Decentralized finance has reshaped money transfers as we know them. The new standards for speed and security challenged traditional payment systems, forcing them to adapt. That’s how PayFi came to be. Combining the qualities of crypto payments with the accessibility and user-friendly interfaces delivered by regular banks, PayFi is making its way into people’s everyday lives. And it’s not going to stop.

Table of Contents

What Is PayFi? (Payment Finance Explained)

PayFi, short for Payment Finance, describes using blockchain for payment systems. Global financial transactions can be processed without intermediaries with the speed and security that we get from decentralized finance. There are no correspondent banks involved, and the process is fully managed by smart contracts. This helps to reduce fees and bypass many issues associated with traditional payment systems. This defines PayFi—seamless, programmable payments built for speed and efficiency, which is why more and more payment processors are turning to this practice.

How PayFi Works: From Payments to Financing

From the user’s point of view, it might seem like PayFi works just like your average bank: you press “send” and your money goes to the recipient. But the inner mechanisms of financial transactions in this system are entirely different. Below is a step-by-step explanation of how PayFi works.

Step 1: A Business Issues an Invoice (a Future Payment)

The seller creates an invoice for goods or services, listing the amount and due date. For the buyer, it looks like a normal bill, but for PayFi, it’s a record that can be moved and financed on-chain.

Step 2: The Invoice Becomes a Tokenized Receivable (RWA)

The created invoice is converted into a digital token representing the receivable (a real-world asset, or RWA). This process is called tokenization, which makes the receivable tradable, traceable, and programmable on the blockchain.

Step 3: Smart Contracts Connect the Buyer, Seller, and Lender

The invoice terms are encoded in a smart contract that automatically links all parties. It enforces all the conditions—payment date, penalty, proof of delivery—that in traditional payments would be presented on paper. The smart contract also triggers additional actions like funding or repayment without manual intervention. It essentially fills the role normally occupied by a third party, thus eliminating intermediary charges.

Step 4: A Liquidity Provider Funds the Receivable Upfront

A lender or liquidity provider buys the tokenized invoice, immediately paying the seller (minus a fee or discount). The provider then holds the receivable and collects the full payment from the buyer later—effectively financing the seller’s cash flow.

Step 5: Settlement with Stablecoins or On-Chain Currency

When the invoice matures, the buyer pays on-chain using stablecoins or another crypto. The smart contract verifies payment and releases funds to the liquidity provider. Any fees or settlements are executed automatically. Thus, PayFi provides a seamless payment experience with transparent transactions.

Because PayFi works on the principles of decentralized finance (DeFi), it allows businesses to send and receive money through real-time payments with instant settlement. Since everything is programmable, PayFi projects can add features like escrow, factoring, or recurring billing without relying on multiple intermediaries.

How to Get Free Crypto

Simple tricks to build a profitable portfolio at zero cost

Key Components of the PayFi Ecosystem

PayFi is used for different types of financial transactions, like cross-border payments, crypto payments, and so much more. All these can’t exist without a few key elements. Every PayFi network relies on these components for cost-efficiency and financial inclusion.

Smart Contracts

Smart contracts are digital agreements that automatically execute when certain conditions are met, ensuring secure and transparent transactions. In PayFi, they remove the need for intermediaries found in traditional finance, reducing transaction fees and fraud risks. Since transactions occur directly between parties, businesses and users benefit from instant settlement and smoother payment processing without hidden fees.

Real-World Assets (RWAs)

RWAs represent tokenized versions of assets like invoices, real estate, or commodities. By bringing tangible assets on-chain, PayFi connects traditional finance with global payments. RWAs also capture the time value of money, giving investors and business owners access to usable funds faster. This bridge between real assets and digital systems allows businesses to grow more efficiently in global finance.

Stablecoins

Stablecoins are digital currencies pegged to stable assets like the US dollar or euro. They make cross-border and crypto payments predictable by minimizing volatility. Within PayFi, they help achieve instant settlement and simple currency conversion during the transaction process. This lets business owners and consumers make global payments easily, without worrying about fluctuating rates or hidden fees.

Learn more: What Are Stablecoins?

