You don’t need to master every chart pattern or predict every move to succeed in crypto trading. What you do need is a strategy that fits your goals, risk tolerance, and available time. The cryptocurrency market is fast, volatile, and unlike any other asset class—so your approach must be specific, not general. This guide gives you a clear, structured look at both passive and active cryptocurrency trading strategies, so you can choose, adapt, and test the right method for long-term success.

Table of Contents

Why It Is Important To Have a Cryptocurrency Trading Strategy

The cryptocurrency market moves fast. Prices shift within minutes, often without clear cause. If you trade without a strategy, you’re reacting to noise, not data. That leads to inconsistent results and preventable losses.

A strategy defines when to enter, exit, and sit out. Instead of guessing, you will be following a method. This is essential in a market where price movements are sharp and frequent. Strategies also give you something to measure. Without a system, you can’t tell whether your gains come from skill or luck. With one, you can evaluate and improve based on actual performance.

Financial markets reward consistency. In crypto, that consistency depends on a clear trading approach.

Read more: Crypto Trading 101.

Passive Strategies for Long-Term Crypto Holders

Passive strategies work well in the volatile crypto market. You’re not trying to time every move: instead, you focus on long-term growth and reduce the impact market sentiment has on your decisions. Successful traders often combine passive methods with disciplined risk management. These approaches are simple in concept but require patience and consistency to perform well over time.

HODLing (Hold On for Dear Life)

HODLing (Holding On for Dear Life) is the act of buying and holding a cryptocurrency over a long period, regardless of market volatility. The goal is to benefit from long-term appreciation of the underlying asset, assuming that its fundamentals will strengthen over time. But this strategy isn’t just to “buy and forget.” It involves specific decision points.

You typically enter a HODL position after researching an asset’s fundamentals like network activity, token supply limits, development progress, or institutional interest. For example, traders may buy Bitcoin after major protocol upgrades or accumulation by public companies, rather than simply buying during hype-driven rallies.

Once a position is opened, it’s often stored in a secure cold wallet (like Ledger or Trezor) to avoid exchange risk and discourage impulsive selling. Regular portfolio reviews are limited (often once or twice a year) so you don’t react to short-term crypto market volatility. Some traders set profit-taking rules to sell portions at key price milestones or when portfolio weight exceeds a set limit, but others hold until a broader macro signal or personal financial goal is reached.

Read more: The Best Cold Crypto Wallets.

HODLing is effective for those who lack the time or don’t want to monitor markets daily. It suits traders who believe in the long-term potential of their crypto assets, trust the project’s trajectory, and accept high drawdowns during bear markets as part of the cycle.

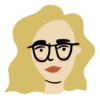

Dollar-Cost Averaging (DCA)

Dollar-Cost Averaging (DCA) is a method where you invest a fixed amount of money into a digital asset at regular intervals, regardless of its current price. This spreads your entry points across time, reducing the risk of investing a lump sum at a market peak. It’s especially useful in the cryptocurrency market, which is known for sudden, extreme price movements.

You don’t need automated tools to use DCA effectively. While many exchanges offer recurring buy features, you can manage the process manually with the same result. What matters is consistency and discipline. Here’s how the strategy is usually applied:

- Choose one or more crypto assets based on fundamental research, such as long-term utility, development activity, or token supply models.

- Decide on a fixed investment amount—such as $100, €200, or 0.01 BTC—and apply it at consistent time intervals (e.g. weekly, bi-weekly, or monthly).

- Execute trades manually or through scheduled buys on platforms like Binance, Coinbase, or Kraken. Manual execution gives more control, automation ensures discipline.

- Track your average cost basis over time using portfolio tools or spreadsheets. This lets you understand how much you’ve actually paid for each unit of the asset.

- Periodically review the asset’s fundamentals or your financial goals, and pause or redirect contributions if conditions change.

DCA benefits traders who prefer routine over active analysis. It’s well suited to people earning income regularly, who want exposure to crypto assets without placing large one-time bets. It also works as a hedge against the emotional impulse to time the market: a mistake even experienced traders make.

To learn more about DCA, read our dedicated article.

