Crypto moves fast, and so do the blockchains that power it. But most networks still operate like separate islands, each with its own rules, tokens, and apps. Blockchain bridges solve this problem by linking those islands together. In this guide, we’ll break down what a crypto bridge is, why it matters, and how you can safely use one to move your assets across chains without getting lost in the technical jargon.

Table of Contents

What Is a Crypto Bridge?

A crypto bridge (also called a blockchain bridge) is a tool that lets users move digital assets or data from one blockchain network to another. Each blockchain—like Ethereum, BNB Chain, or Solana—runs on its own rules and technical standards, which normally makes direct transfers impossible. A crypto bridge solves this by creating a connection between two separate blockchains so that tokens, smart contract instructions, or other information can pass between them securely.

A bridge essentially “locks” or records your tokens on the source chain and then issues an equivalent representation on the destination chain. This allows you to use your assets in ecosystems that weren’t originally designed for them without selling or swapping them on an exchange first.

Think of each blockchain as its own country with its own currency and banking system. Normally, money from one country can’t be spent directly in another. A crypto bridge works like a secure customs checkpoint that takes your funds in one country, verifies them, and then issues an equivalent voucher or receipt you can spend in the other country.

Why Do We Need to Bridge Crypto?

Blockchains operate as separate ecosystems. Ethereum, BNB Chain, Solana, and others each have their own rules, tokens, and applications. This isolation makes it hard for users to move assets or use services across different blockchain networks. Crypto bridges solve that problem by connecting different networks so users aren’t locked into a single one.

The key reasons we need bridges:

- Access to dApps on other chains. You can move assets to a chain where a specific DeFi platform, NFT marketplace, or game is based without selling your tokens.

- Lower fees and faster transactions. Bridges let you shift funds to blockchains with cheaper gas costs or better performance.

- Liquidity and yield opportunities. By bridging, you can supply or stake assets across multiple chains to earn higher returns or diversify risk.

- Improved usability for multi-chain projects. Developers can make their apps available on several blockchains while still serving the same user base, often by using cross-chain bridges.

Read more: Top 10 dApps

Why Can’t Blockchains Talk to Each Other?

Each blockchain is built with its own architecture, consensus rules, token standards, and programming languages, which make it a self-contained system rather than part of a single network. Because there is no universal protocol for communication between chains, one blockchain cannot automatically verify what’s happening on another.

Networks such as Ethereum and Bitcoin use different consensus mechanisms. Their addresses and token standards follow different formats, and their smart contracts are written in different languages. On top of that, strong security boundaries prevent outside data from being accepted without verification, because a malicious actor could spoof information from another chain. Since blockchains are designed to be secure and decentralized on their own, not to communicate with others, they cannot “talk” directly. Bridges act as translators and couriers, verifying events on one chain and safely reflecting them on another.

