Hardly anyone who has any sort of involvement in the crypto space hasn’t at least heard about DeFi.

While decentralization has been the main focus of all things crypto, there’s no other field in the blockchain industry that embraces it as well as DeFi does. Its main goal is to provide users with fully functional and efficient decentralized alternatives to all mainstream financial services such as loans, storage, and so on.

Why do we need DeFi? Well, for the same reason we need blockchain technology — there’s a serious lack of privacy and transparency in the modern world. Decentralized finance aims to eliminate third-party involvement in people’s businesses and personal lives by creating fully secure and anonymous financial services.

Table of Contents

- What Is DeFi in Crypto?

- How Does DeFi Work?

- Uses of Decentralized Finance

- Payments

- Stablecoins

- Lending and borrowing

- DeFi platforms — dApps and DEXs

- Is Ethereum a DeFi?

- Prediction markets

- Centralized Finance vs. Decentralized Finance

- What Are the Benefits of DeFi?

- Is Crypto DeFi Risky?

- What Makes DeFi So Important?

- The Future of DeFi

- DeFi’s Evolution and the Emergence of DeFi 2.0

- DeFi: FAQ

- Is DeFi different from crypto?

- What is the purpose of Decentralized Finance?

- What is the total amount of money locked in DeFi projects?

- What are the ways to generate income with DeFi?

- When will DeFi go mainstream?

- How to get involved with DeFi?

- How does DeFi challenge traditional banking?

- How do you make money with DeFi?

- Is it safe to invest in DeFi?

What Is DeFi in Crypto?

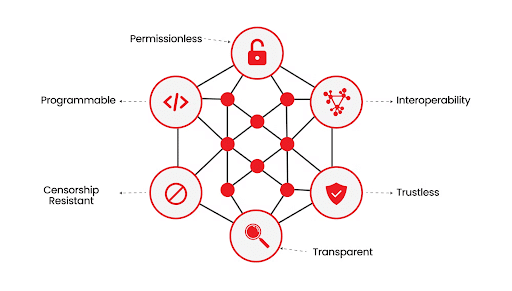

DeFi, also referred to as decentralized finance, is a rapidly growing sector of the cryptocurrency industry. It is a financial system that runs on a network without central control. DeFi differs from the centralized financial system in that it utilizes smart contracts on blockchain technology, which allows users to carry out financial transactions without having to depend on centralized institutions.

DeFi is a new type of financial system that is not controlled by centralized financial institutions. Instead, it is built on decentralized networks that allow for carrying out complex financial transactions without any intermediaries. This allows for greater accessibility to capital and financial services, as well as trustless transactions and direct negotiation of interest rates.

DeFi allows users to lend, borrow, trade, and invest in digital assets without having to go through traditional bank systems. This means that users can access any financial product such as loans, insurance, derivatives, and more without having to go through a bank or other financial institution.

How Does DeFi Work?

DeFi works by using smart contracts on blockchain technology to enable decentralized financial transactions. Smart contracts are self-executing digital agreements that are stored on the blockchain and can be used to facilitate transactions between two parties without the need for a third party intermediary.

Users can access capital and financial services directly through DeFi applications, such as savings accounts, peer-to-peer payments, and borrowing and lending platforms. DeFi protocols mitigate the need for a bank account, allowing users to borrow money and earn interest without going through the traditional financial system.

