People who bought Bitcoin and Ethereum at the beginning of 2023 must be delighted. They’ve raked in double-digit percent points worth of profit by now. But what if we told you that you could make even more money just by adding Coinbase stock to your portfolio? Let’s try to investigate how it works.

Coinbase stock after the IPO

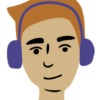

One of the biggest crypto exchanges in the world completed an IPO not so long ago – in April 2021. Entering the stock market was a major event, but it has been painful to watch the result (we can only hope you didn’t buy the shares on their high). The chart below demonstrates an 80% drop. Also, it is worth noting that multiple factors might influence the markets. In order to predict what happens next, you can use different trading tools, for example, economic calendar. It shows the significant economic events that every trader and investor should know about.

Coinbase stock in 2023

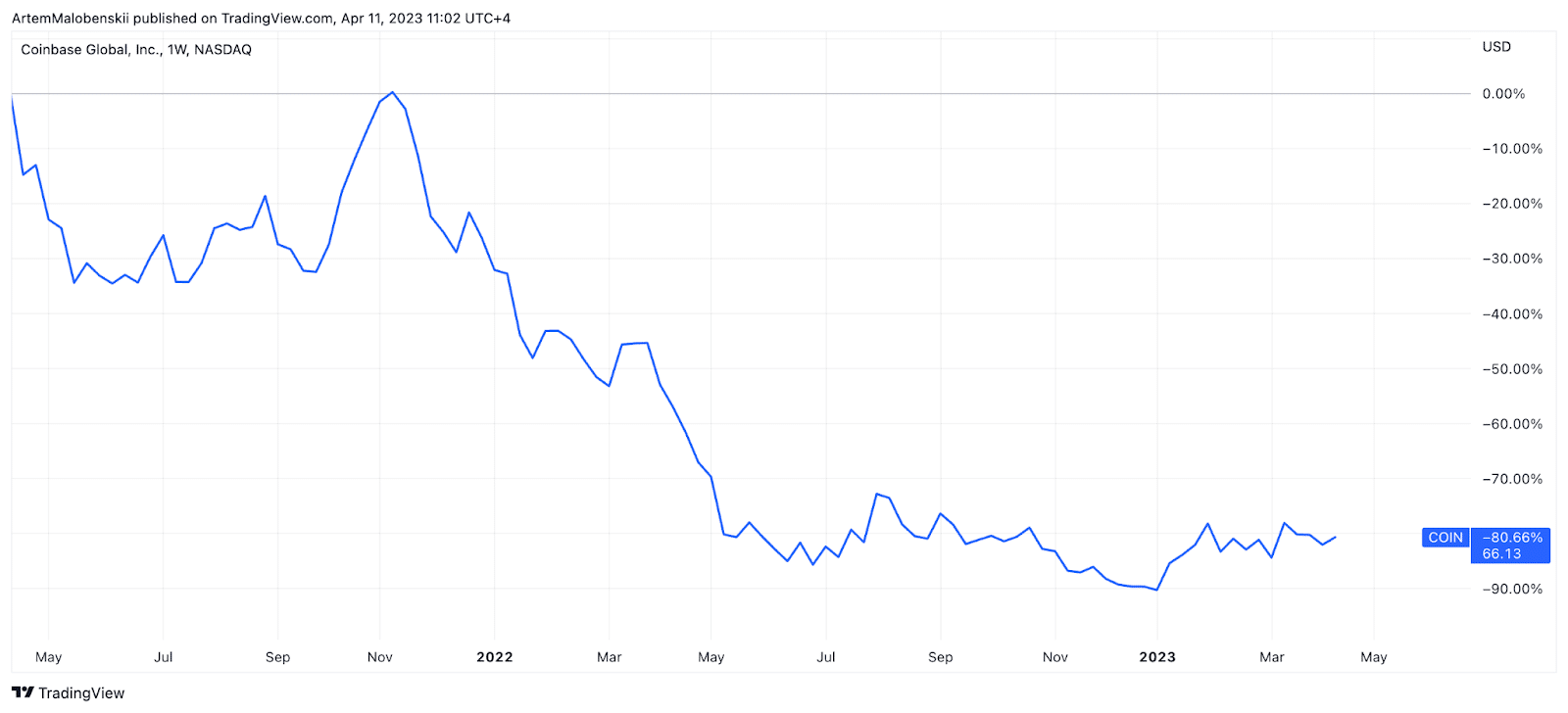

All the movements on the previous chart seem to look insignificant in 2023. But there’s no need to rush yet. Let’s zoom in.

