The rise of cryptocurrency has been nothing short of phenomenal. In just over a decade, digital assets have gone from being a niche interest to becoming a significant player in global finance. Yet, the future of cryptocurrency remains uncertain, and the debate over whether it will eventually replace traditional currency continues to rage. This article will explore the various factors shaping the future of cryptocurrency and consider its potential implications for the global financial system.

Table of Contents

- Why Are Cryptocurrencies Important?

- What Does the Future Hold for Cryptocurrency?

- Epic battles over regulation

- Web3 platforms on a rise

- More losses, more pain

- Truly global bitcoin adoption

- Crypto outside of the sector

- Web3 gets fashionable

- Don’t count out NFTs

- Gaming and DAOs expanding

- The downfall of the big exchanges

- The space regroups

- Why cryptocurrency may not be the future of money

- The truth about trustless systems

- Based on ‘nothing’

- Rise of the CBDC (Central Bank Digital Currencies)

- The Future of Crypto Is Bright If Governments Help Manage the Risks

- Should You Invest in Cryptocurrencies?

- Wrapping Up: Is Crypto the Future Money?

Why Are Cryptocurrencies Important?

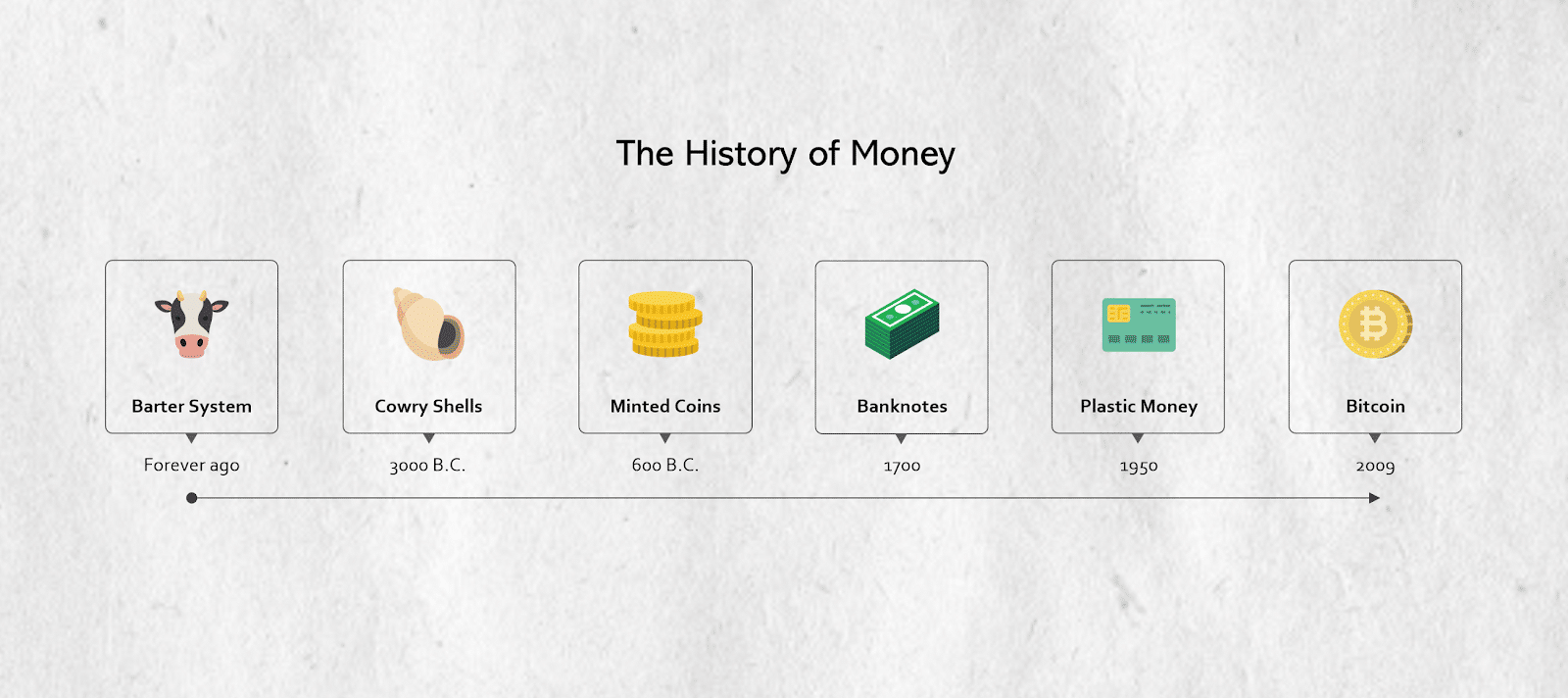

The history of money is a fascinating journey that spans thousands of years, reflecting humanity’s evolving needs and desires for a medium of exchange. From the earliest forms of bartering, where goods and services were directly exchanged, to the use of commodities like shells, salt, and cattle as currency, societies gradually developed more efficient methods for transactions. With the advent of metal coins, money became more portable, durable, and divisible, eventually giving way to paper currency and banknotes. The modern era saw the emergence of digital payment systems, credit cards, and electronic money transfers, further streamlining transactions and promoting globalization. The rapid advancement of technology and the increasing interconnectedness of the world have culminated in the development of cryptocurrencies. Born out of the desire for a decentralized, secure, and borderless form of currency, cryptocurrencies like Bitcoin emerged as a radical alternative to traditional monetary systems, pushing the boundaries of what money can be and how it can function in a rapidly evolving digital landscape.

Cryptocurrencies represent a paradigm shift in the way we perceive and handle money. They offer several key advantages over traditional financial systems:

- Decentralization: Cryptocurrencies operate on decentralized networks, eliminating the need for central authorities and intermediaries. This decentralization fosters greater financial freedom and independence for individuals and businesses worldwide.

- Financial inclusion: Cryptocurrencies have the potential to provide access to financial services for billions of unbanked and underbanked individuals, promoting economic growth and reducing poverty.

- Security and privacy: The use of blockchain technology and cryptography in cryptocurrencies ensures secure and private transactions, protecting users from fraud and identity theft.