Uses of Decentralized Finance

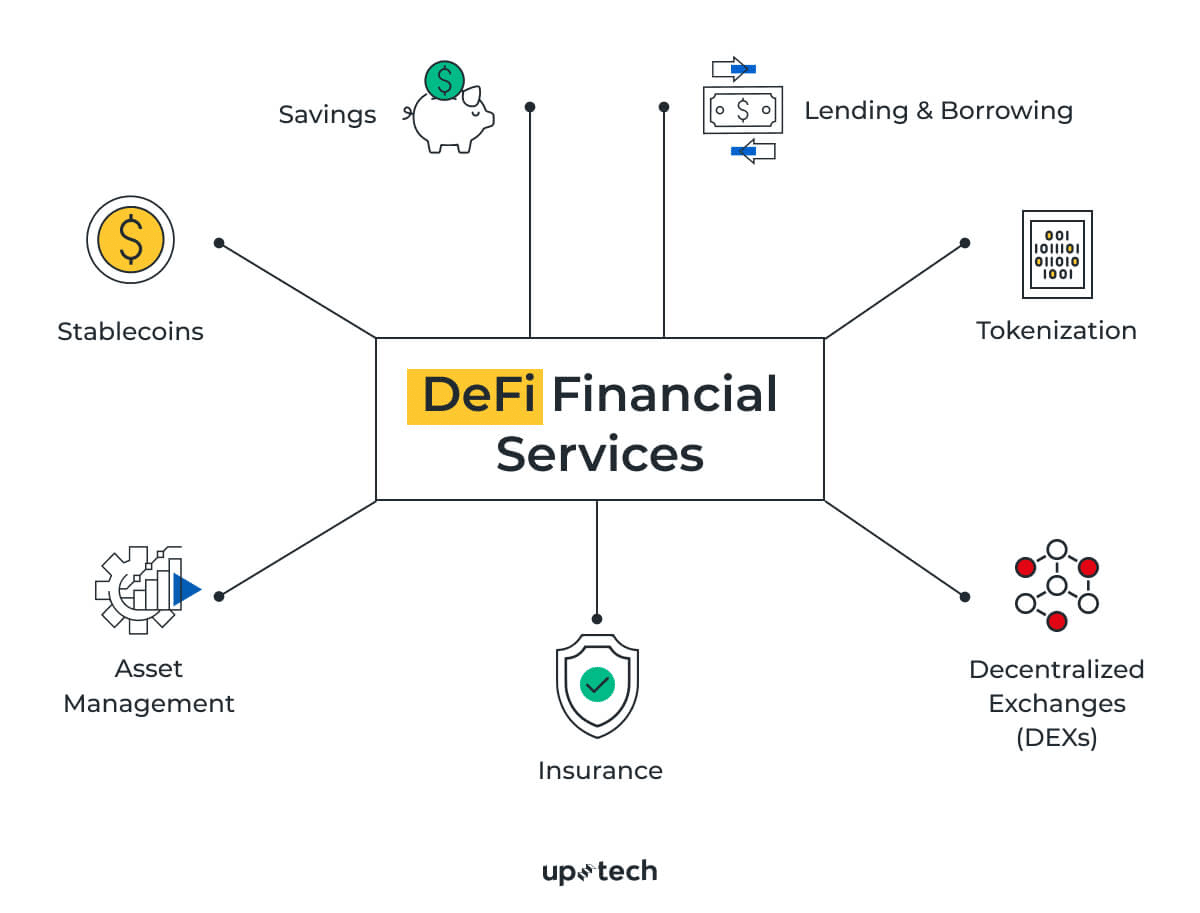

DeFi applications use smart contracts and the distributed ledger technology (DLT) to offer decentralized versions of a wide range of traditional financial products and services.

Payments

DeFi enables users to send payments directly to each other without involving middlemen like banks or payment processors. With this, transactions are conducted quicker and more effectively, as well as with lower fees.

Stablecoins

A stablecoin is another vital entity that supports and improves the decentralized financial industry. Stablecoins are cryptocurrencies aimed at decreasing the volatility of the price of a traditional or digital asset. They can be pegged to fiat currencies like the USD (USDT, USD Coin), the EURO (Stasis EURO), or other exchange commodities like gold (DGX) or even a crypto asset like BTC (imBTC).

The mechanism and importance of stablecoins in the DeFi industry are vividly demonstrated by the MakerDAO DeFi protocol and its stablecoin DAI. DAI aims to bring financial freedom with no volatility to everyone. You can instantly generate the stablecoin on your terms while getting income for holding DAI.

