Want to borrow a few Bitcoins, or have some free cryptocurrency to spare? In both cases, you might be interested in the platforms for crypto lending. They provide the opportunity to get a loan with Bitcoin without visiting banks or meeting with other BTC holders. However, when it comes to the financial sphere and cryptocurrency, cybercriminals don’t miss the opportunity to make their money, so there’s a huge amount of scams.

In our list, we review the most reliable platforms and websites for crypto loans.

Table of Contents

- What is Crypto Lending?

- How to get a crypto loan?

- Possible Risks of Crypto Lending

- Top 10 Crypto Lending Platforms

- 1. Binance

- 2. Poloniex

- 3. Bitfinex

- 4. Nexo

- 5. SALT Lending

- 6. Unchained Capital

- 7. Aave

- 8. YouHodler

- 9. Celsius Network

- 10. BlockFi

- P2P Bitcoin loan platforms

- Pros and cons of Bitcoin lending platforms

- Bottom Line

- About Changelly

What is Crypto Lending?

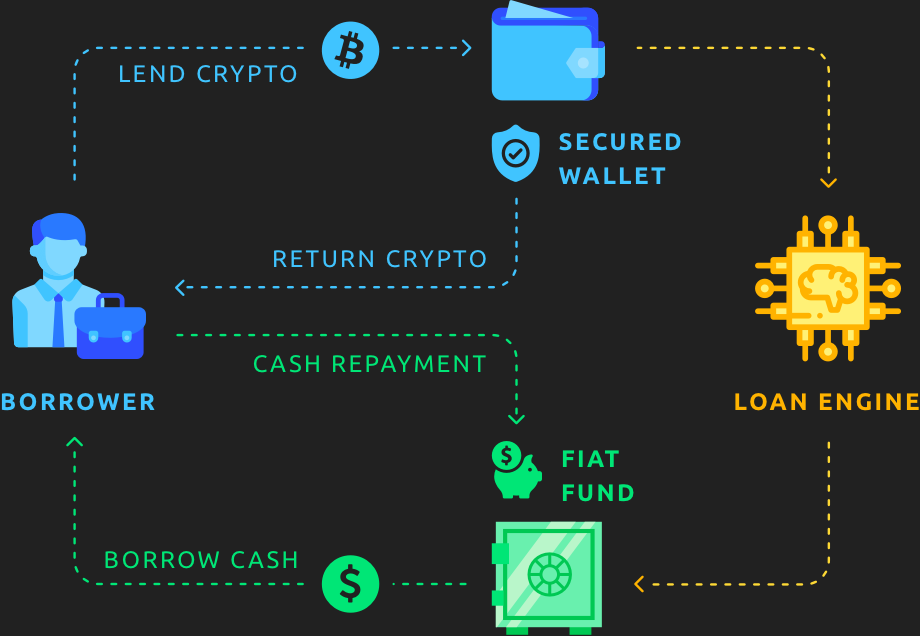

Crypto lending is a process of lending a certain amount of cryptocurrency either directly from a certain person, or from a lending platform, simple as that. It allows traders to start their business without the need to buy or mine crypto themselves, while crypto hodlers are earning more money from the interest, with no need to mine or trade. As with real-life lending, those platforms charge interest for their services.

How to get a crypto loan?

On all Bitcoin lending platforms, the process of borrowing crypto coins is similar. It includes the following steps:

- You register on the resource and go through the verification process.

- After that, upload your personal information and your business plan, if any.

- The business plan goes public, where each potential investor can evaluate it and decide if he wants to lend to you the crypto.

To assess the reliability of the borrower and the depositor, such platforms apply the rating system. It’s based on the information collected and the quality of the proposed purpose of the loan, as well as on estimates from previous partners. If you have borrowed money and paid it back in time, you will have an excellent credit history and new investors will accept you. It’s a very convenient option for Bitcoin loans without collateral.

Possible Risks of Crypto Lending

Since the crypto world is a rather risky place, crypto lending also has its own set of dangers that may catch you unaware.

- The legal side of the lending. Cryptocurrency and associated businesses don’t have a uniform legal framework. There are almost no laws controlling it and in some countries, financial operations with crypto, lending included, are outlawed. So study the laws carefully and operate within regulations.