- Cost efficiency and speed: Cryptocurrency transactions are often faster and cheaper than traditional methods, particularly for cross-border payments.

What Does the Future Hold for Cryptocurrency?

As we stand on the precipice of a new era in finance, the future development of cryptocurrencies is a topic that captures the imagination of investors, technologists, and policymakers alike. The potential of these digital assets to revolutionize the global financial landscape is immense, but so are the challenges and uncertainties that lie ahead. In this text, we delve into the factors shaping the future of cryptocurrencies, exploring the innovations, trends, and regulatory developments that could propel the crypto sector into uncharted territories, ultimately redefining the way we perceive and engage with money.

Epic battles over regulation

— “Regulation is a necessary evil in the cryptocurrency world.” – Charles Hoskinson, Co-founder of Ethereum and Cardano

Governments and regulatory bodies worldwide are struggling to strike the right balance between fostering innovation and maintaining stability in the financial markets. Some countries, like China, have taken a hardline approach, banning cryptocurrencies outright. In contrast, others, such as Malta and Switzerland, have become crypto-friendly hubs, attracting businesses and investors alike.

These differing approaches to regulation have led to epic battles between authorities and the crypto community, with each side vying for supremacy. As cryptocurrency continues to gain traction, the global regulatory landscape will likely remain a battleground for the foreseeable future.

Web3 platforms on a rise

Web3 platforms, which aim to build decentralized internet infrastructure, have been growing at an impressive rate. This growth is driven by a desire to create a more open, inclusive, and secure internet, free from centralized control.

Cryptocurrency is an integral part of Web3, enabling decentralized finance (DeFi) applications and empowering users to take control of their financial lives. As Web3 platforms continue to grow, they will drive greater adoption of cryptocurrencies, increasing their potential to become the future of money.

More losses, more pain

Despite its growth, the cryptocurrency market remains notoriously volatile. High-profile hacks, scams, and sudden price crashes have left many investors nursing significant losses. The emotional and financial pain endured by those affected will likely serve as a deterrent for some potential investors, slowing down the pace of cryptocurrency adoption.

Truly global bitcoin adoption

— “Bitcoin is a remarkable cryptographic achievement, and the ability to create something that is not duplicable in the digital world has enormous value.” – Eric Schmidt, former CEO of Google

One of the most significant selling points of cryptocurrency is its ability to facilitate borderless transactions. As the world becomes more interconnected, the appeal of a truly global currency like Bitcoin becomes increasingly apparent. If Bitcoin can overcome challenges such as scalability, high fees, and energy consumption, it may become widely accepted as a global means of exchange.