How Crypto Bridges Work

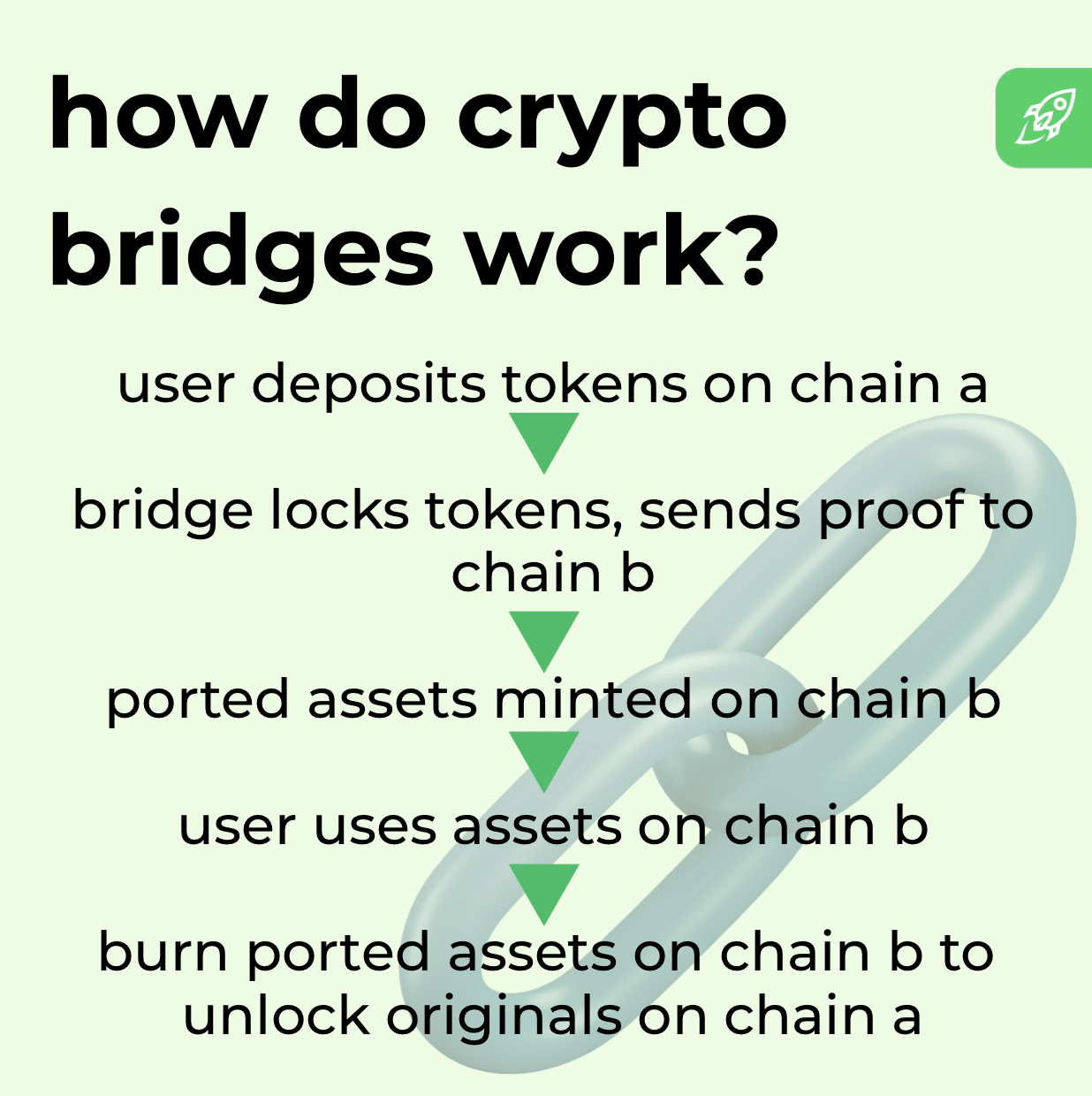

A crypto bridge is more than a simple “lock-and-mint” mechanism. It’s a set of smart contracts, off-chain components, and security checks that link two independent blockchains. When you move tokens through a bridge, the original assets stay on the source chain. A smart contract there locks them, records the deposit, and issues a message or proof that’s relayed to the destination chain. Depending on the bridge design, this relay can be handled by a centralized operator, a group of validators, or an automated contract.

On the destination chain, that proof triggers the minting or release of a ported asset, sometimes called a wrapped token. This ported asset represents the original token you locked, backed one-to-one by the coins sitting on the source chain. You can use it in dApps, DeFi protocols, or trades just like a native token on the target chain, even though the original hasn’t moved.

When you send the ported asset back across the bridge, it’s burned or returned on the target chain, and the bridge unlocks or releases the original tokens on the source chain. Some bridges instead use liquidity pools on each chain to hand you existing tokens on the destination chain immediately, while your deposit refills the pool on the source chain.

Types of Crypto Bridges

Crypto bridges aren’t all built the same way. They differ in how they handle security, custody, and verification. Below are the main categories you’ll come across.

Trusted (Centralized) Bridges

Trusted bridges rely on a central operator or a group of validators to manage the transfer process. When you send tokens, they’re held by this intermediary, which then issues the corresponding tokens on the other blockchain. Because a single entity or consortium controls the bridge, users must trust it to safeguard funds and process transactions honestly. These bridges are often easier to use and faster to set up, but introduce counterparty risk.

Trustless (Decentralized) Bridges

Trustless bridges remove the need for a central custodian. Instead, they use smart contracts and cryptographic proofs to verify that assets are locked on one chain before minting or releasing them on another. No single party holds the funds. On trustless bridges, security comes from decentralized validators and on-chain logic. This design lowers reliance on third parties but can be more complex and may carry higher fees or slower confirmation times depending on the network.