Active Crypto Trading Strategies

Active trading involves frequent, hands-on decision-making to take advantage of short-term price movements. Unlike passive investing, these cryptocurrency trading strategies rely on timing, precision, and technical indicators. You need to understand how to read charts, interpret patterns, and execute quickly, often across multiple trades per day or week.

Day Trading

Day trading is an active trading strategy where you open and close positions within the same day to profit from short-term price movements. Unlike long-term investing, crypto day trading focuses on small fluctuations that occur over minutes or hours. You’ll often place multiple trades in a single session, and their success depends on speed, discipline, and technical analysis.

This strategy is best suited for you if you can monitor markets closely and act quickly. Day trading works best in markets with high trading volume and liquidity, like BTC/USDT or ETH/USD pairs on major exchanges.

To trade effectively, you need to use technical indicators. These tools help you identify entry and exit points based on chart data. One of the most widely used is Moving Average Convergence Divergence (MACD). It compares two moving averages of an asset’s price (usually 12-day and 26-day EMAs) to identify momentum shifts. A typical MACD crossover—when the MACD line crosses above the signal line—can indicate a buy opportunity. The reverse suggests a chance sell.

Other tools used in day trading include:

- Candlestick patterns, which show price direction and market sentiment

- Volume analysis, which confirms breakout strength or signals exhaustion

- Support and resistance levels, which define potential reversal zones

Read more: Chart Patterns Every Crypto Trader Should Know.

Crypto day trading is risky. You’re exposed to slippage, fees, and false signals, especially in volatile markets. You also need a defined risk management plan, usually involving stop-loss orders to limit downside per trade. A common rule is to risk no more than 1–2% of your trading capital on any single position.

Before you start, define your trading style. Will you trade trending assets, or focus on volatility spikes? Are you scalping small moves or holding for multi-hour patterns? Each choice affects which indicators and setups you’ll use.

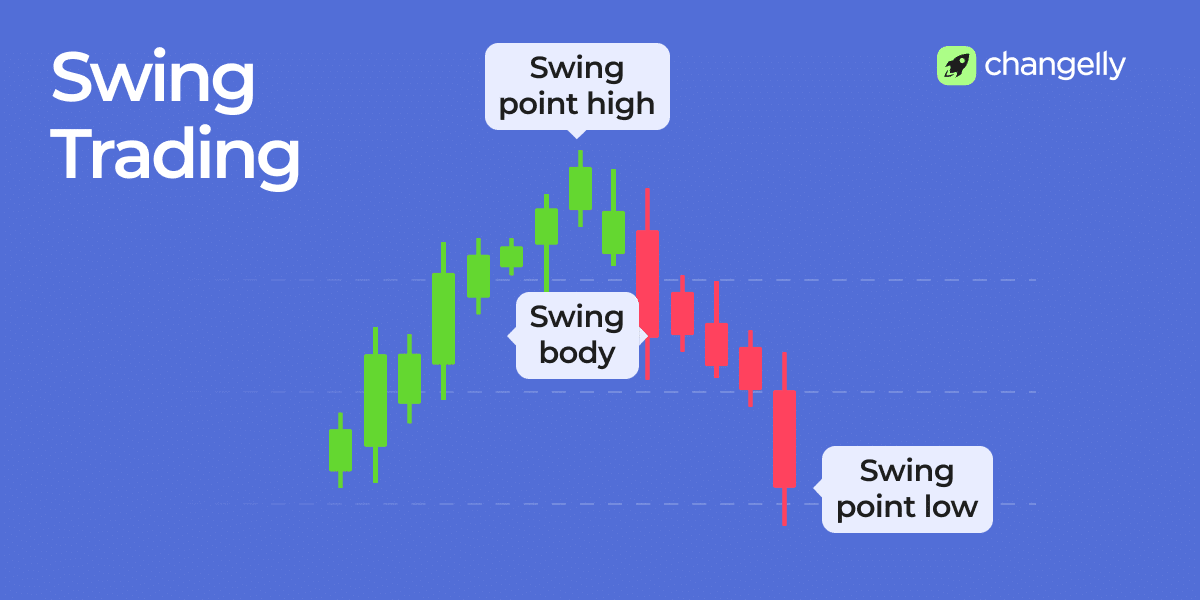

Swing Trading

Swing trading captures price moves that develop over days or weeks. It sits between day trading and long-term investing. You aim to enter at the beginning of a trend and exit before it reverses.

