The Decentralized Finance (DeFi) ecosystem is undergoing robust growth and is attracting a lot of attention. Farming of COMP tokens based on the Compound lending protocol has become a popular topic for making money in the cryptocurrency space over the past two weeks.

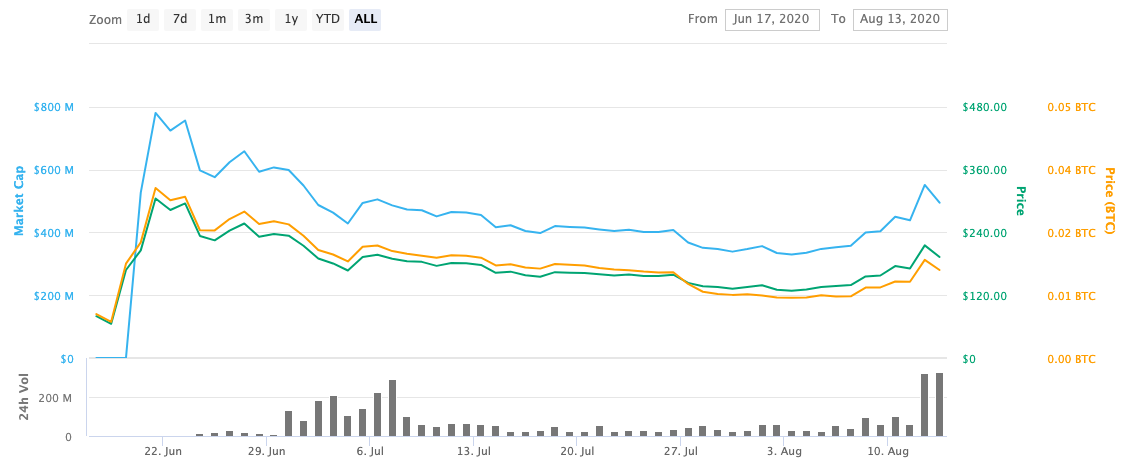

COMP began trading on the Uniswap exchange on June 15th and has been exhibiting sharp fluctuations since then. With a starting price of about $20, the token’s value rose above $350. We’re thrilled to discover the future of Compound cryptocurrency based on the developers’ predictions and prospects.

Table of Contents

Compound Cryptocurrency Place in DeFi

We’ve already explained all the basics in the article about Compound. If you do not realize what we are talking about, we recommend reading this piece before thinking about an investment.

On June 16, Compound began distributing COMP tokens to users. Now every user has the right to participate in the management of the protocol. To receive tokens, you need to open a deposit or take a loan from a smart contract. The distribution will occur in equal parts every week in proportion to the volume of operations performed by each user.

Compound rewards its users for both lending assets and receiving loans. For maximum benefit, users borrow both sides of the deal. They make a deposit, take out a loan, and put it back into a deposit. This makes Compound the most significant decentralized finance (DeFi) project in terms of assets under management.

The Compound team provided $2 million in liquidity on the Uniswap decentralized exchange so that users could buy or sell tokens on the open market. In the very first hours of trading, several large players bought out most of the tokens, which caused the price skyrocket above $100 and then to $230.

Other Compound-integrated projects, such as PoolTogether and Set Protocol, have also begun receiving COMP tokens, setting a precedent for a potential revenue stream for DeFi projects.

Coinbase, the largest US cryptocurrency exchange, announced the COMP listing on the 25th of June. This is an excellent example of how a small team, which received investments from leading Silicon Valley funds and using open technologies and knowledge of the financial markets, could create a cloud bank and release a token on the open market.

However, due to the high prices for the token and the news of its listing on Coinbase, sending funds to any other protocols has become unprofitable, which potentially leads to a monopolization of the liquidity market and creates an inefficient environment for the DeFi ecosystem. The market has not yet decided on what parameters to evaluate the tokens of this type.

Compound (COMP) Crypto Live Price

Compound Cryptocurrency Technical Analysis

According to TradingView users’ ideas, Compound cryptocurrency seems to be a good short-term investment.

COMP/USD (Short Term Uptrend?) by PolarHusk on TradingView.com

Other users recommend to hodl the COMP cryptocurrency for the long term.

long until it breaks the line by superkitty on TradingView.com

Compound Coin Price Predictions for the Next Few Years

Here we’ve found the most popular price predictions from the websites, so we are here to give you some info about Compound future price projections.

According to the Digital Coin Price source, the COMP coin price will increase soon. In one year, the Compound cryptocurrency rate can go up to $380. The asset price will grow exponentially. So by 2025, the asset price will be $807. Bullish, huh? Such a forecast is possible only with the constant development of the project and the cryptocurrency market.

Compound founder Robert Leshner asked investors not to invest client funds in high-margin pharming, as this will sooner or later lead to a loss of assets. There are already proposals to limit the amount of funds in REP, BAT, and ZRX that can be borrowed for every dollar of collateral.

The profitability of COMP farming changes in real-time, so it is very difficult to predict anything. The protocol is programmed to create 2880 COMP per day. The total amount does not change, but the size of payments changes depending on the demand in a particular market. The more activity in each market, the less each investor will earn.

As long as the difference between the cost and the COMP price remains, investors will continue to mine the coveted tokens. However, increased supply and opportunities to liquidate COMP will inevitably put downward pressure on price until it matches real demand for lending through Compound.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.