Crypto outside of the sector

While the cryptocurrency world continues to grow, it’s important to remember that traditional finance is still an essential part of the global economy. In the future, we may see a shift in focus from cryptocurrencies as a standalone asset to their integration with existing financial systems. This integration will likely spur innovation and drive further adoption of digital assets.

Web3 gets fashionable

As cryptocurrencies gain mainstream acceptance, they’re increasingly being embraced by major players in various industries. Luxury fashion brands, such as Louis Vuitton and Gucci, have begun experimenting with blockchain technology and non-fungible tokens (NFTs) to authenticate their products and combat counterfeit goods. This trend will likely continue, with more industries adopting cryptocurrencies and blockchain technology in the future.

Don’t count out NFTs

NFTs have taken the art and collectibles world by storm, enabling artists and creators to monetize their digital works. While some argue that NFTs are a passing fad, others see them as a natural evolution of the digital age, offering new opportunities for artists and collectors alike. As the NFT market matures, it’s likely to become an increasingly important driver of cryptocurrency adoption.

Gaming and DAOs expanding

— “The metaverse is gaming on steroids, and cryptocurrencies are its financial layer.” – Tim Sweeney, CEO of Epic Games

Gaming and decentralized autonomous organizations (DAOs) are two areas where cryptocurrency has the potential to make a significant impact. Gamers are already using digital assets to purchase in-game items and participate in virtual economies, while DAOs enable decentralized decision-making and governance.

As gaming and DAOs continue to grow, they will drive greater demand for cryptocurrencies, further entrenching them in the digital world.

The downfall of the big exchanges

As regulatory scrutiny increases and new technologies emerge, the landscape of cryptocurrency exchanges is likely to shift. Decentralized exchanges (DEXs) are already challenging the dominance of centralized platforms by offering greater security, privacy, and control for users.

In the future, we may see more “disaggregated” exchanges that specialize in specific niches, such as DeFi, NFTs, or gaming, rather than attempting to cater to all aspects of the cryptocurrency market.

The space regroups

As the cryptocurrency industry matures, it will likely undergo a period of consolidation and regrouping. Market participants will need to adapt to new technologies, regulatory environments, and use cases, with some businesses failing and others thriving. This process of adaptation will be crucial in determining the future of cryptocurrency and its role in the global financial system.

Why cryptocurrency may not be the future of money

Despite their numerous advantages, digital currencies face several challenges in becoming the future of money:

- Volatility: Crypto market is known for their extreme price fluctuations, making them unsuitable as a stable store of value. This volatility can deter potential users and hinder widespread adoption.

- Scalability: As cryptocurrencies grow in popularity, their networks must be able to handle increasing transaction volumes. Scalability remains a challenge for many cryptocurrencies, with slow transaction times and high fees during peak periods.

- Regulatory uncertainty: Governments and regulatory bodies worldwide are grappling with how to regulate the crypto industry effectively. This uncertainty can impede the growth and adoption of virtual currency.

- Public perception: Many people still associate crypto projects with illicit activities, scams, and hacks. This negative perception can hinder mainstream acceptance and adoption.

The truth about trustless systems

Cryptocurrencies promise to create a more transparent, secure, and equitable financial system by eliminating the need for trust in centralized institutions. However, the reality is that trustless systems are not entirely devoid of trust. Users must still trust the underlying technology and the developers who maintain it.

Based on ‘nothing’

Critics argue that cryptocurrencies are based on nothing and have no intrinsic value. However, the same can be said for fiat currencies, which are also backed by the trust and belief in their worth. The true value of cryptocurrencies lies in their potential to democratize finance, foster financial inclusion, and enable new forms of economic activity.

