KYC & Security

Does Changelly PRO have KYC and how to get verified?

Changelly PRO is required to identify its users. We do this to help prevent the use of fraudulent accounts, and to also keep our customer base safe. The Changelly PRO risk management team verifies trading activities within the platform ensuring full compliance with international AML and KYC regulations.

We offer different levels of verification for your account – Starter, Trader, and Pro. As soon as you register with your email, you become a Starter and are allowed to start trading, however we urge you to reach the Trader status.

Benefits of upgrading an account to TRADER status

1. Take advantage of lower fees and higher limits

Only verified users have the opportunity to take advantage of Changelly PRO’s 10 levels of discounted fees, rewarding you further based on the volume you trade.

2. Increased security to keep you safe

Imagine ever losing your 2FA device, or getting your account deleted or worse! As a verified user you’ll easily regain access to our Changelly PRO account quickly and easily.

3. Streamlined service

Becoming verified as a user gives you better access to Changelly PRO’s full suite of services, be it; security, customer care and gives you peace of mind that everything is under control.

Verification Guide to TRADER status

1. Choose the level of verification that reflects your trading activities

It’s important to know what you’re being verified for. Via Changelly PRO we have compiled a list of three levels of verification, and what we’d need for there to be no issues for your trades.

- Starter

Withdrawal limit: Withdrawal < 1 BTC equivalent per day

Requirements: No ID required - Trader

Withdrawal limit: Withdrawal <50 BTC equivalent per day

Requirements: National ID required - PRO

Withdrawal limit: Withdrawal > 50 BTC equivalent per day

Requirements: Personal assistance required

2. Prepare all documentation beforehand

Before you start the verification process to upgrade to Trader account status, it’s important to prepare all the necessary documents: your international passport, government-issued national ID card, or driver’s license.

Our identity verification application consists of two parts, one stating your country of residence, phone number, a high-resolution image and providing a document proving your identity.

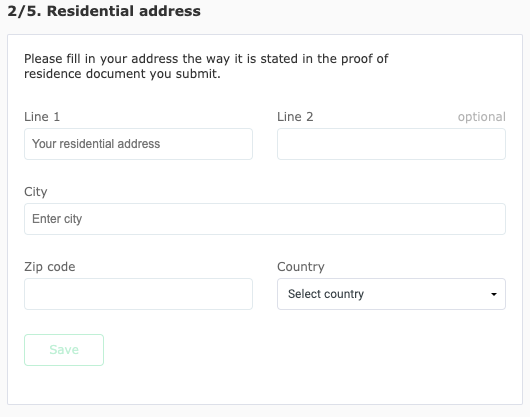

3. Open the KYC tab once you’re signed up and fill in the relevant information, as seen below.

4. Upload a photo of your ID document (front and back)

Here you can provide a photo of your original ID document. Whether you’re taking a photo with your phone or uploading it from your computer, make sure that all letters and numbers are in latin, clearly readable, with no glare.

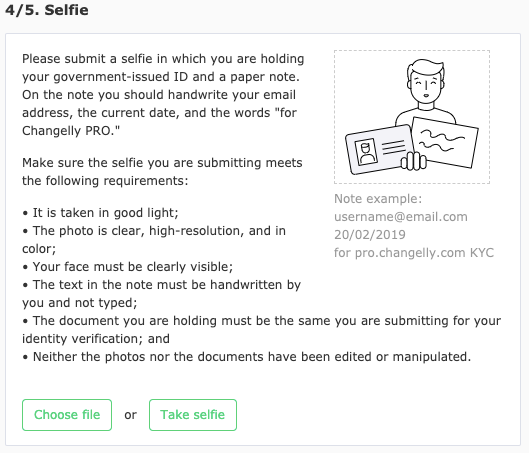

5. Upload a selfie

It’s best to upload a photo of you holding your identity document. Make sure that:

- (Minimum size: 500KB and maximum size: 10MB)

- The document has your signature

- All text is visible

- You are looking straight into the camera

- The background is a light, neutral color

- The photo is in color

- You are not wearing accessories (e.g. sunglasses, a hat, or a headband)

6. Provide your mobile phone number

7. Click on ‘Request Verification’

8. Wait for an email back from the team, and you’re good to go!

You’ve submitted your application for Verification on Changelly PRO.

