If you want to trade crypto, traditional exchanges can sometimes feel like the guards at the gates of profit. They hold your funds, set the rules, and decide which payment methods you can use. That’s where peer-to-peer trading comes in. It’s a direct exchange between two traders: buyers and sellers. That means you call the shots and stay in control. In this guide, you will learn everything you need to know before making your first P2P trade.

Table of Contents

What Is P2P Trading?

P2P trading is when you trade crypto directly with someone else—peer to peer. Instead of a central authority calling the shots, two parties agree on all the details of the cryptocurrency exchange. You pick the price, choose the payment method, and lock in the terms. The crypto sits safely in escrow until the buyer pays, and then it’s released.

At its core, P2P trading is a decentralized method of exchanging crypto. Buyers and sellers interact directly, with the platform providing escrow services and security measures to protect both sides. This setup gives traders more flexibility and often lower fees than CEXs, while still ensuring secure transactions.

When P2P Trading Makes Sense

P2P crypto trading shines when banks or payment networks don’t give you enough access. If local exchanges don’t support your currency, a P2P platform lets you trade directly with other users. P2P is also useful if you want flexibility: Since you choose your preferred payment method, you have options traditional exchanges rarely offer.

Finally, cross-border trades thrive on P2P marketplaces, which link buyers and sellers worldwide—often with better rates and more tailored trading opportunities than banks.

P2P on Different Platforms

Peer-to-peer trading doesn’t happen in a vacuum. You’ll often see it compared to CEXs and DEXs. Each of these three options has strengths, weaknesses, and unique trade-offs. Let’s take a closer look.

Read more: The Main Differences Between CEX vs. DEX

P2P vs. CEX (Centralized Exchanges): Control, Custody, Fees

Centralized exchanges feel familiar. They hold your funds, charge trading fees, and act as the middleman. Peer-to-peer trading goes the other way, putting control back in your hands.

| Feature | P2P Trading | Centralized Exchanges |

| Custody of funds | Non-custodial, held in escrow until release | Exchange holds funds in wallets |

| Control over price | Users set the prices | Exchange sets or limits prices |

| Payment methods | Wide variety (wire transfer, mobile wallets, even cash payments) | Usually either card or bank transfer |

| Fees | Often lower, sometimes zero trading fees + network fees | Full trading fees + network fees |

| Privacy | Extra control, selective KYC depending on platform & location | Full KYC/AML required |

| Risks | Counterparty risk. Scams if it’s off-platform | Exchange hacks, withdrawal freezes |

P2P vs. DEX (Decentralized Exchanges): Smart Contracts, Liquidity

Both of these provide more transparency. DEXs run on smart contracts and handle trades on-chain. Peer-to-peer platforms rely on escrow systems and direct negotiation between buyers and sellers.

| Feature | P2P Trading | Decentralized Exchanges |

| Execution | Escrow-based, released after proof of payment | Automated by smart contracts |

| Liquidity | Limited to posted offers | Shared pools, usually deeper |

| Slippage | Can negotiate fixed terms | Slippage depends on pool size |

| Payment options | Wide variety (fiat and crypto) | Only crypto-to-crypto |

| Privacy | Depends on the platform, more flexibility | Wallet-based, pseudonymous |

| Risks | Counterparty risk, disputes | Smart contract bugs, impermanent loss |

How P2P Crypto Trading Works (Step-by-Step)

P2P crypto trading may seem complicated until you break it down. Here’s the flow from start to finish.

