You’ve probably heard over and over again that you need a crypto wallet—but no one’s actually explained why. Maybe you bought some coins on an exchange and now you’re wondering how to keep them safe. So in this guide, we’ll cover everything you need to know. You’ll learn what a crypto wallet is, how it works, what types exist, and how to pick one that fits you best, while avoiding common mistakes and scams.

Table of Contents

What Is a Crypto Wallet?

A crypto wallet is a tool for holding and controlling cryptocurrency. It doesn’t store coins inside—it stores your private keys. These are the cryptographic codes that prove ownership of your digital assets on the blockchain.

A crypto wallet works like a password manager for your money. When you send or receive crypto, it signs each cryptocurrency transaction with your private key while your public key (aka your wallet address) tells the network where it’s going.

Every cryptocurrency wallet—whether it’s a hardware wallet or software wallet—exists to do one thing: keep your keys safe and enable seamless transactions. Many wallets live on your phone or computer. Others are physical devices you plug in when needed. But all share one job: protecting access to your crypto so that only you are in control.

Core Concepts of Wallets

Before we dive deeper into wallets, you’ll need to figure out the basics. Once you understand these core components of crypto wallets, everything else will start to click.

Public and Private Keys

Your private key is your master password. The proof that your coins are yours. Lose it, and you lose access entirely. It looks like a long string of characters that lets you sign crypto transactions and move funds.

Meanwhile, your public key is what others see. It’s mathematically linked to your private key but safe to share. Think of it like your email address: Your public key lets people send you messages, but your private key makes sure they can’t open your inbox.

Together, these two are called your cryptographic keys, and they’re what make blockchain security possible, while ensuring crypto can move throughout the ecosystem.

Wallet Addresses

A wallet address is the short, readable version of your public key. It’s how the network knows where to send your funds. You can compare it to a bank account number. It identifies you for payments but reveals nothing else.

When someone sends crypto, they paste your receiving address or scan a QR code linked to it. Each blockchain has its own format. Addresses can be case-sensitive, so always double-check before hitting “send.”

Transaction Signing

When you send crypto, your crypto wallet uses your private key to create a digital signature, which is a cryptographic proof that the transaction came from you. Others verify it using your public key, which mathematically matches your private one without revealing it. If the signature checks out, the blockchain accepts the transfer. This way, you never expose your private key, yet everyone can confirm it’s legit. This system keeps crypto secure and verifiable inside wallets.

Recovery and Backup Essentials

The truth is, wallets can break, phones can vanish, and computers can die. But every crypto wallet gives you tools to recover access if something goes wrong.

The Seed Phrase

A seed phrase (or recovery phrase, or seed) is a list of 12–24 words generated by your wallet under the BIP39 standard. These words recreate your private key and restore your wallet if it’s lost or damaged. Write it down once, store it offline, and never share it with anyone, anywhere. Remember that anyone who finds your seed can access your digital assets, so treat it like a vault key.

Passphrase (BIP39 “25th Word”)

A passphrase is an optional, extra “25th word” that encrypts your seed phrase. It adds another wall between you and potential thieves. Even if someone steals your seed, they can’t access funds without your passphrase. It’s powerful, but risky. Forget it, and no one, not even your wallet provider, can help you recover your crypto assets.

Recovery Procedure

If your device fails, recovery is a simple process: reinstall your crypto wallet app, select Restore, and enter your seed (and passphrase, if used). The crypto wallet regenerates your private keys and syncs your balance from the blockchain network. But backups only work if you keep them secure and accurate. If you forget even one word of your seed, your funds are gone.

Metal Seed Backup

Paper burns and hard drives fail, which is why serious holders use metal seed backups, which are engraved plates that can survive fire, water, and time. They’re perfect for long-term cold wallet security. Even if it’s a bit old-school, it works—and it’s one less way for your recovery seed to be destroyed.