Wallets and Custody

Wallets are essential for holding and transferring digital assets securely. In PayFi, they act like digital bank accounts, enabling users to manage usable funds anytime with just an internet connection. Advanced custody solutions and encryption enhance security, reducing fraud risks. PayFi wallets simplify cross-border and traditional payments, making global transactions both safe and fast.

Liquidity Providers

Liquidity providers supply the capital that keeps payment processing smooth in PayFi’s ecosystem. They fund real-world assets upfront, ensuring instant settlement and quick access to money for business owners. By bridging lenders and borrowers directly, PayFi removes multiple intermediaries, lowering transaction fees and speeding up global finance operations.

Read more: What Is Liquidity in Crypto?

Merchants and SMEs

Merchants and small-to-medium enterprises (SMEs) are at the core of PayFi. It helps them receive money globally without hidden fees or banking delays. PayFi’s decentralized structure allows business owners to expand across borders, accept crypto payments, and enjoy instant settlement, all while cutting costs and reducing fraud risks tied to traditional payments.

Off-Chain Data & Oracles

Oracles act as bridges between blockchain and the real world. They bring off-chain data—like exchange rates or credit scores—into smart contracts to make PayFi smarter. This ensures secure and transparent transactions while allowing real-time decisions in payment processing. By combining blockchain automation with external data, oracles help PayFi integrate seamlessly with global finance systems and traditional payments.

PayFi vs. Traditional Finance (TradFi) vs. DeFi

| Feature | PayFi (Payment Finance) | DeFi (Decentralized Finance) | TradFi (Traditional Finance) |

| Core Definition | Hybrid model of payments and financing with blockchain, smart contracts, and tokenized RWAs. | Fully decentralized ecosystem of financial apps on the blockchain, with P2P lending, trading, and yield generation. | Conventional financial system with banks, card networks, and intermediaries that control access and credit. |

| Primary Goal | To enable instant settlement and liquidity from payment flows (e.g., invoices, receivables). | To remove intermediaries and offer open, permissionless financial services. | To maintain stable, regulated financial operations through trusted intermediaries. |

| Underlying Technology | Smart contracts, tokenization, stablecoins, RWAs, and oracles for real-world data. | Smart contracts, liquidity pools, DEXs, and governance tokens. | Centralized databases, bank ledgers, and proprietary payment networks (e.g., Visa, SWIFT). |

| Settlement Speed | Near-instant (seconds to minutes) depending on the blockchain. | Fast but variable, depends on network congestion and gas fees. | Slow (1–3 business days) for cross-border or inter-bank settlements. |

| Currency / Settlement Asset | Stablecoins or CBDCs, sometimes local fiat on/off-ramps. | Crypto tokens and stablecoins. | Fiat currencies (GBP, USD, EUR, etc.). |

| Access Model | Semi-permissioned: KYC usually required for business participants. Consumer apps may be open. | Permissionless: Anyone with a wallet can interact. | Fully permissioned: Requires bank accounts and identity verification. |

| Liquidity Source | Tokenized receivables + liquidity pools funded by lenders. | Liquidity pools funded by users seeking yield. | Deposits and institutional credit lines. |

| Interest / Yield Mechanism | Lenders earn from receivable repayments or transaction fees. | Yield from lending, staking, or liquidity provision. | Interest on loans and deposits determined by banks. |

| Transparency | High: Transactions recorded on-chain, invoices visible via tokenization. | Very high: Open-source contracts, public blockchains. | Low: Opaque institutional processes, off-chain records. |

| Regulation Level | Evolving: It sits between DeFi and fintech. Often regulated under payment and lending laws. | Minimal or emerging regulation. Varies by jurisdiction. | Fully regulated under banking and financial authorities. |

| Credit Evaluation | On-chain + off-chain hybrid that uses real business data and blockchain records. | Algorithmic / collateral-based, with no traditional credit scoring. | Traditional credit scoring based on financial history and documents. |

| Security Risks | Smart contract bugs, token mispricing, regulatory uncertainty. | Smart contract exploits, rug pulls, market volatility. | Insider fraud, human error, systemic collapse (bank runs). |

| Typical Use Cases | Invoice financing, merchant liquidity, cross-border payments, tokenized supply-chain finance. | Decentralized lending, DEX trading, yield farming, synthetic assets. | Loans, credit cards, remittances, savings accounts. |

| Intermediaries | Less, but not none (payment platforms, auditors, oracles). | None by design. | Many: banks, clearinghouses, brokers, regulators. |

| Data & Auditability | On-chain visibility plus real-world data feeds (e.g., invoice metadata). | Fully on-chain but often pseudonymous. | Off-chain and siloed. Requires audits for transparency. |

| Adoption Stage (2025) | Early stage but gaining traction through projects like Huma Finance and Stellar PayFi Stack. | Mature niche: thousands of active DeFi protocols. | Fully established global infrastructure. |

