This article provides a thorough analysis of how Bitcoin is valued, takes a look at its supply and distribution, and, most importantly, answers the burning question: Who owns the most Bitcoin?

Hi! I’m Zifa, a devoted crypto enthusiast. Today’s exploration is intriguing yet nuanced. I’ve compiled a list of major Bitcoin holders that might surprise you. Let’s dive in!

Table of Contents

- Who Owns the Most Bitcoin: A Quick Glance

- Individual with the Most Bitcoin

- Government with the Most Bitcoin

- Public Company with the Most Bitcoin

- How Many Bitcoin Holders Are There?

- Who Are the Bitcoin Billionaires?

- How Much Bitcoin Does Satoshi Nakamoto Hold?

- Cameron and Tyler Winklevoss

- Tim Draper

- Michael J. Saylor

- Others

- Top Companies Holding Bitcoin

- Public Companies

- MicroStrategy

- Marathon Digital Holdings

- Galaxy Digital Holdings

- Tesla, Inc.

- Others

- Private Companies

- Mt. Gox

- Block.one

- Tether Holdings LTD

- Stone Ridge Holdings Group

- Indirect Bitcoin Exposure

- Governments That Own the Most Bitcoin

- What Does Institutional Bitcoin Ownership Mean?

- Top 3 Largest Bitcoin Wallets

- Why is the distribution of Bitcoin ownership important?

- Bitcoin Wealth Distribution

- What Gives Bitcoin Its Value?

- The United States has the largest number of Bitcoin holders – 46 million.

- What Happens After All the Bitcoins Are Mined?

- How to Buy Bitcoin BTC on Changelly

- FAQ

- Who owns the most Bitcoins?

- What country owns the most Bitcoin?

- What makes Bitcoin unique?

- Is Bitcoin a good investment?

- How to get Bitcoin?

- Who owns the most cryptocurrency?

- Final Thoughts

Who Owns the Most Bitcoin: A Quick Glance

Individual with the Most Bitcoin

Satoshi Nakamoto, the pseudonymous creator of Bitcoin, is listed as the top individual BTC holder. Nakamoto reportedly holds about 1.1 million BTC across approximately 22,000 different addresses.

Government with the Most Bitcoin

The Bulgarian and U.S. governments are thought to be the leading holders of Bitcoin among governmental entities, possessing 213,519 and 69,640 BTC, respectively. This belief stems from the fact that both governments acquired their Bitcoin through seizure operations, leading to uncertainty regarding the exact figures and current status of these holdings.

Public Company with the Most Bitcoin

MicroStrategy, under the leadership of Michael Saylor, is the public company with the largest Bitcoin holding. As of 2023, MicroStrategy’s total Bitcoin holdings amount to about 158,000 BTC coins.

How Many Bitcoin Holders Are There?

The number of Bitcoin holders is a frequently discussed topic. A Chainalysis study indicates that over 460 million Bitcoin wallets have been created. However, only 37% of these wallets are considered “economically relevant,” as many are linked to major crypto exchanges.

A more telling figure might be the number of Bitcoin wallet addresses with active balances. According to BitInfoCharts, about 67 million Bitcoin addresses hold at least $1. Of these, 40.5 million have a balance between $1 and $100, suggesting most Bitcoin holders have a relatively small investment.

It’s important to note that some wallet addresses may be inactive. BitInfoCharts tracks dormant Bitcoin wallets, currently estimated at 17.97 million. These are wallets without transactions for the past seven years.

While the exact number of Bitcoin holders is unknown, it is clear that the number has been growing steadily in recent years. This is unsurprising given the increasing popularity of the currency, as well as its rising value. With more and more people understanding the potential of Bitcoin, the number of holders is likely to continue to grow in the future.

Who Are the Bitcoin Billionaires?

In 2023, there were 18 crypto billionaires — individuals who have amassed immense wealth through their involvement in the cryptocurrency market. Coming from diverse backgrounds, these billionaires are associated with various aspects of the industry.