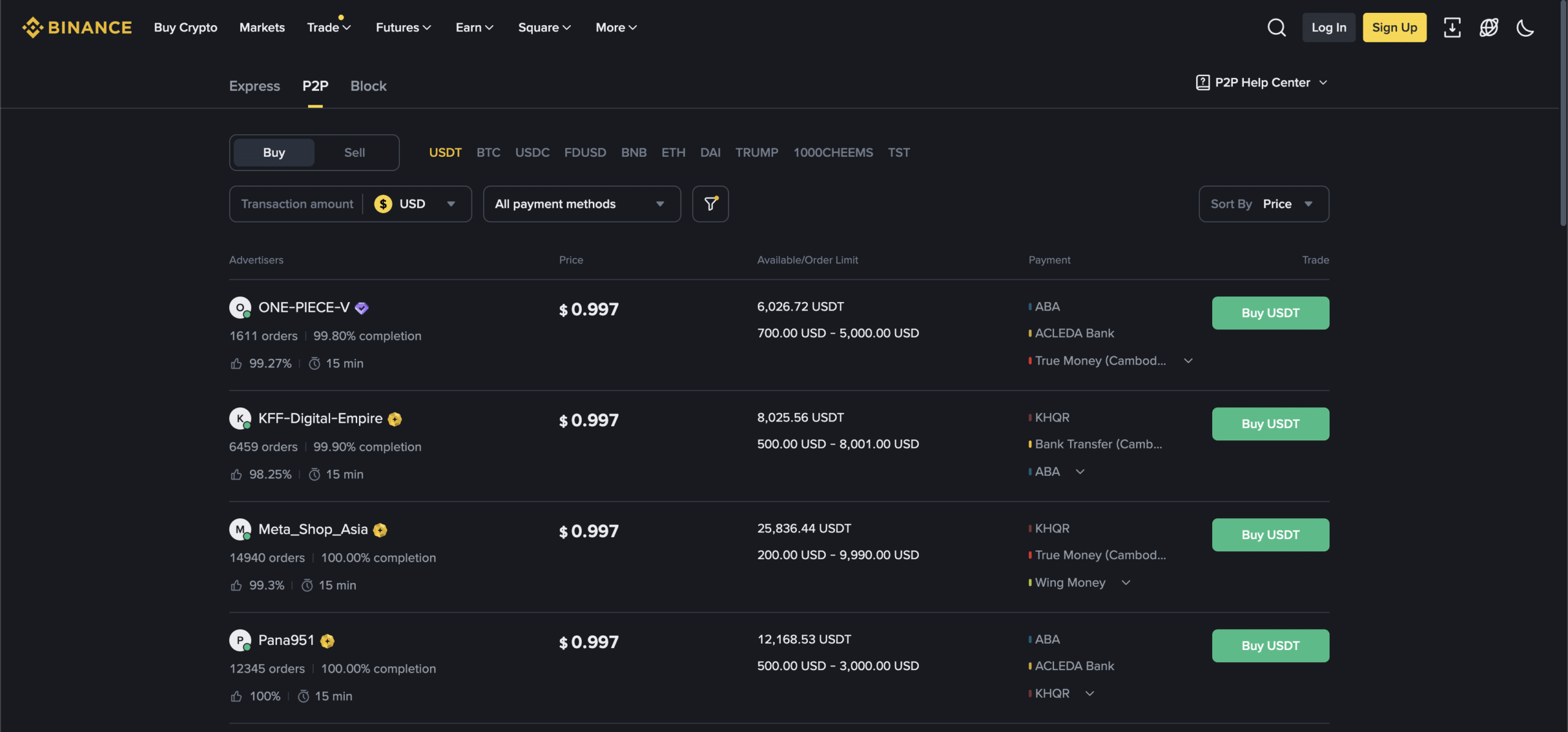

Pick a P2P Marketplace (Platform Reputation & Reviews)

Your first step is choosing a platform. On any P2P marketplace, users connect to each other from across the world, but not all of them are trustworthy. Look for platforms with a reputation system, user reviews, and active moderators. Higher ratings usually mean smoother trades. Avoid off-platform chats that bypass built-in security measures.

Create or Take an Offer (Price, Amount, Terms)

Are you creating an offer or accepting an existing one? Creating means setting your own prices, amounts, and transaction terms. Taking an offer is faster—you just have to agree to the listed details. Either way, both buyers and sellers must confirm the trade before moving forward.

Maker and Taker Roles: Who Does What

In P2P trading, the maker posts an offer. The taker accepts it. Both crypto traders are peers, but the roles define how the trade starts. Makers often wait for potential buyers. Takers act quickly, locking in a suitable offer. Both parties rely on the platform’s escrow system for protection.

Choose a Payment Method (Bank Transfer, Mobile Wallet, Cash)

Pick the payment method you’re most comfortable with. It could be a mobile wallet payment, in-person cash, or even a standard bank wire depending on where you live. Platforms list the available options, so you and the other party must agree on the same method before the trade starts.

Place Crypto in Escrow (What It Is and Why It Matters)

When the trade starts, the seller’s crypto goes into escrow. That means it’s locked until payment is confirmed. Escrow services are extremely important since they protect both parties: the buyer knows the crypto is reserved, and the seller knows funds won’t be released without proof. This system is the backbone of all secure transactions.

Send Proof of Payment and Wait for Escrow Release

Once the buyer pays, they upload proof of payment. It could be a screenshot or receipt. The seller checks the payment proof and confirms. Then the platform releases the crypto from escrow. This step keeps everything transparent and ensures both transaction terms are met.

Dispute Resolution with Moderators If Things Go Wrong

Not every trade runs smoothly. If there’s a disagreement, the platform’s moderators step in. Dispute resolution usually involves reviewing the proof of payment and other records. This process exists to protect buyers and sellers from fraud. Just stay in the platform’s chat and stick to the safeguards keeping the security measures in place.