Lending and borrowing

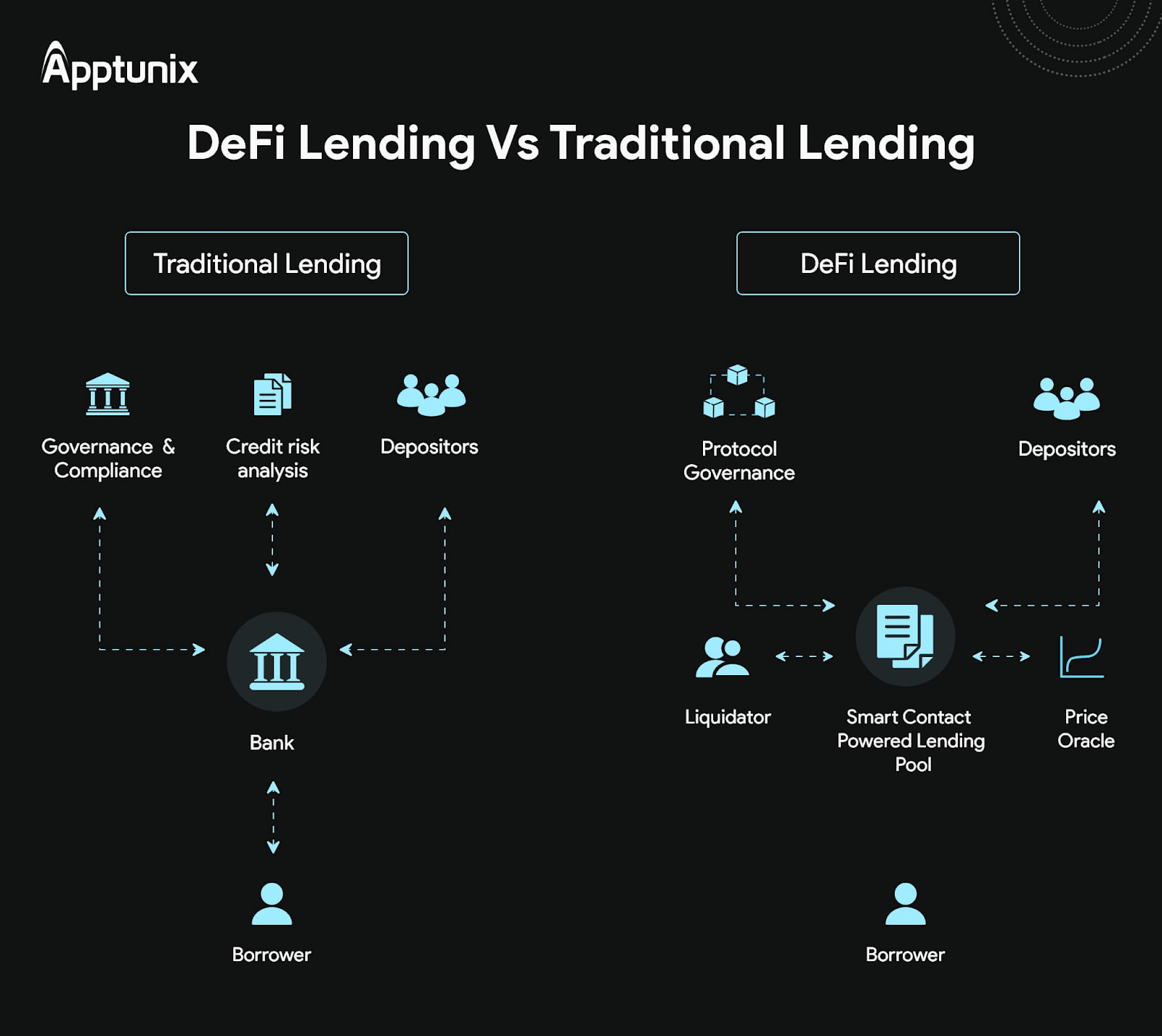

DeFi borrowing and lending platforms enable users to access capital without needing to work with a traditional financial institution. For those without access to traditional banking services, this can be incredibly helpful.

One of the greatest advantages of decentralized lending marketplaces (besides the lack of any third parties) is that they provide an assurance in the form of cryptographic verification methods. Decentralized lending platforms offer not only loans but also an opportunity to earn interest.

