The father of all cryptocurrencies, Bitcoin has become the pioneer in the sphere of blockchain-based money. It’s not surprising: the underlying technology appeared to be revolutionary, and only a few projects managed to come up with completely new types of blockchains (Ethereum, EOS, and Tron). Numerous cryptocurrencies appeared to be Bitcoin forks. What is a Bitcoin hard fork? This guide is here to explain that in detail.

Table of Contents

To start with: What is Bitcoin fork?

The fork is a cryptocurrency with some changes in the current Bitcoin protocol (BTC) and a change in its rules. Imagine you play one game and want to change its rules. It means all other players will have to agree to change the rules. If you reach the agreement, the changes are implemented and the game continues as usual. However, if the consensus was not achieved, two versions of the game are created: version No. 1 with the old rules and version No. 2 with the new rules. This would be a fork in the game. The same logic applies to Bitcoin code.

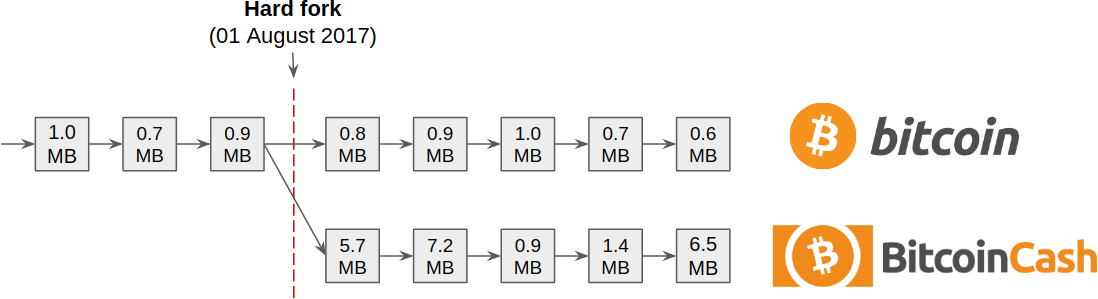

After the fork, the original Bitcoin stays, and the new Bitcoin appears. For example, Bitcoin Cash (BCH) changed the block size from 1 to 8 MB. Supporters switched to a new Bitcoin Cash coin, and those who preferred the original rules continued to use the original Bitcoin. Bitcoin Gold changed the rules of mining in favor of users, and also got many supporters.

Bitcoin hard fork explained

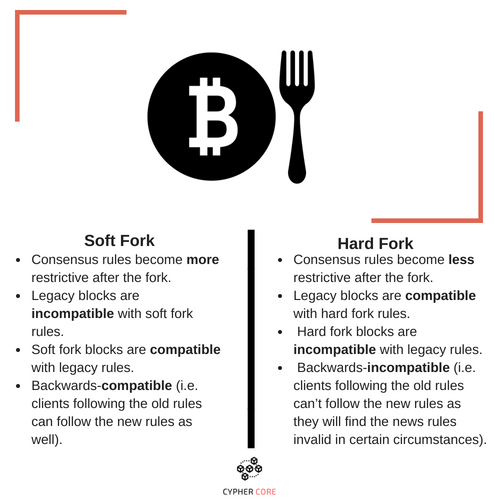

Hard Fork is a change in the cryptocurrency protocol that does not support backward compatibility with older versions of the currency. For example, anyone who runs a node on a Bitcoin network will definitely need to update their software to recognize new blocks.

Hard Fork is a situation where the nodes that launch the new software are separated from the previous version of the cryptocurrency.

If half of the nodes work with the new version and mining blocks, and the other half starts the old version and expands a different set of blocks, then you actually have two different chains.

What is a soft fork?

Soft forks of cryptocurrencies allow you to combine new rules with old ones. While the goal of a hard fork is to weaken the action of some rules that are implemented in an unreduced version of the protocol, the task of a soft fork is to tighten some of them.

SegWit is a good example of Bitcoin soft fork. The Bitcoin community has long been discussing how to boost the speed of Bitcoin transactions. Since a new transaction block is mined every 10 minutes on average (and this point has not been discussed), the idea was to increase the number of transactions that can be included in each block. To do this, the community proposed a solution called Segregated Witness (abbreviated SegWit). The main idea was to free up space in each block, which can be used to include more transactions. This was achieved by removing the public key and signature associated with each transaction from the block and sending them through another messaging channel. Since the public key and signature occupy about 60% of the total transaction size, due to their separate sending, the number of transactions in each block could be doubled.

