Not all crypto losses come from hacks or fake wallets. Some come from design choices hidden in smart contracts. These setups allow entries but block exits—like a trap that only closes once you step inside.

These scams are often called honeypots. They look normal, feel safe, and behave like real projects until you try to leave. This guide explains how honeypots work, common warning signs, and how to protect yourself.

Table of Contents

What Is a Honeypot Crypto Scam?

A honeypot crypto scam is a type of crypto fraud designed to trap you: it’s built to invite in deposits, then block exits.

Scammers promote these traps as attractive investment opportunities and create urgency.

It’s a deceptive scheme where everything looks real at first. The token, website, and activity all appear legitimate, often copying legitimate projects you may already trust. You can buy the token, but you cannot sell it. That design causes direct financial loss once your funds get stuck.

Honeypots succeed because they exploit trust, speed, and basic trading habits. If you ever interact without proper due diligence, you risk falling victim to it, too.

How Honeypot Crypto Scams Work

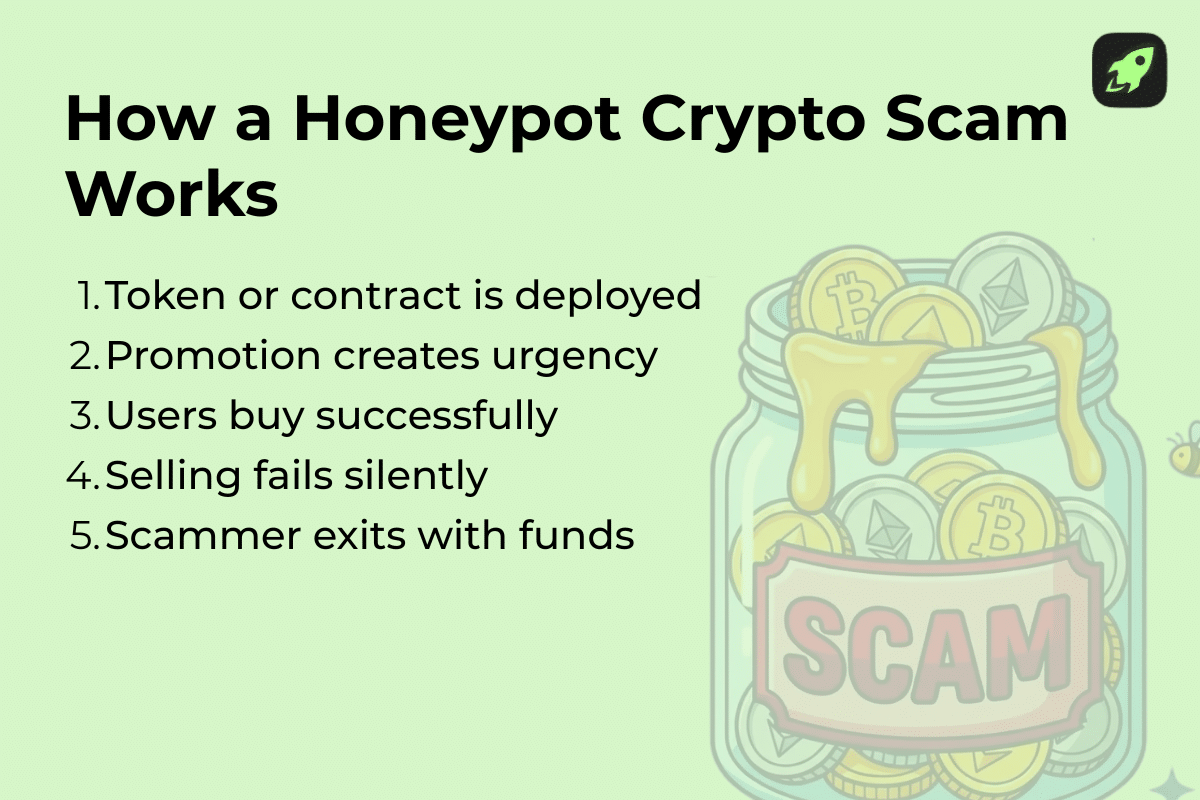

Honeypot attacks follow a repeatable pattern. Scammers design traps that look safe and familiar. They lure investors in with profitable promises and urgency. Once an unsuspecting victim interacts, they quietly lose control of their investment.

