- Alpaca Finance. Once a major leveraged yield farming protocol on BNB Chain, Alpaca Finance is shutting down operations by the end of 2025. Users can still withdraw funds until December 31, 2025.

- Pembrock. Originally launched on NEAR to offer leveraged farming, but as of 2025 the project appears abandoned. Its official X (Twitter) account is shut down, and there have been no updates since 2022. Effectively inactive.

Best Practices and Tips for Safer Farming

Manage risk first, returns second. Start with simple setups, understand each protocol’s liquidation math, and scale only after you’ve verified the process end to end.

- Start small and test first. Use a fresh wallet and a tiny position to run the full loop: deposit, borrow, add liquidity, stake, claim, unwind. If an issue occurs, losses are capped. Record gas, fees, slippage, and how health metrics move at each step.

- Use stable pairs to reduce risk. Begin with stablecoin–stablecoin pools to limit price volatility and lower liquidation pressure and impermanent loss. Watch depeg risk, pool depth, and oracle sources; avoid directional exposure until you’re confident.

- Set alerts for liquidation levels. Calculate your liquidation price and health factor, then set alerts through the app, bots, or a portfolio tool. Keep a buffer below the protocol’s maximum LTV, and know how quickly oracles update during volatility.

- Monitor borrow interest and rewards regularly. Lenders can raise variable rates when utilization spikes, while emissions often decay. Track net APY (rewards + trading fees − borrow interest − costs). If it turns negative, de-lever or exit.

- Take profits, rebalance, and learn. Claim and realize gains on a schedule, repay debt when rates jump, and rebalance if your LP drifts from target weights. Keep a simple journal of decisions to refine your approach over time.

Final Thoughts: Should You Try Leveraged Yield Farming?

Leveraged yield farming can turn modest deposits into much larger positions, boosting potential rewards. But it also amplifies every risk in DeFi, like price swings, impermanent loss, rising interest rates, or even smart contract exploits.

This strategy isn’t for beginners. It requires active monitoring, risk controls, and a solid grasp of how lending and liquidity pools work. If you’re still learning the basics, staking or normal yield farming is safer. If you already understand liquidation mechanics and can track debt ratios in real time, leveraged farming can be a powerful tool.

Approach it as a calculated risk: start small, test the process, and never commit more than you’re willing to lose. In the end, leveraged yield farming isn’t about chasing the highest APY—it’s about using leverage wisely to make your capital work harder without letting risk get out of control.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.