These days, the term “cryptocurrency” is well known to everyone. Cryptocurrencies are of interest due to their security and reliability and, more importantly, the privacy and anonymity they can provide to users making transactions. With the growing popularity of crypto coins and tokens, the demand for exchanges where they can be traded has also gone up. Today, crypto exchanges play a crucial role in the development of the blockchain industry.

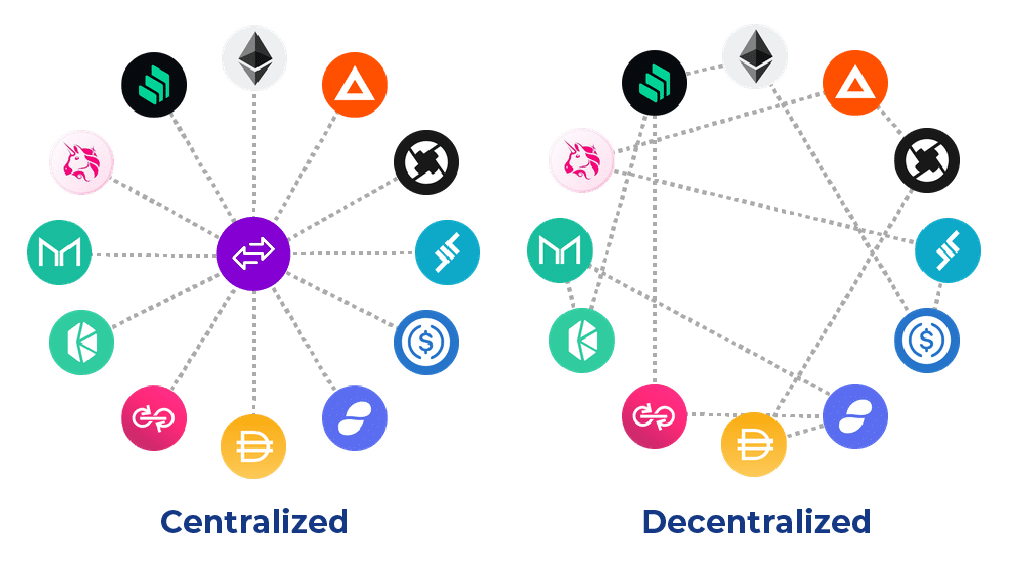

Typically, cryptocurrency exchanges support trading in more than 100 different currencies. Accordingly, people get the opportunity to use their cryptocurrency assets as profitably as possible and exchange them for one another. Nowadays, we have both centralized and decentralized cryptocurrency exchanges. What is the difference? Are decentralized exchanges more popular? Let’s find out!

Table of Contents

- What Is a Centralized Exchange (CEX)?

- Centralized Exchanges: Pros & Cons

- What Is a Decentralized Exchange (DEX)?

- How Do Decentralized Exchanges Work?

- Decentralized Exchanges: Pros & Cons

- What’s the Difference? CEX vs. DEX

- Security

- Trading Pairs

- Liquidity

- Fees

- How to Choose a Cryptocurrency Exchange

- Reputation

- Security Measures

- Fees

- Other Factors

- Bottom Line

- FAQ

- What exchanges are more popular, decentralized or centralized ones?

- Should I use a centralized or a decentralized crypto exchange?

What Is a Centralized Exchange (CEX)?

Centralized exchanges are the most commonly seen crypto exchange type. Despite operating in many ways as any other centralized platform does — being operated by a singular central authority, having a centralized order book, and so on — they still cannot be equated to traditional financial institutions. After all, those platforms are still crypto exchanges at the end of the day.

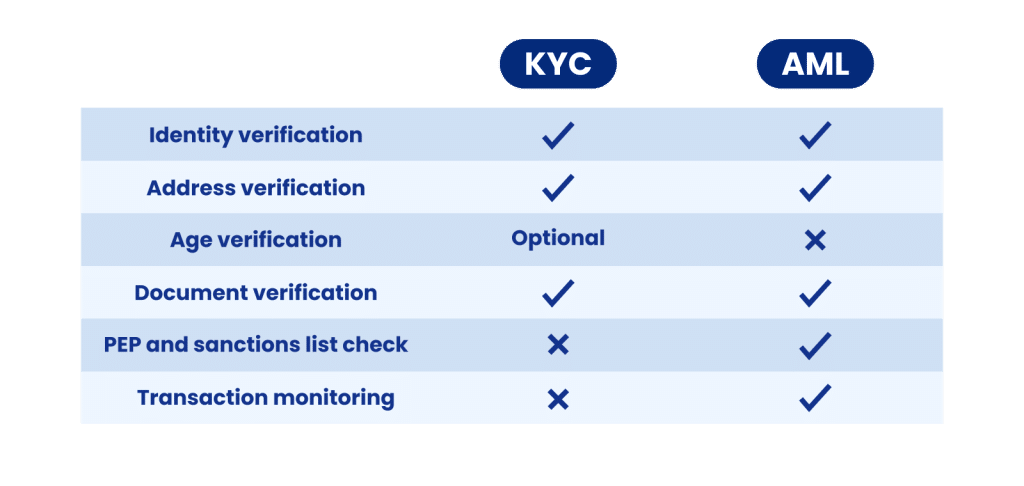

CEXs offer their users a wide range of services, including but not limited to crypto trading, withdrawals, and deposits of crypto assets, and can even act as crypto wallets. However, they are typically regulated and often have the KYC/AML procedure.

