Crypto markets move fast. To make sense of that movement, traders use support and resistance levels as a basic framework. These levels don’t just appear on charts: they represent the collective behavior of buyers and sellers reacting to the same price levels over and over.

Understanding these levels gives you more than chart knowledge. It gives you structure, a way to plan your trades, limit losses, and time entries with purpose. Whether you’re scalping short-term swings or holding for larger price movements, identifying support or resistance zones is one of the few universally applicable skills in crypto trading.

Table of Contents

What Are Support and Resistance Levels in the Crypto Market?

Support and resistance are key price levels on a crypto chart. These levels show where the price tends to stop and reverse.

- Support is the level at which the price stops falling and may bounce back up. It’s where buying pressure is strong enough to overcome selling.

- Resistance is the level at which the price stops rising and may fall back down. It’s where sellers overpower buyers.

Think of it like a ball bouncing inside a room. The floor is support: it prevents the ball from falling lower. The ceiling is resistance, as it keeps the ball from going higher. The ball (price) moves between them until it breaks through.

These levels aren’t exact prices. They’re zones where traders often act based on past behavior. When many traders expect a level to hold, their trades help reinforce that level.

Support and resistance can form:

- After large price moves

- Around psychological levels (like $20,000 or $30,000 for Bitcoin)

- Near moving averages or Fibonacci retracement levels

Understanding these zones helps you decide when to enter or exit trades, and avoid buying at peaks or selling at lows.

Do I Need to Use Support And Resistance When Trading Crypto?

Yes, you do. At least, if you want to improve your overall trading performance.

Support and resistance levels are not optional tools. They are the foundation of technical analysis. Without them, you’re trading blind. These levels help you understand where buying or selling pressure is likely to increase. Every significant price movement in crypto happens for a reason. Most reversals, breakouts, and consolidations occur near support or resistance zones. Ignoring them means missing clear signals, or worse, entering trades at the wrong time.

Let’s say you buy Bitcoin just below a resistance level. Without knowing it, you’ve entered right where many traders are planning to sell. The price is more likely to drop than rise. That’s how skipping resistance/support analysis can hurt your trades.

When you use support and resistance correctly, you can time entries with better precision, set more effective stop-loss and take-profit levels, as well as filter out noise in volatile markets. You don’t need a complex system. You just need to find support or resistance areas, understand how price reacts to them, and make informed decisions based on that behavior.

Okay, we’ve already determined that support and resistance levels are important. But how exactly do you find them?

How to Identify Support and Resistance Levels

The easiest way to spot support and resistance is by following seasoned analysts or crypto market experts. But that’s not a strategy. No one cares about your portfolio more than you do. For effective risk management, you must learn how to identify support and resistance levels on your own. Here’s how to do that using standard tools and methods.

Analyzing Historical Price Data

Start by looking at price charts over different timeframes. Focus on zones where the price has reversed multiple times in the past. For example, if Bitcoin consistently dropped near $100,000 and bounced back from it, that level becomes a strong support area. Similarly, if Ethereum has repeatedly failed to break above $4,000 and falls every time it approaches that level, then that becomes a strong resistance area.

When price reacts to roughly the same price point over time, it signals where market participants tend to place buy or sell orders. Historical data doesn’t predict the future, but it helps you understand crowd behavior.

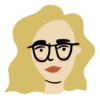

Drawing Trend Lines

Trend lines connect a series of higher lows (in uptrends) or lower highs (in downtrends). When drawn correctly, these lines show dynamic support or resistance. Unlike horizontal levels, trend lines move with time and price.

If a rising trend line has been tested three or more times, it often becomes a strong support zone. A break below that trend line could signal a shift in momentum.

Recognizing Psychological Price Levels

Humans think in round numbers. So do traders. Levels like $1,000, $20,000, or $50,000 often act as psychological support or resistance. These numbers attract attention simply because they’re easy to remember and widely watched. You’ll often see price stall, reverse, or break aggressively around these areas. That’s because many orders cluster there, and not due to logic, but human behavior.

