You’re watching one of your coins surge, and it feels great—that is, until the price drops back to where you started. Crypto profits can evaporate fast. You don’t want to be stuck wishing you had sold sooner. You want a plan. You want blueprints, not hope. This article will show you proven exit strategies—using tools, orders, and signals—that help you decide how to take profits in crypto trading.

Table of Contents

What Is Crypto Profit-Taking and Why It’s Important

Put simply, crypto profit-taking means selling your crypto assets after they’ve gone up in value, so you can lock in gains and cut future risk. Until you sell, your profit is only on paper—what’s often called unrealized P&L (profit & loss). But once you do sell, it becomes realized P&L—and that’s the only profit you can actually use or move into stablecoins, fiat, or other assets.

Crypto profit-taking strategies are important because the crypto market is notoriously volatile. Prices can swing double-digits in hours, wiping out gains you thought were safe. Profit-taking turns these fragile, potential gains into cash or stablecoins you can control. It also helps you plan for taxes and trading fees, since realized profits trigger capital gains tax in many countries (for example, this is how it works with the IRS in the US).

Why Beginners Should Take Profits (Not Just HODL)

Beginners should take profits because HODLing alone doesn’t protect you from crypto market fluctuations, which can be extremely volatile. Holding on can work long-term, but without any profit-taking, you risk watching your hard-earned rewards disappear in a single downward move. Selling some at planned points locks in real gains and reduces your risk, giving you cash or stablecoins to redeploy.

HODLing—keeping assets through short-term ups and downs—remains a valid long-term investment strategy, but it works best when combined with clear profit targets. Even small sales at key milestones can fund your next move, pay taxes, or simply secure your hard-earned gains. By taking profits along the way, you avoid emotional decision-making and FOMO, two traps that hit new traders hardest.

Read more: What Is ‘HODL’?

How the Crypto Market Cycle Affects Your Profit Strategy

Your profit-taking strategy has to match the crypto market cycle, because each phase rewards a different approach. In a bull market, where prices trend upward, taking profits at fixed targets or using trailing stop strategies can lock in gains while still riding the momentum. In a bear market, where prices are falling, selling faster or rotating into stablecoins can protect your capital. During range-bound markets, partial sells at resistance levels and buys at support help you grind out steady profits instead of waiting for big moves.

Market cycles reflect shifts in supply, demand, and sentiment. They’re shaped by catalyst events like halving dates, regulation changes, or geopolitical news that can spark sharp price moves. Recognizing these phases with technical analysis tools such as moving averages (MA), support and resistance levels, and on-chain metrics like the MVRV ratio gives you an early signal to adjust your plan. Without this awareness, you risk using the wrong strategy at the wrong time.

Read more: The Complete Guide to Crypto Analysis

Factors That Determine When to Take Crypto Profits

You should take crypto profits when clear, measurable factors tell you it’s time, not when fear or excitement strikes. If you base trading decisions on these facts instead of emotions, you keep more of your gains. Here are three important rules to keep in mind:

- Know Your Numbers.

Track your entry price, position size, and the average cost basis (the average price you paid per unit of a crypto asset, including fees) to see exactly how much you’re up. Always set a risk/reward ratio—many traders aim for at least 2:1. It helps decide when a trade has paid enough to exit. If you don’t have these numbers to anchor you, your profit-taking turns into blind guesswork. - Read the Room.

Market conditions, liquidity, and volatility determine how fast profits can vanish. Technical analysis tools like support and resistance, moving averages, and Bollinger Bands show when momentum weakens. Fundamental analysis of upcoming protocol changes or political events, for example, can also warn you to tighten stops or rotate into stablecoins. - Plan for Invisible Costs.

Taxes and trading fees eat into net profit. For example, realized profit triggers capital gains tax in the US. Factor these costs in before selling crypto assets so you don’t overestimate your return.

