Uniswap (UNI) Price

$5.4951 0.10%

Latest Updates

Updated at 16:34Market cap

$3,490,237,533.7

Market rank

#30

Volume 24H

$181,187,578.53 43.90%

Price change 24h

-$0.00531 0.10%

Price change 7d

-$0.34296 6.24%

What about Uniswap?

UNI is a native token of an Ethereum-based decentralized cryptocurrency exchange platform where anyone can swap any ERC20 tokens. The cryptocurrency was created slightly later than the platform — that’s why 66 million UNI tokens were airdropped among those who had used the exchange before September 2021. Moreover, right after the launch of Uniswap V3, developers expanded the possibilities for UNI holders.

Hayden Adams, the creator of both the platform and the cryptocurrency, was inspired by Vitalik Buterin’s post about market makers. That’s why Ethereum is used as a base platform.

UNI tokens grant its owners rights to vote on protocol development pace. Also, they open up a wider range of fee tiers, which makes swapping any volatile assets safer.

The Uniswap governance token succeeded in taking place in the top ten cryptocurrencies by market capitalization.

Being one of the leading decentralized platforms, Uniswap established itself as a safe place to conduct business and turned its token into a really worthwhile investment.

Buy Uniswap Without Any Hassle

Uniswap (Uni) Overview

Uniswap (Uni) is a peer-to-peer system that enables the seamless exchange of cryptocurrencies in a decentralized manner. It operates through a series of smart contracts on the Ethereum blockchain, ensuring continuous functionality and 100% uptime.

Uniswap Labs developed the Uniswap Protocol and the Uniswap Interface. The platform eliminates the need for trusted intermediaries and unnecessary rent extraction when exchanging digital assets. This enables secure, user-friendly, and efficient exchange activity.

The Uniswap protocol is designed to be fully decentralized, using a trading model known as an automated liquidity protocol. Such an approach gives users incentives to provide liquidity, which guarantees a liquidity pool, ensuring trades can be executed instantly at a known price.

The Uniswap Protocol supports ERC-20 token pairs and represents a position in the form of an NFT (ERC-721). Uniswap employs automated market makers. Liquidity reserves are held in smart contracts, enabling users to trade against them based on a fixed formula-determined price. Individuals can contribute liquidity and earn trading fees in proportion to their contribution.

There are currently three versions of the Uniswap protocol. Uniswap V1 and Uniswap V2 are open source and licensed under GPL. Uniswap V3 features greater capital efficiency for liquidity providers, better execution for traders and enhanced infrastructure.

Uniswap aims to tackle liquidity problems with the help of automated solutions, improving the efficiency of trading versus traditional cryptocurrency exchanges. A governance system of the Uniswap Protocol is enabled by the UNI token.

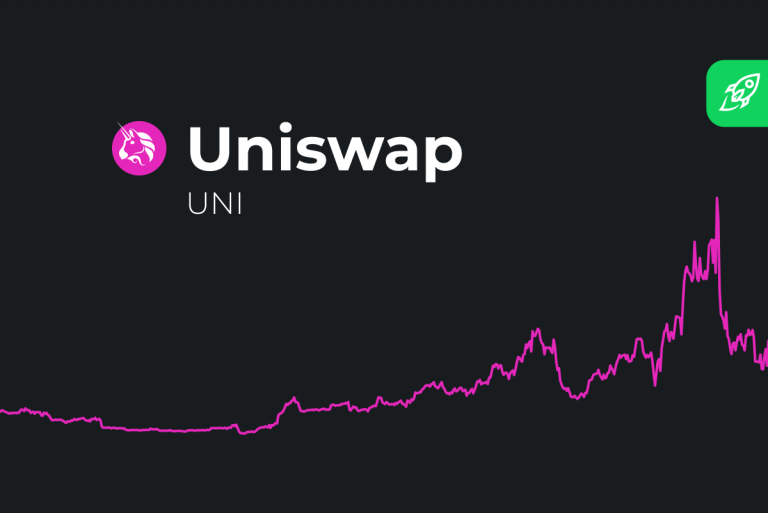

You can see the current Uniswap token price with the latest Uni market statistics on the chart above. Changelly is a popular crypto-price tracking service that provides comprehensive information regarding the Uniswap governance token. This includes the current market capitalization (market cap), 24-hour trading volume, recent price change, along with the live Uni price.

Additionally, through our cryptocurrency exchange platform, you can easily swap your Uni tokens for other cryptocurrencies, such as Bitcoin, USD Coin, or Binance Coin. Also, with us, you can buy Uniswap with fiat money, using regular payment schemes like a debit card or bank transfer.