Why do hard fork BTC currencies appear?

The cryptocurrency blockchain is usually open-source, which means that the code is free and accessible to everyone; both for viewing and for use.

As currencies evolve and change over time, some changes need to be made to their protocols. Such changes can range from a small addition of a new function to mass changes, such as increasing the maximum block size.

Sometimes, within the community of miners, blockchain changes can be viewed in different ways. Some accept changes, while others do not. Such divisions in the network infrastructure can also lead to the creation of new blockchains and new cryptocurrencies.

7 Bitcoin forks

The Bitcoin hard fork list is actually longer, but those were rather small improvements than separate viable cryptocurrencies. Below, we observe seven main Bitcoin hard fork cryptocurrency projects.

Bitcoin XT

The fork appeared on August 19, 2015. The authors were the developers of the original Bitcoin Core – they created Bitcoin XT to solve the problem of network scaling. Bitcoin XT developers went by increasing the block size, which in the original Bitcoin chain was 1 MB.

At the time of the creation of the first block of Bitcoin XT, it was supported by 12% of miners, however, as conceived by the creators, a complete transition required 85% of the network nodes to join the Bitcoin XT network. Later, the share was reduced to 75%.

Right from the start, the Bitcoin XT project has been harshly criticized by many leaders of the Bitcoin community. Moreover, an account, allegedly owned by the creator of Bitcoin Satoshi Nakamoto, spoke out against the fork. However, back in 2014, information was circulating in the community that the profile could be hacked, and therefore there is a theory that it was Satoshi who opposed Bitcoin XT.

Bitcoin Unlimited

The Bitcoin Unlimited project appeared almost half a year later than Bitcoin XT – in January 2016. It solved the same problem – increasing the size of the block – but in a fundamentally different way. Bitcoin Unlimited let network nodes to decide what size blocks they should issue. The creators relied on democracy – everyone who has a complete node got the opportunity to decide on the size of the block.

Creators considered that the system itself would stop at the average value chosen by the majority: too small blocks would be “forked” from the network by the system itself, it would not accept too large blocks since most nodes would not see them.

The power of the free market, which rules the world of the traditional economy and financial systems, was created by the creators of Bitcoin Unlimited to serve the digital economy. The impact of the project was added by the joining of developers Tom Sonde and Tom Harding, who left Bitcoin XT, which had begun to decay, and another, which appeared a little later, but also did not last long, – Bitcoin Classic.

Bitcoin Unlimited, like its predecessor, Bitcoin XT, was not successful – the community was thrilled by the prospect that the proposed scheme could be used by large centralized pools, suppressing the opinion of the majority of users with superior computing power. This would lead to a concentration of influence in the network in the hands of only a few groups and devalue the whole idea of Bitcoin decentralization.

Besides, a large number of blocks of different sizes could lead to multiple involuntary forks and the formation of a number of false chains – which would ultimately lead to the fall of bitcoin itself.

Bitcoin Classic

Bitcoin Classic appeared only a month later than Bitcoin Unlimited, in February 2016, but began to crumble even faster. The creator of the fork was Gavin Andersen, the author of Bitcoin XT, who continues to pursue his goal – to increase the throughput of the blockchain by increasing the size of the block. This time it was planned to increase exactly twice, up to 2 Mb, and two years later – up to 4 Mb. Jonathan Tumim, another of the creators of Bitcoin Core, also joined Andersen.

Unlike Bitcoin XT, Bitcoin Classic has been favorably received by the community. It was supported by such mining pools as Antpool (Bitmain), BW.COM, HAOBTC.com, Genesis Mining, Multipool.us, as well as Coinbase, OKCoin, and Foldapp. Roger Ver, the owner of Bitcoin.com, also expressed his sympathy for the project – he is confident that increasing the block size will allow for the creation of a larger number of full nodes, which means to further increase the decentralization of the network.

Bitcoin Classic never found direct and high-profile opponents, but it never became fully functional. The main reason why discussions have been dragging on for the second year now is the need to conduct a hard fork, which will temporarily affect the overall security of the network and may result in a split. However, after the appearance of Bitcoin Cash, which produces blocks up to 8 MB, the developers of Bitcoin Classic said that they considered the goal to be achieved.