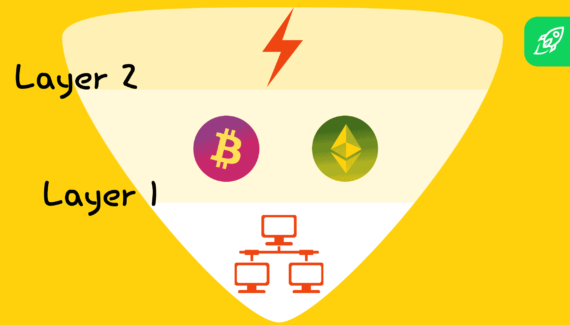

DeFi platforms — dApps and DEXs

Ethereum-based DeFi enables developers to create decentralized apps (dApps) on the Ethereum blockchain, facilitating different types of financial transactions. Similar DeFi apps also exist on a wide variety of other networks, like Solana. A DeFi application is a much more democratic alternative to traditional platforms and games. They are typically powered by utility DeFi tokens.

Decentralized exchanges or DEXs have been on the market for almost 3 years. Being built predominantly on top of the Ethereum blockchain (the most popular platform for a dApp deployment), each decentralized exchange provides real-time digital money trading along with high transaction throughput. They have many advantages, like lack of central authority, total transparency, accessibility, and so on.

Is Ethereum a DeFi?

No, Ethereum is not DeFi, but it serves as the primary foundation upon which many DeFi applications are built. Ethereum is a blockchain platform that allows developers to create and deploy smart contracts and decentralized applications (dApps). DeFi, or Decentralized Finance, refers to a subset of financial applications and services that are built on blockchain platforms, primarily Ethereum, to operate without traditional intermediaries like banks. Many DeFi projects utilize Ethereum’s smart contract functionality to create decentralized lending platforms, stablecoins, exchanges, and other financial services. So, while Ethereum itself is not DeFi, it provides the infrastructure that has enabled the DeFi ecosystem to flourish.

Prediction markets

DeFi technology also makes it possible to build oracles and prediction markets, helping to generate more accurate data for financial transactions.

Conventional centralized prediction markets have always been in great demand. Today, with the help of DeFi, we’ve got a chance to make them more open and decentralized. Here are three main advantages of decentralized prediction markets over centralized ones:

- No restrictions. Anyone from Alaska to South Africa can participate in a decentralized prediction market.

- Open-source code. Unlike closed-source centralized prediction markets, peer-to-peer markets are publicly available, and all the transactions can be seen in the blockchain.

- Trust. Users don’t need to trust anyone but the code and themselves. There is no third party that holds your funds. You are responsible for and in control of your digital assets.

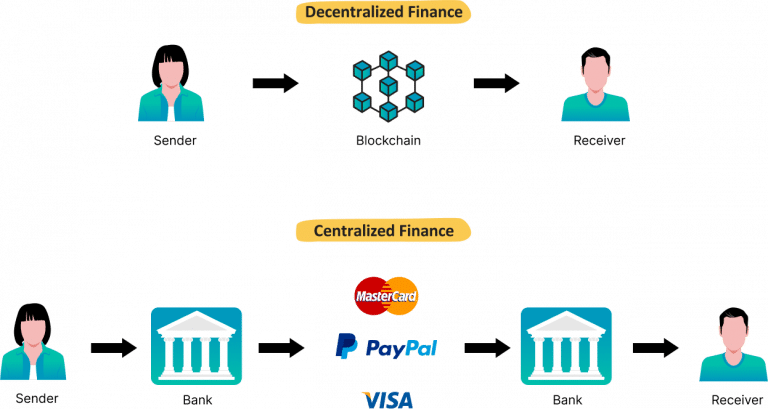

Centralized Finance vs. Decentralized Finance

When people say centralized finance, they usually mean traditional financial institutions like banks, not the centralized exchanges on the crypto market. Traditional finance is typically managed by centralized financial institutions, while decentralized finance is based on distributed networks.

Centralized systems are something that pretty much everyone is familiar with and knows how to navigate — what adult, or even a kid, doesn’t have a debit or credit card these days?

