The crypto market is known for its volatility. Even the most popular currencies, like Bitcoin and Ether, are prone to price fluctuations. It’s as easy to make money on them as it is to lose it.

Stablecoins offer a refuge from this market uncertainty, and financial inclusion for those who avoid traditional currencies. They have become so popular that today, USDT has the third-largest market cap among all cryptocurrencies.

This is why understanding what exactly stablecoins are, what types of stablecoins exist, and how they work is the best way to start navigating the world of crypto.

Table of Contents

What Is a Stablecoin?

A stablecoin is a token whose price remains relatively stable.

While a regular coin’s price depends on external factors, popularity, and users’ trust, a stablecoin depends on whatever its price is pegged to. Usually, that’s a fiat currency like USD or EUR. This makes them ideal for interacting with cryptocurrency without having to worry about jumping exchange rates.

Stablecoins are also backed by collateral in the form of assets such as gold or Treasury bills. These coins are ideal for savings, transactions, and even shopping—it’s as easy as having actual money in your wallet.

Keep reading: What Is a Stablecoin?

Types of Stablecoins

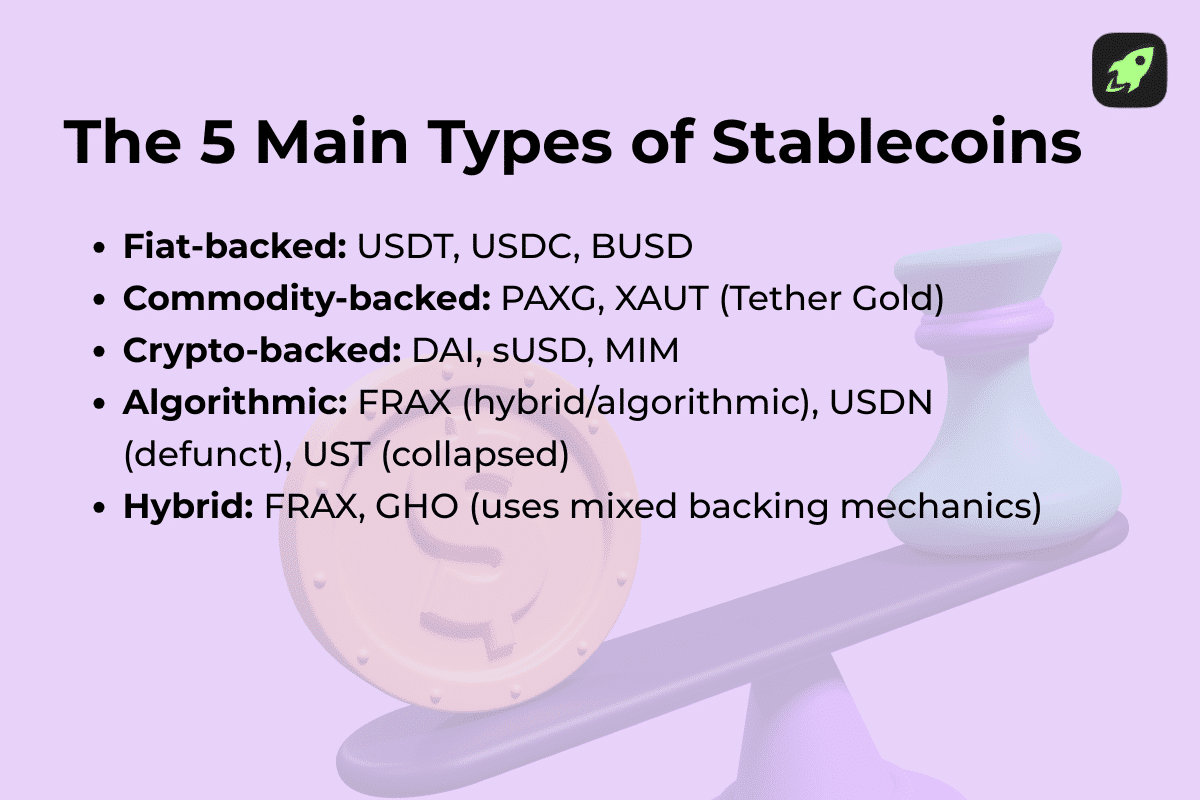

Stablecoins are cryptocurrencies designed to keep their value stable by being linked to a less volatile asset, like gold or traditional money. Different types of stablecoins are backed by different assets, each with its own benefits and drawbacks.

Fiat-Collateralized Stablecoins

A fiat-collateralized stablecoin is a digital currency that is tied to a traditional currency like the US dollar or euro. These types of stablecoins are backed by physical reserves, such as Treasury bills, which means the issuer guarantees that there are enough reserves to cover all the coins in circulation. Examples of such stablecoins are USDT (Tether) and USDC (Circle), and their value does usually stay close to 1:1 with the dollar.