1. Creation of a Fake Token or Smart Contract

Originally deployed on Ethereum, these techniques now appear across EVM-based networks.

The scam begins with a malicious smart contract that hides its restrictions. It behaves like a standard Ethereum smart contract, a pattern common across the Ethereum network and other EVM-compatible chains.

Scammers issue a native token that looks tradable. Its on-chain data appears real. But the token is still fake by design.

When the victim interacts, the contract allows buying but silently blocks selling.

2. Attracting Investors with Promises

Scammers then drive attention to the scam. They promote the token across social media platforms using coordinated social media campaigns. Some posts claim fake partnerships or staged celebrity endorsements. Such early ‘activity’ makes the token look popular and like it’s gaining traction. New users see movement and rush in. The pitch frames the scam as exclusive investment opportunities with a limited time window.

3. The Trap: Deposit, but No Withdrawal

Buying works without issues. Selling fails.

Error messages often blame gas fees or network problems, but the truth is that the contract is programmed to prevent withdrawals.

You check the wallet address. Everything looks correct. You never shared your private key, yet the funds remain locked. This behavior is a clear red flag: the setup most likely funnels liquidity into a single permissioned sell address.

4. Scammer Cashes Out

Once enough liquidity builds, the scammer’s wallet activates. Bad actors use automated tools like sweeper bots to ‘sweep’ funds: assets are immediately transferred to a third wallet. Your funds disappear, while scammers exit quietly. This final stage ends the operation and leaves you with no recovery path.

Types of Honeypot Crypto Scams

The setup varies, but the goal stays the same: honeypot attacks eventually lock your funds while looking safe. Every version has a bad actor abusing trust, speed, and poor checks. Below are the most common types you will encounter.

1. Smart Contract-Based Honeypots

This type relies on a malicious smart contract. These scams dominate Ethereum-based tokens because anyone can deploy contracts quickly.

The code allows for buy functionality but quietly restricts exits. An address blacklist lets the deployer decide who can sell.

Scammers automate the trap using automated scripts to hide the restrictions. The exploit stays invisible to casual users. Once you interact, the attacker controls outcomes.

2. Liquidity Honeypots

Liquidity honeypots abuse liquidity pools on an automated market maker. You can add funds and trade in, but exits fail. Scammers may route trades through decentralized exchanges to look safe. Behind the scenes, contract logic or pool rules prevent withdrawals. Charts move, volume appears real, but liquidity only flows one way.

3. Ponzi Scheme Integration

Some honeypots blend with Ponzi-style mechanics. These deceptive schemes promise rewards for early users. Scammers lure investors by paying early participants with later deposits. The structure collapses once inflows slow. At that point, trapped funds remain locked, while the scammer exits.

4. Fake Airdrops

Fake airdrops target curiosity and greed. Scammers advertise free tokens that look fake only after the damage is done. You’re asked to connect your wallet or sign a transaction. This does not expose private keys, but can approve malicious contract actions. As a result, the interaction can silently grant spending permissions or execution rights.

The scam operates on a real network, which adds credibility. No funds arrive, but access gets compromised.

5. False ICO or Token Sale Scams

These scams copy early token launches. They advertise exclusive investment opportunities tied to known brands. Websites mimic legitimate projects and claim backing from a trustworthy company. Some projects even rely on paid actor marketing to simulate organic interest. But once sales end, tokens lock or disappear. Buyers are left holding assets they cannot sell.

