FTT token becomes more and more popular among crypto users and investors. At the beginning of the year, the price of the coin began to go up gradually. What is the reason for FTT coin positive price changes? What are the prospects of the FTT coin? Let’s find out in the article.

Table of Contents

FTT Token Origin

FTX is a cryptocurrency derivatives exchange that is specialized in over-the-counter (OTC) trading and provides futures and leveraged tokens.

Launched in April 2019, FTX is owned by FTX Trading LTD, incorporated in Antigua and Barbuda. It is supported by Alameda Research, a trading company and cryptocurrency liquidity provider with almost $100 million in assets and trading up to $1 billion per day (roughly 5% of global volume).

FTT Team comes from leading Wall Street companies such as Jane Street, Optiver, Facebook, Google. Their goal is to become as profitable as giants Bitmex and OKEx within a year.

OTC Trading

In 2018, the FTX team launched an automated OTC RFQ system. FTX OTC portal enables users to receive crypto quotes on over 20 coins instantly and trade them 24/7. As they were able to offer some of the tightest spreads with a fast settlement and no fees, they immediately increased their volume to $30 million per day without massive marketing infusions. They became a source of liquidity for well known OTC desks and exchanges. FTX team also built a settlement system and a world-class portal with an intuitive UI and API.

FTT is the FTX ecosystem utility token. FTT holders receive a lot of benefits, including:

- Weekly buying and burning of fees

- Lower FTX trading fees

- OTC rebates

- Collateral for futures trading

- Socialized gains from the insurance fund

Note: There are no fees on OTC trading or converting in users’ wallets; all costs are built into the price users are quoted.

FTX Futures

FTX has quarterly and perpetual futures on the essential cryptocurrencies, including USDT, BNB, and LEO.

FTX liquidation engine and backstop liquidity provider system provide a three-step solution to handle margin calls, preventing clawbacks.

FTX Futures Fees

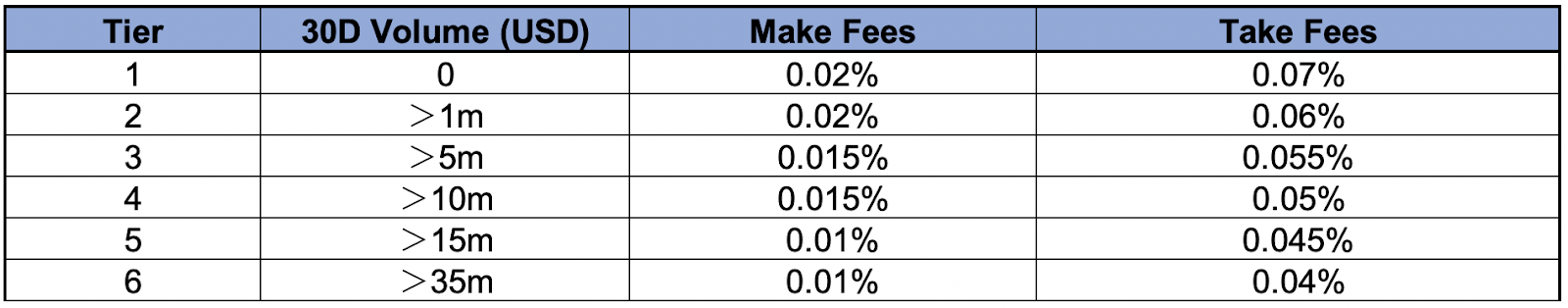

FTX has a tiered fee structure for all futures and spot markets, as follows:

There are no fees on futures settlement. The leveraged tokens have creation and redemption fees of 0.10%, and daily management fees of 0.03%.

Using leverage of 50x increases trading fees by 0.02%, and 100x or higher trading fees increases by 0.03%, which is paid to the insurance fund. There are no deposit and withdrawal fees.

MOVE-Contracts

FTX has launched its industry-first MOVE contracts. These are futures that expire to the raw amount BTC moves in a time period, letting users trade on the amount bitcoin is going to move without having to know the direction.

Note: Fees for contracts depend on the price of the underlying index, not the price of the move contract.

