Though the cryptocurrency market is quite volatile, with every year the number of crypto investors is increasing. Thanks to that at the beginning of 2019 the market capitalization reached the mark of more than 130 billion dollars. This article is indeed not a primer for cryptocurrency trading, but it will help you understand the term of exchange rates, how do they form and differ.

Table of Contents

What Is Exchange Rate

An exchange rate is a rate at which one currency can be exchanged for another. In other words, it is the value of a currency you want to get compared to that of your own.

Hence, if you are exchanging Ethereum for XRP, the exchange rate shows the amount of XRP you get depending on the amount of ETH that you choose. For example, at the moment the video below was taken the approx. ETH-XRP exchange rate was 1ETH:457.2025XRP

What is Fixed Exchange Rate

A fixed exchange rate is a rate that totally matches with the amount displayed to the user at the beginning of the exchange, independently from further rate volatility. Due to the volatile nature implementing fixed rates can be very risky for the exchange.

Both Changelly website and Changelly mobile apps offer users a way to avoid exchange rate risk during the transaction interval.

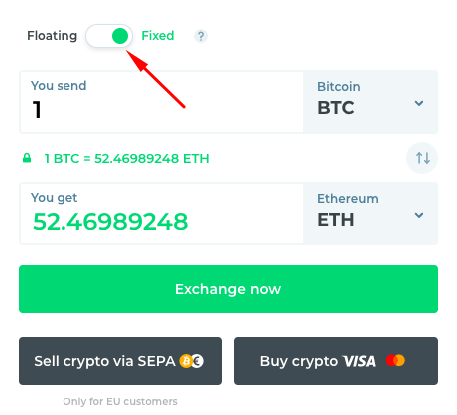

To lock the rate, (which Changelly refreshes every 30 seconds), you need to shift the rate switch from Floating to Fixed position (as shown on the screen below) – that will activate the “fix rate” feature and guarantee the rate displayed on the screen. As soon as the transaction is created, a user has 15 minutes to send the money.

PROS: You know the amount you are going to get from the very beginning of the exchange.

CONS: You pay an extra fee for eliminating risks. If the market goes up during the transaction, the rate won’t raise along with it, hence you won’t get additional revenue.

What is Floating Exchange Rate

During the standard flow, any transaction has its own unique exchange rate. Due to the volatile nature of the cryptocurrency market, ever-changing network fees, the floating rate might change any other second. As a result, you might receive more or less than you thought you would. The GIF below clearly illustrates how the floating exchange rate may change within minutes.

PROS: As a rule when exchanging one crypto for another using the floating rate mechanism, the exchange service offers the best rate on the market plus the user pays the minimum possible fee. Moreover, if the market fluctuations play into your hands, you may get a more significant amount of the desired crypto than the amount that was displayed at the very beginning of the exchange.

CONS: You should always take into account the volatility risks. As the rate may change both in positive and negative ways, you may either get some extra income or less than expected.

How Rates Get Formed on Changelly

Below are the general principles of how rates form on Changelly:

- Let’s say a user has some amount of Crypto#1 and wants to exchange it for Crypto#2.

- The user enters the amount of Crypto#1 for the exchange.

- Changelly finds the best exchange rate among several crypto exchanges and gives the estimation, which means it reports the approximate amount of Crypto#2 that the user will get.

- Changelly estimates the final amount of Crypto#2 according to the floating rate, not the fixed rate, which means the service does not set the exact time of sending the asset, but when Crypto#1 reaches the address given by Changelly service, it exchanges automatically at the rate given by that moment. Hence, the amount that is provided at the beginning of the exchange, and the final amount that reaches the user’s wallet might slightly differ.