Uniswap vs. Typical Markets

Uniswap (Uni) distinguishes itself from traditional exchanges in two fundamental ways: its Automated Market Maker (AMM) design and its permissionless system.

The AMM Approach

Unlike conventional centralized crypto exchanges that rely on central limit order books, Uniswap employs an AMM model, which uses a pricing algorithm to value assets. Instead of matching buyers and sellers through orders, Uniswap utilizes liquidity pools consisting of two crypto assets with relative values. As traders exchange one digital asset for the other, the prices of both assets adjust accordingly, establishing a new market rate. Rather than interacting with specific orders, buyers and sellers directly engage with the liquidity pool.

Permissionless Access

Uniswap operates on a permissionless system, adhering to the core principles of Ethereum. This means that anyone can access and utilize the protocol's services without restrictions or discrimination. Unlike traditional financial services that often impose limitations based on geography, wealth, and age, Uniswap welcomes participation from anyone, anywhere.

The protocol is also immutable, meaning it is incapable of being modified or manipulated by any party. Contracts cannot be paused, trade executions cannot be reversed, and the protocol's behavior remains intact.

How Does Uniswap Work?

Uniswap operates on two smart contracts called "Factory" and "Exchange."

The "Factory" smart contract is responsible for creating new markets (or exchanges) for different tokens. It helps in setting up the infrastructure required for trading various tokens on the Uniswap platform.

The "Exchange" contract is created by the Factory contract for each token market. It manages the buying and selling of tokens within that specific market. The Exchange contract holds the funds of users who want to trade tokens and allows them to swap one token for another.

As an automated market maker, Uniswap (Uni) utilizes smart contracts to establish liquidity pools and facilitate asset swapping. Uniswap liquidity pools consist of two assets and maintain aggregate liquidity reserves and predefined pricing strategies. The reserves and prices are automatically updated with each trade, and Uniswap differs from traditional exchanges as it does not require individual counterparties for trades, ensuring tokens are always readily available for buying or selling.

Uniswap DEX Trading Fees

The trading fee on the Uniswap decentralized exchange (DEX) is determined by a formula known as the Constant Product Market Maker (CPMM) equation. This equation ensures that the trading fee is proportional to the size of the trade and the liquidity in the pool.

When a trade occurs on the Uniswap exchange, the protocol adjusts the token quantities in the trading pair to maintain the constant product. This adjustment directly affects the price of the tokens. The fee is a percentage of the trade size and is calculated as follows:

The fee percentage is set by the liquidity providers (LPs) who deposit tokens into the trading pair. They can set it anywhere between 0% and 1%, with 0.3% being the commonly used default.

Liquidity providers receive a portion of the trading fee proportional to their share of the liquidity pool. This incentivizes them to contribute to the liquidity of the platform. The fee collected is typically distributed among liquidity providers after deducting any other costs, such as gas fees.

The Uniswap Token

Uni, the native token of Uniswap Protocol, plays a crucial role in facilitating automated trading and protocol governance. It provides shared community ownership and empowers Uni token holders to actively participate in decision-making.

With a total supply of 1 billion Uni coins, the token allocation is distributed over four years. Initially, 60% of Uniswap's governance token is allocated to the Uniswap community members, ensuring that those who have been part of the journey have a responsible role in shaping the protocol's future.

Each Uni token holder holds the power to vote on important matters related to protocol development, usage, and the broader Uniswap ecosystem. This shared governance system ensures that decision-making is inclusive and aligned with the interests of the community.

Aside from its governance role, Uni also facilitates automated trading on the Uniswap Protocol. It enables liquidity providers (LPs) to add liquidity to various pools and earn fees. This liquidity provision is essential for ensuring smooth and efficient trading for users.

While the Uni cryptocurrency has a fixed total supply of 1 billion, the circulating supply will increase over time. A perpetual inflation rate of 2% per year will start after four years, encouraging active participation and contribution from Uni holders.

The live price of Uniswap with regular updates is provided on the interactive chart above. The Uniswap (Uni) price history is also easily accessible through this clever graph. You can safely use this data for your Uniswap technical analysis and Uniswap Uni price prediction.

Uniswap Benefits

As the largest decentralized spot exchange, Uni provides a range of advantages.

Uni allows users to easily start swapping tokens without the need for intermediaries or centralized exchanges. With a user-friendly interface, swapping tokens becomes accessible to both beginners and experienced traders.

Moreover, the Uniswap platform eliminates the hassle of Know Your Customer (KYC) requirements. Users can freely trade without the need to disclose personal information, preserving their privacy and providing a seamless trading experience.