These stablecoins are issued by centralized companies, which are responsible for maintaining reserve transparency and ensuring that these reserves match the amount of coins issued. For instance, if there is 1,000 USDT in circulation, the issuer must hold 1,000 USD in a bank account. This connection to traditional financial institutions helps reassure users of the coin’s stability.

Before buying a fiat-backed stablecoin, you need to pay attention to these three roles:

- Issuer: The entity responsible for minting the coin and maintaining its reserve.

- Custodian: The organization that stores the digital asset (stablecoin).

- Auditor: The company that performs the audit of the coin’s code, ensuring transparency and security.

The advantage of fiat-collateralized stablecoins is that their value is easy to understand and stable, making them convenient for transactions and trading, especially on decentralized exchanges.

However, they come with risks because users must trust the issuer to keep sufficient reserves. Plus, they’re not fully decentralized since they depend on and are regulated by the issuing companies.

Read more: What is Tether (USDT)?

Commodity-Backed Stablecoins

Commodity-collateralized stablecoins are backed by physical assets like gold. This isn’t a new practice introduced by crypto—some fiat currencies function in a similar manner, being backed by oil or gold and foreign reserves.

The way they work is basically the same as fiat-backed coins, but with a different asset for collateral. These stablecoins are also centralized and managed by a specific company or organization.

How to Get Free Crypto

Simple tricks to build a profitable portfolio at zero cost

Since certain commodities offer a relatively stable value, this type of stablecoin remains popular as an investment. On paper, buying them is like buying the asset itself. In reality, users and investors must remain cautious and verify that the reserves do, in fact, exist.

That’s why an audit performed by a trustworthy and impartial company is crucial: Before buying a commodity-backed coin, you must familiarize yourself with the documentation regarding the coin’s reserves.

Some of the most popular gold-backed stablecoins are PAX Gold and Tether Gold. Every PAXG coin is said to be backed by an ounce of gold, and you can trace it using the serial number on the Paxos website.

The main advantage of these stablecoins is their exposure to commodities. Depending on the commodity, they can provide stability and even growth over time.

Still, just like anything else, a commodity, even gold, can lose its purchasing power, devaluing the stablecoin. Needless to mention that reserves have to be stored and kept safe by the issuer.

Crypto-Collateralized Stablecoins

Certain stablecoins are backed by crypto assets. This means that the issuer’s reserves contain other cryptocurrencies. Since they are volatile by nature, occasionally, issuers overcollateralize, meaning the reserves exceed the amount of currency in circulation, thus covering for potential price movements.

Crypto-backed stablecoins are secured by cryptocurrencies stored on the blockchain and managed through smart contracts. These stablecoins rely on price oracles to provide up-to-date information about the value of the collateral.

Their parameters, such as collateral types and stability rules, are set through community governance and a whitelist of approved assets.

DAI and MakerDAO are examples of such currencies. MakerDAO provides an interesting illustration of combining decentralization and stability. The coin’s price is soft-pegged to USD, which means 1 DAI coin equals 1 USD. The coin is collateralized by Ethereum and several other cryptocurrencies. It can be issued by anyone, but to mint or borrow a coin, you must deposit collateral in the amount of no less than 150% of the coin’s value.

This system is put in place to protect coins from devaluation.

Cryptocurrency-backed stablecoins provide two core components of crypto—decentralization and transparency. You can look up all the required information before investing in these coins. The downside of this system is vulnerability to market volatility. You must also risk the possibility of liquidation cascades if collateral prices fall sharply, and potential manipulation of the oracles that feed price data into the system.

Algorithmic Stablecoins

Similar to the other types of stablecoins, algorithmic coins maintain a stable value. To do that, though, they don’t rely on traditional collateral. Instead, they use mechanisms such as seigniorage systems or dual-token models.

A seigniorage system adjusts the supply of coins automatically. Dual-token models use one token to stabilize the other.

Both these designs reduce the need for large reserves in an attempt to achieve capital efficiency. But these systems carry significant risks. A major example is the collapse of TerraUSD, where the coin lost its peg dramatically due to reflexive failures and low trust among users.

Keep reading: What Is an Algorithmic Stablecoin?

Hybrid Stablecoins

Hybrid stablecoins combine the features of different types of stablecoins in order to balance out their existing pros and cons. The aim is to achieve safety and capital efficiency without compromising the decentralized structure.

For example, some coins use partial reserves as collateral while implementing the burn/mint logic, where a portion of issued tokens is burned. This helps keep the price and demand in check.

Which Stablecoin Is Considered the Safest Right Now, and Why?

Currently, USDC is widely regarded as the safest stablecoin. It’s issued by Circle Internet Group, Inc., known for its transparency and regular audits. USDC’s reserves are fully backed by cash and short-term US Treasuries, confirmed by independent auditors—making it one of the most trusted fiat-backed stablecoins on the market.

