Cryptocurrency trading is a vital part of the crypto industry. It’s been developing and upgrading while adopting trading tools from a regular stock exchange. As of 2020, cryptocurrency margin trading is an integral part of pretty much every reliable crypto exchange like Changelly PRO.

Changelly is always on guard to provide a comprehensive explanation of sophisticated cryptocurrency and blockchain concepts. What is margin trading? And how to start a cryptocurrency margin trading? Let’s inspect it all together with Changelly.

Table of Contents

- What Is Margin Trading?

- Margin Trading Basics

- Margin & Leverage

- Margin Call and Liquidation Price

- Isolated Margin

- Cross Margin

- Stop-loss Trading Order

- Difference between Spot and Margin Trading

- Margin Trading Risks

- How to Start Margin Trading

- How to Choose an Exchange

- Top 3 Exchanges for Margin Trading

- Changelly PRO

- Binance

- BitMex

- Bottom Line

What Is Margin Trading?

Margin trading (also trading with leverage, or leverage trading) is a type of trading that allows users to trade assets using funds provided by an exchange or other traders.

Cryptocurrency trading implies risks. Cryptocurrency margin trading involves even higher risks as in this case a trader can open a position that will be larger than his/her initial balance. However, margin trading may bring you significant profit, if you know how to deal with it.

Please note that this type of trading is not recommended to novice traders, as it requires advanced trading skills.

Margin Trading Basics

Before getting into margin trading, it is highly recommended to either study essentials (if you are a beginner) or refresh the trading vocabulary (in case you are a level-up trader). We’ve gathered the main terminology of margin trading.

Margin & Leverage

Margin in margin trading can refer to two things. First, it’s the amount the trader borrows on top of their initial investment. Second, it can also mean the trader’s own funds.

As mentioned above, margin trading is also referred to as trading with leverage. The leverage is determined by the following ration: leverage = (borrowed funds + margin) / margin. The ‘x’ symbol usually represents the leverage (2x, 5x, 20x, …) or by a ratio 2:1, 5:1, 20:1.

Example: Bob has $10,000 of his own capital but wants to place an order of $100,000. He decides to place a margin order at leverage 1:10. Bob borrows $90,000 from a third party to open a position of $100,000.

Margin Call and Liquidation Price

A margin call is a demand from the exchange for you to either add money to your account or to close your position that occurs when the value of a trader’s account falls below a pre-specified level.

Exchanges monitor the value of digital assets on a margin account not to fall below a certain level. If prices rise, the position can be kept open for as long as there is no risk of losing one’s own and borrowed funds.

If the price falls, the exchange will prevent loss by liquidating the position. A trader can prevent this by selling a certain amount of assets or by depositing additional funds in a margin account.

When starting margin trading, there is a liquidation price set automatically. Once the liquidation price is reached, the trader’s position is forcibly closed (liquidated). This is a necessary precaution to decrease trading risks.

Isolated Margin

Isolated margin aims to manage risk while trading on margin. Isolated margin helps a trader by restricting the amount of margin set for each position. Suppose a trader’s position is liquidated while he/she trades in an isolated margin mode. In that case, an isolated margin balance will be liquidated, while the rest of the funds will not be affected.

To help novice traders start margin trading, Changelly PRO provides isolated margin mode, so that users can be in charge of the risk.

Cross Margin

Trading in cross margin mode means an entire margin balance is shared among the trader’s positions to prevent liquidation.

Stop-loss Trading Order

Stop-loss is a type of order that limits trading losses as soon as the price reaches a specified (pre-defined) price level. Stop loss is considered one of the main tools for effective trading.

From a technical point of view, this is simply a pending order that automatically activates at a given rate value. Stop-loss allows you to get rid of the constant monitoring of the position.

Difference between Spot and Margin Trading

Spot trading and margin trading refer to different concepts: spot trades are the opposite of futures contracts and refer to contracts that are settled (paid and delivered) immediately on a spot date. Spot trading requires you to own all the funds that you trade with.

Example: Alice wants to exchange 1,000 USDT for BTC. She deposits her funds on the Changelly PRO platform to trade it for bitcoin.

When trading on margin, traders use both the money they own and the funds they borrowed from an exchange or another trader.

Example: Bob researched the market and knew he can get profit. However, all he has is 1 BTC. He decides to start margin trading on Changelly PRO and places 1 BTC at the 1:10 leverage. Now, he has 10 BTC to trade.