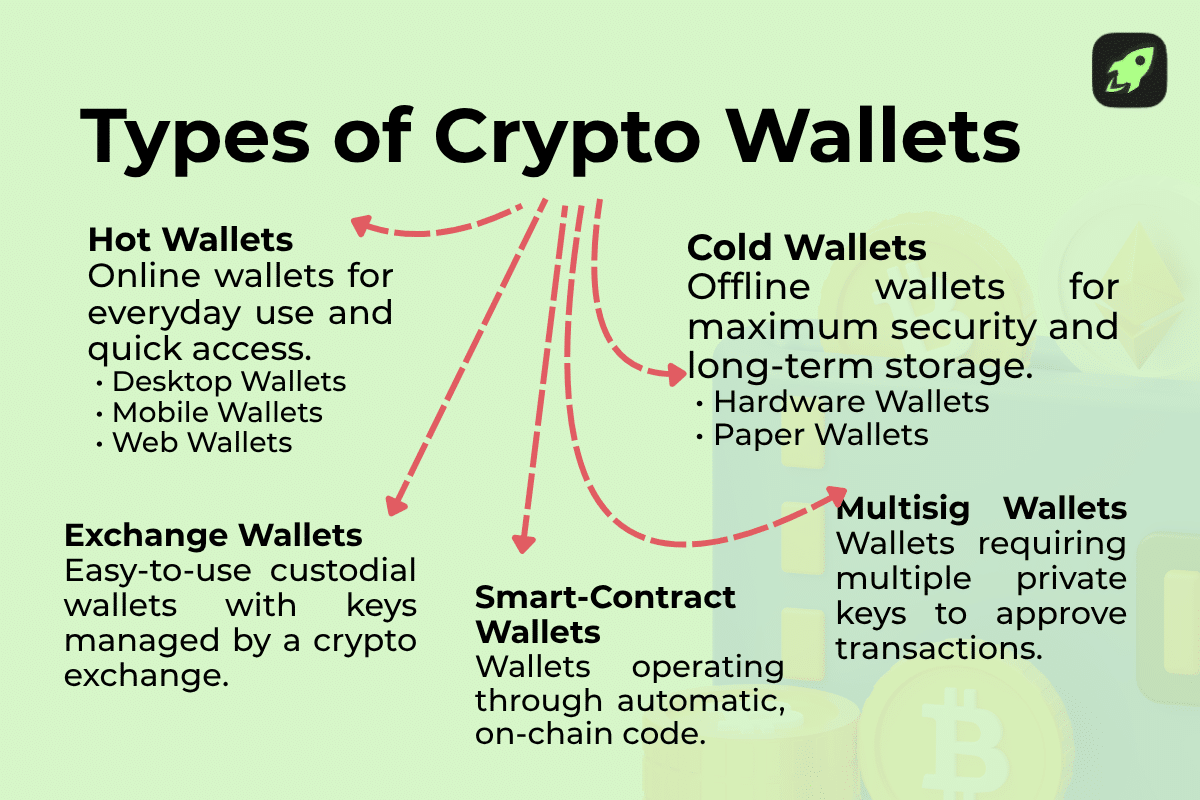

Types of Crypto Wallets

Cryptocurrency wallets differ by how they connect and who controls them. You’ll see many types of crypto wallet, from hot, cold, multisignature, smart-contract, to exchange wallets. Below is a breakdown of each.

Hot Wallets (Software, Mobile, Web)

Hot wallets are also known as online wallets. Being entirely online makes them faster to use on a daily basis. They include software wallets installed on your computer or mobile phone, web wallets in your browser, and many mobile wallets. You can easily send or receive crypto with hot wallets. But because they’re always connected to the internet, they’re more vulnerable to hacks. Use them for smaller, active balances, not your full stash.

Cold Wallets (Hardware, Paper)

Cold wallets are entirely offline. This slashes your exposure to risks like hacks and downtime. There are two main kinds of cold wallets: hardware wallets (small devices) and paper wallets (printed keys).

Hardware wallets typically cost between $50 and $200. They sign transactions internally so your private keys are offline, and never leak. Paper wallets are even more simple: they’re just your keys printed out. But they have a higher risk of damage or loss.

