Are you looking for ways to maximize yield from your cryptocurrency investments? If so, then you’ve probably heard of Yearn Finance. This DeFi platform has quickly become one of the most popular in the crypto space. Actually, it became one of the DeFi ventures with the quickest growth to date after attracting approximately $800 million in assets in just one month of operation. That’s because it provides users with a wide range of benefits they can take advantage of. From automated savings accounts to yield farming strategies, Yearn Finance gives investors access to high return on investment opportunities, no matter their experience level.

In this post, we’ll be examining what sets Yearn Finance apart from other DeFi protocols and why it’s become such a sensation amongst crypto enthusiasts.

Table of Contents

- Yearn Finance & YFI Crypto, Explained

- Yearn Finance: Origin Story

- How Does Yearn Finance Work?

- Earn

- Zap

- APY

- Vaults

- Key Benefits of Yearn Finance

- Who Is behind Yearn.finance?

- YFI Tokenomics

- How to Buy Yearn Finance Tokens

- FAQ

- Is Yearn Finance a good investment?

- Is Yearn Finance higher than Bitcoin?

- What is Yearn Finance in crypto?

- Is Yearn Finance a good token?

- Does YFI have a future?

Yearn Finance & YFI Crypto, Explained

Yearn Finance (YFI) is an open-source, decentralized finance platform that supports lending aggregation, yield generation, and insurance on the Ethereum blockchain. It uses a sophisticated set of DeFi protocols, allowing users to maximize their capital gains through yield farming and arbitrage trading while also managing risk with automated stabilization features like liquidity pools and asset dimension optimization.

Exploring the concept of Yearn Finance reveals some strong points that may make it an attractive investment choice. Within the DeFi space, the competitive edge of Yearn Finance lies in its ease of use and full automation, thanks to which users don’t need previous technical knowledge to start earning right away. Additionally, its structured products bring together multiple yield-generating pieces of software under one interface, allowing investors to make the most out of their yields while reducing risk.

The platform’s impressive suite of features includes advanced routines for accumulating interests and hedging crypto assets in decentralized products such as stablecoins and lending services. By leveraging the expertise of the team behind Yearn Finance from both the traditional tech sector and the maturing crypto community, YFI is poised to be a leader in the burgeoning DeFi space for years to come.

Would you like to stay informed on the latest news from the crypto sphere? Subscribe to our emails and receive the freshest news compilation every week!

Yearn Finance: Origin Story

Yearn Finance (YFI) has a fascinating origin story. It came about in early 2020 when its creator, Andre Cronje, released the protocol (which is technically a set of protocols) with the idea of creating an automated yield optimization platform.

YFI’s innovative concept and flexible design system were a hit in the DeFi community as it quickly grew in popularity throughout the summer and fall months. With an emphasis on building a strong open-source community around YFI, Cronje released YFI tokens as a way for developers to reward each other for their contributions to the project. This strategy proved successful, and before long, YFI’s market cap dramatically rose.

Today it stands as one of the most talked-about topics in the crypto sphere and is widely seen as one of the most influential digital projects launched in 2020.

How Does Yearn Finance Work?

Yearn Finance set up a number of unique tools to act as a yield aggregator for the biggest lending protocols, including Aave, Curve, Balancer, and Compound. A protocol called yearn.finance was created to deploy contracts on the Ethereum blockchain and various decentralized exchanges that run on it, like Balancer and Curve.

Yearn finance offers several lending and trading services, and here’s a closer look at them.

Earn

With its first product, Earn, yearn.finance has enabled its customers to always receive the highest rates as they take advantage of changes in interest rates on three liquidity platforms — Aave, dYdX, and Compound.

Zap

Zap allows platform users to make multiple investments with a single click. For example, a user can exchange DAI for yCRV in one action, compared to three actions on the yearn.finance and the Curve Finance platform.

APY

The APY feature scans all of the lending protocols that Earn employs and provides the user with an estimate of the annualized rate of interest they can expect to earn for a specific amount of capital.

