Before putting real money at risk, traders use crypto backtesting to see how a strategy would have performed under past market conditions. It’s the fastest way to test ideas, spot weaknesses, and refine what works without emotional or financial pressure. This guide walks you through how to backtest step by step, from setting rules and collecting data to measuring performance like a pro.

Table of Contents

What Is Backtesting in Crypto Trading?

Backtesting is the process of testing a trading strategy against historical market data to see how it would have performed in the past. Instead of risking real capital, traders simulate trades using past price movements to understand how a strategy behaves under different market conditions.

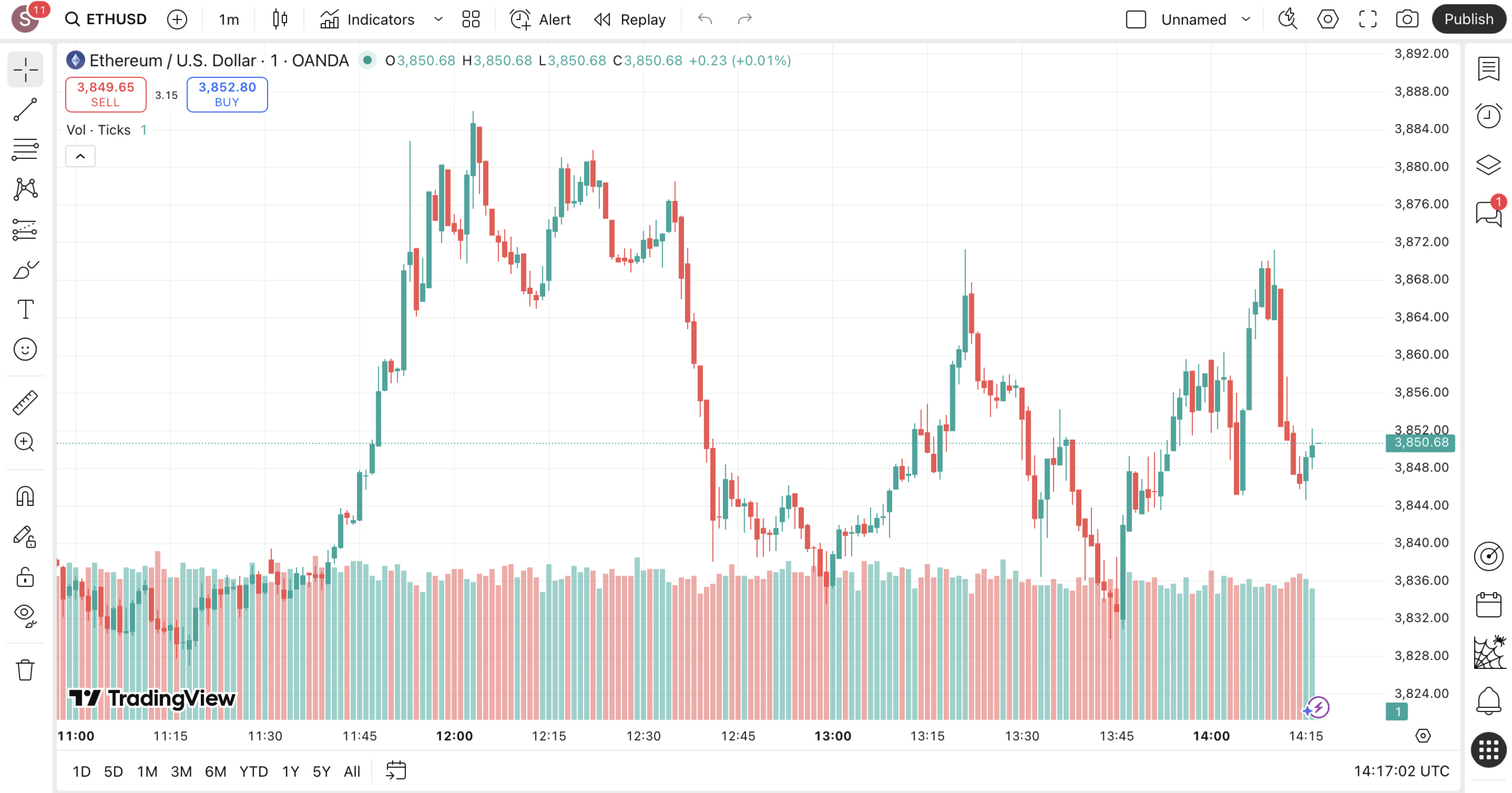

In crypto, backtesting typically relies on OHLCV data—open, high, low, close, and volume—to recreate the price action over a specific period. By applying your strategy’s entry and exit rules to this dataset, you can measure hypothetical results such as win rate, drawdown, and total returns.