Margin Trading Risks

As we have mentioned previously, when trading on margin, there is always a specified price level at which your position will either be liquidated or you will be required to add more funds to your account. Because margin trading involves you borrowing money from an exchange (or a third party), the exchange will sell (liquidate) your position if there is a danger of loss to them. When you trade with your own funds only, you will lose your entire initial investment only when the price falls to 0. However, with margin, the price only needs to fall by a fraction in order for you to lose your entire investment.

Here’s an example: say you have $10k, and that’s what 1 BTC costs at the moment, so you buy it. You will only lose your funds if BTC goes down to 0, which is highly unlikely. Your friend also has $10k, but he is an experienced trader and, after researching the market, has come to the conclusion that BTC price is going to rise in a week. So he buys BTC on 10x margin, which brings his total funds up to $100k and allows him to buy 10 BTC.

Now, imagine the price falls to $9k the next week. You sell your Bitcoin and lose one thousand dollars. Your friend, however, has bought 10 BTC, and when selling them he loses one thousand times ten, so the $10k he initially invested. In fact, he won’t even be the one selling those Bitcoin, as if the price goes any lower, his initial investment won’t be able to cover up the loss and the exchange can’t allow that, so they will forcibly liquidate his position or will ask him to invest more, which can lead to more losses in the future.

Liquidation price is set at a level below which the initial investment won’t be able to cover the losses if the position is liquidated.

Additionally, there’s also an extra risk to crypto margin trading. Cryptocurrency prices are highly volatile, and they can fall below the specified liquidation price before the exchange can liquidate your position. In that case, traders will have to pay extra to cover the loss. (edited)