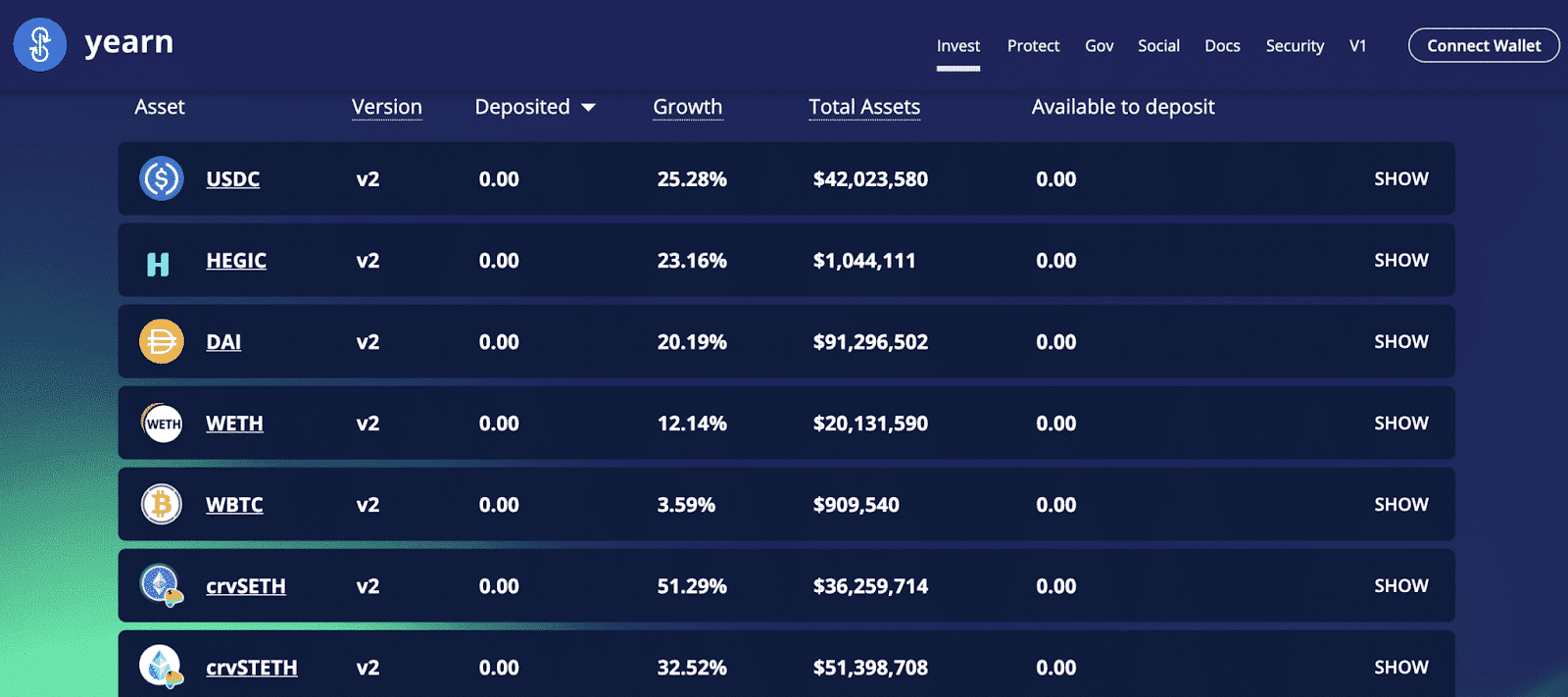

Vaults

The platform’s self-executing code helps users pursue active investment plans with Vaults, yearn.finance’s most sophisticated feature. Yearn Vault is a smart contract that collects liquidity from investors on various platforms. Vaults are comparable to actively managed mutual funds in this regard.

Vaults are financial pools that adhere to specific investment strategies. Their usage allows community members to collaborate on developing techniques that identify the optimal yield protocol.