Verification Guide to PRO status

Firstly, you need to upgrade to TRADER status. Secondly, to access a PRO status that includes negotiable fees, higher API limits, dedicated account manager, you would have to leave contacts for video call where we conduct an interview and request additional documents.

If you’ve got further questions surrounding our verification process you’re welcome to send an email to [email protected].

How long does it take to verify ID on Changelly?

As a rule, it takes up to 24 hours. Sometimes, it may take a longer time due to security reasons.

Why should I complete the KYC procedure?

Changelly PRO is required to identify its users. We do this to help prevent the use of fraudulent accounts, and to also keep our customer base safe. The Changelly PRO risk management team verifies trading activities within the platform ensuring full compliance with international AML and KYC regulations.

Why are my documents rejected?

There are some cases where your KYC can be rejected:

- There have been discrepancies (a mismatch) between your selfie and the picture on the ID you provided;

- You reside in a country where we do not operate;

- We have discovered your documents to be fake and/or edited;

- The photos are blurry;

- and more…

If your KYC gets rejected, Changelly PRO Compliance team will contact you to resolve the issue and help you pass the procedure. If you don’t receive an email from them, please contact them at [email protected].

We want to ensure that all of our users pass KYC successfully, so we do our best to contact every person who has expressed dissatisfaction with our service and help them resolve their issues. However, there are cases where applications are rejected not because of the user’s honest mistake but because the person who submitted it purposefully attempted to deceive us.

Unfortunately, there are kinds of fraudsters who either don’t understand the role of AML compliance in mass adoption or don’t care about the future prosperity of crypto. In some cases, they start spreading negative feedback on the Internet in hopes that we will make an exception for them in exchange for positive publicity.

However, because we take AML very seriously, we will not compromise our commitment to the security of our customers and services.

My ID has expired, and I’m waiting for a new one. What can I do?

To pass our verification process, you must submit an ID valid for at least one month from the submission date.

How is my personal information stored?

Since we care about the security of your data, we store all your personal information in accordance with applicable laws and regulations — for instance, the GDPR.

The data is processed lawfully, fairly, and transparently. We have implemented appropriate technical and organizational measures in accordance with data privacy laws and regulations. Learn more about how we keep your data safe in our Privacy Policy.

How can I secure my account?

Changelly PRO pays particular attention to the safety of your funds. Here are some of the security methods that we offer:

- 2FA (two-factor authentication)

- email confirmations for major account activities

- withdrawal whitelists

We strongly encourage you to switch on the security tools available and be careful while trading.

What is 2-factor authentication?

2FA is a method that keeps your account protected. To log in to your Changelly account, you’ll need to use one of the authentication apps (for example, Google Authenticator). You may turn 2FA off anytime you want.

How does 2-factor authentication work?

Two-factor authentication works by adding one more level of security to your account. Beyond a username/email and a password, you need to verify it’s you with the authenticator app on your mobile phone.

What is the authenticator app?

The authenticator app is an app on your mobile phone that generates a 6–8 digits code every 30 seconds. Every time you sign in to your account, you need to verify it’s you and fill in that code. You can download the authenticator app from your application store (e.g., Google Authenticator).

How to enable 2FA for my Changelly PRO account?

Please follow these steps in order to switch 2FA on your Changelly PRO account:

- Please open the settings. Click the “Security” tab.

- Download an app for your 2FA codes. We highly recommend you to use Authy. FreeOTP and Google Authenticator are also possible options.

If you need a more detailed guide on setting 2FA with code-generating apps, please refer to this article.

You can also set up 2FA with YubiKey.

Didn’t find the answer to your question?