Cryptocurrencies are way past being just digital money. Today, you can easily find tokens built for payments, governance, gaming, and even digital ownership. There’s a coin for everything nowadays, and knowing the types of cryptocurrency is essential to fluently navigate the market. We’ve collected all the types of coins in one simple list to help you understand their differences.

Table of Contents

What Are Cryptocurrencies?

Cryptocurrencies are digital assets—they exist virtually, but can represent physical objects or traditional money. Crypto transactions and records are supported by a decentralized system, using cryptography, hence the name. Cryptocurrencies don’t need a bank to function, but they do exist within an ecosystem that includes exchanges, different blockchain networks, specific platforms, and apps.

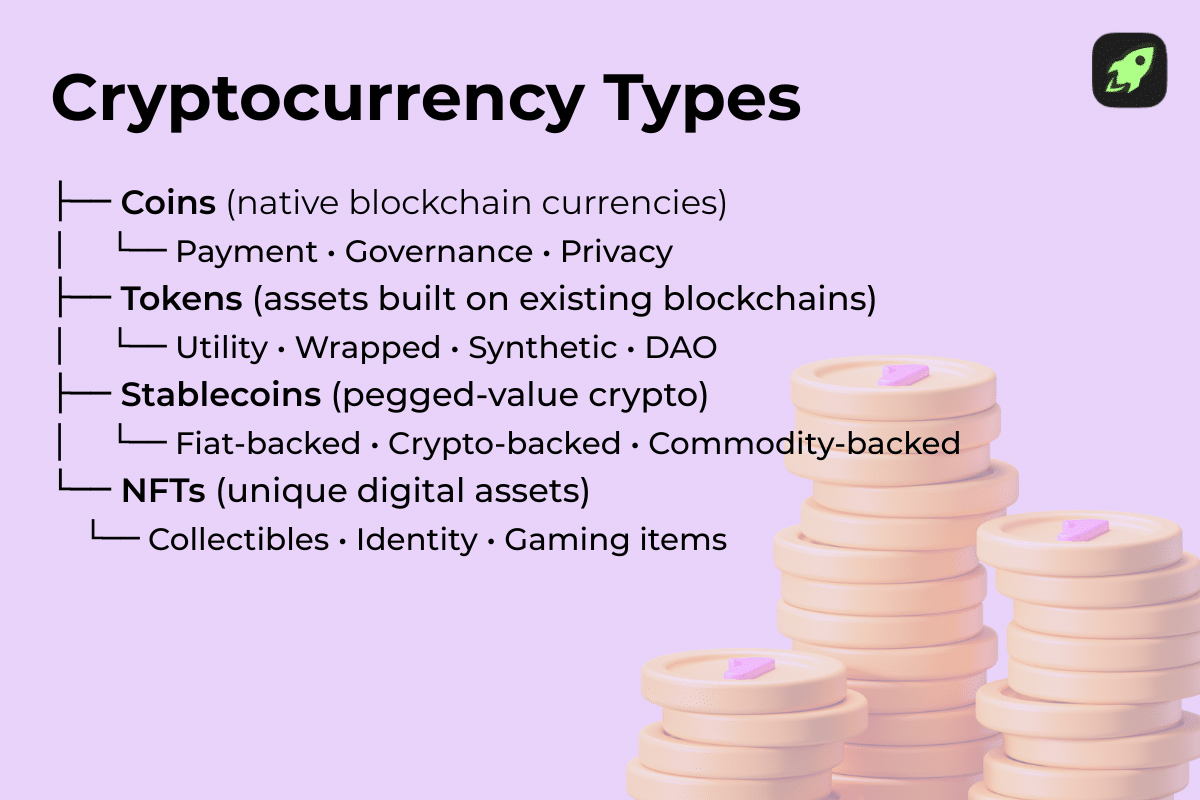

Main Types of Cryptocurrency

Different cryptocurrencies serve different purposes. For example, native currencies power their own blockchains, while other tokens rely on existing networks and often represent either a project or an asset. Of course, there are also stablecoins that aim to maintain a stable price and keep the market more or less in sync with traditional finance.

You’ve probably heard of NFTs (non-fungible tokens), which are unique digital collectibles that prove ownership of art, music, or in-game items. And finally, Central Bank Digital Currencies (CBDCs) are doing their humble part in maintaining government presence within the market. In this guide, we will focus on each type in detail.

Coins: Native Cryptocurrencies

The idea behind coins—native cryptocurrencies—is to be able to pay transaction fees or reward network participants. These currencies help the chain they exist on.