Key Benefits of Yearn Finance

DeFi was made available to the typical internet explorer by Yearn Finance. In the absence of Yearn Finance, traders would have to manually transfer their liquidity to the protocol with the highest rate of return. Being a skillful programmer, Andre Cronje was able to automate this practice and scale it up for the general public in the form of Yearn Finance.

Investors, developers, and even other DeFi initiatives interested in working with yearn.finance can all find something to their liking on the Yearn platform. The Earn, Zap, and APY products assist cryptocurrency investors in lending or trading their holdings for short-term yields in an effort to increase their chances of creating passive income. When users utilize the Earn product — basically a yield farming tool — to obtain the highest interest rates among the Aave, dYdX, or Compound lending protocols, Zap and APY significantly enhance their user experience.

Who Is behind Yearn.finance?

Andre Cronje, a veteran of the crypto and DeFi industries, introduced the yearn.finance protocol without any backing from either the public or the business sector. Instead, the software architect applied more than 20 years of software development knowledge before issuing YFI tokens to retail investors.

According to Cronje, DeFi has become so technical that it is now almost impossible for the typical person to connect with it, which is why yearn.finance focuses on creating a straightforward and basic user interface.

Cronje recently declared that he was the first to deposit his money into yearn.finance and that he would be the last to take it out in an effort to make it the safest DeFi protocol currently available.

YFI Tokenomics

The Yearn Finance platform has its own native cryptocurrency — Yearn Finance (YFI) — which is an ERC-20 utility and governance token. The Yearn protocol initially intended to set a fixed supply of 30,000 tokens. However, that number was increased to 36,666 tokens based on YFI holders’ consensus. As a result, token holders reap the benefits of incentives from Yearn’s earnings from transaction fees.

Yearn Finance has all the hallmarks of a truly decentralized DeFi initiative that puts the interests of YFI token holders first by granting them the ability to vote on community-submitted ideas. Any member of the yearn.finance governance forum can initiate Yearn Improvement Proposals (YIPs). If the majority of members agree with it, the YIP will be submitted for official voting using the YFI governance staking mechanism.

How to Buy Yearn Finance Tokens

If you are looking for the best options to buy or sell Yearn Finance tokens, do not hesitate to turn to Changelly — we’ve gathered the best rates across the industry in one place for you. Check it yourself, and you’ll be pleasantly surprised by favorable rates, low fees, instant transactions, and the highest security standards we offer!

FAQ

Is Yearn Finance a good investment?

When assessing whether Yearn finance is a good investment, it is important to weigh both the risks and the rewards. Yearn provides access to a wide range of digital assets as well as other high-yielding DeFi products and services. That makes it ideal for those willing to take on some risk while capturing high returns. Overall, Yearn Finance can be a wise choice for investors who understand the associated risks and have researched their options thoroughly.

Wanna know what the future holds for the YFI cryptocurrency? Click here to see our YFI price prediction.

Is Yearn Finance higher than Bitcoin?

No, the YFI token is not higher than BTC at the moment. Although this crypto asset set its all-time high (ATH) of $90,787.00 in May 2021, the coin appears to be falling due to a period of DeFi weakness, which is brought on by a number of factors.

What is Yearn Finance in crypto?

Yearn Finance is a decentralized finance (DeFi) platform that allows users to deposit cryptocurrencies and benefit from yield farming opportunities. It serves as a DeFi protocol, providing investors with both the liquidity they need and access to yield-bearing assets in one place.

Is Yearn Finance a good token?

Despite its relatively short time on stage, the YFI token seems to have gained impressive popularity and interest among crypto traders and enthusiasts alike. Yearn Finance has partnerships with some of the leading industry players, giving it even more credibility as a good token.

Does YFI have a future?

Since its launch in 2020, YFI has become one of the most popular cryptocurrencies, gaining attention from both institutional and retail investors. Thanks to its status as a DeFi token, holders generally believe it will remain popular and valuable due to the fact that more and more investors are choosing to invest in digital assets such as Ethereum, Bitcoin, Uniswap, and YFI. Many traders also feel secure knowing that YFI’s inflation rate is low enough to ensure future gains for those who decide to hodl their tokens.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.