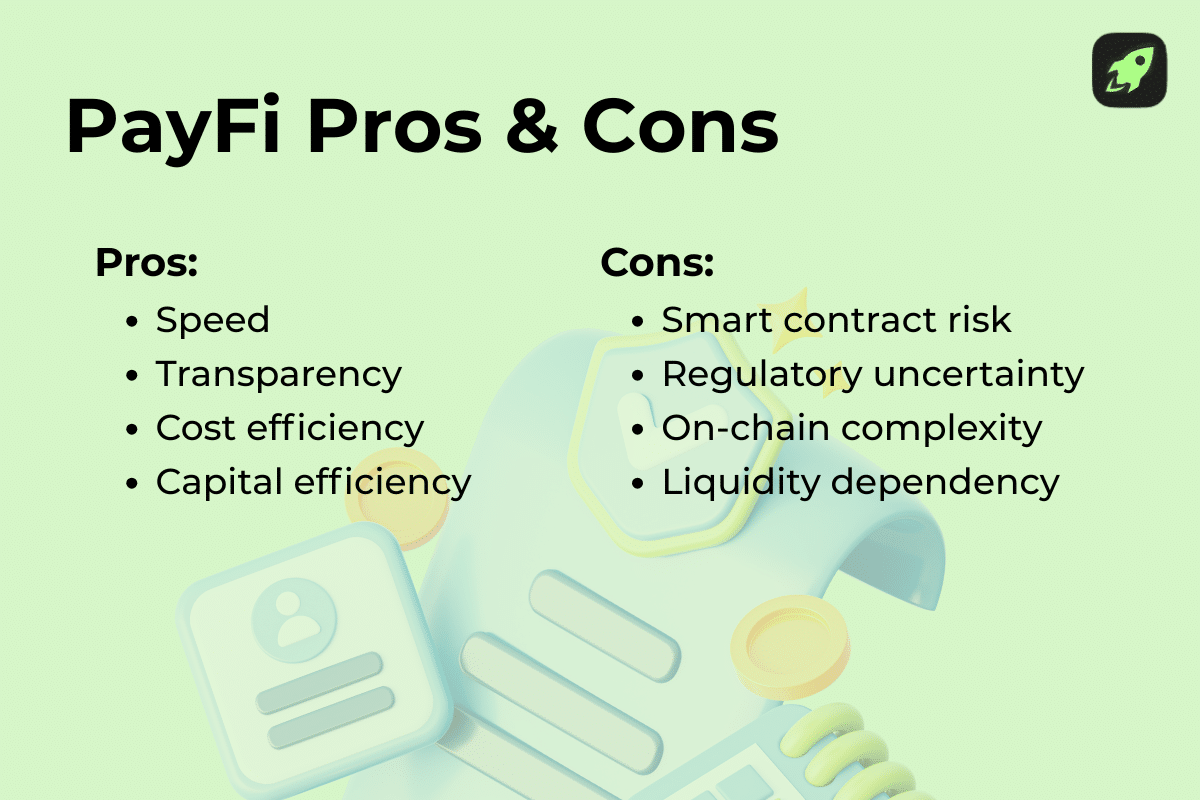

Benefits of PayFi for Businesses and Developers

Like any new development, PayFi focuses on the biggest issues of traditional finance and offers a solution. Along the way, it also offers some interesting advantages.