Read more: Coins vs. Tokens: What’s the Difference?

Payment Coins: Bitcoin, Litecoin, Dash

Payment coins are the original form of cryptocurrency—built to move value quickly, securely, and without middlemen. They focus on being efficient digital cash instead of serving complex functions like smart contracts. Bitcoin (BTC) is the pioneer of payment coins. Bitcoin was created to let people send money peer to peer without relying on banks. Litecoin (LTC) followed as a faster, lighter version of Bitcoin. It’s not as popular, but often used for smaller or more frequent payments. Dash (DASH) took it a step further by introducing optional privacy features and instant transactions, making everyday crypto payments even more practical.

Privacy Coins: Monero, Zcash, Dash PrivateSend

The main purpose of privacy coins is keeping your financial activity private. Privacy coins use advanced cryptographic methods to hide details like sender, receiver, and amount. For example, Monero (XMR) uses technologies like Ring Signatures and Stealth Addresses, making transactions completely untraceable.

If you’re looking for more flexibility, Zcash (ZEC) takes a selective approach, allowing users to choose between transparent and shielded transactions using zero-knowledge proofs. Then there are coins like Dash PrivateSend, which offer optional privacy by mixing funds from multiple users and making it difficult to trace where any single coin came from.

Governance Coins: Tezos, Cardano (ADA)

Governance coins turn holders into active participants. They let users propose, vote on, and influence key decisions for a blockchain or protocol they’re using. Tezos (XTZ) was one of the first to introduce on-chain governance and allow upgrades and rule changes to be approved by the community without hard forks. Cardano (ADA) follows a similar principle, giving holders the power to vote on development proposals and funding allocations.

Tokens: Cryptocurrencies Built on Other Blockchains

Tokens are cryptocurrencies that run on existing blockchains, using their infrastructure to serve a project or represent an asset. Here is a list of different types of tokens. We’ll explore each of these in more detail below.

How to Get Free Crypto

Simple tricks to build a profitable portfolio at zero cost

Utility Token

A utility token gives you access to a product or service within a blockchain ecosystem, like paying fees, using features, or unlocking premium tools.

Governance Token

A governance token lets holders vote on project updates, proposals, and decisions, giving its community a say in how the platform changes.

Security Token

A security token represents ownership in real-world assets like stocks or real estate. Because of that, security tokens are regulated similarly to traditional financial securities.

Non-Fungible Token

Non-fungible tokens, or NFTs are one-of-a-kind digital collectibles. They prove ownership of items like art pieces, music, or any unique digital asset.

Read more: Fungible vs. Non-Fungible Tokens

Wrapped Token

A wrapped token is a tokenized version of another coin (like Wrapped Bitcoin on Ethereum). Simply put, they allow the original token to be used on different blockchains.

Synthetic Asset

A digital token that mirrors the price of real assets is a synthetic asset. Synthetic assets aren’t backed by anything, but thanks to cleverly crafted smart contracts, they replicate the market behavior of whatever they represent—stocks, currencies, or commodities. Their main goal is giving their owner exposure to the assets without actually owning them.

Staking Derivative

A staking derivative is a token you receive when staking crypto. It represents your locked assets and allows you to trade or use them elsewhere.

Rebase Token

A rebase token automatically adjusts its supply to maintain a target price. In other words, the number of tokens in your wallet increases or reduces as market conditions change.

Memecoin

Memecoins are designed to be fun and popular. Their power is in the community and the sheer faith that they can succeed. Memecoins are often inspired by memes or pop culture, like Dogecoin or Shiba Inu, and sometimes they even gain real value.

Read more: 10 Best Memecoins to Buy

Asset-Backed Token

If you’re serious about your investment, an asset-backed token is your best bet. These digital tokens are fully supported by real assets like gold, oil, or property. They link crypto value to tangible resources.

Exchange Token

An exchange token is a native token of a crypto exchange platform. These tokens are used for fee discounts, rewards, or, like their governance counterparts, for voting on exchange-related proposals.

Charity Token

Every once in a while, a charity token gets released. Charity tokens are designed to support social causes and a portion of transactions or profits goes directly to charitable organizations.

Fan Token

Celebrities and organizations sometimes release fan tokens—assets that let fans interact with and support their favorite sports teams, artists, or brands. These tokens can allow people to vote, or get rewards and exclusive perks.

Soulbound Token

A soulbound token is a type of non-transferable NFT. Soulbound tokens represent achievements, credentials, or identity. They are permanently tied to the holder’s wallet.