Cross-Chain Bridges

A cross-chain bridge is a broad term for any system that allows assets, data, or smart contract calls to move between two or more blockchains. Both trusted and trustless designs can be cross-chain. The key feature is that it enables interaction between separate chains, letting users access dApps, liquidity, and services across multiple networks without having to sell or swap their tokens first.

Blockchain Bridge Types by Mechanism

Bridges can also be grouped by the technical mechanism they use to move value between chains. The two most common approaches are wrapped asset bridges and liquidity pool–based bridges.

Wrapped Asset Bridges

A wrapped asset bridge works by locking your original tokens on the source blockchain and minting an equivalent “wrapped” version on the destination chain. For example, if you bridge ETH to another network, the bridge holds your ETH on Ethereum and issues Wrapped ETH (wETH) on the other chain. When you return the wrapped tokens, the bridge burns them and releases your original ETH. This method keeps a one-to-one backing between the wrapped token and the underlying asset.

Liquidity Pool–Based Bridges

Liquidity pool–based bridges don’t mint wrapped tokens. Instead, they rely on pools of tokens already deposited on each chain. When you send tokens to the bridge, it withdraws an equivalent amount from its pool on the destination chain and sends it to you. Meanwhile, your deposited tokens add to the pool on the source chain. This approach can allow faster transfers and a simpler user experience, but it depends on the depth and management of the liquidity pools to maintain smooth operation.

Learn how to spot scams and protect your crypto with our free checklist.

Examples of Popular Crypto Bridges

There is a wide variety of well-known cross-chain bridges that give users easy access to applications, liquidity, and assets across chains. These platforms provide the cross-chain functionality that lets you move tokens between two different blockchain networks without going through an exchange.

Some of the most widely used bridges include:

- Polygon Bridge, which connects the Ethereum network to Polygon, allowing quick cross-chain transfers of ETH and ERC-20 tokens.

- Arbitrum Bridge, a cross-chain bridge that moves assets between Ethereum and Arbitrum’s Layer 2, helping users cut gas fees while staying inside the blockchain ecosystem built around the Ethereum blockchain.

- Binance Bridge, a blockchain bridge that links Binance’s BNB Chain and other chains to Ethereum, often using unified liquidity pools to speed up transfers.

- Avalanche Bridge, a high-capacity blockchain bridge for shifting assets from Ethereum to Avalanche and back.

Each of these bridges is designed to make the blockchain ecosystem feel more connected, so users can access dApps and liquidity on multiple networks without selling or swapping their tokens first.

Benefits of Using Crypto Bridges

Bridges offer several meaningful advantages that help expand how and where crypto can be used:

- They enable cross-chain transfers so you can move tokens between different blockchain networks without turning them into another asset first.

- You gain access to dApps, liquidity, and protocols in chains you couldn’t reach otherwise, unlocking more yield and use cases.

- By shifting assets to chains with lower fees or faster throughput, you can reduce costs and improve transaction speed.

- Bridges help grow interoperability in the blockchain ecosystem, making it smoother for users and developers to work across multiple networks.

- They reduce dependence on centralized exchanges: instead of selling on one chain and buying on another, you can simply bridge your existing assets.

- In some cases, bridges enable cross-chain governance, lending, and composability, letting your assets participate in more complex cross-network strategies.

Risks of Using Crypto Bridges

While bridges unlock powerful cross-chain functionality, they also introduce significant risks and attack surfaces. Some of the main dangers include:

- Smart contract vulnerabilities are common because bridge code is often complex, and bugs or flaws in logic can let attackers drain funds.

- Bridges sometimes rely on a small set of validators or operators, and if one is compromised the system can be manipulated or funds stolen.

- Bridges often import data or messages from other chains or off-chain sources, and if these inputs are faked or tampered with the bridge can process fraudulent transactions.

- If a network connected by a bridge is attacked (for example, via a 51% attack), the compromise may propagate to other chains via the bridge linkage.

- Bridges are among the most targeted parts of Web3, and over $2 billion has been lost in bridge hacks in recent years, including large exploits like Poly Network.

- Bridges using liquidity pools may face imbalances or insufficient reserves, making transfers less efficient or more costly.

- In some designs, converting bridged tokens back to their original form can incur delays or dependency on off-chain processes, introducing the risk of stuck funds.