How a Buyer and Seller Complete a Safe Trade

Let’s go through what a safe trade on a P2P platform could look like. A buyer selects a suitable offer to buy Bitcoin. They agree on payment terms with the seller. The crypto goes into escrow. Then, the buyer sends the full, agreed-upon amount using their chosen payment method, and uploads proof. The seller confirms receipt, and escrow releases the funds, both Bitcoin and payment. Both users walk away happy. That’s peer-to-peer trading in action.

Payment Methods for P2P Trading

A P2P platform doesn’t limit you to one way of paying. You and the other party decide what works best for you both. Here are just some of the most common options.

Bank Transfer (SEPA, Faster Payments, Wires)

Bank transfers are popular because they’re direct and traceable. They provide clear proof of payment and work well with escrow. The downside? Transfers can take hours or days, depending on the network. Reversals are also possible, creating chargeback risk. If you use this method, double-check transaction terms before confirming.

Mobile Wallet / E-Money Apps

Mobile wallets and e-money apps make trades quick. Payment arrives instantly, letting escrow release faster. They’re handy for small amounts but often come with limits. Some apps can reverse payments if users file complaints, which means extra caution is required. Great for speed but less ideal for large transactions.

Cash in Person

Cash is still king in many regions, but using it comes with extra responsibility. Always meet in public, verify funds, and keep the platform’s escrow active. This way, the crypto only releases after you’ve counted the bills.

Regional and Country-Specific Payment Options

Local payment networks are common on global marketplaces for P2P trades. In Latin America, e-wallets and vouchers are popular. In Africa, mobile money dominates. These methods help users access crypto even without traditional banking. Just make sure to always check rates and terms, since fees and speed vary by region.

Others

Some platforms also accept gift cards or online vouchers. These aren’t as common, but they add extra flexibility when standard payment options aren’t available.

Benefits of P2P Trading

P2P trading gives you options that traditional platforms can’t match. Let’s examine the key advantages.

Flexible Payment Methods and Local Currency Access

P2P marketplaces support a wide range of payment types. You can settle trades in your local currency using options that fit your region. From mobile wallet payments to in-person cash deals, the flexibility is unmatched. This makes it easier for buyers and sellers to connect.

Potentially Better Rates and Lower Fees

P2P trading often means setting prices yourself. That can lead to better rates than you’d see on traditional platforms. Trading fees are also minimal—some places even have zero-fee deals for them. The result is lower costs and more competitive pricing for both buyers and sellers. Just remember that you’ll still need to cover network fees whenever crypto moves on-chain.

Useful in Underbanked or Restricted Markets

In many countries, people don’t have easy access to crypto through banks or centralized platforms. P2P crypto trading fills that gap. It creates opportunities where formal rails don’t exist. Whether it’s a cash-heavy economy or a market facing restrictions, peer-to-peer trading helps users stay connected to global networks.

More Control and Selective Privacy (with Caveats)

Unlike centralized exchanges, P2P trading lets you decide what info to share. Some places require KYC, others don’t. With P2P, you get more say over your personal finance decisions—how you trade and what data you provide. But still, that privacy isn’t total. Platforms still log activity, and compliance rules may apply depending on your country.

Risks and Challenges of P2P Trading

Peer-to-peer trading opens a lot of doors, but it’s not totally risk-free. Here are the biggest issues to keep in mind.

Counterparty Risk and Non-Payment Issues

Your trade depends on the other party doing their part. But if a buyer doesn’t pay, or a seller refuses to release crypto, you’re stuck. Escrow reduces counterparty risk but doesn’t erase it completely.

Chargeback Risk from Reversible Payments

Some payment types allow chargebacks. A buyer could send money, get the crypto, then reverse their payment. This chargeback risk makes irreversible methods, like cash or certain wallets, safer choices in peer-to-peer trading.

Common Scams: Fake Proof, Overpayment, Off-Platform Contact

Scammers thrive anywhere two traders meet directly. Fake proof of payment, intentional overpayment, or luring you off the platform are classic tricks. Platforms warn against these scams because they bypass built-in security measures.

Learn how to spot scams and protect your crypto with our free checklist.

Low Liquidity and Slippage Risks

Liquidity on P2P platforms isn’t endless. Fewer offers can mean slower order matches. You might also face slippage if prices shift between offers. That makes large trades harder to execute quickly.

Hidden Fees or Poor Exchange Rates

Some offers look attractive until you notice hidden fees or unfavorable rates. Always read the terms carefully. A lower price upfront doesn’t guarantee the cheapest deal once all costs are included.