USDT, issued by Tether Limited Inc., remains the most popular stablecoin by volume, but it has faced criticism for limited disclosure of its reserves. While both USDT and USDC are centralized and tied to traditional financial systems—which offers a sense of safety—that doesn’t make them risk-free.

Read more: USDT vs. USDC: Which Is a Better Choice?

A stablecoin pegged to fiat might sound like a safe bet. But keep in mind that the safety of each stablecoin is first and foremost determined by its backing. If the collateral loses value, so does the coin.

This isn’t the only danger you face with stablecoins, since the regulatory framework for cryptocurrencies is still in its early stages. Malicious issuers could falsely claim the existence of reserves, and without the necessary due diligence, many users end up exposed to price fluctuations.

Aside from that, it’s not uncommon to fall victim to fraud. In 2024, the FBI issued a warning regarding impersonation tokens, where criminals contact users with an offer to purchase fake stablecoins that resemble real ones.

When it comes to stablecoins, it falls upon you to research everything prior to investing. You have to become fluent in the stablecoin market—knowledge is key to your assets’ safety.

How to Choose a Stablecoin

There’s a reason DYOR (Do Your Own Research) is the universal motto of the cryptocurrency market. Here’s a way to quickly obtain all the necessary information if you’re thinking of buying stablecoins.

Step 1. Popularity

Find a list of the most popular stablecoins. Pick the one that fits your interests. For beginners, it’s best to start with fiat-backed stablecoins issued by a trustworthy project. If you prefer decentralized finance, be extra vigilant in your research. To be completely sure that the coin maintains price stability, review the recent price history on exchanges.

Step 2. Regulatory Framework

Find out which organization serves as the issuer, where they’re based, and who supervises them. Make sure that your local jurisdiction matches theirs, especially if you’re planning cross-border payments. A good example is the Hong Kong Monetary Authority, as it provides a detailed guide on its requirements for stablecoin issuers. Crypto assets in the European Union are regulated by MiCA, and the US will require compliance with the GENIUS Act starting in 2027.

Step 3. Underlying Assets

Verifying that the claims of the issuer are true might be the most complex step in your research. Users have to rely on the word of the auditors, so make sure that these are respected companies with a stellar reputation. In your research, don’t be afraid to seek out negative reviews, but remain impartial. It helps if organizations or representatives from traditional banking systems have connections to the issuer.

Step 4. Security

Every coin requires auditing. This is relevant to fiat currency, gold, or other crypto assets used to back the coin, but it’s much more important in regard to the smart contracts of the stablecoin project. They have to be safe, and the possibility of errors or external influence has to be minimal. Familiarize yourself with the project’s audit. Review the versions presented by the auditor and the coin issuer. Avoid any stablecoin projects that omit or edit their audits.

Step 5. Adoption and Ecosystem

Widespread adoption isn’t a guarantee, but it’s easier to trust a coin when you can rely on the experience of others. It’s also important to make sure the coin is versatile and can offer cross-border transactions, usability, liquidity, and stability.

Final Thoughts

Understanding the different types of stablecoin is essential for navigating the crypto market. Each one offers a balance between stability, transparency, and decentralization. Fiat-backed coins like USDC are among the most trusted, as they’re supported by reserve assets such as US Treasury bills and regulated by reputable issuers. Commodity-backed stablecoins link their value to other assets like gold, while crypto-backed stablecoins rely on blockchain technology and smart contracts to maintain trust. Algorithmic stablecoins, though capital-efficient, remain risky due to their reliance on economic models instead of collateral.

FAQ

Are stablecoins the same as digital dollars?

No. Stablecoins are often pegged to the value of a fiat currency like the US dollar, but they aren’t issued or guaranteed by central banks. They’re created by private stablecoin issuers and backed by reserve assets such as US Treasury bills, gold, or cryptocurrencies. This makes them similar to “digital dollars” in function but not in legal status or protection.

Can stablecoins lose their peg? How often does that happen?

Yes, stablecoins can lose their peg, and these kinds of situations are called de-pegging. This happens when the value of the backing assets drops, liquidity issues arise, or market trust declines. While large coins like USD Coin (USDC) and Tether (USDT) rarely experience major de-pegs, smaller or poorly managed stablecoins can lose their peg more frequently, sometimes leading to permanent collapse (as seen with algorithmic stablecoins like TerraUSD).

Are algorithmic stablecoins safer or riskier than crypto-backed ones?

Algorithmic stablecoins are generally riskier. While crypto-backed stablecoins hold real collateral on the blockchain, algorithmic versions rely on code and economic incentives to maintain stability. If user confidence drops, they can spiral into a reflexive failure, causing rapid price collapse.

As a beginner, should I stick to just one stablecoin or spread across a few?

For beginners, it’s usually best to start with one reputable fiat-backed stablecoin such as USDC or USDT. Once you’re more familiar with the stablecoin market, you can diversify across several types.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.