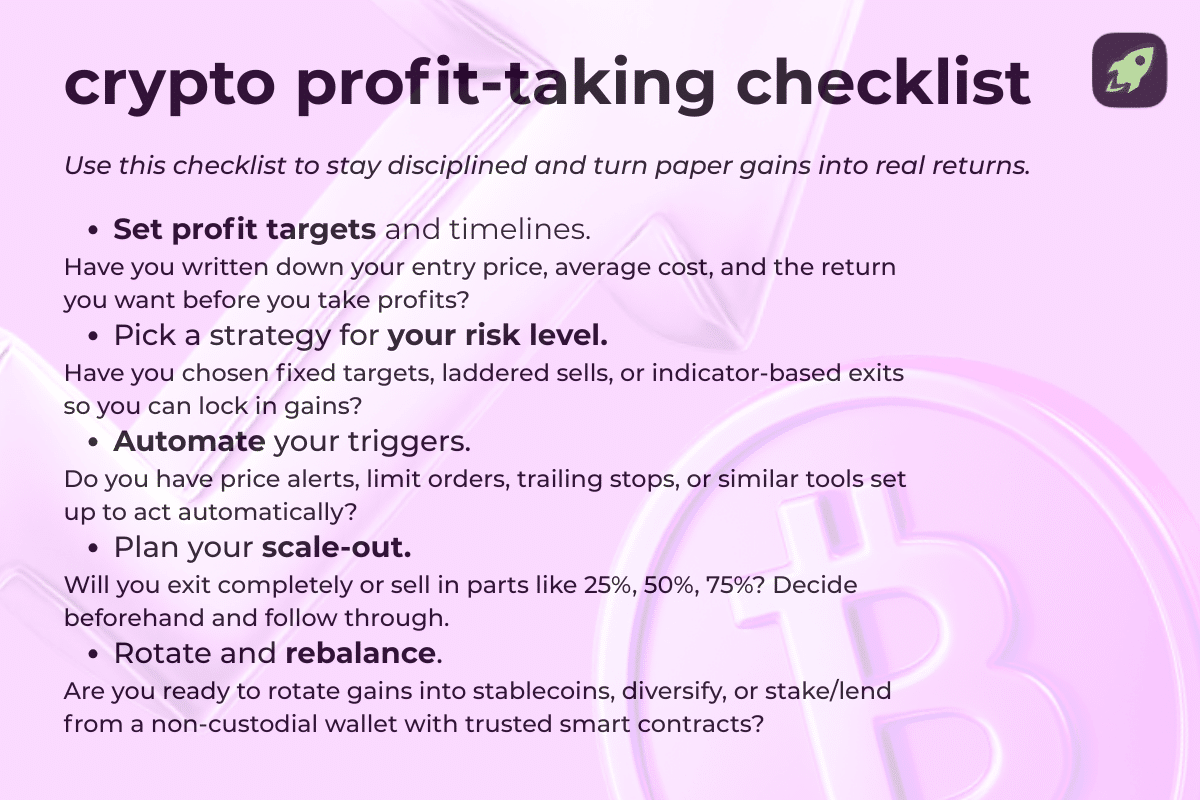

How to Create Your Own Profit-Taking Plan

A solid plan gives you control over when and how you take profits. Let’s go through the steps of creating one.

Define Your Profit Goals and Timeline

Write down exactly how much profit you want and when. Track your entry price and average cost basis so you know where you stand. Set a profit target and a time window—short term or long term—to decide when to take profits. Also make sure to adjust these targets as needed over longer timeframes. Clear numbers keep you from moving the goalposts after every price move.

Pick the Right Strategy for Your Risk Level

Match your plan to your risk tolerance. Fixed-target profit-taking locks in gains at set levels. Laddered sell orders split exits across prices. Dollar-cost averaging can help smooth volatility. Trailing stops follow a rising price and exit automatically if it reverses. Combining these crypto profit-taking strategies helps you capture profits effectively in different market conditions.

Set Up Price Alerts or Limit Orders

Don’t rely on memory or late-night screen checks. Use exchange tools to set price alerts and place limit orders (orders that execute only at your chosen price) so you’re ready when price hits your profit targets, even if you’re offline. Add a stop-loss order (an order that sells once price drops to a preset level) or a trailing stop order (a stop that automatically moves up with the price) to protect gains in volatile markets. You can also use an one-cancels-the-other (OCO) order or a bracket order to combine entry, stop, and profit targets in one setup.

Sell Your Entire Position

It’s a serious pivot, but sometimes selling your entire position is the cleanest move. A market order (an order that sells immediately at the current market price) gets you out fast when conditions change with a catalyst event and you’ve planned an event-driven exit. This can be useful in bearish chart patterns, when liquidity dries up and you want to offset losses before they grow.

