Liquidity provider (LP) tokens are one of the cogs that help decentralized finance work. For many beginners, they’re also quite confusing. If you’ve ever used a decentralized exchange, you’ve relied on liquidity pools and the users who fund them, even if you didn’t realize it. LP tokens explain how this system works behind the scenes. They show what happens when you provide liquidity, how rewards are tracked, and why decentralized exchanges can function without traditional market middlemen.

In this guide, we’ll break down what LP tokens are, how they work, and why they matter in decentralized finance, using simple explanations and real use cases to help you understand where they fit into your crypto journey.

Table of Contents

What Are LP Tokens in Crypto?

Liquidity provider tokens (LP tokens) are tokens, issued specifically to liquidity providers within a decentralized exchange (DEX). Usually, these DEXs run on an automated market maker (AMM) protocol, which means they use smart contracts and liquidity pools to maintain their operations, instead of order books. This allows them to automatically set prices and facilitate trading.

Most popular swaps distribute LP tokens to their liquidity providers.

What Are Liquidity Providers?

A liquidity provider (LP) in crypto is either a person or an organization that supplies tokens to a trading platform, usually a DEX. This way, there are always assets to buy or sell on the platform. In return, LPs receive rewards or fees gained from transactions that used their cryptocurrency. This system allows the platform to facilitate trading, while the token has higher chances of maintaining its value.

How Do LP Tokens Work?

On decentralized exchanges, users deposit two crypto assets of equal value into a crypto liquidity pool—for example, a trading pair like ETH/USDC. These deposited assets are locked in a smart contract to make it possible for other users to start trading.

How to Get Free Crypto

Simple tricks to build a profitable portfolio at zero cost

In return, liquidity providers receive liquidity provider tokens (also called liquidity pool tokens). These LP tokens represent your share of the overall liquidity pool. That includes the underlying assets and the trading fees generated. After that, when traders swap assets, the accumulated transaction fees are added to the pool, so when you redeem your pool’s LP tokens, you get back your share of the pool’s assets plus fees generated—making it a way to earn passive income.

Because the liquidity pool fluctuates with market volatility and token prices, returns can change over time. Some DeFi platforms offer additional rewards like liquidity mining, yield farming, or staking LP tokens to earn governance tokens (for example, CRV tokens). LP tokens can also be used across other protocols in the DeFi ecosystem for further rewards.

LP tokens act as proof of contribution, giving crypto liquidity providers complete control—you can transfer ownership or exit anytime.

How Do You Get LP Tokens?