- Different lending platforms have different fees and interest rates, so you can accidentally lend crypto from a platform with really high rates that are set on a daily basis. You can lose your entire trading profit (and maybe even more) to pay this platform off.

Crypto lending is rather light on risks, so if you are being careful, there wouldn’t be many problems for you.

Top 10 Crypto Lending Platforms

1. Binance

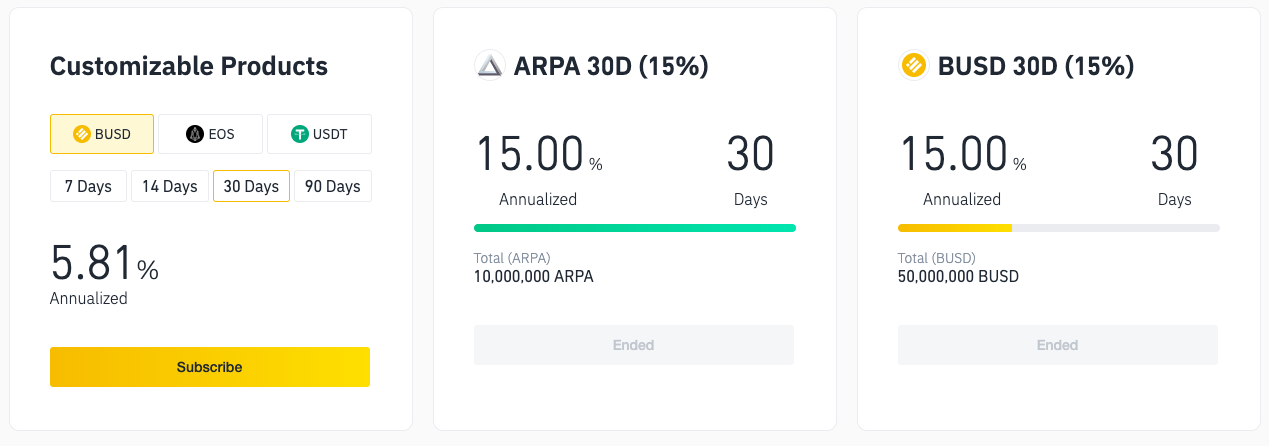

Binance is one of the biggest and the most popular crypto platforms in the world, so it isn’t a surprise that they’re working as a lending service as well. Unlike many other platforms, they allow crypto hodlers to earn interest by lending their crypto to margin traders, instead of giving out loans themselves. The interest depends on the asset in question, with some going up to 15% annually.

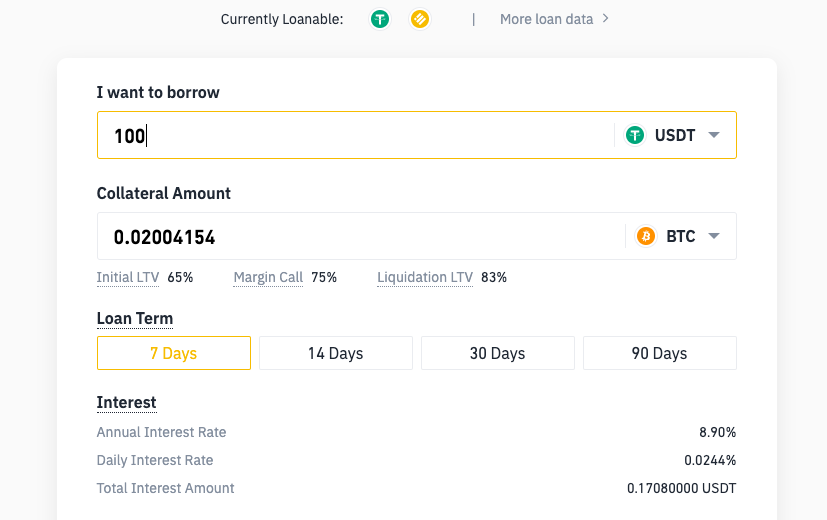

They also offer crypto loans, though currently only USDT and BUSD are available. The interest rate on both starts at 8.90%, with loan terms from 7 to 90 days.