Meanwhile, decentralized finance is a much more novel concept — most people would probably go “Huh? What is DeFi?” if it is ever mentioned in a conversation. However, as it provides solutions to a lot of key issues people typically have with the traditional institutions, like one’s local bank, it has a place in the current world and the future.

The decentralized nature of dApps and DEXs makes them a lot less vulnerable to attacks and much less expensive compared to their traditional counterparts since blockchain ensures the immutability of all data recorded on it.

What Are the Benefits of DeFi?

DeFi, or Decentralized Finance, is a burgeoning system that stands poised to redefine the landscape of traditional finance. It offers a myriad of advantages, chief among them being improved efficiency and access to a global pool of investors.

- Universal Accessibility: DeFi democratizes financial services by providing unparalleled access to those who are unbanked or have limited banking services. Its decentralized nature means that anyone with an internet connection can tap into these services, breaking down geographical and socio-economic barriers.

- Direct Control Over Assets: Users have increased autonomy over their assets in the DeFi ecosystem. They can manage and control their funds directly, sidestepping the need for third-party intermediaries like banks.

- Cost Efficiency: By eliminating middlemen, DeFi significantly reduces the costs associated with financial transactions. This democratization of finance leads to more affordable services for end users.

- Enhanced Security: DeFi platforms leverage distributed ledger technology (DLT), making them inherently resistant to hacking and fraudulent activities. This decentralized approach distributes data across multiple nodes and, therefore, eliminates a single point of failure.

- Transparency and Trust: All transactions and activities on the blockchain are recorded and can be audited by users. This transparency fosters a sense of trust and accountability, which is often lacking in traditional financial systems.

- Innovative Financial Products: The DeFi space is a hotbed of financial innovation. Users can explore novel opportunities like yield farming, prediction markets, and liquidity mining, which are often more lucrative and versatile than traditional financial products.

Is Crypto DeFi Risky?

Yes, investing in crypto and DeFi (Decentralized Finance) can be risky. Here are some reasons why:

- Market Volatility: Cryptocurrencies are known for their price volatility. Prices can swing dramatically in short periods, leading to significant gains or losses.

- Smart Contract Vulnerabilities: DeFi platforms rely on smart contracts. If these contracts have bugs or vulnerabilities, they can be exploited, potentially causing substantial financial losses for users.

- Lack of Regulation: The DeFi space operates in a regulatory gray area in many jurisdictions. This lack of oversight can expose investors to fraud and scams.

- Liquidity Risks: Some DeFi platforms might struggle with liquidity, making it difficult for users to withdraw or exchange their assets when desired.

- Loss of Funds: In the crypto world, if you lose access to your private keys or fall victim to a scam, you might not be able to recover your funds. There’s often no central authority to turn to for recourse.

- Impermanent Loss: In DeFi liquidity pools, there’s a risk called “impermanent loss,” which can occur when providing liquidity in a decentralized exchange. It happens when the price of your deposited assets changes compared to when you deposited them, leading to potential losses.

- Platform Risks: The failure or shutdown of a DeFi platform can result in the loss of user funds. This can be due to technical issues, regulatory crackdowns, or other unforeseen challenges.

- Complexity: DeFi platforms and tools can be complex, and a lack of understanding can bring about mistakes and financial losses.

While the potential rewards can be high, it’s essential to approach crypto and DeFi investments with caution, thorough research, and an understanding of the associated risks. Always consider diversifying investments and only invest what you can afford to lose.

What Makes DeFi So Important?

DeFi is so significant because it provides a more accessible and comprehensive way to access and employ financial services. This disruptive technology has the power to upend traditional financial organizations and create a more distributed financial system.

The democratization DeFi apps offer to users can provide substantial benefits to small and big businesses alike, and the increased integrity of decentralized applications can help to combat manipulation and tax evasion. Decentralized finance can help to build a more secure, accessible financial system that will benefit all of its participants (excluding criminals, of course!).