Most people prefer to use cold wallets for long-term secure storage of their holdings in large amounts.

Multisignature Wallets

A multisignature wallet (or multisig) needs multiple private keys to move funds, for example, 2 of 3 or 3 of 5. Each signer has their own key, and the transaction only goes through when enough of them approve. This setup protects against theft or mistakes, since no single key can drain the crypto wallet. It’s ideal for teams, DAOs, or joint accounts that want an extra layer of shared control and prioritized security.

Smart-Contract Wallets

Smart-contract wallets run code on the blockchain. They can have rules built-in: daily limits, guardians who approve moves, or automated actions. These wallets let you interact with decentralized applications (dApps), DeFi, and NFTs without exposing raw keys. The wallet’s logic protects your assets according to defined rules.

Crypto Exchange Wallets

When you create an account on a cryptocurrency exchange, you automatically receive an exchange wallet. This type of crypto wallet is a custodial wallet. In this setup, the exchange holds your private keys. That makes it much easier for you to trade, but also much riskier. If the exchange is hacked, you could lose all your funds. Still, many beginners start here since these wallets are the easiest to open and operate.

Custody Models

Who holds the keys—you or someone else—defines your wallet’s custody model. Knowing the difference decides how much control (and risk) you take on.

Custodial Wallets

A custodial wallet means that a third party, usually a cryptocurrency exchange, holds your private keys. You log in with a password, and the company manages the tech behind the scenes. The upside is clear: convenience. You can recover access easily and trade faster. But there’s an equally obvious downside—you don’t have full control. And if the service is hacked or freezes accounts, your crypto assets are in serious danger.

Overall, custodial wallets suit beginners or short-term traders who want a quick, managed experience. Just remember that if you don’t hold the keys, you don’t truly own the coins.

Non-Custodial Wallets

A non-custodial wallet gives you complete control. You hold the private keys, not a company. That means no one can block transactions, recover your password, or take your funds without your say-so. It’s pure self-custody, which is both empowering and demanding. If you lose your seed, you’re locked out forever. Still, many prefer it for better security and more freedom.

Non-custodial wallets work great for long-term holders and DeFi users who want to stay independent.

How Wallets Work Under the Hood

A crypto wallet might seem simple, but under the surface, it’s doing serious math. When you hit “send,” the wallet builds a transaction and signs it with your private key. That signature is unique, and anyone can verify it using your public key, but no one can fake it. The blockchain network checks the math, confirms it’s really you, and adds the transaction to its permanent record.

Read more: Blockchain Technology Explained for Beginners

To stay consistent and secure, Bitcoin cryptocurrency wallets follow a set of open rules called Bitcoin Improvement Proposals (BIPs). These standards define how these wallets create and manage your keys safely:

- BIP39 (Seed Phrases): explains how wallets turn random data into a 12–24-word recovery phrase that recreates the user’s private keys if needed.

- BIP32 (HD Wallets & Derivation Paths): shows how a single master key can generate an unlimited number of child addresses through a “derivation path,” so one backup restores everything.

Most modern crypto wallets also connect to decentralized apps through protocols like WalletConnect, which let you approve transactions from your phone without exposing your private keys.

Finally, different types of blockchains record balances in different ways:

- UTXO Model (Bitcoin): treats each transaction like cash. You spend specific chunks called unspent transaction outputs (UTXOs), and your wallet adds them up to show your balance.

- Account Model (Ethereum): works more like a bank ledger. Each address stores its balance directly, and every action—sending cryptocurrency tokens, minting NFTs, or interacting with smart contracts—costs a bit of gas.

Together, these systems make every wallet a cryptographic engine, signing, verifying, and syncing your crypto securely across the blockchain.

How to Get Free Crypto

Simple tricks to build a profitable portfolio at zero cost

Why Wallets Matter

Wallets give you direct control over your assets, whether you’re investing for the long haul, spending daily, or diving into Web3 apps. They’re the bridge between owning crypto and actually using it. Let’s go over just some of the ways you can use your crypto wallet.