Swing traders rely on indicators like 50-day and 100-day Simple Moving Averages (SMA), Fibonacci retracement levels, and volume breakouts. A typical setup might include buying an asset after a confirmed breakout above resistance, then holding it as long as the asset maintains higher highs and higher lows. Indicators like MACD crossovers and RSI divergences can help confirm entry or exit signals.

You usually hold fewer positions but apply more thorough analysis to each. Since trades can last several days, swing trading suits you if you can’t sit at your screen all day but still want to act on short- to mid-term trends. It’s also less sensitive to intraday volatility, making risk management more predictable.

Scalping

Scalping aims to profit from very small price changes that occur over seconds or minutes. You might enter and exit dozens or even hundreds of trades in a single day. Success depends on tight spreads, fast execution, and low fees.

This strategy requires you to monitor order book depth, tick-level price movements, and real-time volume spikes. Scalpers often use 1-minute or 5-minute charts, and tools like the VWAP (Volume Weighted Average Price) or Bollinger Bands to identify ultra-short-term imbalances.

You must place trades with precision—often using market orders for speed—and immediately cut losses when a setup fails. Since the profit per trade is minimal, scalping only works if your platform offers high liquidity and very low fees. It’s ideal for traders who thrive in high-speed environments and can make rapid decisions without hesitation.

How to Get Free Crypto

Simple tricks to build a profitable portfolio at zero cost

Trend Trading

Trend trading involves identifying and trading in the direction of a sustained market move. You don’t try to catch tops or bottoms, you aim to ride the middle of the trend, where momentum is strongest.

Common tools include the 200-day SMA for long-term trend confirmation, the ADX (Average Directional Index) to measure trend strength, and price channels or trendlines to define structure. You might go long when price breaks above a downtrend line on strong volume, with confirmation from RSI holding above 50.

Trend traders stay in trades as long as the trend remains intact. You exit only when technical signals—like lower highs forming, MACD reversal, or volume fading—suggest weakening momentum. This strategy suits you if you’re patient, prefer fewer decisions, and are comfortable holding positions for days or weeks.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that helps you spot overbought or oversold conditions. Readings above 70 often signal that an asset is overbought, while readings below 30 suggest it may be oversold.

RSI isn’t just for spotting reversals. You can use RSI trendlines, divergences (where price makes new highs but RSI does not), and RSI crossovers (e.g., RSI moves from below 30 to above) to time entries. Many day and swing traders combine RSI with MACD or moving averages to avoid false signals.

For example, if Bitcoin’s RSI drops below 30 during a strong uptrend and then reverses back above 30, it can signal a short-term buying opportunity. RSI is beginner-friendly, but effective enough for more advanced setups, especially when filtered with other indicators.

Arbitrage

Arbitrage takes advantage of price differences across exchanges. For example, if ETH is trading at $3,050 on Coinbase and $3,080 on Binance, you could buy on the cheaper platform and sell instantly on the other for a near risk-free profit—assuming low enough fees and fast transfers.

There are several types of arbitrage:

- Spatial arbitrage: Between different exchanges

- Triangular arbitrage: Between trading pairs on the same exchange

- Statistical arbitrage: Using algorithms to spot price inefficiencies

To use this strategy, you need access to multiple exchanges, fast execution, and preferably automated trading tools or bots. Spreads are often small, and profits per trade are low, so you must execute with high volume and speed. Blockchain transaction times, fees, and withdrawal limits can reduce profits, making execution the most critical part.

Arbitrage isn’t for everyone—it suits technically skilled traders who can build or operate bots, monitor latency, and react quickly. But during periods of high crypto market volatility, profitable price gaps can appear frequently, especially on smaller exchanges or illiquid assets.

How to Choose the Right Trading Strategy

The crypto market moves faster than traditional financial markets, and not every strategy fits every trader. Choosing the right one means understanding how much time, risk, and analysis you’re prepared to handle. It’s not (at least, not always) about picking the most profitable strategy. It’s about choosing the one you can execute consistently.