The Future of DeFi

The trajectory of DeFi seems bright as the momentum shifts towards decentralized applications and pioneering financial services. While there’s a consensus on the potential of DeFi to reshape the financial landscape, the question of regulation looms large. Proper regulation is pivotal to ensure consumer protection and security, but the extent and nature of such oversight remain subjects of intense debate.

Beyond just the realm of cryptocurrencies, DeFi has the potential to democratize the entire financial spectrum. It promises to grant unparalleled access and control over financial assets to users globally. The growing adoption of tools like VPNs underscores a rising concern about personal data security. Given this trend, DeFi’s emphasis on decentralization and privacy positions it favorably for continued growth and popularity in the coming years.

DeFi’s Evolution and the Emergence of DeFi 2.0

However, as with any nascent technology, there are critics who argue that DeFi hasn’t fully lived up to its initial promises, particularly concerning accessibility, sustainability, and true decentralization. This sentiment has given rise to the concept of “DeFi 2.0” — a new wave of projects and protocols aiming to address the shortcomings of the first generation. To delve deeper into this evolution and what DeFi 2.0 entails, be sure to check out my article on the topic — click here.

DeFi: FAQ

Is DeFi different from crypto?

Yes, DeFi (Decentralized Finance) is different from crypto, though they are closely related. “Crypto” generally refers to cryptocurrencies, which are digital or virtual currencies that use cryptography for security and operate independently of a central authority. Bitcoin and Ethereum are examples of cryptocurrencies. DeFi, on the other hand, refers to a movement or system that aims to recreate traditional financial systems (like lending, borrowing, and trading) without intermediaries, using blockchain technology. While DeFi operates using cryptocurrencies and smart contracts (primarily on the Ethereum blockchain), not all cryptocurrencies are involved in DeFi. In essence, crypto is the broader category of digital assets, while DeFi represents a specific application of those assets to disrupt and decentralize financial services.

What is the purpose of Decentralized Finance?

DeFi leverages blockchain and smart contract technology to establish decentralized applications that are responsible for providing decentralized financial services, eliminating the need for conventional centralized banking.

What is the total amount of money locked in DeFi projects?

The Total Value Locked in DeFi is a measure of the cryptocurrency assets held in decentralized finance platforms, protocols, and lending services. At the time of writing, the Total Value Locked in DeFi was 48 billion USD.

What are the ways to generate income with DeFi?

Making money with DeFi can be done in multiple ways, such as yield farming, lending platforms, and prediction markets. People can access financial services such as earning interest or borrowing money quickly and without being limited by geographical boundaries or needing a bank account. It is important to be mindful of the potential risks and other issues that come with investing in DeFi.

When will DeFi go mainstream?

As increasing numbers of people become familiar with blockchain technology and DeFi, it is expected that the cryptocurrency phenomenon will continue to gain traction among investors, resulting in widespread acceptance. Nevertheless, it can be difficult to pinpoint an exact timeframe for when this will take place. It is challenging to determine an accurate timeline of when this will happen.

How to get involved with DeFi?

To get involved with DeFi, users need an internet connection, a digital wallet, and, preferably, crypto tokens to access capital and use DeFi applications (DeFi dApps). Users can use decentralized exchanges to trade cryptocurrencies or access a DeFi platform to earn interest or borrow money. It is important to understand the risks involved and to use caution when investing in DeFi projects.

How does DeFi challenge traditional banking?

DeFi seeks to disrupt traditional banking by providing decentralized financial services and products independent of centralized financial providers. Utilizing smart contracts and blockchain technology, DeFi seeks to facilitate trustless financial transactions, with the aim of offering users a greater degree of transparency, privacy, and control.

How do you make money with DeFi?

Individuals can generate profits by utilizing yield farming, lending platforms, or investing in any DeFi app through the decentralized finance ecosystem. Investors should be aware of the potential high returns as well as the risks associated with investing in these assets before committing.

Is it safe to invest in DeFi?

Placing money in DeFi comes with inherent dangers, including possible smart contract flaws and other challenges related to blockchain technology. Nonetheless, there are consumer protections and decentralized insurance available through many DeFi protocols and projects to reduce these risks. One should always do their due diligence and exercise caution when investing in DeFi.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.