Reward Token

Earned through staking, gaming, or loyalty programs, a reward token encourages participation and rewards user activity within the project it represents.

DAO Token

A DAO token is a type of governance token. It’s used for voting and participation in decentralized autonomous organizations, where members collectively govern and fund shared projects.

Learn more: What Are DAOs and How Do They Work?

Inflation-Resistant Token

The purpose of an inflation-resistant token is to maintain long-term value. This is done by limiting supply growth or pegging the value to stable or deflationary assets like Bitcoin.

Governance NFT

A governance NFT is an NFT with the characteristics of a governance token. It’s a unique collectible that grants its owner decision-making power or voting rights in a project’s system.

Reserve-Backed Token

The name “reserve-backed token” is self-explanatory—it’s a token backed by reserves of stable assets (like fiat or crypto) with the aim of ensuring its liquidity and trust in its value.

Fractional NFT

A fractional NFT is used to split ownership of a single NFT into smaller parts. This way, multiple users can co-own and trade shares of a valuable asset.

Wrapped NFT

Similarly to a wrapped coin, a wrapped NFT tokenizes the original NFT and allows it to be traded or used across different blockchains or platforms.

Metaverse Coins

Digital currencies used inside virtual worlds are called metaverse coins. With these coins, users can buy land, items, or experiences in metaverse platforms like Decentraland or The Sandbox.

Play-to-Earn Coins

Play-to-earn coins are tokens earned by playing blockchain games. The games aim to reward users for time, skill, and participation with real, tradeable value.

Stablecoins: Cryptocurrencies Pegged to Real Value

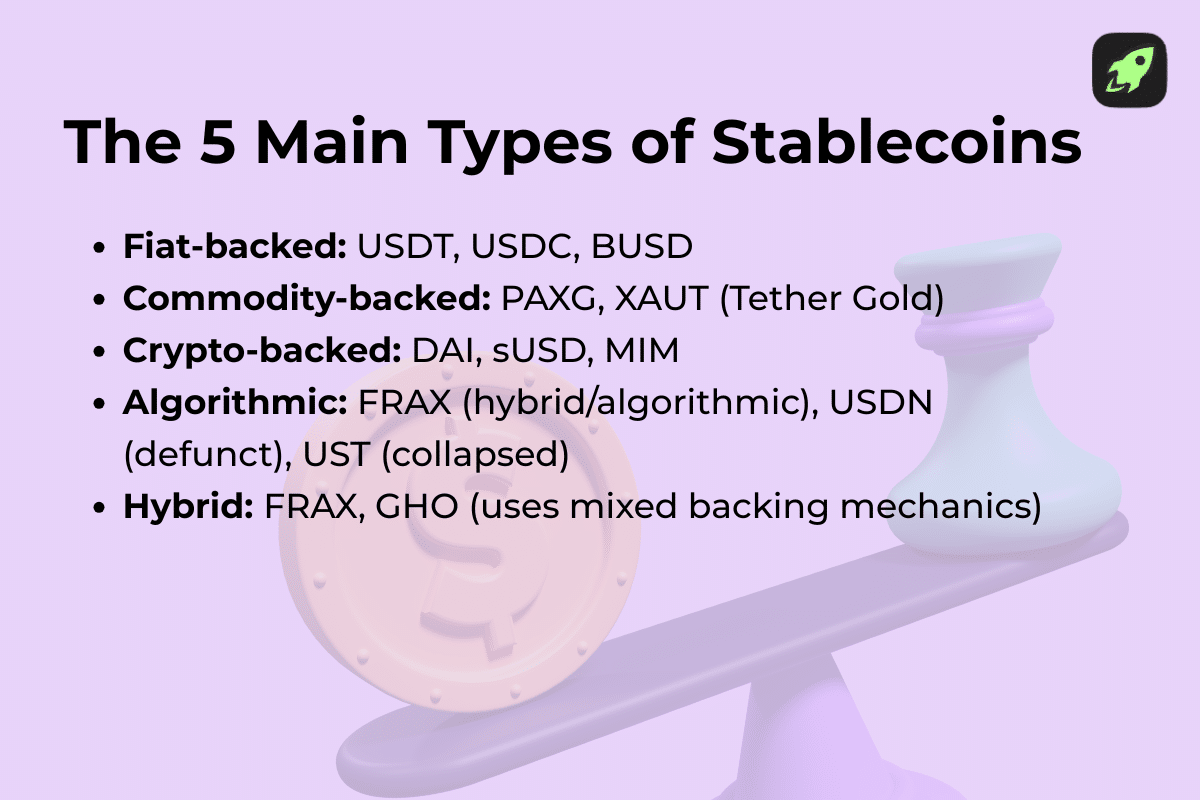

Stablecoins are cryptocurrencies designed to keep a steady value. They’re either backed by real-world assets—like the US dollar, gold, or other crypto—or maintain their value with the help of an algorithm. A stablecoin’s price is pegged to a specific asset, usually one dollar, which makes these coins perfect for storing money and making transactions. Let’s take a quick look at the types of stablecoins.

