DeFi Swap

What’s the difference between Changelly DeFi Swap and a standard Exchange on Changelly?

Changelly was created as an instant exchange platform that can exchange cryptocurrencies even on different blockchains. So, Changelly is an intermediary between you and crypto platforms.

The “Exchange” feature on Changelly provides the possibility to convert a cryptocurrency into another cryptocurrency. Changelly searches for a best available rate for a chosen crypto pair among the markets we work with and offers you the best rate before you start the conversion. With this feature our customers can exchange more than 500 cryptocurrencies both within one network and cross-network as well.

DeFi Swap is a decentralized exchange aggregator that encompasses a wide range of decentralized exchanges’ offers to make the most profitable instant swaps within one blockchain. It doesn’t involve any third parties, the swaps are processed within the blockchain itself. The trades are executed with the help of smart contract technology and Automated Market Maker (AMM) protocols. Roughly speaking, the exchanges in case of DeFi swaps serve mostly as aggregators of offers and a user-friendly interface, yet the swap itself takes place directly between crypto traders and a third party has no control over it.

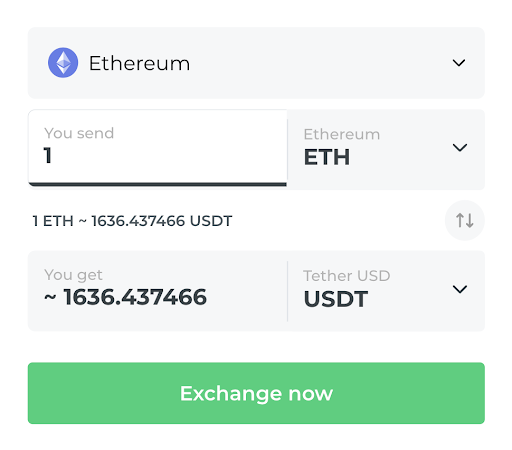

So, when you’re using DeFi Swap, you can swap crypto tokens within one blockchain at the most competitive rates and usually with lower fees. For instance, ERC-20 tokens can be exchanged for each other because they are created in the Ethereum blockchain.

Look at the picture below: when you choose the Ethereum blockchain, you can pick USDT (ERC-20 standard) and any ERC-20 token.

Is DeFi Swap safe to use?

All exchanges are executed by a transparent and immutable smart contract (i.e., the reliability of the exchange is guaranteed by the blockchain itself). However, as with all cryptocurrencies, there are certain risks involved. When swapping one token for another, always do thorough research on the currencies you’re going to exchange and the exchange platform you’re using.

What is a DEX aggregator?

A DEX aggregator is a kind of unified explorer for prices and liquidity offered by decentralized exchanges. DEX aggregators use a complicated algorithm that considers multiple factors when choosing the best provider for a given token pair to swap.

DEX aggregators work like Skyscanner. You choose the pair of cities you want to fly from and to (as you choose the crypto pair on a DEX) and then look for the most suitable variants: rates, fees, etc. So, you select the best option for you to swap crypto tokens instantly.

What is the gas price?

The gas price determines the approximate transaction fee that is paid for transactions made or smart contracts executed on a blockchain. As a rule, the price of gas is determined in Gwei, where 1 native coin of the blockchain is equal to 1×10^18 Wei. The smallest price unit is Wei. However, the price of gas is usually estimated at 1,000,000,000 because 1 Gwei equals 109 Wei.

You can control the price of gas yourself, but it will still depend on network congestion. For example, if you want your transaction to be completed faster, you need to pay more.

In order for the transaction to be confirmed, you need to have a balance greater than the amount that must be sent: it’s required to cover the fee for the resources of the Ethereum virtual machine and measure the computing power in this network.

Gas fees are variable. For example, a transaction requires 25,000 gas, but in practice, only 21,000 gas is spent on processing. In that case, the remaining amount of gas will be immediately returned to the party that sent the funds.

Why do I need ETH to make a swap?

We insist on you having the blockchain’s native currency on your balance before any swap so that you can exchange ERC20 or BEP20 tokens. For example, to cover the transaction fees in Ethereum, you will need ETH coins. Similarly, you will need BNB coins for swaps in the BSC network.

What is slippage tolerance?

Let’s start from the beginning. Price slippage is the execution of a market order at a price that differs from the price specified in the order on the exchange. Slippage happens when crypto assets have too high volatility or insufficient liquidity.

Now, let’s get back to the question. Slippage tolerance is the difference between the price at the moment of transaction confirmation and the actual price at the moment of swapping. Slippage tolerance is a percentage of the total swap value.

Higher slippage tolerance is extremely helpful in the case of volatile markets or low-liquidity pools.

Why do I have to approve tokens?

To exchange ERC-20 or BEP-20 tokens, it’s important to first complete the “approving” transaction. This step grants permission for our smart contract to access and utilize your tokens during the swap process. This is a standard procedure in DeFi protocols, and once approval is given for a specific token type, it will remain valid for future exchanges. Please note that this doesn’t apply to native cryptocurrencies like Ethereum or BNB.

Why can't I see tokens in my wallet?

No worries! Since there is a great variety of tokens (and anyone can create new ones), it’s impossible to keep a record of them. That’s why Metamask or any other wallet can’t detect that somebody has sent you some tokens.

What should you do? Just add the actual smart contract address of this token to your wallet, and then it will show you this token with the current balance so that you can continue to track it.

If it doesn’t help, we also advise you to re-sync your wallet with the blockchain, update it or contact the support team of your wallet. With the hash proving the transfer or a successful DeFi swap they should be able to locate your deposit.

Didn’t find the answer to your question?