Another significant benefit of Uni is its ability to operate without professional market makers. Traditional exchanges often rely on market makers to provide liquidity, but Uniswap utilizes an automated market-making (AMM) model. This model allows anyone to become a liquidity provider, contributing to the liquidity pool and earning fees in return.

The Uniswap network has a unicorn logo because a unicorn symbolizes rarity and uniqueness. Uniswap is one of the first decentralized exchanges built on the Ethereum blockchain, offering a groundbreaking approach to trading and liquidity provision. The unicorn logo represents the exceptional and innovative nature of the platform.

Uniswap Drawbacks

The main disadvantage of Uniswap (Uni) is the risk of impermanent loss. Impermanent loss refers to the potential loss of value when providing liquidity to a Uniswap pool compared to holding the two crypto assets separately outside the pool. It occurs when the price of one token rises or falls relative to the other. The larger the price change, the higher the potential impermanent loss.

Uniswap Ecosystem

The Uniswap ecosystem consists of various projects, including hundreds of DeFi (decentralized finance) applications, integrations, and tools built on top of the Uniswap Protocol. These projects span various domains, such as decentralized exchanges, liquidity aggregators, yield farming platforms, lending protocols, decentralized derivatives, and more. Some notable projects include 1inch, Yearn finance, Aave, Curve Finance, Balancer, and many others.

Uniswap Brief History

Uniswap, the leading decentralized exchange protocol on the Ethereum blockchain, was created by Hayden Adams, who had limited coding and financial experience before embarking on this venture. In 2017, Adams came across a Reddit post written by Ethereum creator Vitalik Buterin, shared by his friend Karl Floersch, an Ethereum Foundation employee, introducing him to the concept of an automated market maker (AMM).

Despite being unemployed, Adams delved into coding Uniswap and attended cryptocurrency conferences throughout the following year. In July 2018, the Ethereum Foundation provided Adams with $50,000 in funding, leading to the release of the first version of Uniswap on the Ethereum mainnet in November 2018. Impressive growth followed, with Uniswap surpassing $1 billion in completed transactions by July 2020 and reaching a milestone of over $10 billion in weekly transaction volume by April 2021.

To counter the rise of rival DEX (decentralized exchange) SushiSwap and retain users, Uniswap introduced its governance token UNI in September 2020. The launch included the creation of 1 billion UNI tokens, distributed with 60% allocated to community members and the remaining portion allocated to team members, investors, and advisors. This move aimed to strengthen Uniswap's position and enhance community participation in decision-making processes.

Current Uniswap Price

Changelly offers an interactive Uniswap price chart where you can track the real-time price of the crypto asset, access Uni price history, and make informed choices about buying or selling the Uniswap cryptocurrency.

Our Uni-USD price updates in a real-time manner, ensuring that you have the most accurate and up-to-date information on the exchange rate between Uniswap (Uni) and USD (United States Dollar).

Along with the current price of Uni today, our chart allows you to view other important data regarding the asset’s performance on the crypto market. In particular, you can learn about the lowest and highest price paid for Uniswap (Uni) as well as the current trading activity and market cap.

This information provides valuable insights into the coin price trends and overall market sentiment surrounding the Uni coin. These facts can be used for your technical analysis if you are working on the Uniswap price prediction.

Alternatively, you can read our Uniswap price forecast to get an understanding of the projected price movements for the digital asset. However, you want to be cautious when you buy, sell, or trade Uniswap coins. The crypto market is highly volatile and unpredictable, posing your investments at risk. The live price of any digital asset can change rapidly.

If you consider the Uniswap coin a good investment and want to diversify your crypto investment portfolio, Changelly is a secure and swift crypto exchange service to buy Uni and other crypto assets. No need to rack your brains on how to purchase cryptos. We support standard payment methods, such as credit cards, debit cards, wire transfers, and more, for an easy Uni coin purchase.

Trending

24h top price changes+$0.00096 65.13%

+$0.00549 25.97%

+$0.01998 22.88%

+$0.00156 19.51%

+$0.00881 19.26%

+$0.03769 16.47%

+$0.00311 13.98%

+$0.00311 13.98%

+$0.01273 13.10%

+$0.02276 12.97%

FAQ

What determines the price of Uniswap?

What was the starting price of Uniswap?

What was the highest price of Uniswap?

What was the lowest price of Uniswap?

Related articles about Uniswap

Subscribe to our newsletter to get the latest crypto insights and price updates.

![Best Cheap Crypto to Buy Right Now [November 2025]](https://changelly.com/blog/wp-content/uploads/2025/11/Best-Cheap-Crypto-770x513.png)