Additionally, approximately 36,000 individuals are estimated to be Bitcoin millionaires. However, determining the precise number is challenging due to the anonymous nature of Bitcoin addresses and the cryptocurrency’s inherent price volatility.

The term “whales” refers to large Bitcoin holders who possess 1,000 or more BTC. This can be people, businesses, institutions, countries… The individuals with the most BTC holdings are listed below.

How Much Bitcoin Does Satoshi Nakamoto Hold?

- ~1.1 million BTC

In addition to creating Bitcoin, Satoshi Nakamoto was the first miner to add blocks of transactions to the blockchain. From January 3, 2009, until their departure from the project in 2011, Satoshi mined almost 22,000 blocks, earning 1.1 million BTC in return. An estimated 22,000 addresses are used to house Satoshi’s Bitcoin hoard.

Cameron and Tyler Winklevoss

- 70,000 BTC

The twins purportedly hold 70,000 BTC and have made investments in numerous cryptocurrency start-ups. In addition to Bitcoin holdings, the Winklevoss brothers have invested in other cryptocurrencies and launched the cryptocurrency exchange Gemini in 2014. They appeared on Forbes’ crypto billionaires list in 2022.

Tim Draper

- 29,000 BTC or more

Tim Draper, a venture capitalist well-known for his initial investments in start-ups like Skype and Tesla, made his first Bitcoin purchase in 2012. In 2014, he bought 29,656 BTC for $18.7 million when U.S. Marshals auctioned off Bitcoin seized from the notorious dark web marketplace Silk Road.

Michael J. Saylor

- 17,732 BTC

The American entrepreneur frequently tweets in favor of Bitcoin and makes the headlines for his business, MicroStrategy, which consistently purchases Bitcoin — even during bear markets. Besides, Saylor apparently possesses at least 17,732 Bitcoins himself — he disclosed the amount of Bitcoin he personally owned in his 2021 interview.

Others

CEO of the Digital Currency Group Barry Silbert and CEO of Coinbase Brian Armstrong are among people rumored to be in possession of significant quantities of Bitcoin. The exact number of BTC they own is unknown. FTX CEO Sam Bankman-Fried, involved in the recent epic FTX exchange collapse, also used to be on the list of prominent Bitcoin whales.

Check this out: 20 crypto influencers you should know.

Top Companies Holding Bitcoin

Although a sizable portion of Bitcoin is owned by individuals, both public and private companies embrace this digital currency. Companies have the option to use their corporate funds, known as treasuries, to invest in Bitcoin. In order to hedge against inflation and negative-yielding bonds, several businesses have chosen to invest in Bitcoin and other digital assets.

Over 1.5 million BTC, or over 7% of the total supply, is held by ETFs, public enterprises, and private businesses combined.

Public Companies

MicroStrategy

- ~158,245 BTC

Michael Saylor’s Microstrategy is a public corporation with the largest amount of Bitcoin. Approximately 0.82% of the total supply, or more than 130,000 BTC, has been obtained by Microstrategy since it first started to purchase Bitcoin in August 2020. Other publicly traded companies may have taken their cue from MicroStrategy and added Bitcoin to their balance sheets.

Marathon Digital Holdings

- ~13,286 BTC

Marathon, a prominent digital asset firm, specializes in mining Bitcoin and holds it as a key investment. The company is recognized as one of the largest in Bitcoin mining efficiency and technology in North America. Besides, it is a major Bitcoin holder among public companies. Marathon focuses on turning energy into economic value while supporting the security and update of the Bitcoin ledger.

Galaxy Digital Holdings

- ~12,545 BTC

Financial services and investment management company Galaxy Digital also engages in Bitcoin mining. The corporation currently holds around 12,545 BTC.

Tesla, Inc.

- ~10,500 BTC

Tesla purchased around 4,200 BTC in February 2021 but sold 75% of the purchased Bitcoin during the crypto bear market in 2022. This move didn’t sit right with those who remember the tweet Elon Musk made in 2021 saying: “Tesla will not be selling any Bitcoin.”

Others

Other publicly traded companies, including Bitfarms Limited, Voyager Digital Limited, Argo Blockchain PLC, Hut 8 Mining Corp., and Coinbase Global, also own Bitcoin.