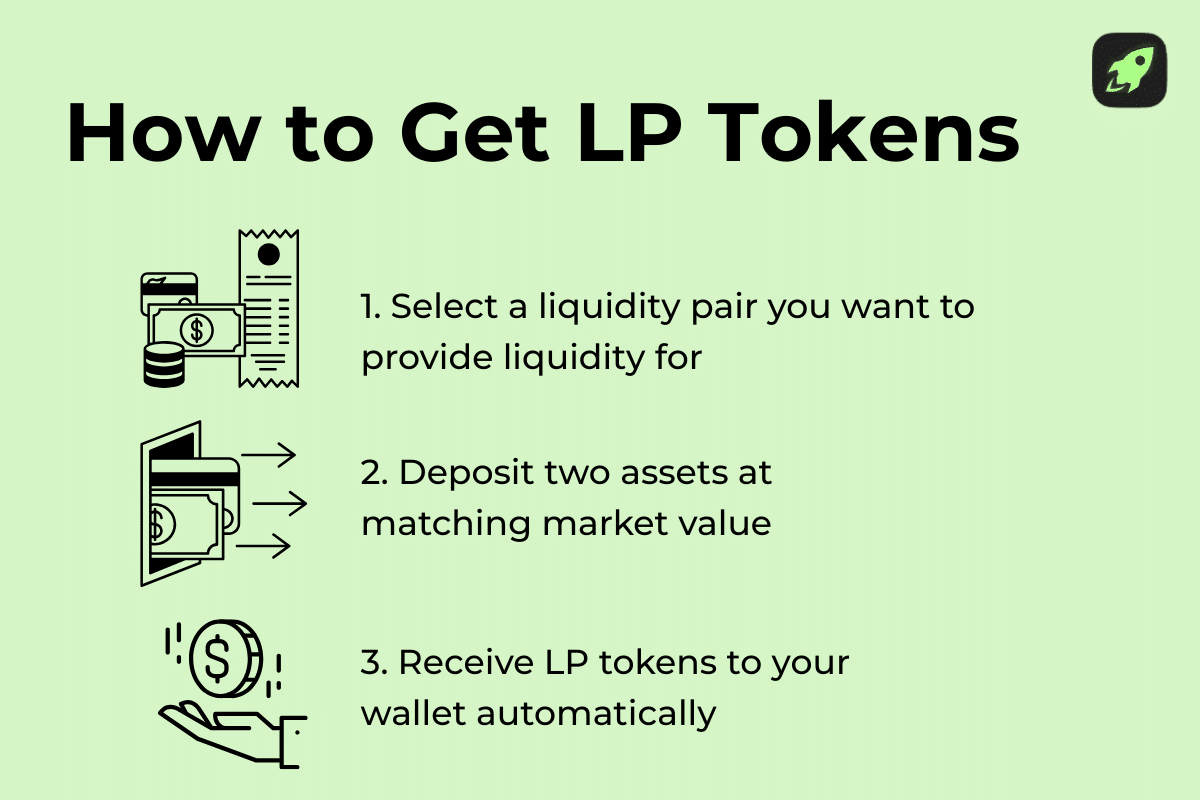

You can get LP tokens by providing liquidity to a pool on a DEX. Just follow this simple guide:

- Choose a trading pair, like ETH/USDC.

- Deposit both assets in equal value into the pool.

- Once the deposit is complete, the protocol automatically issues LP tokens to your wallet.

You keep these LP tokens until you withdraw your liquidity, at which point you redeem them for the underlying assets and earned fees.

What LP Tokens Represent

LP tokens represent the crypto assets you put into a liquidity pool. They are your share of that pool. Let’s say you add ETH and USDC into a pool. These tokens become the underlying assets of your LP tokens. In simple terms, LP tokens are a receipt that shows which assets you deposited and how much of the pool you own. As trading happens, fees are added to the pool, so the value of your LP tokens grows or changes with the pool. When you exit, you return the LP tokens and receive the underlying assets back, plus your share of the fees.

What Are the Use Cases of LP Tokens?

LP tokens are versatile, and they don’t just serve as proof of investment. They unlock several ways to use your liquidity position across the DeFi ecosystem and receive additional income.

Collateral in a Loan

Some DeFi lending platforms let you use LP tokens as collateral. So, instead of selling your position, you can borrow against it. This way, you keep exposure to the underlying assets and potential trading fees.

Yield Farming

LP tokens are often used in yield farming programs. By depositing them into special reward pools, you can earn extra tokens on top of regular trading fees. That helps to increase your overall returns, especially over time.

LP Staking

With LP staking, you lock your LP tokens in a protocol to earn additional rewards or governance tokens. This is a common way to generate more income from liquidity you already provided.

Why Are Liquidity Provider (LP) Tokens Important?

Liquidity provider (LP) tokens play an important role because they help keep decentralized exchanges running smoothly. These tokens both reward users who supply liquidity, and make sure that enough assets are available for trading at all times. LP tokens serve liquidity providers as proof of their contribution and a clear claim on the assets and fees inside a liquidity pool. Without LP tokens, users would have little motivation to lock their funds in pools, and trading would likely become slow and expensive. It’s by rewarding those who participate most actively that LP tokens support fair pricing, lower slippage, and efficient trading across the decentralized finance ecosystem.

How to Earn Rewards with LP Tokens

To earn rewards with LP tokens, start by providing liquidity to a pool on a decentralized exchange. After depositing two tokens of equal value, you’ll receive LP tokens. As people trade on the platform, you earn a portion of the fees automatically.

To earn additional rewards, first check if the platform offers yield farming or LP staking. If it does, you can deposit your LP tokens into these programs. That way, you can passively earn governance tokens that will give you voting power on certain platforms.