The goal isn’t to predict the future perfectly, but to verify whether your approach has a consistent logic and risk profile before moving to live trading. When done properly, backtesting helps traders identify weak assumptions early and refine strategies for better real-world performance.

Why Backtesting Is Important for Crypto Traders

Backtesting gives traders a way to evaluate whether a strategy is likely to work before real money is on the line. It transforms trading ideas into measurable results, showing how a plan would have performed under different market conditions.

By reviewing performance metrics such as total return, win rate, or maximum drawdown, traders can identify if their strategy is consistent or too risky. These metrics highlight strengths and weaknesses that aren’t obvious from a single trade or a short live-testing period.

More importantly, backtesting encourages disciplined decision-making. It replaces guesswork with data, helping traders focus on refining what works and discarding what doesn’t. A well-tested strategy provides confidence and structure—two things every crypto trader needs when the market gets volatile.

Different Ways to Backtest a Crypto Strategy

Crypto traders can backtest in several ways, depending on their skills and goals. Each method offers a trade-off between speed, accuracy, and flexibility.

Manual Backtesting with Spreadsheets or Charts

This is the most straightforward method. You scroll through historical price charts (usually candle-by-candle) and mark where your entry and exit signals would trigger. Each simulated trade is logged in a spreadsheet with its open price, close price, profit or loss, and notes about the setup.

Manual testing helps you understand market structure and how your rules behave in different conditions. However, it’s time-consuming and prone to bias since traders can subconsciously skip losing trades or adjust signals after seeing results. It’s best for validating simple strategies before moving to automated tools.

Backtesting with TradingView Scripts or Bots

TradingView allows users to code strategies in Pine Script or use built-in templates. Once written, a script automatically tests your logic on years of historical data and produces charts showing entry/exit points, win rates, and drawdowns.

Behind the scenes, these tools use an event-driven backtester—a system that reacts to each new price “event” (like a candle close) and triggers simulated trades accordingly. This makes results more accurate and reproducible. Traders can also forward-test these bots in live mode to confirm performance in real markets.

Automated Backtesting Tools (No Coding Needed)

No-code platforms like Coinrule, Kryll, or 3Commas let users design strategies visually through logic blocks (e.g., “if RSI < 30, then buy”). These services run your logic on historical price data and report profit curves, trade counts, and average returns.

They typically use a vectorized backtester, meaning the system processes historical data in bulk arrays instead of step-by-step. This approach enables fast testing across many coins and timeframes. It’s great for non-technical traders who want efficiency but can’t customize execution as deeply as with code-based solutions.

Using Python (for Advanced Users)

Python backtesting offers maximum flexibility. Traders can build or use open-source frameworks like Backtrader, Zipline, or vectorbt to simulate any crypto strategy. This setup allows integration of live data, complex indicators, and multiple exchanges.

More importantly, it enables optimization: adjusting parameters such as stop-loss levels, indicator thresholds, or lookback periods to find the most robust combinations. Python backtesting can also include advanced techniques like walk-forward validation and Monte Carlo simulations, giving traders the same analytical power used by quantitative funds.

How to Prepare Before You Backtest

Start by defining your entry signals, the precise conditions that trigger a buy or sell. These could be based on indicators like moving averages, RSI thresholds, or price breakouts. Just as important are your exit signals, which tell you when to close a position. Consistent, rule-based signals remove emotion and make performance easier to measure.

Next, decide how you’ll handle risk management. Set rules for maximum position size, stop-loss levels, and profit targets. This ensures your strategy remains sustainable even during drawdowns.

Finally, document every rule before testing. A well-prepared backtest mirrors real trading discipline, allowing you to focus on improving logic instead of improvising during analysis.

Learn how to spot scams and protect your crypto with our free checklist.

Step-by-Step Guide to Backtesting a Crypto Strategy

Now, let’s talk about backtesting itself. It works best when done systematically. Follow these steps to ensure your results are reliable and repeatable.

Step 1: Define Your Strategy

Start by outlining the logic behind your trading idea. Identify which indicators you’ll use to generate buy or sell signals, such as moving averages, RSI, or volume filters. Then, decide the exact conditions that trigger a trade. Clarity here prevents confusion once you start testing.

Step 2: Get Historical Crypto Price Data

Collect high-quality market information from reputable sources or exchanges. In addition to candles and volume, advanced users may include order book data to simulate liquidity and slippage. Clean, complete data ensures your backtest mirrors realistic trading conditions.