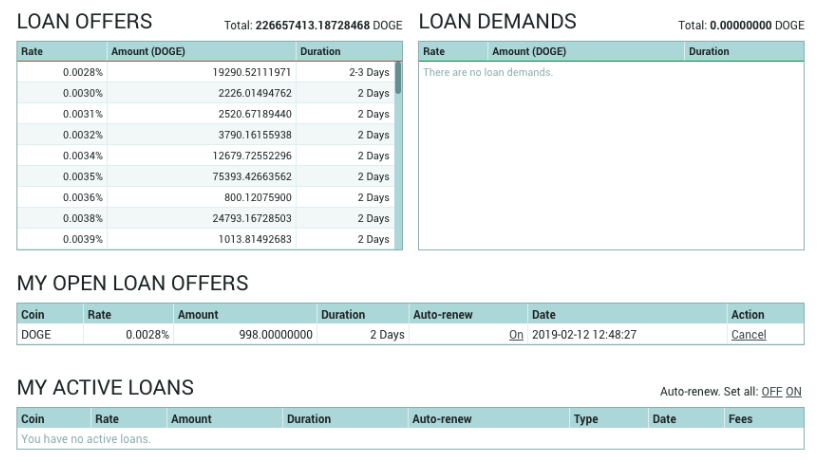

2. Poloniex

Another lending platform that allows users to lend money to traders, Poloniex offers a reliable and comfortable way to earn passive income. With a few features, like “Auto-renew” and a user-friendly interface, it is a good platform for both the starting and experienced crypto hodlers to earn additional coins.

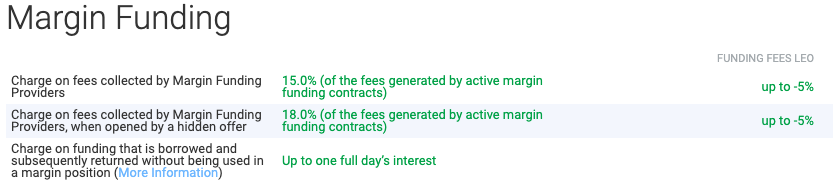

3. Bitfinex

While Bitfines doesn’t call it as such, their Margin Funding feature is basically a lending service for margin traders. It allows traders to invest more in the asset, for a fee of 15% flat for a usual deal, and 18% if the trade was opened with a hidden offer.

It should also be noted that if Bitfines takes over your positions with a sum exceeding $250,000, you will be charged a 5% fee for the losses incurred.

4. Nexo

Nexo is undoubtedly one of the leaders in the instant crypto loan sphere. The affordable loan sums here are from $500 to $2,000,000. Nexo utilizes Onfido for the compliance procedure. Also, the website counts over $1,5 billion in instant crypto-backed credit demands.

On the drawback, Nexo is blamed for its hidden expenses, a limited number of insurance crypto wallets, and confinements with regards to money withdrawals.