If you find this article entertaining, you might also like our list of public companies using blockchain technology.

Private Companies

Around 316,067 BTC, or 1.5% of the total supply of Bitcoin, is held by private companies.

Mt. Gox

- 141,686 BTC

The largest private Bitcoin holder is the defunct Mt. Gox exchange, with 141,686 BTC, or 0.7% of the total.

Block.one

- 140,000 BTC

Block.one is the organization that created the EOS crypto.

Tether Holdings LTD

- 61,000 BTC

The creator of the USDT stablecoin reported controlling about 61,000 BTC in their Q3 2023 reserve attestation.

Stone Ridge Holdings Group

- 10,000 BTC

The American private company owns around 10,000 BTC.

Indirect Bitcoin Exposure

For investors looking to obtain exposure to Bitcoin without actually purchasing it, indirect Bitcoin exposure is one investing strategy. Some investors think that diversifying their holdings across a wide range of Bitcoin-related assets may lower their risk. Bitcoin ETFs attempt, albeit imperfectly, to track the Bitcoin price. Stocks, mutual funds, and exchange-traded funds are applied as traditional techniques of indirect investing. Equities and other Bitcoin-related assets may be included in a Bitcoin exchange-traded fund (ETF), creating a more diverse portfolio.

- Purpose Bitcoin ETF (BTCC)

- Launch: February 2021

- Location: North America (trades on the Toronto Stock Exchange)

- Holdings: Over 25,000 Bitcoins as of September 2023

- Assets: Over $1.1 billion under management

- 3iQ CoinShares Bitcoin ETF (BTCQ)

- Location: Canada (trades on the Toronto Stock Exchange)

- Holdings: Over 21,000 Bitcoins as of September 2023

- QBTC11 by QR Asset Management (QBTC11)

- Launch: June 2021

- Location: Latin America (trades on the Brazilian Stock Exchange)

- Holdings: 727 Bitcoins as of September 2023

- Grayscale Bitcoin Trust (GBTC)

- Status: Awaiting ETF conversion review

- Holdings: 623,645 Bitcoins (largest Bitcoin ETP)

These ETFs highlight the surging global interest in Bitcoin investment, with substantial holdings and significant potential for growth, especially if a U.S. ETF is launched.

Governments That Own the Most Bitcoin

Bulgaria is rumored to be a major Bitcoin holder, with an alleged 213,519 BTC seized in 2017 from a criminal group involved in hacking Bulgarian customs computers. The specifics of this seizure, including whether Bulgaria still possesses these Bitcoins or how it plans to use them, remain unclear. Should the Bulgarian authorities retain these Bitcoins, their holdings would rank them among the largest cryptocurrency whales.

As of the latest available information in 2023, the United States government holds approximately 69,640 Bitcoins. This accumulation is primarily due to legal seizures rather than direct purchases.

What Does Institutional Bitcoin Ownership Mean?

In general, it’s not a big deal if countries and institutions possess a major portion of Bitcoin. Moreover, the use of Bitcoin increases as businesses like Tesla invest in it. In fact, it’s conceivable that as more institutions turn to Bitcoin, its usage as a conventional currency — with fewer restrictions — will grow.