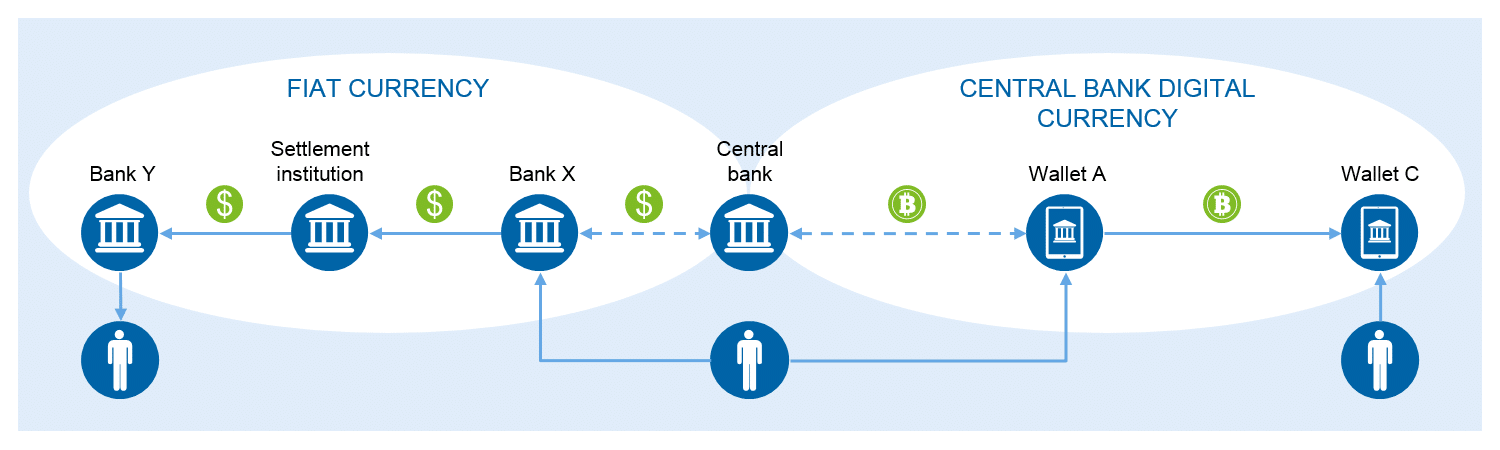

Rise of the CBDC (Central Bank Digital Currencies)

A growing number of countries, such as China and Sweden, are exploring the possibility of issuing their own Central Bank Digital Currencies (CBDCs). These digital currencies would be backed by the respective central banks, providing a stable and secure digital alternative to traditional fiat money. As central banks around the world recognize the potential benefits of digital currencies, such as faster transaction times, reduced costs, and increased financial inclusion, they are taking steps to develop and potentially implement CBDCs. This trend highlights the growing interest in digital currencies among central banks and may significantly impact the future of finance, both in terms of monetary policy and the broader digital currency ecosystem.

The implementation of CBDCs could have several potential implications for the crypto sector:

- Increased competition: CBDCs could provide an alternative to existing cryptocurrencies, especially for those primarily used as a means of payment or store of value. As CBDCs offer the stability of fiat currencies and the convenience of digital assets, they could potentially attract users away from cryptocurrencies, increasing competition in the digital currency space.

- Enhanced regulation and oversight: The introduction of CBDCs might be accompanied by increased regulation and oversight of the entire digital asset ecosystem. As central banks and governments become more involved in the digital currency space, they may establish stricter regulations for existing cryptocurrencies, exchanges, and wallet providers to ensure a level playing field and maintain financial stability.

- Improved public perception: The launch of CBDCs could help legitimize digital currencies in the eyes of the public, as they would be issued and backed by central banks. This could lead to increased interest and adoption of digital currencies in general, including cryptocurrencies.

- Interoperability challenges: CBDCs and cryptocurrencies may operate on different technological platforms and protocols, potentially leading to interoperability challenges. The integration of CBDCs and existing cryptocurrencies may require the development of new technical solutions and standards to ensure seamless transactions between the two types of digital assets.

- Financial inclusion and innovation: The implementation of CBDCs could promote financial inclusion by providing a digital payment option to underbanked and unbanked populations. This could, in turn, spur innovation in the broader crypto sector, as companies and developers seek to capitalize on the growing interest in digital currencies and create new products and services.

- Collaboration between central banks and the crypto sector: The development and implementation of CBDCs may encourage central banks to engage with and learn from the crypto sector. This could lead to collaboration between the two spheres, fostering innovation and the development of new technologies to support both CBDCs and cryptocurrencies.

In conclusion, the introduction of central bank digital currencies could have both positive and negative implications for the crypto sector. While CBDCs may increase competition and regulation in the digital currency space, they could also contribute to the legitimacy, innovation, and growth of the industry. The ultimate impact of CBDCs on the crypto sector will depend on the specific design and implementation choices made by central banks and the ability of the crypto sector to adapt and evolve in response.