Long-Term Holding (HODLing)

If you plan to hold crypto for years, cold wallets (such as hardware wallets) are your best bet. They keep your private keys offline, safe from hacks and phishing. Devices like the Ledger Nano X or Trezor Model T store your recovery phrase internally and never expose it on the internet.

Read more: What is ‘HODL’?

Offline storage, often called cold storage, is how long-term investors can sleep at night. It’s slower to access but far more secure, which is a small trade-off for protecting your future gains.

Everyday Spending

For quick payments and on-the-go use, hot wallets shine. You install them on your phone, scan a QR code, and can send crypto in seconds. Apps like Exodus or Trust Wallet make this as easy as paying with a credit card.

Hot wallets require an internet connection, so they’re great for convenience—just stick to small balances on there, and use strong security (like two-factor authentication and difficult passwords) to stay safe.

Using Wallets with dApps

Your cryptocurrency wallet is also your way into Web3. Through connectors like WalletConnect or MetaMask, you can access dApps directly, with no usernames or passwords. That’s because, when you sign in, your public key verifies your identity, while your private key stays hidden. You can lend, borrow, trade, or play, all from your wallet. It’s your passport to the decentralized web.

Wallets in DeFi

In DeFi, your non-custodial wallet acts like your bank. You connect, approve a transaction, and interact with smart contracts that handle lending, swaps, and staking. No middlemen. Every action you take is recorded on the blockchain and paid for in gas. DeFi rewards independence, but it also demands you keep your seed and private keys secure, since there’s no reset button if you mess up.

Wallets and NFTs

NFTs live in crypto wallets too. They’re tokens tied to your public address, proving ownership on-chain.

When you mint or buy an NFT, it’s stored in your wallet alongside your crypto. You can display it in a marketplace or move it between wallets just like any other asset. Whether it’s art, collectibles, or in-game items, your wallet is what proves they’re truly yours.

How to Choose Your First Wallet

Your first crypto wallet should match how you actually use crypto. The right pick balances security, ease of use, and control. There are no one-size-fits-all answers here.

Security Features

Start with safety. Look for wallets that support two-factor authentication (2FA), strong passwords, and regular firmware updates. Many also let you whitelist addresses, so your wallet only sends crypto to approved accounts.

Hardware wallets offer the strongest defense, since your private keys never touch the internet. Software wallets should at least encrypt your keys locally. As a general rule, the more steps it takes to get access to your crypto, the harder it is for hackers to reach it.

Ease of Use (UX)

If a crypto wallet feels like a puzzle, you won’t use it. Beginners should pick something simple, with clear menus, easy recovery, and quick swaps. Mobile options are great for this—using a wallet on your phone, you can send or receive cryptocurrency in seconds.

Supported Blockchains / Cryptocurrencies

Some wallets handle just one blockchain, while others support hundreds. If you plan to manage multiple assets, make sure your wallet lists all your cryptocurrencies and networks, such as Bitcoin, Ethereum, and Solana.

Backup & Recovery Options

Your backup is your lifeline. Choose a cryptocurrency wallet that generates a seed and allows you to add a passphrase for extra protection. Make sure recovery is simple and well-documented, too. If you value self-custody, this is where it matters most. Losing your seed means losing your assets forever. Keep it offline, on paper, or better yet, in a metal backup.

Cost and Fees

Software wallets are usually free. Hardware wallets cost money, usually between $50 and $200, but that’s cheap insurance if you have large holdings.

Also, don’t forget transaction costs. On networks like Ethereum, you’ll pay gas fees every time you move crypto. Some wallets estimate these for you, helping you plan transfers in advance.

Reputation & Open Source / Audits

Finally, pick a crypto wallet you can trust. Stick with names that have public code, independent audits, and active development. Open-source wallets are easier to verify, since anyone can check they’re not hiding unwanted surprises.

A good reputation means years of updates, not flashy ads. When it comes to crypto safety, transparency always beats hype.

Common Risks & How to Avoid Them

Mistakes or scams can cost you everything, no matter how good your crypto wallet is. But the good news is that most wallet disasters are preventable if you know what to watch out for.