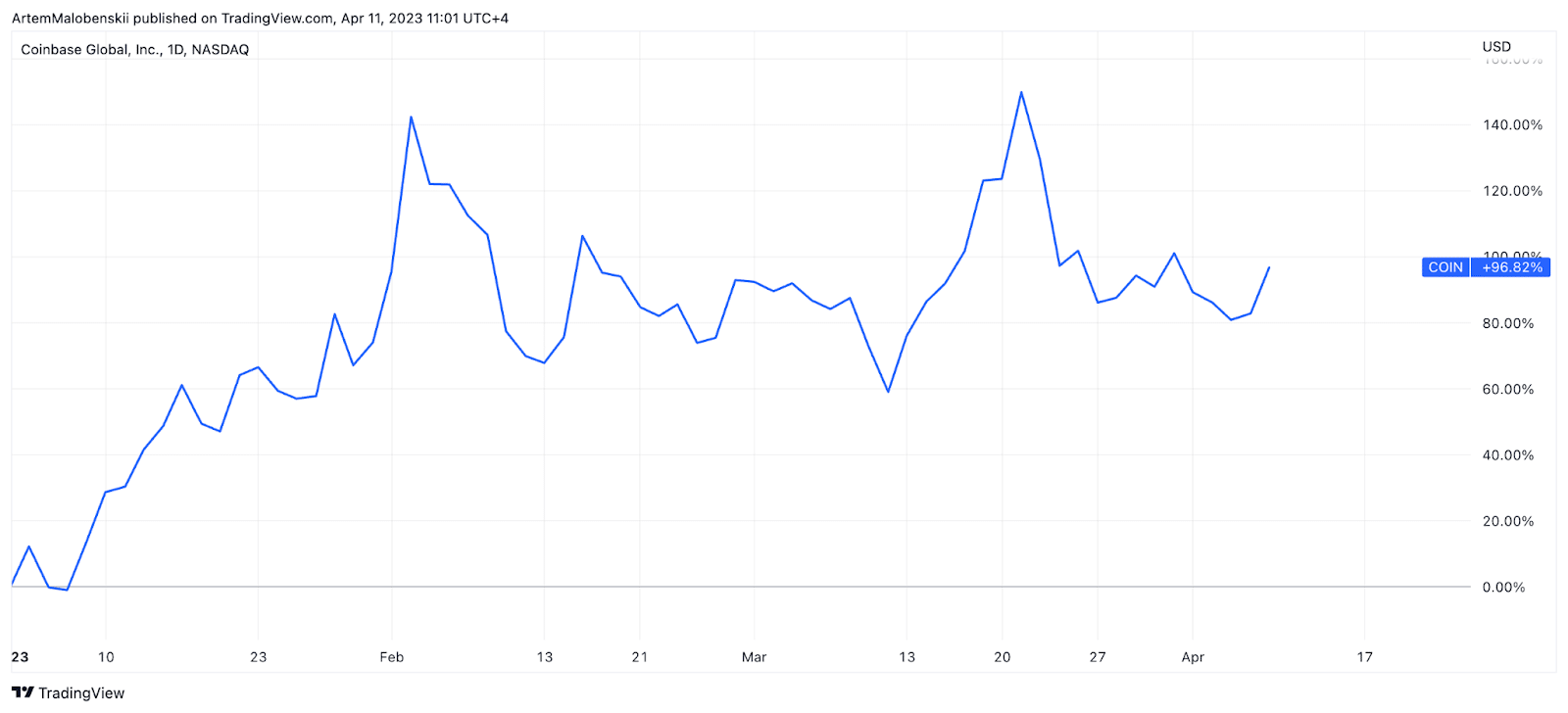

Now we can clearly see that this year is a period of abnormal growth – 96%. For comparison, Bitcoin has hiked “only” by 77% and Ethereum by 57%.

Why has Coinbase stock hiked so much?

Although Coinbase has raised even more than BTC and ETH, that strong growth owes to the impressive explosive increase of crypto. First, there is a direct correlation – when coins are rising, investors make more deals. As such, the cryptocurrency exchange gets more profit. Second, Coinbase stock movements are historically connected with Bitcoin movements as it has the largest market cap among cryptocurrencies (Bitcoin dominance provides a ratio of BTC market cap to cumulative market cap of cryptocurrencies). It’s hard to imagine that this will change any time soon.

Among the other possible growth drivers, there is the collapse of several US banks where some crypto companies held their reserves. These events might have pushed people to look at Coinbase as an alternative platform for depositing.

Also, the price of Coinbase stock was fairly low because of its poor financial performance and reports about layoffs – COIN might currently be underestimated if these issues are behind it.

There is more in this than meets the eye

The abovementioned poor financials are a big downside however. It’s not surprising that most investors prefer to add to their portfolio profitable and reliable businesses that are able to bring stable income. Right now Coinbase may not look like a stock you buy from a long-term perspective.

One more Schrödinger drawback is a connection with crypto coins movement because it can go either direction. When BTC and other cryptocurrencies are rising, Coinbase stock is doing the same. But if coins are falling down, this exerts downward pressure on Coinbase.

Coinbase stock forecast

Coinbase’s shares are pretty volatile, and analyst opinions (especially forecasts for the year) can change a lot. But, on the other hand, high volatility gives traders an opportunity to make money on every stock movement.

The consensus forecast for Coinbase stock is +7% in the next 12 months. That might not look too impressive, but don’t forget that you would be making money on crypto growth as a result of investing.

But it doesn’t matter if you make deals in the crypto or stock market. You should always do your own extensive research on whatever stock or crypto you are considering investing in.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.