- Faster Settlement & Liquidity

PayFi has near-instant payments, giving businesses immediate access to funds instead of having to wait days for bank processing. Real-time settlement improves cash flow, liquidity, and financial planning. For developers, this speed supports seamless global transactions within apps, operating 24/7—even on weekends and holidays. - Transparent & Auditable Transactions

Every PayFi transaction is recorded on an immutable blockchain ledger. This transparency simplifies audits, reduces fraud, and ensures payments are fully traceable. Developers can build tools that verify and track payments in real time without relying on opaque intermediaries or legacy systems. - Lower Costs & Fewer Intermediaries

Traditional systems depend on banks, card networks, and processors, each adding their own fees. PayFi enables direct transfers between sender and receiver, cutting out middlemen and lowering transaction costs. This efficiency benefits businesses managing high-volume payments and developers integrating cost-effective financial APIs. - Capital Efficiency for SMEs & Merchants

Small and medium-sized businesses often struggle with delayed payments. PayFi’s real-time settlements improve liquidity and allow for faster reinvestment, reducing reliance on loans or credit lines. Developers building fintech tools can offer better user experiences with transparent and predictable cash flows.

Limitations of PayFi

Despite its benefits, PayFi can’t always guarantee absolute security. Developers need to stay alert when building PayFi systems. Not all systems manage to avoid problems, even after multiple audits. Understanding what might go wrong could help users keep their money safe.

- Smart Contract Risks

Smart contracts automate PayFi operations, but they’re only as safe as their code. Bugs or vulnerabilities can be exploited, even after audits. Developers must follow strict coding standards, perform audits, and use secure frameworks. - Liquidity & Default Risks

PayFi systems often depend on liquidity providers. In times of market stress, liquidity shortages or collateral drops can delay or block transactions. Transparent reserves and smart contract safeguards help reduce these risks. - Regulatory Uncertainty

Digital asset regulations vary across regions. Businesses and developers must stay informed, use compliant partners, and be ready to adapt as laws evolve. - Adoption Challenges

Mainstream users remain cautious of decentralized systems. Clear UX, education, and partnerships with traditional institutions can help build trust. - RWA Valuation Risks

Tokenized real-world assets may be mispriced or poorly audited. Projects should rely on independent, transparent audits and regularly publish valuation reports to ensure confidence and investor protection.

Real-World PayFi Use Cases and Examples

Real-world PayFi use cases are quickly expanding across industries. In e-commerce, merchants use PayFi to accept crypto and stablecoin payments instantly, avoiding high transaction fees and delays from traditional processors. Cross-border businesses benefit from real-time settlements without hidden charges or currency conversion hassles. Freelancers and gig workers receive global payments in seconds, improving cash flow. In DeFi, PayFi enables tokenized invoices and on-chain lending, allowing businesses to access liquidity faster. Even remittance services are being reinvented—families can send money worldwide with minimal costs. Overall, PayFi bridges traditional finance and blockchain, making global payments faster, fairer, and more inclusive.

Final Thoughts

PayFi represents a major shift in how we handle payments and financial transactions. By combining blockchain technology, smart contracts, and tokenized real-world assets, it offers faster settlements, lower fees, and greater transparency than traditional systems. Businesses, SMEs, and developers benefit from improved liquidity, capital efficiency, and seamless integration with modern applications. While there are still some challenges, like smart contract risks and regulatory uncertainty, PayFi’s potential to make payments more inclusive, secure, and efficient is undeniable. As adoption grows and technology advances, PayFi is poised to redefine global finance for both people and businesses.

FAQ

Can I use PayFi today, or is it still new?

Yes, PayFi is operational and gaining traction. It enables real-time, low-cost payments using blockchain and stablecoins, facilitating 24/7 global transfers without intermediaries.

Why would anyone use PayFi instead of PayPal or a bank?

PayFi offers instant settlement, lower fees, and global accessibility without the need for traditional banking intermediaries. It integrates decentralized finance (DeFi) protocols, allowing users to earn yield while making payments.

Does PayFi use real money, or just crypto?

PayFi supports both fiat currencies and cryptocurrencies. Users can transact using stablecoins, such as USDC, or convert between crypto and fiat seamlessly.

Do I need crypto to try PayFi?

Not necessarily. While PayFi facilitates crypto transactions, many platforms offer user-friendly interfaces that allow individuals to engage without prior cryptocurrency knowledge.

Is PayFi only for companies, or can regular people use it too?

Regular individuals can use PayFi. It provides access to global payments, allowing users to send and receive money, pay bills, and even earn yield through DeFi protocols.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.