Because of these risks, it’s essential to choose well-audited, decentralized bridges with strong security practices (and to limit exposure when bridging!)

How to Use a Crypto Bridge: A Step-by-Step Guide

Using a crypto bridge is usually straightforward. Here’s a clear, beginner-friendly walkthrough you can adapt to almost any bridge interface:

- Choose a bridge that supports your assets and chains. Make sure the bridge works between the two blockchains you want to connect (for example, the Ethereum network and BNB Chain) and that it handles your token.

- Connect your wallet. Open the bridge website or app and connect a compatible crypto wallet (such as MetaMask or WalletConnect). Approve the connection so the bridge can view your balances.

- Select the source and destination chains. Pick the blockchain you’re sending from and the blockchain you’re sending to. Confirm that you’re on the correct network in your wallet.

- Choose the token and amount. Enter how much you want to bridge. Some bridges only support specific tokens or require minimum amounts.

- Review fees and estimated time. Check the gas fees on the source chain and any service fees the bridge may charge.

- Approve and confirm the transaction. Your wallet will prompt you to approve the token transfer and then confirm the bridging transaction.

- Wait for confirmation. The bridge locks your tokens on the source chain and issues (or releases) equivalent tokens on the destination chain. This can take from seconds to minutes depending on the networks.

- Verify your balance on the destination chain. Switch your wallet to the destination network to see the bridged tokens.

Best Practices and Safety Tips for Using Blockchain Bridges

When moving assets between blockchains, it’s important to understand how and why bridges work to protect yourself. Before trusting a platform, look closely at its track record and audits. Ask yourself: How do blockchain bridges work usually, and does this one work reliably? Has it suffered downtime or security issues? High-profile incidents such as the Wormhole Bridge exploit show that even large, well-funded projects built on cutting-edge blockchain technology can be vulnerable.

Always start with a small test transaction to confirm that the transfer behaves as expected before moving larger amounts. This is especially important if you are bridging high-value assets like BTC representations of the Bitcoin blockchain into decentralized finance protocols on another chain. Use official URLs and verified apps to avoid phishing sites, and keep your wallet software up to date. Hardware wallets or multisig setups add another layer of protection.

Check which tokens and networks a bridge officially supports. Unsupported assets may be delayed or lost if sent through the wrong channel. Pay attention to network fees and estimated times before confirming a transfer—congested chains can increase costs or slow final settlement. After the transaction, switch your wallet to the destination network and verify the arrival of your tokens before deploying them into decentralized finance strategies.

Finally, stay informed by following a bridge’s official announcements and security updates. Bridges are evolving quickly within the blockchain technology space, and their safety depends on active maintenance and clear communication. Treat bridging as you would any high-value financial move: verify first, act cautiously, and keep security a priority.

Final Thoughts

Crypto bridges are quickly becoming the glue of a multi-chain world. They make once-isolated networks part of an interconnected ecosystem, letting users move assets, tap into decentralized finance, and explore apps without switching wallets or selling tokens. As the technology matures, expect more secure and user-friendly bridges—but also stay alert to risks. By understanding how they work and following best practices, you can take advantage of cross-chain opportunities while keeping your funds safe.

FAQ

What does a crypto bridge do?

A crypto bridge lets you transfer assets from one particular blockchain to a target chain, acting as a link that enables communication in an interconnected network of blockchains.

Are blockchain bridges safe?

Yes… and no. Safety varies: well-audited or federated bridges can be secure, but exploits have shown that cross-chain blockchain bridges remain high-value targets in the crypto industry.

What is the most popular crypto bridge?

The most widely used bridges often involve the Ethereum network, such as Polygon or Arbitrum, because they handle large volumes of cross-chain activity.

How long does bridging crypto take?

Bridging usually takes a few seconds to several minutes depending on the bridge, the networks involved, and congestion on the target chain.

What kind of wallet do I need to bridge crypto?

You need a wallet that supports multiple chains—like MetaMask or a hardware wallet—so it can interact with both the source and the target chain.

Why do people bridge instead of just buying crypto on another chain?

Bridging lets users keep the same asset across chains and access apps or liquidity without selling, which can be cheaper and faster than buying it again on another blockchain.

Is crypto bridging the same as swapping tokens?

No. Swapping exchanges one token for another on the same chain, while bridging moves the same token between chains in an interconnected network.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.