Step 3: Run the Backtest (Manually or Using Tools)

Apply your rules to the historical data using your chosen platform: manual spreadsheets, TradingView scripts, or automated software. The backtest will simulate how your trades would have unfolded over time.

Step 4: Record Trades and Outcomes

Track every position, including entry price, exit price, profit or loss, and notes about market behavior and context. Visualize trade performance over time with an equity curve—a chart showing how your account balance would have changed. It helps you spot volatility, drawdowns, and overall consistency.

Step 5: Check Key Performance Metrics

Analyze your results using key statistics like return and max drawdown. Return shows how profitable the strategy is, while drawdown reveals how much risk it carries. A good system balances both—steady gains with manageable declines.

How to Measure Backtesting Results

After running a backtest, your next step is to evaluate performance objectively. Beyond basic returns, traders use ratios to understand how much risk was taken to achieve those results.

The Sharpe Ratio measures how much excess return your strategy produced per unit of total volatility. A higher Sharpe means more consistent performance relative to risk.

The Sortino Ratio refines this by focusing only on downside volatility—penalizing losses but not stable or positive returns. It’s often better for crypto, where markets are volatile but trend-driven.

Together, these metrics show whether your strategy’s profits come from skill or from taking excessive risk, helping you compare different approaches on an equal footing.

Common Backtesting Mistakes to Avoid

Even strong strategies can produce false confidence if the backtest isn’t realistic. Keep these points in mind.

- Using bad or incomplete data. Missing candles, gaps, or incorrect timestamps distort results. Always verify that your historical data is accurate and complete before testing.

- Overfitting your strategy to past results. Overfitting occurs when a model is tuned too closely to historical data and fails in live markets. Keep strategies simple and validate them on fresh datasets.

- Ignoring slippage, fees, or market impact. Slippage changes trading outcomes when execution differs from expected prices, and trading fees reduce returns. Include these costs to reflect realistic performance.

- Mistaking short-term luck for long-term performance. Avoid look-ahead bias and confirm results across multiple market cycles. A profitable backtest over a few months doesn’t guarantee future consistency.

Best Tools for Crypto Backtesting

Professional traders rely on reliable software tools to simulate strategies under past market conditions and evaluate past performance before risking capital. The right platform helps you collect data, test ideas quickly, and refine setups that lead to trading success.

Essential tools include:

- TradingView: Ideal for visual strategy testing and performance tracking. Great for both beginners and advanced users.

- Backtrader or vectorbt: Python frameworks that let traders automate the backtesting process with full control over data and execution.

- Coinrule, Kryll, and similar no-code platforms: Let users design and test trading logic without coding, useful for fast experimentation.

- Paper trading: A critical step after backtesting. It allows traders to simulate live execution with virtual funds, confirming that a strategy performs as expected in real market conditions.

What to Do After Backtesting Your Strategy

Backtesting is just one part of strategy development. Once you’ve confirmed that a setup performs well, the next step is to validate it under new conditions and refine how you manage risk.

Use walk-forward analysis to test your strategy across different time periods or market phases. This method shows whether performance holds up when conditions change, helping you filter out systems that only worked during specific trends.

Then review your position sizing. Even a profitable strategy can fail if trade sizes are inconsistent or too large. Applying a clear sizing model keeps results stable and prevents impulsive decisions during volatility. Professional traders often maintain multiple strategies to diversify performance and reduce drawdowns.

Final Thoughts: Is Backtesting Worth It?

Backtesting isn’t about predicting the future. A well-designed test reveals whether your trading logic is sound, your assumptions realistic, and your risks under control.

When combined with disciplined risk management and forward testing, crypto backtesting helps traders refine their edge without emotional or financial pressure. It turns raw ideas into structured systems, making success measurable instead of accidental.

In short: backtest thoroughly, manage risk carefully, and let data guide your strategy.

FAQ

Can I backtest a crypto trading strategy without knowing how to code?

Yes. Many platforms now offer visual builders or automated tools that let you test strategies without programming. They handle data, execution, and reporting for you.

What are the risks of relying too much on backtesting results?

Overconfidence is common. Data snooping bias (when you tweak a strategy until it fits past data) can make results look strong but fail in real trading.

Is it worth backtesting simple strategies like RSI or moving average crossovers?

Absolutely. Simple strategies are easy to test, interpret, and improve. Even basic systems can reveal how different market conditions affect performance.

What’s the best timeframe to use when backtesting a crypto strategy?

It depends on your goals and data frequency. Scalpers use minute-level data, while swing traders rely on 4-hour or daily charts for more stable results.

Is 100 crypto trades enough for backtesting?

Usually, no. Reliable testing requires larger sample sizes across both in-sample and out-of-sample periods to confirm consistent performance.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.