Utilizing Technical Indicators

Indicators add context to raw price action. They don’t create support or resistance, but they highlight zones where price may react. Use them to confirm what you see on the chart.

Moving Averages

Simple and exponential moving averages (e.g., 50-day or 200-day) act as dynamic support during uptrends and resistance in downtrends. Price bouncing off these levels is common, especially when they align with historical zones.

Fibonacci Retracement Levels

These levels are calculated from recent price drops or rallies. Common retracement points like 38.2%, 50%, and 61.8% often match real reaction points on the chart. They work best when price is in a corrective phase.

Pivot Points

Used heavily in day trading, pivot points are calculated from the previous day’s open, high, low, and close. They project potential intraday support and resistance levels and are useful for short-term setups.

Incorporating Volume Analysis to Validate Levels

Support and resistance zones are stronger when volume confirms them. If the price bounces off a level with high trading volume, that means many traders agree on its importance. When the price breaks a support level but volume is low, it may be a false move. High volume during a breakout or breakdown shows real conviction.

Volume gives insight into whether a level is likely to hold or fail, making it one of the most powerful confirmation tools in your trading setup.

How to Get Free Crypto

Simple tricks to build a profitable portfolio at zero cost

Practical Examples with Bitcoin Charts

Let’s take a look at a practical example of finding support and resistance levels on a Bitcoin price chart.

Popular Trading Strategies Using Support and Resistance

Of course, simply knowing what support and resistance levels are isn’t enough to automatically make a profit. No, you need a coherent trading strategy. When the current price nears a support level or approaches strong price barriers, it often sets the stage for strategic entries or exits. Two common approaches—bounce and breakout trading—rely on these patterns.

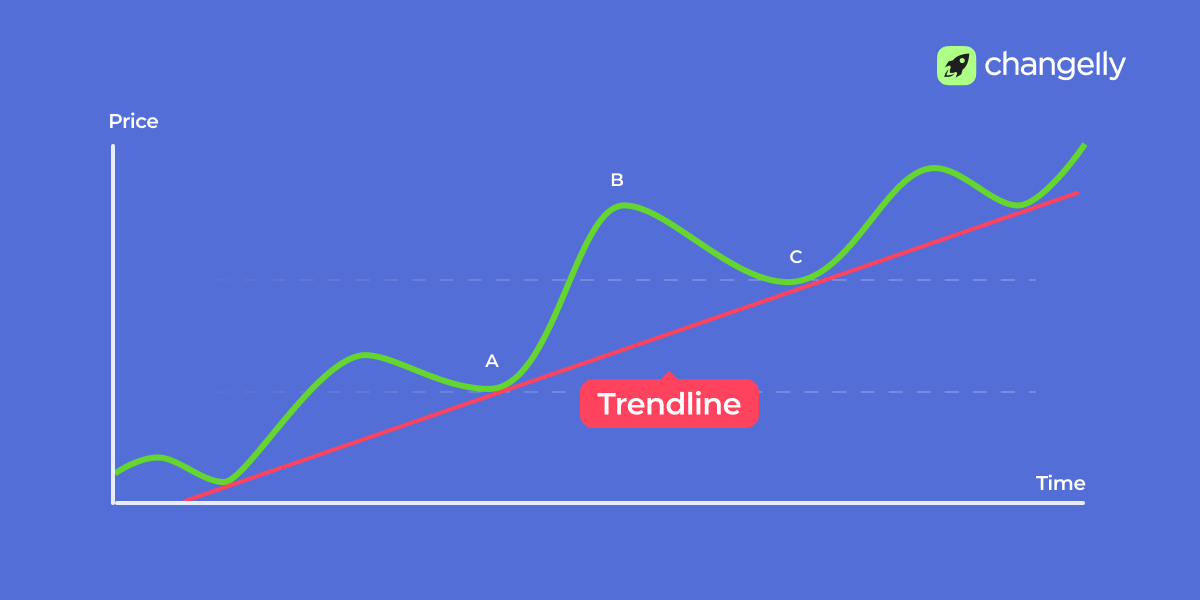

Bounce Trading Strategy

Bounce trading is based on the idea that price often reacts at familiar levels. When the price declines and touches a known support level, it may reverse direction. This bounce occurs when buying interest exceeds selling pressure, often due to previous market behavior.