6. Fake DeFi Protocols

Fake DeFi protocols are built to look like a real system you can trust. The interface feels complete and functional. Deposits work without issues. Rewards appear on-screen. Behind the scenes, however, the platform operates as a honeypot system. Once you deposit funds, withdrawals stop. Errors appear or transactions fail silently. By the time you realize what’s happened, control already belongs to the scammer.

Some Honeypot Technologies

Honeypots did not start in crypto. They actually come from cybersecurity. Security teams use them to study attacks without risking real assets. Scammers just borrowed the same ideas and reversed the goal. Instead of studying attackers, they trap users. Understanding these technologies helps you see how crypto honeypots are designed.

At a basic level, honeypots exist to lure attackers into interacting with something that looks valuable. The system records behavior and exploits trust. In crypto scams, meanwhile, you become the target instead of the attacker.

Client Honeypots

Client honeypots simulate normal user behavior. They interact with websites, apps, and contracts automatically. Security teams pair them with intrusion detection systems to catch real threats. This setup creates fewer false positives than passive monitoring. Scammers adapt this logic to watch how users trade, sign, and approve transactions.

Malware Honeypots

Malware honeypots exist to observe malware attacks in a controlled way. They collect data on how malicious code spreads, triggers, and executes. Security teams use this to understand attack patterns and improve defenses.

Crypto scammers reuse the same logic: They track how wallets interact, which approvals succeed, and where users hesitate. This feedback helps scammers refine scripts that drain wallets, block withdrawals, or trigger only after specific actions. Over time, the scam becomes harder to detect because it adapts to user behavior.

Honeynets

Honeynets are groups of connected traps. They look like active environments, not single decoys. They often connect to other systems to appear realistic. Some even resemble a real system with ongoing activity. This realism increases trust and keeps victims engaged longer.

Database Honeypots

A database honeypot focuses on stored value. Its purpose is to obtain information from anyone who interacts with it. These systems often contain fake but realistic sensitive information.

In crypto scams, this approach targets wallet approvals, signatures, or private metadata. You may be asked to approve a transaction that looks harmless. That approval can grant ongoing access to your funds. Once signed, the scammer can act without asking again.

Low- vs. High-Interaction Honeypots

- Low-interaction honeypots offer limited functions and collect basic data.

- A high-interaction honeypot behaves almost like a real product.

In crypto, high-interaction traps cause the most damage because everything appears normal. You can trade, stake, or claim rewards without errors for a long time, but when you finally try to withdraw, the contract blocks you and locks your funds.

Real Examples

Squid Game (SQUID) Token Scam, 2021

In late October 2021, a fraudulent token called Squid Game (SQUID) exploded in popularity after launching on Binance Smart Chain. It claimed to be tied to a play-to-earn game inspired by the hit Netflix show Squid Game.

The price surged by thousands of percent in days. Investors raced in, hoping for quick gains.

Then, many discovered that they could not sell their tokens: sales were technically blocked by a sell restriction in the smart contract. Within hours, developers withdrew liquidity and vanished. The token price crashed to nearly zero, and victims lost millions of dollars. This remains one of the most infamous crypto honeypot scams of the Web3 era.

Dechat PancakeSwap Honeypot Incident, 2024

In February 2024, the Dechat project mistakenly linked a honeypot token in an official announcement.

This error on PancakeSwap directed users to a trap token instead of the legitimate contract. Investors tried to interact, thinking they were engaging with a real project, only to find their funds locked.

Recurring Sophisticated Honeypot Campaigns, 2024

Blockchain security firm Hacken reported that in early 2024, a single attacker executed multiple honeypot scams totaling about $3.2 million in stolen funds.

These attacks used deceptive smart contracts with hidden mechanisms that either blocked withdrawals or drained victim assets after interaction. They were promoted through various channels, including Telegram and crypto forums, using coordinated tactics that resembled low-effort promotions, and ended up causing real damage.