Sell Only a Portion of Your Total Long Position

More often, selling in parts (rather than in whole) reduces risk and keeps upside. Laddered sell orders or dollar-cost averaging out let you take profits incrementally at different price points. Rotating some profits into stablecoins preserves gains while leaving you with exposure to potential growth. You can also close a derivatives contract such as a perpetual or options position to reduce risk without selling your spot positions. This approach works well when market trends look strong but you want to de-risk gradually.

Learn how to spot scams and protect your crypto with our free checklist.

Five Easy Crypto Profit-Taking Strategies for Beginners

These five simple profit-taking strategies work in most market conditions and give you a framework for when and how to sell. Pick one or combine several to fit your risk tolerance and trading style.

Fixed Target Strategy (Sell at Pre-Set Price)

Set clear profit targets at specific prices before you enter a trade. Place a take-profit order (an order that automatically sells at your chosen price) so the exit happens without hesitation. This works well in an upward trend where you’ve planned your gains ahead of time.

Example: You buy ETH at $1,800 and place a take-profit order at $2,200. When price hits that level, your order fills automatically and locks in the gain.

Laddering or Scaling Out (Sell in Parts)

Break your position into chunks and sell portions at different price levels. Laddered sell orders let you lock in profits gradually and still benefit if the price keeps climbing. This reduces risk compared to selling your whole position at once.

Example: You hold 1 BTC bought at $30,000. You plan to sell 25% of your position at $38,000, another 25% at $42,000, and the rest at $45,000 to capture rising prices without exiting too soon.

Stop-Loss and Trailing Stop Orders

A stop-loss kicks in if price drops to your preset level, while a trailing stop moves up automatically as the price rises. They guard your gains without you having to hover over the charts 24/7.

Example: You buy an altcoin at $5, set a stop-loss at $4 to limit loss, and a trailing stop at 10% below the highest price so if it peaks at $6.50 you exit automatically at $5.85.

Dollar-Cost Averaging Out (DCA Exit)

Sell equal amounts of your crypto on a fixed schedule instead of trying to time the top. The dollar-cost averaging approach smooths out volatility and removes the stress of guessing when to sell.

Example: You sell $500 worth of SOL every week over three months regardless of price, gradually reducing exposure and locking in profits.

Technical Indicators for Profit-Taking (RSI, Fibonacci)

Use simple signals to guide an indicator-based exit. Overbought readings on the Relative Strength Index (RSI, a momentum indicator that measures how stretched a price move is) or price hitting Fibonacci retracement or extension levels (mathematical ratios traders use to mark potential support and resistance) can flag where to take profits. Combine these with moving averages or Bollinger Bands to confirm momentum before you sell.

Example: BTC rallies from $30,000 to $39,000 and hits the 161.8% Fibonacci extension while RSI reads 75. You sell part of your position at that level to lock gains before a pullback.

Step-by-Step Profit-Taking Example with Bitcoin

Imagine you bought 1 BTC at $30,000. Let’s break down an example profit-taking plan you could use:

- Sell 25% at $36,000: about a 20% gain. You take some money off the table when the price hits your first profit target or a key resistance level on the chart. This covers your initial risk and frees up capital without closing the whole trade.

- Sell 50% at $42,000: about a 40% gain. You exit half your remaining position if momentum slows, RSI shows overbought conditions, or the price hits a major Fibonacci extension level. You’ve now banked most of your profit and can ride the rest stress-free.

- Sell 75% at $48,000: about a 60% gain. You lock in nearly everything if a catalyst event (like regulatory news or a sharp reversal in market sentiment) threatens the rally. This leaves you with a small piece to capture any final push higher while protecting the bulk of your gains.

This staged approach turns vague hopes into a clear exit strategy (what traders call a risk/reward target exit). It uses fixed targets, technical indicators, and market cues to decide when to scale out, keeping you disciplined even as price moves fast.

Managing Risk and Reinvesting Crypto Profits

Taking profits is only half the job. Managing risk and deciding where to put those profits next keeps your portfolio healthy and your stress low.

- Cut your exposure first. Move some gains into stablecoins to shield them from sudden drops while still staying in the crypto ecosystem. Some platforms also let you use cryptocurrency as collateral for loans, giving you access to capital without selling your assets. Just make sure to factor in trading fees and any tax liability before you move funds so you know your real net profit.

- Diversify your approach. A rebalancing strategy—selling high-performing assets to return to your target allocation—keeps one coin from dominating your portfolio. Following a simple position sizing rule (risking only 1–2% of your capital on any single trade) and setting a maximum drawdown limit (the maximum loss you’re willing to tolerate before stopping) stops small mistakes from turning into disasters. Essentially, this diversification rule helps keep all your eggs out of one basket.