Here, the entry point is placed near support. Traders expect the price to rebound, using the support level as a protective zone. A stop-loss is usually set just below support to manage risk in case the bounce fails.

This strategy works best when support has been tested multiple times. Inexperienced traders tend to ignore volume or market conditions, but a successful bounce setup often comes with clear confirmation—such as a rejection wick or price stalling near support.

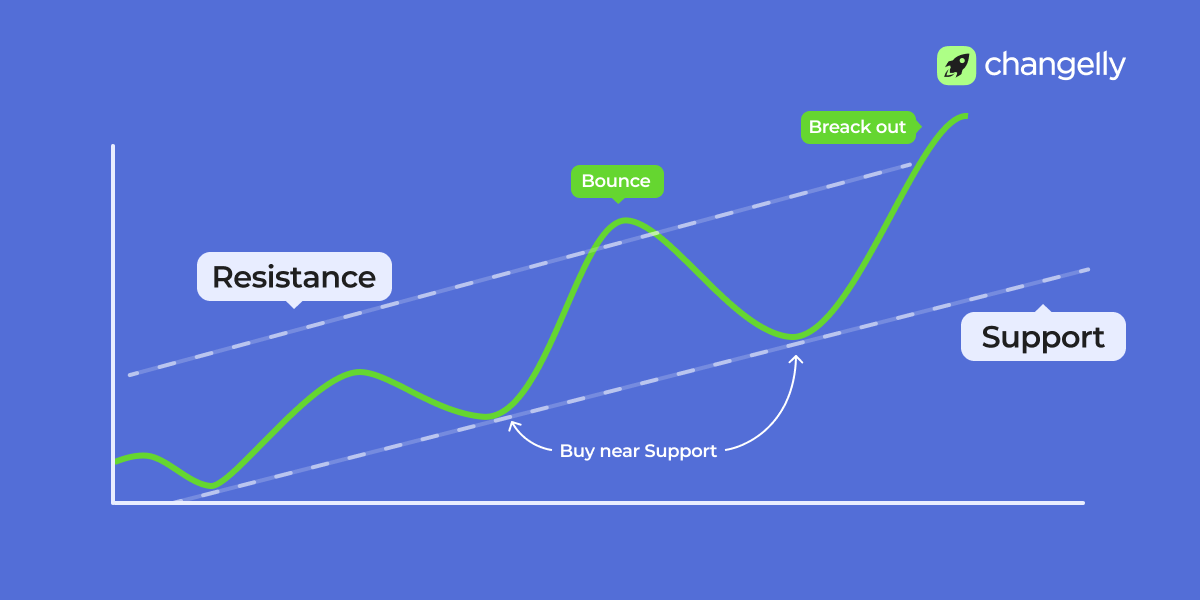

Breakout Trading Strategy

Breakout trading focuses on the price breaking through strong resistance levels. When selling, interest weakens and buying pressure builds up, so the price may surge beyond resistance. That breakout is typically fast, and the move is backed by high volume.

Traders enter just above resistance after a confirmed breakout. The idea is to catch the momentum that follows once the price clears the barrier. The same logic applies to breakdowns below support—when support levels fail and a rapid price decline follows.

This strategy requires discipline. Many false breakouts trap inexperienced traders who enter too early. To avoid this, experienced traders wait for confirmation, such as a strong candle close beyond resistance and an increase in volume.

Breakout setups are powerful but must be backed by clear signals and risk controls.

Mistakes Beginners Often Make (And How to Avoid Them)

The volatile crypto market tempts new traders into rushing trades. But most losses come from basic errors, not market conditions. If you understand how to use support and resistance levels, you can avoid these pitfalls and manage risk effectively.