Assess Your Time Availability

How often can you trade? If you can’t monitor markets throughout the day, forget day trading. Crypto moves fast, and missing even a few hours can break a setup.

With limited time, passive methods like DCA or weekly swing trading are more realistic. They focus on broader price movements, not short-term signals.

Consider Your Risk Tolerance

Not everyone is built for high-risk trading. Scalping and leverage-based strategies don’t just offer quick rewards, but quicker losses, too. If volatility makes you second-guess every decision, lean toward longer-term strategies tied to fundamental analysis. Choose setups where time, not timing, works in your favor.

Are You More Analytical or Intuitive?

Your decision-making style shapes what kind of crypto strategy you can stick with.

If you’re analytical, you’ll likely prefer structured, rule-based systems. Strategies that rely on technical analysis—like day trading, scalping, or trend trading—will feel more natural. You’ll base trades on indicators like MACD, RSI, and price patterns, not subjective opinions.

If you’re more intuitive, you’re probably drawn to momentum shifts, narratives, and macro trends. You might respond faster to positive news, social sentiment, or changes in market tone. In that case, strategies like HODLing, swing trading, or event-driven trades may suit you better.

Combining Passive and Active Strategies

You don’t have to commit to one method. You can, for example, hold a long-term portfolio (BTC, ETH) and actively trade altcoins on the side. This hybrid approach adds flexibility. It lets you manage risk through passive holdings while still using technical analysis to act on short-term opportunities when time allows.

Crypto Trading Strategy Tips

Even with a solid crypto trading strategy, small execution errors can ruin your results. The cryptocurrency market is fast, sentiment-driven, and often irrational. These tips focus on often-overlooked but practical adjustments that can help you make better trading decisions and avoid common traps.

- Avoid trading immediately after major token unlocks or vesting events: they often trigger unpredictable price moves that don’t align with chart patterns. Monitor unlock schedules via tools like TokenUnlocks or project docs.

- Use trading volume as confirmation, not just price: a breakout without rising volume usually lacks strength. Real moves in crypto are often driven by coordinated buying.

- Stay out of low-liquidity pairs, even if the chart looks perfect: slippage can turn a winning setup into a loss. Liquidity matters more in crypto than in many traditional markets.

- Track funding rates on perpetual futures: extremely positive or negative rates reveal crowd positioning. This gives you valuable insights into investor sentiment before making trading decisions.

- Backtest your setups across different market conditions: a strategy that works in a bull cycle might break down in sideways or bear markets. Backtesting with historical data keeps you honest.

- Use alerts instead of screen-watching: tools like TradingView let you set custom alerts for specific price levels or indicator crossovers, so you react only when needed.

- Always define invalidation before entry: know exactly what condition would prove your trade idea wrong. That’s your stop—not a guess based on how much you’re willing to lose.

- Try the “moonbag” strategy: take profits after significant gains while leaving a smaller portion of your funds in a “moonbag” (in your wallet) for a chance of benefiting from any potential future rallies.

Final Words

No strategy works all the time, but the right one for you will likely work most of the time. Whether you’re tracking small price movements or building a portfolio for the long haul, consistency and self-awareness matter more than trying to outsmart the market.

The cryptocurrency market rewards clarity and punishes guesswork. By understanding your trading style, setting limits, and committing to one or more well-defined cryptocurrency trading strategies, you’re not just reacting to volatility, you’re managing it. That’s the real edge in this asset class.

FAQ

Which crypto trading strategy is the best for beginners?

Dollar-Cost Averaging (DCA) is the most beginner-friendly because it avoids the need to time small price movements. It allows you to build a position gradually without reacting to short-term investor behavior.

How much money do I need to start trading crypto?

You can start with as little as $10–$50 on most exchanges, but at least $100–$500 is more practical for applying real cryptocurrency trading strategies and covering fees while managing risk properly.

What tools or indicators should I learn first for technical analysis?

Start with Relative Strength Index (RSI) and Moving Averages, as they’re simple but effective for identifying trends and momentum. These tools help you understand common setups behind frequent gains and losses.

How many strategies are there in crypto trading?

There are at least 6–8 core strategies, including day trading, swing trading, scalping, trend trading, arbitrage, DCA, and HODLing. Each one reflects different goals, timeframes, and investor behavior.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.