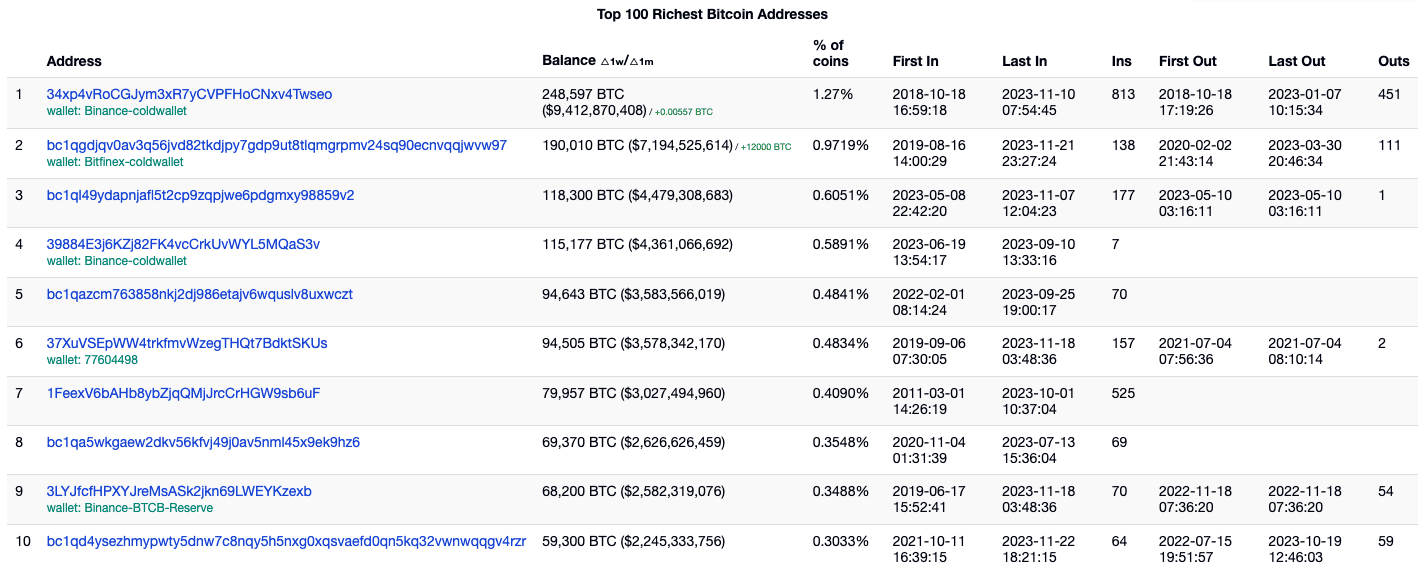

Top 3 Largest Bitcoin Wallets

There are around 200 million Bitcoin wallets in existence, although these statistics do not accurately represent the actual number of Bitcoin owners because a single person or organization may own many wallets.

According to BitInfoCharts’ Bitcoin Rich list, there are 1,019,738 addresses with balances of 1–1,000,000 BTC at the time of writing this article.

Two of the three largest Bitcoin wallets are those of Binance and Bitfinex crypto exchanges. 248,597 BTC are stored in Binance’s cold wallet. Additionally, the 4th largest Bitcoin wallet — which also belongs to Binance — has 115,177 BTC, making the exchange the biggest BTC holder with an astonishing 248,889 BTC accumulated. Bitfinex’s cold Bitcoin wallet has 190,010 BTC. Due to the fact that they also store customers’ Bitcoin deposits, the cryptocurrency exchanges may not actually be the sole owners of all these currencies. 2.9% of the total circulating supply of Bitcoin is split amongst the top three wallets.

Why is the distribution of Bitcoin ownership important?

The distribution of Bitcoin ownership is a critical factor in the cryptocurrency world because it influences several key aspects:

- Accessibility and Inclusion: The way Bitcoin is distributed reveals much about its accessibility. A concentration of Bitcoin in a few hands suggests limited access for the broader population, potentially impeding the democratization of wealth and the societal benefits of cryptocurrencies. Conversely, a more equitable distribution indicates wider access and participation, fostering financial inclusion.

- Market Manipulation and Price Volatility: Ownership distribution affects market dynamics. When a few hold large Bitcoin amounts, they can potentially manipulate the market, causing price volatility. A more evenly distributed ownership might lead to a more stable market and reduce the likelihood of manipulation.

- Decentralization and Blockchain Security: Bitcoin’s decentralization principle is also tied to its ownership spread. A balanced distribution ensures no single entity can dominate, maintaining the integrity and security of the blockchain network.

- Systemic Risk and Financial Stability: The concentration of Bitcoin ownership can pose systemic risks. If key holders suddenly sell off their holdings or lose trust, it could destabilize the market. A more dispersed ownership reduces the risk of such shocks, which contributes to financial stability.