When you put your tokens to work, you still need to monitor your position and withdraw when it fits your goals. Your rewards come from fees, incentives, and time in the pool.

Risks of Providing Liquidity

Providing liquidity can be rewarding, but it also comes with risks beginners should understand.

One common risk is impermanent loss, which happens when the prices of the two tokens you put into a liquidity pool change in different directions. Because the pool automatically rebalances the tokens, you can end up with less total value than if you had simply kept the same tokens in your wallet instead. There are also smart contract risks: if a protocol has bugs or vulnerabilities that are exploited by a third party or, sometimes, from within the project, funds could be lost. Market volatility can affect returns, and pools with low liquidity may generate fewer fees. Finally, some platforms offer extra rewards that depend on token prices, which can fluctuate.

Understanding these risks is important if you’re looking into providing liquidity. After all, you’re leaving your money in someone else’s hands.

Can I Lose Money With LP Tokens?

It’s possible to lose money with LP tokens, especially if you’re not aware of the risks. The value of your LP tokens can change if the prices of the underlying tokens move sharply, which may result in less value than if you’d simply held them. Market volatility, low trading activity, or sudden drops in token prices can reduce returns. There are also technical risks such as smart contract bugs or platform failures. While trading fees and rewards can offset some losses, LP tokens are not risk-free and understanding how pools work helps you manage those risks better.

Staking LP Tokens to Earn More

Staking LP tokens is relatively simple once you figure out how things work. Plus, it’s a good way to earn extra rewards on top of trading fees.

- First, provide liquidity to a pool and receive LP tokens into your wallet.

- Next, check if the platform offers an LP staking or yield farming program.

- Deposit your LP tokens into the staking contract, and the protocol will start rewarding you, usually with governance or incentive tokens.

Your rewards grow over time as long as your LP tokens remain staked. When you’re ready, you can unstake your tokens and withdraw your liquidity, along with any earned rewards.

Are LP Tokens Worth It?

LP tokens can be worth investing in. If you understand how they work, consider the risks, and choose your pools carefully, you can start providing liquidity and earning rewards. Here are some things to keep in mind:

- Start by looking for liquidity pools with steady trading activity and well-known tokens, as these usually generate more fees.

- Consider whether extra rewards like LP staking or yield farming are available.

- Always balance potential earnings against risks such as price changes or smart contract issues.

Remember that LP tokens work best for users who plan to stay in a pool long enough for fees and rewards to add up. If you prefer active management and learning as you go, LP tokens can be a useful tool.

Final Thoughts

LP tokens help keep the decentralized finance ecosystem running. They align incentives between traders and liquidity providers, making decentralized exchanges more efficient, accessible, and scalable. While LP tokens offer opportunities to earn trading fees and additional rewards, they also come with risks that shouldn’t be ignored.

Now you understand how liquidity pools work and what LP tokens represent. When you know how to manage risk, LP tokens can become a powerful way to participate in DeFi beyond simple trading, and a practical step towards becoming an active contributor to decentralized markets.

FAQ

Are LP tokens the same as regular crypto tokens?

No. LP tokens are different from regular cryptocurrencies like BTC or ETH. They don’t represent a standalone asset. Instead, LP tokens represent your share of a liquidity pool, including the underlying assets you deposited and the fees the pool has earned.

What happens when I remove my liquidity?

When you remove your liquidity, you return (or “burn”) your LP tokens. In exchange, you receive your share of the pool’s underlying assets plus any trading fees you earned, based on the pool’s current state.

Can I use LP tokens in other DeFi protocols?

Yes. Many DeFi platforms let you use LP tokens for yield farming, staking, or as collateral for loans. This allows you to earn additional rewards without removing your liquidity from the pool.

Are LP tokens safe?

LP tokens are only as safe as the protocol behind them. Risks include smart contract bugs, market volatility, and impermanent loss. Using well-known platforms and understanding the risks helps limit potential losses.

What happens when you burn LP tokens?

Burning LP tokens permanently removes them from circulation. This process happens when you withdraw liquidity and allows the protocol to return your share of the pool’s assets and earned fees.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.