Read more: Crypto Trading 101.

Here are common (and some not-so-common) mistakes cryptocurrency trading rookies make when it comes to support and resistance levels.

- Treating support and resistance as exact price points

Price rarely stops at the same level to the cent. These are zones, not lines. Expect some price movement around the level before the market reacts. - Entering trades too early

New traders jump in as soon as the price nears support or resistance. Without confirmation, this is just guessing, not technical analysis. - Ignoring previous resistance turning into support

After a breakout, previous resistance levels play a new role as support. Missing this can lead to late entries or poor exits. - Forcing trades in flat or uncertain markets

If the chart shows no clear price trends, don’t guess. Wait for structure to form. Resistance trading without context is a losing game. - Using the same levels across all timeframes

A level on the 1-hour chart may not matter on the daily. Always align your levels with your trading strategy and timeframe. - Neglecting volume confirmation

Breakouts or bounces without strong volume are likely to fail. Volume helps confirm the strength of a price level reaction. - Blindly copying levels from others

Following other people’s charts without understanding the context leads to errors. Learn to draw your own support and resistance levels based on how other participants of the crypto market behave. - Relying only on horizontal levels

Dynamic levels, like moving averages, can be just as important. They adjust with the market, and often catch price action that static lines miss.

Best Tools and Resources to Identify Support and Resistance

To analyze support and resistance levels effectively, you need the right tools for different parts of your workflow. From reading price charts to confirming price movements and managing trades, each category of tools serves a specific function. Here’s how to structure your setup.

1. Charting and Technical Analysis

These tools help you draw resistance lines, mark support zones, and spot dynamic support levels based on market trends.

- TradingView – most popular charting tool with custom indicators

- Binance / Bybit – exchanges with built-in advanced charting

- Changelly App – an exchange with built-in price charts and real-time updates

2. Market Monitoring and News

For tracking fundamental events and price activity that may affect resistance/support areas:

- Cointelegraph – the most popular digital crypto news platform

- CoinMarketCap / CoinGecko – coin tracking, volume spikes, trending tokens

3. On-Chain and Sentiment Analysis

Use these to understand whether a price level is likely to hold or break by analyzing wallet activity and investor behavior.

- Glassnode – wallet balances, exchange flows

- CryptoQuant – miner actions, reserve changes, volume metrics

- Santiment – social sentiment and network activity

4. Alerts and Automation

Stay informed when price nears a resistance zone or support level:

- TradingView alerts – trigger alerts when price touches key levels

- CoinStats / CoinMarketAlert – price-based notifications and portfolio tracking

Final Words

Support and resistance aren’t magic lines. They’re a reflection of how people behave when price reaches areas they’ve seen before. Knowing how to read those reactions can turn a random trade into a calculated decision. Don’t treat them as a one-time checklist. As market conditions change, so will your levels. Combine your technical knowledge with practice, adjust your risk-reward ratios, and stay patient. The market always gives you another chance—if you’re ready for it.

FAQ

Does support and resistance work in crypto?

Yes, support and resistance levels work in crypto just as they do in other markets. While crypto is more volatile, price movements still tend to respect areas where support refers to buying strength and resistance levels occur when selling pressure builds.

What is the best indicator for crypto support and resistance levels?

There is no single “best” indicator, but tools like moving averages, Fibonacci retracements, and pivot points help highlight where a price level might act as support or resistance. These indicators add structure to your trading strategy and improve your market timing.

Which time frame is best for support and resistance?

It depends on your trading strategy. For day trading, the 15-minute to 1-hour chart is effective. For swing or position trading, the 4-hour and daily charts offer well-defined support and resistance zones with better risk-reward ratios.

Which chart is best for support and resistance?

Candlestick charts are the most effective for identifying support levels, price reversals, and entry points. They give clear visual cues when price approaches prior support or resistance and help confirm reaction zones.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.