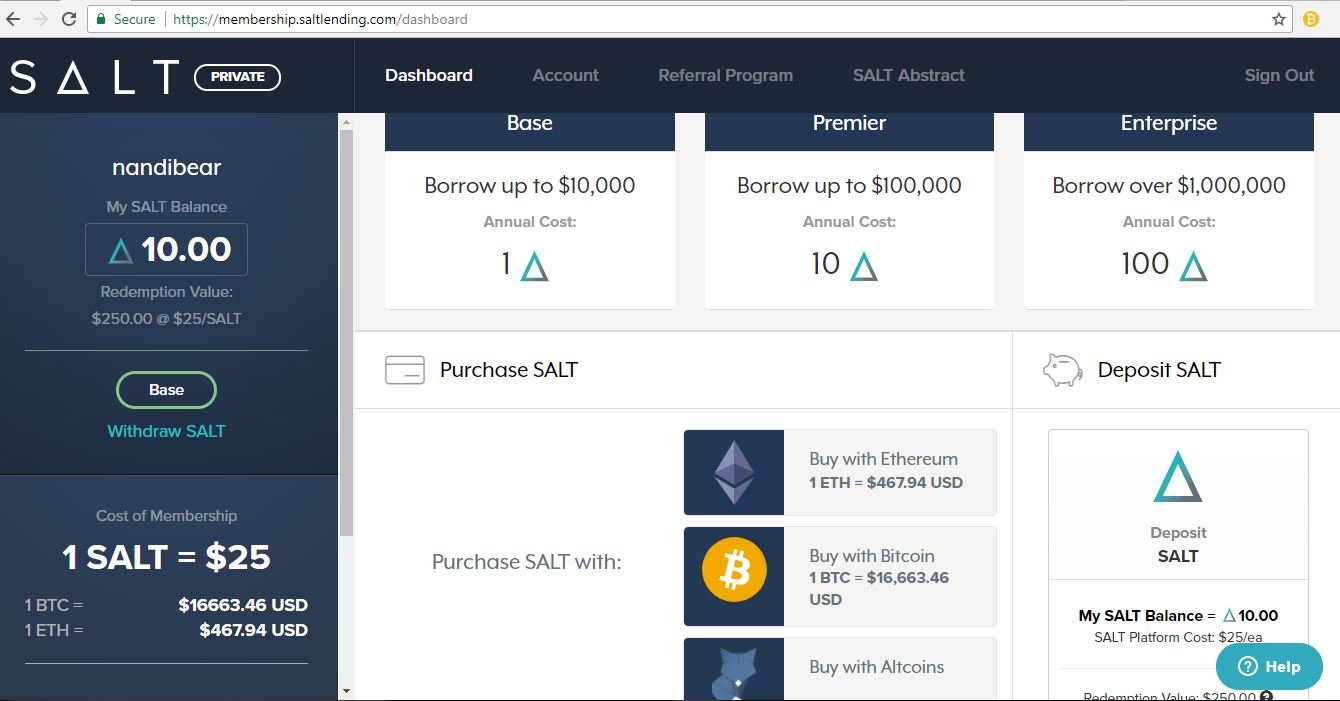

5. SALT Lending

SALT Lending is a blockchain-based website that enables you to get money sent straightforwardly into your bank account. The loan starts from $5,000 and fees from 5.95%, with terms covering from 3 to 12 months, allowing for a flexible loan.

Unfortunately, SALT is restricted to a low number of coins that can be utilized as collateral. Moreover, the loan-to-value ratio proportion is generally low (up to 60%).

6. Unchained Capital

Unchained Capital is a website that offers dedicated collateral addresses on blockchain for simple monitoring. The site offers 10.91-14.22% APR over a length of 3-36 months. There are no hard credit checks. Interest percent will change by state.

There’s one serious drawback: the site offers BTC credits only. Additionally, the loan to value ratio is truly low – 35-half.

7. Aave

Aave is a successor to the ETHLend platform, and also allows crypto-backed loans, using the same LEND token to be utilized as the mechanism of trade where expenses can be decreased to 0.

The digital assets that are utilized as loan guarantee are put away in an open Ethereum blockchain to reach high system security with the utilization of a non-custodian depositary smart contract. Since the transaction is broadcasted on an open Ethereum blockchain record, the exchanges are straightforward and auditable by the public.

Please, note that Aave doesn’t have any collaterals.

8. YouHodler

Relatively young but promising, YouHodler provides crypto-backed credits and works with financial accounts in Switzerland. Users are allowed to take a loan of up to $30,000 USD, EUR, USDT and BTC, and pay for up to 120 days. Customizable loan terms with larger amounts and more days are also available upon request.

The website allows you to loan crypto as collateral with a high loan-to-value proportion of up to 90%, for up to $30,000 in fiat/crypto (greater sums are offered to chosen borrowers). Saving accounts allow for earning interest of up to 12%.

YouHodler has its own fund and acknowledges all significant digital currencies as collateral (BTC, ETH, LTC, BCH, XRP, and so forth.). Furthermore, the stage acknowledges all major bank cards (Visa, MasterCard, Maestro, American Express, and so on.) and every popular kind of web payment (Qiwi, PayPal, Apple Pay, Skrill, and so on.).

Not at all like most of the other crypto-supported stages, YouHodler offers straightforwardness and positively no concealed expenses. No credit checks are required. YouHodler’s interface is straightforward and user-friendly. On the drawback, YouHodler doesn’t serve U.S. natives, just as residents of China and Korea.