How to Start Margin Trading

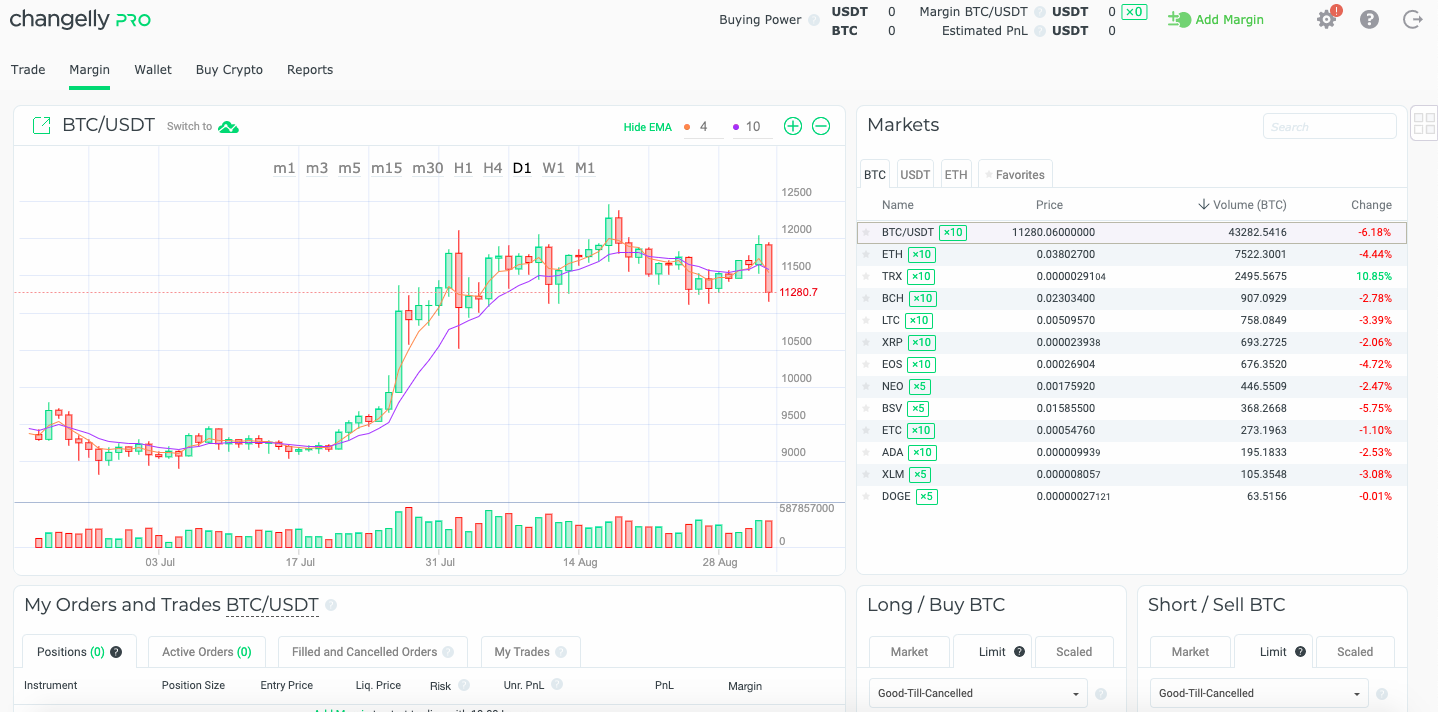

Changelly PRO provides quick access to cryptocurrency margin trading. We are going to explain how to start crypto leverage trading on Changelly PRO.

Note: Pretty much every exchange requires you to pass a simple KYC procedure and enable 2fa in order to trade on margin.

- Register on full-featured crypto exchange Changelly PRO;

- Make sure, there are some funds on your trading account;

- Click the ‘Margin’ tab. See the green ‘Margin’ button in the upper right corner and click it;

- Choose a cryptocurrency you want to trade on margin;

- Enter the margin amount. To do so, you need to transfer some funds from your trading account to the margin one;

- Voila! Now you are ready to start margin trading. See the leverage value in the upper right corner (the “Buying Power” block). Mind also, that you can add more funds to your margin at any time!

How to Choose an Exchange

Before starting margin trading, one should do deep research about cryptocurrency exchanges that provide such an option. There are several vital points that should be taken into account.

- Check the leverage offered. Mind also that the leverage might be different for each cryptocurrency traded;

- Fees. Learn more about fees charged. How much will it cost to withdraw funds? Are there additional fees? Research the market in order to determine the best cryptocurrency exchange for you;

- Liquidity. The more liquidity does the exchange attract, the faster and more efficient will be trading;

- Cryptocurrency exchange reputation. The security of your funds must be a priority of every exchange. When initiating margin trading, there are greater risks implied. Thereby, the trading platform has to provide a robust connection, high-level security, a wide range of trading instruments and tools, and so on.

Top 3 Exchanges for Margin Trading

Changelly PRO

Changelly instant crypto exchange has been providing flawless cryptocurrency swaps since 2015. This year has been remarkable to the platform. In addition to Changelly Marketplace, upgraded Affiliate Program, and many other new features, there is a great milestone gained.

Changelly PRO is a full-featured cryptocurrency exchange that allows both novice and experienced traders to place orders and trade like a PRO. Changelly PRO provides one of the most competitive withdrawal and trading fees on the market.

Margin trading on Changelly PRO perfectly suits those who decide to start trading with leverage and want to get into it with minimum risks. Users can trade a range of digital assets with up to 10x leverage, which enables newcomers to learn margin trading safely. Besides, the UX/UI are intuitive so it won’t take too much time to delve into the world of cryptocurrency margin trading.

Binance

The behemoth of the industry, Binance, provides a decent ecosystem for secure and diverse trading. Margin trading on Binance works for more advanced traders as the trading terminal is full of additional information that may scare off newbies. Design and user-experience follow Binance style, yet they might seem quite tricky.

To provide users with all the necessary details, Binance offers guides and tutorials for every feature it has. The exchange offers an opportunity to open both long and short positions for a list of cryptocurrencies. Binance enables cross margin with the 3x leverage and isolated margin with the 10x leverage. Please note, that margin trading is not available for users from the USA, Japan, Canada, etc.

BitMex

Being a veteran of the trading market, BitMex provides a wide range of trading tools and derivatives (futures, options, etc.). The exchange also offers cryptocurrency trading but we have to admit that BitMex suits highly experienced traders only. According to coinmarketcap data, BitMex provides active markets for BTC, ETH, and XRP.

One of the most remarkable features of BitMex is that the exchange provides an insane 100x leverage for cryptocurrency margin trading. In this context, novice traders should avoid cryptocurrency margin trading on this platform until they get proper expertise in the field. It is crucial to remember about the risks implied by margin trading.

Bottom Line

Unlike standard trading, where any unexpected movement of the rate can most often be simply waited, here a long-term drawdown will mean a loss of deposit. You should start margin trading only when you can seriously approach risk control and the formation of a trading strategy.

Be mentally prepared for potential losses in advance. Only with this approach will it be possible to derive stable benefits from trading with cryptocurrencies with leverage.