Fiat-Collateralized Stablecoin

A fiat-collateralized stablecoin is backed by traditional money like US dollars. The money is kept in a bank, while these coins (like USDT or USDC) remain stable specifically because each token represents real cash held in reserve.

Find out which of these two popular stablecoins is the better choice: USDC or USDT?

Crypto-Collateralized Stablecoin

A crypto-collateralized stablecoin is backed by other cryptocurrencies instead of fiat. Excess crypto (like ETH or BTC) is locked on a smart contract to keep the token’s value stable, even if prices swing.

Commodity-Collateralized Stablecoin

A stablecoin pegged to physical goods such as gold, oil, or silver, is called a commodity-collateralized stablecoin. The steady value of real-world assets helps these tokens maintain price stability and value.

Algorithmic Stablecoin

An algorithmic stablecoin uses smart algorithms to balance supply and demand. It helps keep prices stable through automatic minting or burning of tokens.

Read a deeper dive into the topic here: Algorithmic Stablecoins Explained for Beginners

Privacy Stablecoin

Just like a privacy coin, a privacy stablecoin keeps transaction details hidden. The difference is, this coin also has a stable value. It’s ideal for users who want a guaranteed price with extra discretion for their transfers.

Synthetic Dollar

A synthetic dollar is a blockchain-based token that mimics the US dollar’s value using decentralized collateral or smart contracts—without actually holding real dollars in reserve.

Wrapped Stablecoin

A wrapped stablecoin is a version of an existing stablecoin (like Wrapped USDC) that can move across different blockchains for better flexibility and compatibility.

Synthetic Euro

A synthetic euro is designed to follow the value of the euro, often built through decentralized systems using crypto collateral or algorithms.

Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies or CBDCs are digital versions of national money issued by central banks. In every sense they’re just like regular cash, but they only exist online. People can use CBDCs for everyday payments, transfers, or savings—just faster, safer, and more transparent than traditional banking systems.