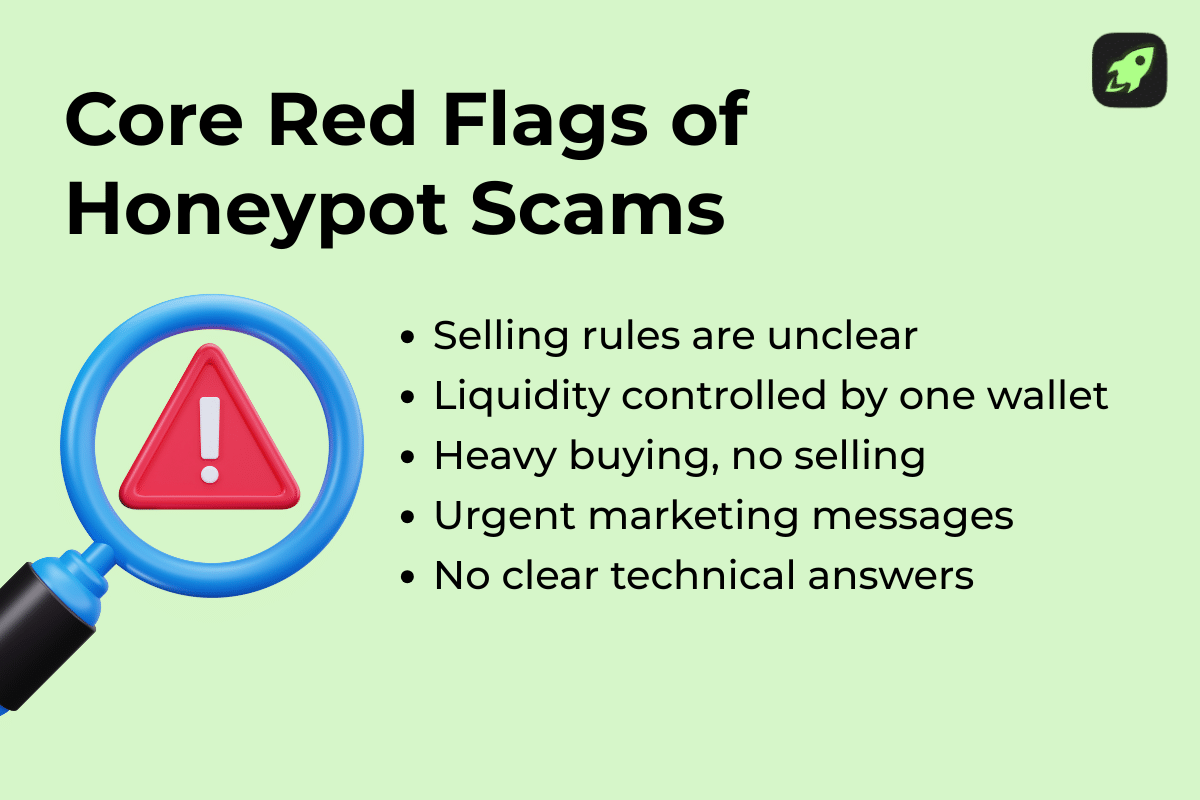

Common Characteristics of Honeypot Crypto Scams

Honeypot crypto scams all share the same structure. You can spot them early if you know where to look.

The first red flag is missing or unclear selling rules. The project explains how to buy, not how to exit.

As you dig deeper, signals stack up:

- Contracts hide permissions

- Liquidity sits in one wallet

- Teams avoid direct answers

- Marketing pushes urgency instead of facts

When you ignore these signs, the result is predictable financial loss.

How to Protect Yourself

You protect yourself by slowing down and checking the basics. To avoid falling victim to these scams, assume nothing is safe by default. Every trade needs due diligence. That means reading the rules, not trusting the hype. Strong security habits help you identify risks early, before money leaves your wallet.

If you want a practical tool for daily use, we’ve created a short anti-scam checklist PDF. It covers the most common warning signs and decision checks before you click, connect, or send. Drop your email address below and we’ll send it your way.