- Put your profits to work. You don’t always have to sell out of crypto to earn yield. Staking can generate passive income. You can also earn steady returns by lending your assets through reputable platforms or participating in liquidity pools and automated market makers (which provide liquidity without traditional buyers or sellers). Liquidity mining—depositing crypto assets to facilitate trades on a DeFi platform—is another common source of extra income, and some investors even use crypto savings accounts to earn higher interest on deposited coins.

Read more: A Practical Guide to Crypto Risk Management

Avoiding Greed, FOMO, and Emotional Selling

The fastest way to lose crypto profits is to let emotions drive your trades. Greed makes you hold too long, fear makes you dump too early, and FOMO pulls you into bad entries. Without a plan, these mood swings cost more than any fee. Let’s learn how to avoid them:

- Set rules before you trade. Decide your profit targets and stop levels while you’re calm. Write them down and stick to them. This prevents impulse exits and helps you avoid emotional decision-making, even when prices spike or drop.

- Automate where possible. Use trading bots and limit orders to execute your exit strategy automatically, or run an algorithmic strategy that scales your exits. Automation removes the need to watch price charts 24/7 and keeps you from second-guessing your plan when the market moves fast.

- Track your own behavior. After each trade, note why you entered and exited. Over time you’ll see patterns—maybe you always sell on a dip or chase a pump. Spotting these habits helps you correct them and build discipline like other traders who last through cycles.

By controlling your emotions with rules and automation, you protect your gains, take profits with confidence, and position yourself for long-term success instead of short-term mistakes.

Common Mistakes to Avoid When Taking Crypto Profits

Even a solid profit-taking plan can fail if you fall into these traps. Let’s go over these common mistakes again so you can spot them early and achieve long-term success.

- Waiting for the perfect top.

Trying to sell at the exact peak usually backfires. Set realistic profit targets and stick to them instead of chasing every uptick. - Ignoring trading fees and taxes.

Trading fees and capital gains tax can quietly eat into your net returns. Always calculate what you’ll actually keep before you sell cryptocurrency. - Selling everything or nothing.

Dumping your whole position at once can leave money on the table. Never selling at all can erase paper gains. Use laddered sells or dollar-cost averaging out to scale profits gradually. - Skipping risk management.

Skipping stop-losses, trailing stops, or a maximum drawdown limit exposes you to big losses. Build these rules into your exit strategy to protect your crypto assets. - Letting emotions drive your decisions.

FOMO and panic often cause retail traders to exit positions too early or hold too long. Automating your orders with limit or take-profit orders helps you avoid emotional decisions.

Final Thoughts: Is Backtesting Worth It?

Backtesting—testing your crypto profit-taking strategy on past price data—lets you see how your exit strategy, profit targets, and stops would have worked without risking real money. It can’t predict the future, but it highlights weak spots in your strategy and shows how your plan behaves in different market conditions. Used this way, backtesting is definitely worth your time. It gives you informed decisions, helps you refine your strategy, and turns your profit-taking plan into something you can trust when the crypto market gets volatile.

In general, clear goals, the right crypto take-profit strategy, and disciplined risk management turn unrealized gains into lasting results. Use fixed targets, laddering, trailing stops, or dollar-cost averaging with automation to take profits confidently.

FAQ

How do I know when it’s the right time to take profits in crypto?

Take profits when your preset targets, technical signals, or risk/reward rules are met, and not when fear or hype strikes. This keeps your exit disciplined instead of emotional, and more likely to benefit you in the long run.

Should I sell all my crypto or just a part of it?

Selling part of your position locks in gains while keeping upside exposure. Full exits work best when market conditions turn sharply bearish or your plan calls for it.

What percentage of profit should I take when my coin goes up?

There’s no magic number, but many traders scale out 25%, 50%, and 75% at planned price levels. Choose the amount that works for your goals, expected taxes, and risk tolerance.

Is it better to HODL or take profits regularly?

Combining HODLing with planned profit-taking works best. You keep a core long-term stake but secure gains along the way to avoid watching them vanish.

What if I miss the top—is it too late to take profits?

It’s rarely too late. You can sell according to your plan at the next profit target or rotate part of your holdings into stablecoins to protect what’s left.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.