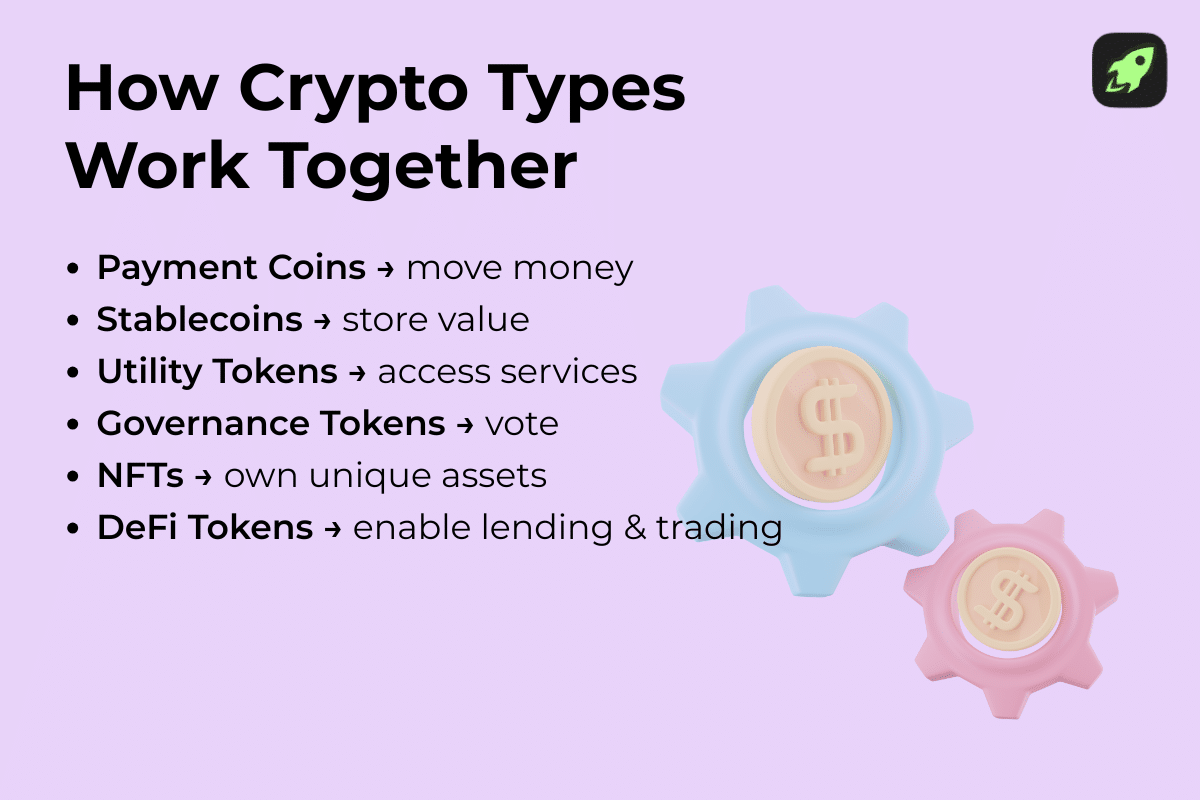

How Crypto Types Work Together

Different types of cryptocurrency work together to build a complete digital ecosystem. Payment coins handle everyday transactions, transferring value between users. Stablecoins keep prices steady for trading and savings, utility tokens grant access to services, and governance tokens let users vote on changes. In that same ecosystem, NFTs represent unique assets, and other tokens enable lending, borrowing, and yield farming. All types of digital assets are vital when it comes to building a connected, flexible financial system that can rival traditional finance.

How to Choose the Right Type of Cryptocurrency for You

Before you start buying the most talked-about coins, ask yourself: what do you need them for? Now that you know how each type of coin is used, you can pick the one that serves your goals.

- Payments and Transfers. You can use payment coins like Bitcoin, Litecoin, or Dash to send money instantly across borders, pay for goods and services, or transfer funds without banks.

- Saving and Stability. Stablecoins such as USDT or USDC are great for storing value or protecting against crypto volatility.

- Investing and Earning. You can use staking tokens (like ETH or ADA) to earn rewards, or hold security tokens that represent real-world assets and generate passive income.

- Accessing Services. Utility tokens unlock features within crypto platforms, like paying gas fees, accessing premium tools, or joining ecosystems.

- Voting and Governance. Governance tokens (like UNI or AAVE) let you participate in community votes.

- Collecting and Gaming. NFTs give ownership of digital collectibles, art, or in-game assets. Play-to-earn tokens reward players for time and skill in blockchain games.

- Trading and Speculation. Buy and trade memecoins or established assets with long-term growth potential.

- Exploring New Worlds. Metaverse coins let you buy land, items, or experiences in virtual worlds like Decentraland or The Sandbox.

How Do I Buy My First Cryptocurrency?

To buy your first cryptocurrency, you’ll need a crypto trading platform (CTP)—an online service that connects buyers and sellers. Some platforms deliver crypto straight to your wallet, while others keep it in their custody. Before signing up, always check if the platform is registered and regulated.

You can choose any of over 1000 coins available on Changelly to start your portfolio.

You may also come across Initial Coin Offerings (ICOs) or Token Offerings (ITOs). New projects run them to raise funds. These tokens often have no guaranteed value and can be risky. Do your research and invest only what you can afford to lose.

Final Thoughts

Navigating the types of crypto can seem overwhelming, but just remember—everything you need to know should be presented in the project’s whitepaper. It’s a document that helps you learn all about the token’s use, perspectives, and tokenomics. Once you know the basics, you’ll be better equipped to evaluate projects and make informed decisions in the crypto space.

FAQ

Why are there so many different coins and tokens?

Each crypto project serves a different purpose—some focus on payments, others on gaming, DeFi, or governance. Developers create new tokens to solve specific problems or power their own ecosystems.

Do all cryptocurrencies have real use?

Not all crypto has real use. Some have strong use cases like payments or lending, while others exist mainly for speculation or hype. It’s best to research how a token is actually used before buying.

Which type of crypto should beginners start with?

Start with well-known coins like Bitcoin or Ethereum. They’re easier to understand, widely supported, and more stable compared to new or experimental projects. A good alternative for beginners is stablecoins, as they’re designed to maintain their price.

How can I spot fake or scam projects?

Check if the team is transparent, the website looks professional, and the project has clear goals. Avoid offers that promise guaranteed profits or sound too good to be true.

Can one crypto be more than one type?

Yes. Some cryptocurrencies fit multiple categories—for example, a governance token might also act as a utility token inside its platform. It depends on how the project is designed.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.