Bitcoin Cash

Bitcoin Cash is one of the most famous forks, which really ended with a chain split and the formation of a new cryptocurrency of the same name. This happened on July 23, 2017, and so far, Bitcoin Cash is showing good results in the market. Many experts are inclined to believe that while the authority of the original Bitcoin and its associations keep it afloat, but even Bitcoin Cash itself has managed to gain some influence and stays firmly in the top ten most popular cryptocurrencies.

Bitcoin Cash has a number of significant differences from the original Bitcoin. There are three main code additions:

- The block size limit increased from 1 MB to 8 MB at a time;

- Additional protection against transaction failures is set – retries and erasures. Bitcoin Cash guarantees the safety of the user if two parallel chains are saved – the code allows them to coexist without duplicating or erasing the operations performed;

- The type of transaction has changed. This is part of a previous security code change – Bitcoin Cash has launched a new type of transaction in which input values are signed. This ensures the security of hardware wallets and solves the issue of quadratic hashing.

The creators of Bitcoin Cash also created two more hard forks: Bitcoin SV and Bitcon ABC.

Bitcoin Gold

Bitcoin Gold is another cryptocurrency that separated from Bitcoin on October 24, 2017, a day earlier than the developers planned deadline. The creators’ goal is to make their own cryptocurrency more significant than the original Bitcoin, turn it into real “digital gold”.

To achieve this goal, the authors changed the hashing algorithm, switching to using Proof of Work by Equihash. The peculiarity of this PoW is that Equihash is suitable for GPU mining – mining of cryptocurrency, passing through graphic cards. The same type of mining is already used in some other cryptocurrencies, in particular, ZCash. Equihash is also resistant to ASIC processors.

In fact, the creators of Bitcoin Gold are trying to expand the circle of potential miners – the distribution and availability of GPUs are higher than the ASICs, which means there will be more users who can mine cryptocurrency and become network nodes. This will increase the level of decentralization and reduce pressure on the community from large commercial mining pools. The main slogan – “Make Bitcoin decentralized again”, “Let’s make Bitcoin decentralized again” is also aimed at this. According to the developers, large pools have actually monopolized the network, and the community must fight this. The result of this struggle was Bitcoin Gold.

There were ideas and opponents who insisted that the market for GPU processors is controlled by only two large manufacturers, which means that there is a risk again – but the hard fork was produced anyway, and Bitcoin Gold is now traded on exchanges – albeit with a rather unstable rate.

Bitcoin SV

The main idea behind Bitcoin SV was the preservation of the vision of Bitcoin, which was founded by Satoshi Nakamoto himself. The abbreviation SV stands for Satoshi Vision.

The developers have preserved the best from Bitcoin Cash, namely low fees on the network, scalability and security, and various chips have been created for miners and investors.

In the fall of 2018, the Bitcoin Cash community split into two camps, each of which presented its vision for the development of cryptocurrency. The developers could not reach consensus, and as a result, investors had to choose.

Bitcoin Cash ABC, led by Roger Ver, chose to implement decentralized applications and transactions between blockchains. Bitcoin SV, led by Craig Wright, solves the scalability problem (which affects transaction adoption speed). Creators plan to expand the block to 128 MB. The BCH network was divided at block No. 556767. Therefore, Bitcoin SV repeats BCH technology in many respects, in particular, the developers chose Proof-of-work consensus algorithm and are not going to change it yet. On block 557301, blocks were reorganized, which is typical of PoW cryptocurrencies.

B2X

B2X, the brainchild of the SegWit2x hard fork, was supposed to become another cryptocurrency. The fork was going to be launched on November 16, 2017, and provoked hot discussions in the community, but was eventually canceled – the creators announced this in an open letter on November 8. However, officially it was not completely canceled, but postponed for some time. A number of supporters also said they continued to support SegWit2x even after the cancellation of the hard fork.

The main reason for the abolition of the hard fork was split of opinions – the next division was breaking the community, and SegWit2X authors were trying to avoid it by all means. In addition, some Segregated Witness supporters who later refused to support the agreement stated that the terms of the fork were not transparent, there was no consensus between the various groups, and the code was incomplete.

Bottom Line

The problem of increasing the block size in the main Bitcoin chain remains, and over time it becomes more acute. So, most likely, in the near future, new forks will appear, trying to win the sympathy of the community and change Bitcoin. In addition, the farther, the more acute the problem of anonymity arises, which in the Bitcoin network is becoming more and more illusory, and this issue also remains to be resolved – which means there will be changes in this direction.