Learn how to spot scams and protect your crypto with our free checklist.

Red Flags in Token Contracts

Start with the code. Many scams rely on a malicious smart contract that hides selling limits. Look for restrictions on transfers or selling.

Be careful even on trusted production systems like the Ethereum mainnet, Binance Smart Chain, or Polygon. A scam can run on a live network with real users and real volume. Network legitimacy does not equal project safety.

Legitimate projects will regularly publish smart contract audits from known firms. Stick to trustworthy company audits with public reports.

Signs in Liquidity Pools and Exchanges

Next, study trading conditions. Always check how trading actually works.

Start with liquidity pools. Look at who provides the liquidity. If one wallet controls most of it, you depend on that wallet’s behavior. That’s a real risk.

Then check crypto exchange activity. Sudden price spikes without a long history should slow you down. Fast pumps attract attention, not stability.

Next, open the transaction history. Scroll for a minute. Do you see real sells, or only buys? When buying works but selling barely happens, something’s wrong. One-way trades often generate fake liquidity signals, indicating the exits are blocked by design. If selling works for some wallets only, an address whitelist may be active.

If trading feels one-directional, trust that feeling. Markets need exits. When exits disappear, safety disappears with them.

Warning Signs in Marketing and Social Media

Now look at how the project talks to you.

Scammers push speed. They flood social media platforms with urgency and promises. Aggressive social media campaigns focus on price, and not on the product.

Be extra careful with celebrity endorsements. YouTube, X, Reddit, and Discord are flooded with fake promotions and AI-generated deepfakes pushing shady projects. Screenshots, reposts, or vague shout-outs prove nothing. Anyone can fake a mention or pay for exposure.

Real teams publish clear documentation, explain risks, and answer hard questions. Scams avoid details and rush you to act.

Tools for Contract and Token Analysis

You don’t need coding skills to verify claims yourself.

Tools like Token Sniffer scan contracts automatically. They flag blocked sells, hidden taxes, and risky permissions. This helps you spot problems before you interact. Treat warnings seriously, even if hype looks strong.

Blockchain explorers such as Etherscan and BscScan show real on-chain activity. Open a block explorer to review holders, transaction flows, and contract controls. This data shows who holds power and whether real users can sell.

These checks reveal who controls the token and how it behaves. Learn more about how to stay safe in crypto in our dedicated guide.

What to Do If You’re Trapped in a Honeypot

If you hit a honeypot, treat it as a security incident. You need to act quickly but calmly.

- Stop interacting with the contract.

- Do not approve new transactions.

- Revoke existing permissions.

- Transfer safe assets to a new wallet.

- Document what happened.

Be careful with recovery services. Many promise help but cannot actually reverse smart contracts. In most cases, the locked amount cannot be recovered. It helps to accept that early and shift your focus. Protect what you have left, secure your wallet, and avoid making the situation worse.

Final Thoughts

Honeypots work because they blend in. They look like any other token at first. That’s why a skeptical mindset helps. When details about selling are missing or unclear, pause. A few minutes of due diligence often prevent weeks of frustration later.

FAQ

How is a honeypot scam different from a rug pull?

Honeypot scams trap you at the contract level. You can buy, but selling fails by design. A rug pull works differently. Developers remove liquidity after launch. Both exploit trust, but honeypots block exits from the start. Rug pulls collapse suddenly. Honeypots lock you in quietly.

Can I recover my funds if I fall for a honeypot scam?

No, you usually can’t recover funds lost to a honeypot. Smart contracts execute as written. There is no reversal. Law enforcement rarely helps due to jurisdiction limitations. Accept the financial loss and focus on prevention. Recovery services promising refunds are often also scams.

What tools can I use to detect honeypot scams before investing?

Tools like Token Sniffer can flag blocked sells and risky permissions. Blockchain explorers can confirm real trading activity. Remember that legitimate projects publish audits and allow contract source verification. These checks take minutes and prevent expensive mistakes.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.