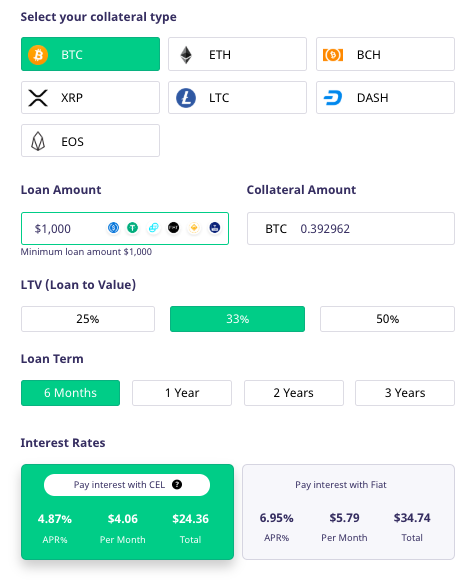

9. Celsius Network

Another organization that loans you dollars for your digital forms of money is Celsius Network. Celsius isn’t just a P2P lending organization: it plans to bring the next $100 million individuals who aren’t connected with banking yet.

This way, the investors who have extra crypto and need to earn on those without losing the benefit of holding them can again use the Celsius system to earn interest back in real money or coins. At Celsius, you can expect yearly rates from 3.47% to 12% contingent on your collateral and can get loans up to residency of 3 years at LTV of up to 50%.

10. BlockFi

BlockFi is one of the pioneer organizations to raise institutional subsidizing for their crypto-supported loan start-up. At BlockFi you can acquire from $4000 to $100 million at an LTV up to half. The yearly rate of interest varies for how a lot of term one is getting, however, their lowest starting rate is 4.5 % APR.

To have the option to utilize BlockFi you should have at least $4000 or more in crypto, and as of now, BlockFi is accessible only in the US.

P2P Bitcoin loan platforms

P2P is a type of platform that allows you to take Bitcoin from other people or organizations. Such websites appeared almost as soon as other forms of lending. You can list some of the most popular ones:

- BTCpop.co is positioned as a full-fledged crypto bank, providing not only borrowed funds but also investment opportunities by deposit type and account opening

- IoanBase.io – here loans are provided mainly for business purposes. A business plan is often requested. Popular among those who want to open exchange or run their own application. Due to the low non-refundable percentage, interest rates are very low here

- StemFund.com – here, the loans can also be obtained by ordinary citizens, without any business projects. In addition to loans, an investment package is also available. That is, you transfer the coins, and they will bring profit at the expense of interest from the occupants

Pros and cons of Bitcoin lending platforms

Are Bitcoin and crypto loans worth it? It’s up to you to decide.

| Pros | Cons |

| Pretty urgent issuing. On some websites, there’s a possibility of getting individual loan conditions. | You need to provide strong evidence of your ability to repay the debt. User reputation matters a lot. |

| The interest rate on English services is pretty low (less than 10%). | Most of the largest sites are in English, and other languages are hardly supported. Therefore, without communicating on English, it is almost impossible to get a loan. |

| The investor gets excellent earning opportunities if he selects reliable clients. | High volatility can put you in a tricky position. Say, you borrowed 1 Bitcoin for 8,000 dollars, and sometime later you will have to return 1 BTC that costs $10.000. Yet, during the bear falling market, you can return even less than borrowed (though the interest will be quite high). The time span of loans is not usually long enough to earn on it. |

| The resulting capital easily turns around. You can immediately transfer funds to an exchange account. And if you have a positive experience in trading, you can withdraw the credit quickly, and then work on your profits. | |

| Higher amounts are transferred faster than through traditional means. And the fees for such transactions are much lower. |

And should you want to buy some crypto instead of taking a loan, you can do it on Changelly.

Bottom Line

What is the best platform for Bitcoin loans without collateral? Where to get crypto with minimal credit fees? There is no universal solution – each platform has its pros and cons. Read the fine text before signing an agreement and always read customer reviews. This way, you eliminate the risk of losing more than you can get.

You actually explained it really well. [url=https://acyclovir-buy.com/]acyclovir 800 mg[/url]

Cheers, I value this. [url=https://acyclovir-buy.com/]acyclovir[/url]