The Future of Crypto Is Bright If Governments Help Manage the Risks

Cryptocurrencies undoubtedly hold immense potential to transform the global financial system. However, realizing this potential will require cooperation between various stakeholders, including governments, regulatory bodies, businesses, and users.

Governments and regulators must strike a delicate balance between fostering innovation and mitigating risks associated with cryptocurrencies. They can achieve this by:

- Establishing clear regulatory frameworks: Well-defined regulations can provide legal certainty and encourage responsible innovation in the cryptocurrency space.

- Collaborating with industry stakeholders: Governments should work closely with businesses, developers, and users to understand their concerns and create informed policies that support the growth of cryptocurrencies.

- Promoting education and awareness: By educating the public about the benefits and risks of cryptocurrencies, governments can help create a more informed and responsible user base.

- Implementing risk management measures: Governments can help manage the risks associated with cryptocurrencies by developing robust anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, as well as implementing cybersecurity measures to protect users and the broader financial system.

Should You Invest in Cryptocurrencies?

The decision to invest in cryptocurrencies is a personal one and depends on various factors, including your risk tolerance, investment goals, and financial situation. As crypto investors, it’s crucial to weigh the potential rewards against the risks associated with investing in this rapidly evolving sector. Here are some key factors to consider:

- Crypto winter: The cryptocurrency market is known for its extreme volatility, with periods of rapid growth often followed by sharp declines, referred to as “crypto winter.” Prospective cryptocurrency investors must be prepared to weather these fluctuations and potentially hold onto their investments during downturns.

- Diversification: Crypto trading can be an attractive option for those looking to diversify their investment portfolios. As an emerging asset class, cryptocurrencies often exhibit low correlation with traditional assets, such as stocks and bonds, providing diversification benefits.

- Crypto regulation: The regulatory landscape for cryptocurrencies is constantly evolving, and changes in regulations can have significant impacts on the market. Investors should stay informed about regulatory developments, such as those from the Securities and Exchange Commission (SEC), as they may affect the value and viability of their investments.

- Market maturity: The cryptocurrency sector is still relatively young and evolving rapidly. This presents both opportunities and risks for investors. While early adopters may reap substantial rewards, the market’s immaturity also means that there may be limited historical data and established best practices for crypto trading.

- Risk management: Investing in cryptocurrencies can be high-risk, and it’s essential to employ proper risk management strategies. This includes allocating only a small portion of your investment portfolio to cryptocurrencies, diversifying your crypto holdings, and being prepared to withstand potential losses. It’s also crucial to conduct thorough research and due diligence before investing in any cryptocurrency or related project.

- Technological advancements: The cryptocurrency sector is driven by constant innovation and technological advancements. While this can present exciting investment opportunities, it also means that the landscape can change quickly, making it crucial for investors to stay informed and up-to-date on the latest developments in the space.

- Long-term perspective: Given the inherent volatility of the cryptocurrency market, adopting a long-term investment perspective can be beneficial. By focusing on the potential long-term growth of the sector, rather than short-term price movements, investors may be better positioned to weather market fluctuations and realize potential gains.

- In conclusion, investing in cryptocurrencies can be a rewarding but high-risk endeavor. Prospective crypto investors should carefully consider their risk tolerance, investment goals, and the various factors affecting the cryptocurrency market before diving in. By staying informed about regulatory developments, employing proper risk management strategies, and adopting a long-term perspective, investors can make more informed decisions and potentially capitalize on the growth of the cryptocurrency sector.

Wrapping Up: Is Crypto the Future Money?

In conclusion, the future of cryptocurrency is rife with both opportunities and challenges. Its potential to revolutionize the global financial landscape is immense, offering new pathways to financial inclusion, economic growth, and decentralized governance. However, the path to becoming the future of money is far from certain, with obstacles such as regulatory battles, market volatility, and integration with traditional financial systems posing significant hurdles.

As the cryptocurrency ecosystem continues to evolve, it will be crucial for all stakeholders – governments, regulators, businesses, and individuals – to work together to address these challenges and unlock the full potential of digital assets. By fostering innovation while managing risks, we can ensure that the future of cryptocurrency is not only bright but also sustainable, ultimately paving the way for a more inclusive and equitable financial system.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.