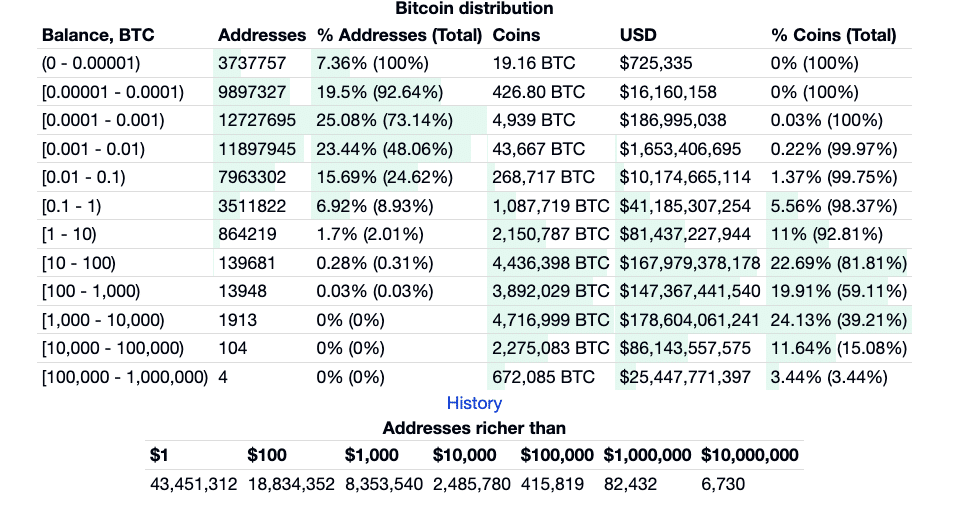

Bitcoin Wealth Distribution

At the time of writing, Bitcoin’s current circulating supply was 19.55M BTC. It is believed that around 4 million BTC out of this number has been lost since the digital currency first entered circulation.

What Gives Bitcoin Its Value?

As you are probably aware, Satoshi Nakamoto had the idea for Bitcoin and envisioned it being a more open, democratic, and popular alternative to fiat money in the future. But what exactly is Bitcoin, and what gives it its value?

Bitcoin is a decentralized peer-to-peer network that allows users to send and receive payments without the need for a third-party intermediary such as a bank or a credit card company. Transactions are recorded on the Bitcoin blockchain — a distributed ledger — and each transaction is verified by Bitcoin miners who use powerful computer rigs to solve complex mathematical problems.

Since Bitcoin is not regulated by any central authority, it is largely immune to government interference or manipulation. This decentralization is one of the key features that give Bitcoin its value. Another factor that contributes to Bitcoin’s value is its limited supply: there will only ever be 21 million Bitcoins in existence. As demand for Bitcoin increases, so does its price. Thanks to its unique properties, Bitcoin has emerged as a popular alternative to traditional fiat currencies.

BTC is often referred to as “digital gold” because it shares many of the same properties as physical gold. For example, BTC is scarce, durable, and divisible. Like gold, BTC is also a popular investment choice because it can serve as a hedge against inflation. However, BTC has several advantages over gold, which makes it even more attractive as an investment.

First and foremost, BTC is much more portable than gold, making it easy to store and transport. In addition, BTC is digital, which means that it can be easily divided into smaller units and bought or sold in fractions. Finally, BTC is global, meaning it can be bought and sold anywhere in the world without the need for conversion. As a result of these advantages, BTC is emerging as a popular alternative to gold

The United States has the largest number of Bitcoin holders – 46 million.

The United States has emerged as the frontrunner in terms of the largest number of Bitcoin holders, with a staggering 46 million individuals actively engaging in cryptocurrency investments. Several key factors contribute to the United States’ dominance in Bitcoin ownership.

Firstly, the United States boasts a technologically advanced society with widespread access to internet services and digital platforms. This fosters a conducive environment for Bitcoin adoption and trading, enabling millions of Americans to enter the crypto space.

Secondly, the United States is home to numerous cryptocurrency exchanges and trading platforms that facilitate easy access to Bitcoin. These exchanges, such as Coinbase and Binance US, provide a user-friendly interface and reliable security measures, attracting a significant number of American investors.