Losing a Private Key or Seed Phrase

Your private key and seed are the only way to access your crypto. Lose them, and no support team can bring your funds back. Write your recovery phrase down once, store it offline, and never upload it to cloud storage. Make a backup copy if needed, but store it in a different, secure way. Treat your seed like a master key—because that’s exactly what it is.

Phishing / Malware / Fake Apps

Phishing is the oldest trick in the crypto book. Scammers can send you fake emails, build clone websites, or make counterfeit wallet apps that steal your private information. Double-check every URL before logging in. Download wallets only from official links. Never enter your seed into a web form, even if the page looks legit. When in doubt, always assume it’s a trap.

Exchange / Custodial Risk

If you keep your funds on a custodial wallet or exchange wallet, you’re putting your trust (and your money) into someone else’s security. Crypto history is full of cases of exchanges getting hacked or freezing withdrawals overnight. Use them for trading, not for storage. Once you buy crypto, transfer it to a non-custodial wallet. Remember the golden rule: not your keys, not your coins.

Hardware Failures, Backup Issues

Hardware wallets are tough, but not unbreakable. Water, fire, or even firmware glitches can brick any device. That’s why you always need a backup. Ideally, a metal seed backup that can survive the worst. Test your recovery process once. If you can restore your wallet safely, you’ll never panic if your main device fails.

Privacy Issues

Blockchains are transparent. Your public keys link to every transaction you’ve ever made. Anyone can trace funds if they know your address. To stay private, use a new receiving address each time or switch to wallets that generate them automatically. Avoid posting addresses publicly, and use privacy-focused wallets when you can.

Best Crypto Wallets by Changelly

The crypto wallets we’ve picked below are trusted by millions of users and integrate smoothly with Changelly, making it easy to buy, sell, or swap crypto across hundreds of assets and networks. Whether you’re storing for the long haul or trading daily, here are top picks that fit every style.

| Name | Type | Best For | Key Features |

| Ledger Nano X | Hardware Wallet | Long-term holders | Stores private keys offline, supports 5,000+ assets, Bluetooth connection for mobile use |

| Trezor Model T | Hardware Wallet | Security-focused users | Open-source firmware, touch screen, advanced passphrase protection |

| Exodus | Software Wallet (Desktop & Mobile) | Beginners | Simple interface, integrated swap features, supports 300+ coins |

| Trust Wallet | Mobile Wallet | Everyday spending | Built-in dApp browser, supports NFTs, multiple blockchain networks |

| MetaMask | Browser & Mobile Wallet | DeFi and DApps | Connects to decentralized applications, supports WalletConnect, customizable gas fees |

| AliceBob Wallet | Self-Custody Software Wallet | Active traders & users focused on self-custody | Supports 1,000+ assets across 300+ blockchains, built-in CEX/DEX swaps, fiat purchases, portfolio tracking & full control of private keys |

Final Thoughts

At its core, a crypto wallet is freedom. It holds your private keys, proving that your digital assets belong to you. Not to an exchange, not to a platform. Just you.

The golden rule still stands: protect your digital keys, guard your seed phrase, and put your trust into math, not emotions. With a solid wallet and smart habits, you can move, trade, and store your crypto confidently—the way it was always meant to be.

FAQ

What happens if I lose my seed phrase?

You lose access permanently. Your seed is the only way to restore your private keys, so keep it backed up offline and never share it with anyone.

Is my crypto stored inside the wallet?

No. Your crypto always lives on the blockchain network. The wallet just stores the keys that let you access and move it.

Can I use multiple wallets at once?

Yes. Many users keep hot wallets for quick trades and cold wallets for long-term storage.

Is an exchange wallet safe enough?

It’s a convenient solution, but risky. Exchange wallets are custodial, meaning you don’t actually hold the keys, so if the exchange gets hacked or freezes funds, you could lose your access.

Do I need to pay gas fees for every transaction?

Yes, most networks charge gas fees to process transactions. The cost depends on network demand. Higher traffic, higher fees.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.