Legal and Regulatory Uncertainties (Country Differences)

Rules for P2P trading vary by country. In Nigeria, for example, regulators forced crypto exchanges to drop local currency pairs in 2024. In the US, heavy KYC rules apply. Always check your local laws before trading.

Fees, Pricing, and Execution Quality

Trading on a P2P platform usually costs less than centralized exchanges. Many places charge minimal trading fees, and some even run zero-fee offers to attract new users (though this doesn’t include network fees). P2P pricing is flexible, too. Instead of fixed quotes, people post their own prices. This competition creates a small marketplace where cryptocurrency exchange rates shift constantly. Sometimes you get a lower price than on centralized exchanges. Other times, demand drives a higher price. Either way, execution quality depends on liquidity and timing. If there aren’t enough offers, you may face slippage or slower trades, so always check the details before committing.

Compliance, KYC/AML, and Local Laws

P2P trading feels free and flexible, but it still runs into real-world rules. Platforms must deal with compliance, identity checks, and the laws of each country where users trade.

KYC/AML Basics for P2P Marketplaces

Most platforms now require Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. Regulators treat P2P operators as financial service providers. In the US, FinCEN classifies many of them as money transmitters, which means identity verification must be part of the process before you can start trading.

Compliance Screening (Sanctions, Geo-Limits)

Platforms also screen for sanctioned countries and restricted regions. If you try to connect from a banned jurisdiction, access is blocked. This compliance screening protects the platform from penalties and shields users from illegal trades. Always check the fine print, as geo-limits vary by service, and some are stricter than others.

Tax Considerations (Keep Records; Check Local Rules)

Every trade can be a taxable event. In the US, the IRS may require you to report your digital assets. Other countries set their own rules. The safest approach is to keep records of your trades—prices, amounts, and terms—so you can calculate profit or loss later.

Privacy and Data Protection (What Platforms Collect)

P2P trading may feel private, but platforms still collect data. They log user activity, store identity documents, and share data with regulators when required. Some ask for more than others, so always read the policy. Privacy exists, but only within the limits of local laws and compliance duties.

Is P2P Legal At All?

Yes, but it depends on where you live. In the US, regulators treat P2P platforms as money transmitters, which means KYC/AML rules apply. In other places, rules are less clear or still developing. Some governments even restrict trading, as we’ve seen in Nigeria. Here’s the bottom line: peer-to-peer trading isn’t banned globally, but legality and enforcement vary. Always check your country’s stance before you start trading.

Best Practices for Safe P2P Trading

P2P trading works best when you keep safety front and center. Most platforms do their best to create a secure trading environment, but you still need to follow best practices.

- Check the reputation system and trade history. Look at ratings and past trades before dealing with another user. A strong reputation system protects buyers and sellers alike.

- Always use escrow and platform safeguards. Escrow services are the backbone of secure transactions. Enable two-factor authentication on your account to add another layer of protection, and skip off-platform deals altogether.

- Stick to approved payment methods. Platforms list safe options. Avoid shortcuts—they could cost you everything.

- Keep records and proof of payment. Screenshots and receipts help later down the line, if any disputes come up.

- Start small with trades and scale carefully. Trade small amounts first. Once you’re more familiar, and know your way around, feel free to scale up.

Why Use a Crypto Exchange Like Changelly for Buying Crypto

Changelly works as a fiat on/off-ramp, letting you buy Bitcoin or sell crypto with cards, wire transfers, or stablecoins. You don’t need to negotiate with other users or worry about disputes—the exchange handles everything for you. Fees are clear, the process is fast, and you get direct access to virtual currency without any extra steps. For beginners, that simplicity is hard to beat.

Final Thoughts

Peer-to-peer trading opens doors that regular crypto exchanges can’t match. It gives you trading opportunities in tough markets, flexible payment options, and the chance to set your own terms. Start with small trades, learn the flow, and grow with confidence.

FAQ

Is P2P trading legal where I live?

Yes, in most countries—but rules differ. In the US, P2P platforms must follow KYC/AML requirements, while other countries restrict local currency trades. Always check your regulations before trading.

How long does a P2P trade usually take?

Most P2P trades settle within minutes once payment is confirmed. Delays usually happen if one side is slow to provide proof of payment or confirm release.

Which payment method is safest?

Escrow-protected options with clear proof of payment, like standard bank wires, are safest. Cash in person can work too, but only with strict safety precautions.

Do I need a crypto wallet?

Yes. You’ll need a non-custodial wallet to store your crypto safely. Crypto exchanges or platforms can hold funds temporarily, but long-term storage is on you.

What if a dispute isn’t resolved?

Moderators review the case using records like proof of payment. Their decision is final. Make sure to always keep your communication and data inside the platform.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.