FTX Token

Leveraged FTX tokens are ERC20 and BEP2 tokens that already contain the leverage algorithm. These tokens allow traders to put on short or leveraged positions without margin trade. Leveraged tokens are ERC-20 tokens and can list on any spot exchange.

Reasons for using leveraged tokens:

1. Managing Risk. Leveraged tokens automatically reinvest profits into the underlying asset and reduce risks in case of money loss.

2. Managing Margin. You can buy leveraged tokens like regular ERC20 tokens on a spot market.

3. Leveraged tokens are ERC20 tokens so that owners can withdraw them from their accounts, unlike margin positions.

FTX (FTT) token is the native ecosystem exchange’s utility token, running on top of the Ethereum network.

Launched in 2019 for the cryptocurrency derivatives exchange FTX, FTX (FTT) Token is an ERC-20 token, governed by FTX Trading.

FTT started trading on exchanges on the 1st of August 2019 and had raised 8 million dollars worth of seed venture capital by the 6th of August 2019.

FTX token owners can expect to receive exchange related benefits, including lower trading fees, OTC trading rebates, and the use of FTT for collateral in futures trading.

FTX Information

- Website

- FTX Whitepaper

- FTX Coinmarketcap

- FTX Token Price: $2.29 USD

- Market Cap: $222,150,322 USD

- Circulating Supply: 96,888,230 FTT

- Total Supply: 347,760,566 FTT

- Markets: https://coinmarketcap.com/currencies/ftx-token/#markets

- Hashing algorithm: Ethereum (ETH) Token algorithm

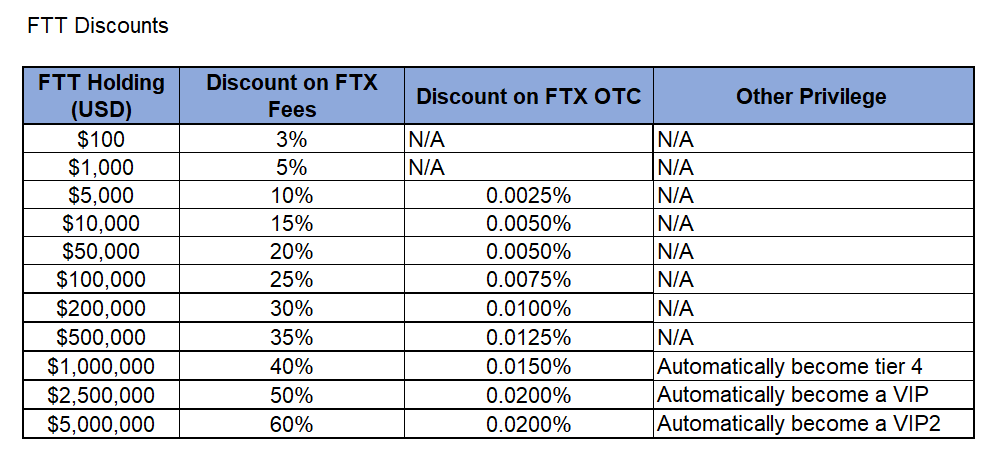

Discount for FTT holders

FTT holdings cannot decrease taker fees below 0.015%.

FTX Token (FTT) is not available in the United States or other prohibited jurisdictions. If you are located in, incorporated or otherwise established in, or a resident of the United States of America, you are not permitted to transact in FTT.

Where to Buy FTX Token (FTT)

On July 29th, 2019, FTX listed standard two-way spot FTT/USD, FTT/USDT, and FTT/BTC markets that can be freely traded. FTT has also listed on the following exchanges:

Where to Store FTX Token (FTT)

You can store your FTX Tokens in any Ethereum and ERC-20 compatible crypto wallet. You can find the most suitable wallet in our list of the best Ethereum wallets.

Conclusion

FTX (FTT) Token contains various unique features that differentiate it from the competitors. The FTX (FTT) team’s extensive work experience with Wall Street companies and such technology giants as Jane Street, Optiver, Facebook and Google, and the platform’s ability immediately to enter a crowded market as one of the leaders, proves its significant potential for impressive growth.

Disclaimer: This article about FTX Token (FTT) should not be considered as offering trading recommendations. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

You said this terrifically. fluconazole 150 mg

Helpful facts. Kudos.