While the exact number of Bitcoin holders in the United States remains uncertain, it surpasses that of any other country. India and Pakistan are often mentioned as having the second and third highest number of Bitcoin holders, respectively. However, due to the decentralized nature of Bitcoin transactions, it is challenging to ascertain the exact number of holders in any country. Privacy and anonymity measures are embedded in Bitcoin’s design, making it difficult to track individual ownership.

What Happens After All the Bitcoins Are Mined?

Because the cryptocurrency system is still evolving, it can be challenging to predict what happens once all Bitcoins have been mined. But as soon as all 21,000,000 Bitcoins are in use, the economics of this crypto asset will unavoidably shift.

As an illustration, the incentives for dealers and miners will differ. Miners could make money and profits from transaction fees in place of collecting block rewards. The Bitcoin network is actually completely uncontrollable, even for those with the highest amount of Bitcoin owned. Consequently, it is difficult to forecast what will actually occur and what the price of “fully diluted Bitcoin” will be.

How to Buy Bitcoin BTC on Changelly

Buying Bitcoin BTC on Changelly is an easy way to get started with cryptocurrency. Changelly is a popular crypto exchange that allows users to buy crypto at the best market rates and with the lowest fees. It also supports purchasing crypto with fiat currencies — USD or EUR, you choose!

The process of purchasing BTC is fast and intuitively simple. Try it yourself!

FAQ

Who owns the most Bitcoins?

According to most common estimates, it is Satoshi Nakamoto, the anonymous creator of BTC, who has the largest Bitcoin holdings in the world. However, we don’t really know who this person (or group of people) is. Therefore, it is currently impossible to answer the question: Who owns the most Bitcoin?

What country owns the most Bitcoin?

Surprisingly, Bulgaria owned the most Bitcoin out of all countries at the time of writing.

What makes Bitcoin unique?

Bitcoin stands out as a distinct digital asset due to decentralization, immutability, censorship resistance, and limited supply.

Is Bitcoin a good investment?

Yes, Bitcoin can be a good investment, but only for those who are willing to take on some risk.

How to get Bitcoin?

To buy Bitcoin, you need to find a good crypto exchange and a reliable wallet. And even if there may be difficulties with the latter, there are no doubts about the former — Changelly is always at hand! You can also join the ranks of Bitcoin holders with the help of a Bitcoin ATM.

Who owns the most cryptocurrency?

There are hundreds of thousands of crypto owners out there, and it is nigh impossible to measure how many crypto coins and tokens every single person has, considering that they store their digital assets in different, fully anonymous wallets.

Final Thoughts

So who owns the most Bitcoin? The answer is not as straightforward as you might think. While there are a number of individuals and organizations holding large quantities of Bitcoin, it is impossible to know for certain who has the biggest holding.

What we do know, however, is that the total value, or market cap, of all Bitcoins in circulation exceeds $1.03 trillion, and this figure continues to grow each day. With such a high value at stake, it is no wonder that people are increasingly interested in learning more about Bitcoin and its underlying technology. As cryptocurrency continues to gain popularity, it will be curious to see how the landscape changes and which players emerge as the dominant forces in this new digital economy.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

Amazing article and I like it a lot. A well laid out story. The fact that Bulgaria owns so many bitcoins is new to me and I am going to read more about it. The total valuation of all bitcoins stated in the Final thoughts are 1 trillion and this is true of the price is quoted at the all time high. Although the current price is lower, in reality one could never buy all bitcoins for 1 trillion because if you start buying the price goes up significantly and the second bitcoin will be priced higher than the first bitcoin you buy and the price would skyrocket if you would want to buy let’s say 10% of all the bitcoins in circulation which is almost impossible. But the 1 trillion woud be 331.4 billion right now which is an undervaluation of the asset. I am a nett buyer at those levels.

I´ve lost control about 33,000.00 BTC due to reflash my mobile back to stock rom for proper work and locked me out of my portfolio with 2FA Google authenticator, which got factory reset by me… What now?