Centralized Exchanges: Pros & Cons

CEXs are incredibly popular among crypto investors, even though they offer less privacy and anonymity than their decentralized counterparts. But why do crypto traders like centralized exchanges? What are their benefits? Here are some of them.

- User- and beginner-friendly

Centralized exchanges are especially popular with newer crypto users. They are similar to centralized payment platforms and often have straightforward user-friendly interfaces.

- Advanced trading tools

Many centralized trading platforms give users access to various tools like futures or margin trading that are less likely to be available on DEXs.

These two advantages make centralized exchanges great for both newbies and experienced crypto traders. However, CEXs have some downsides, too. Here’s the biggest one.

- Centralized control

This is one of the things that drives many traders away from CEXs. Having a central entity in control makes CEXs vulnerable to attacks as well as regulatory pressure.

What Is a Decentralized Exchange (DEX)?

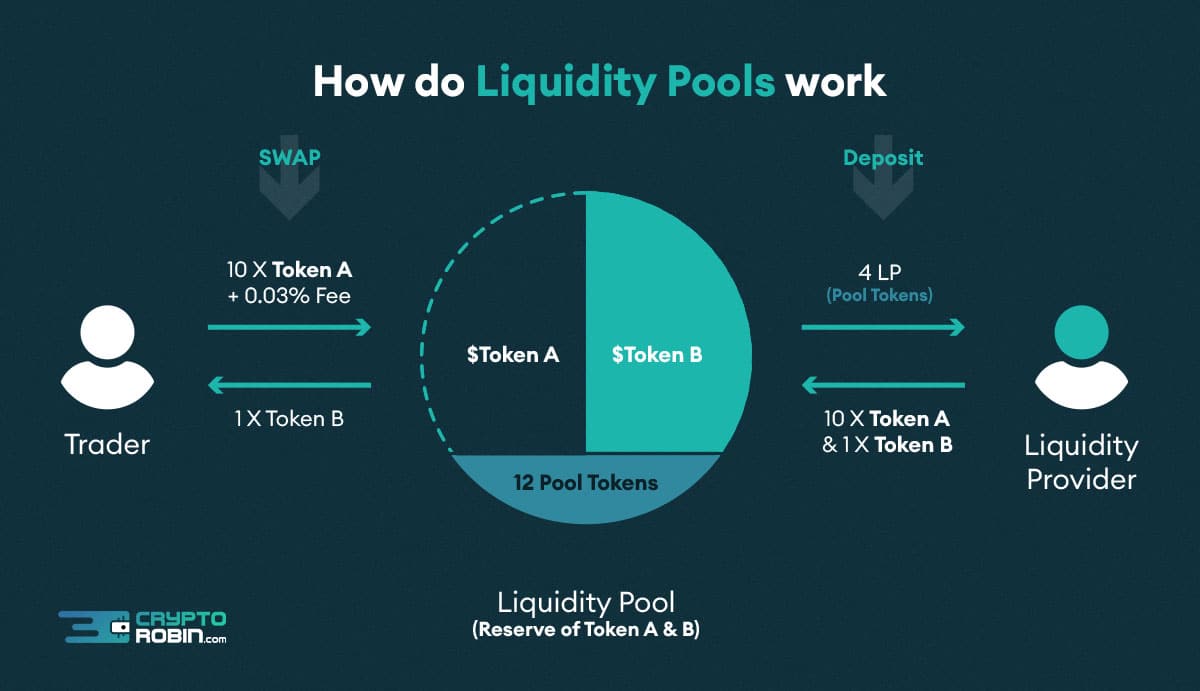

Decentralized exchanges don’t have a centralized authority controlling them or their operations. Instead, they rely on their users and liquidity providers and organize trades using AMMs — automated market makers. They are a type of algorithm that determines the price of assets via mathematical formulas and supply and demand. It operates with the help of smart contracts technology and liquidity pools.

Decentralized exchanges are trading platforms without any intermediaries, allowing users to exchange digital assets in a trustless way. They also don’t hold user funds or private keys during exchanges.

How Do Decentralized Exchanges Work?

A decentralized exchange works as follows:

- A liquidity provider deposits their funds in a liquidity pool to earn interest.

- When users exchange tokens, the rate is calculated using smart contract technology and an AMM.

The cost of any exchange on decentralized platforms is made up of two parts: network fees and the DEX fee. The latter is typically lower than that of centralized exchanges since decentralized services don’t have to pay the costs of maintaining centralized infrastructure. However, in some cases, it can be higher.

Decentralized Exchanges: Pros & Cons

Just like their centralized counterparts, decentralized platforms have their intrinsic advantages and disadvantages. Here are some of the benefits users can get access to when using DEXs:

- No central authority

Just like the name suggests, DEXs are decentralized, meaning that they are not governed by a single centralized authority. They don’t hold your private keys or funds during the exchange. As a result, they are less vulnerable to hacking attacks as well as pressure from regulators.

- No KYC/AML* requirements

Decentralized exchanges pretty much guarantee full user anonymity as they don’t require clients to go through the verification process.

And here are some of the cons of decentralized exchanges.

- Limited trading tools

DEXs often offer fewer trading tools to their clients than an average centralized exchange.

- Non-beginner-friendly

Decentralized platforms have user-friendly features and interfaces these days, but they are still more complicated than almost any centralized exchange.

What’s the Difference? CEX vs. DEX

A decentralized exchange is a platform that allows users to fully control their funds and private keys. In addition, there are no intermediaries. Decentralized exchanges have emerged to solve the problems associated with centralized platforms. Many crypto users are incredibly passionate about anonymity and privacy, so it is only natural that services that can fully adhere to these principles have appeared in the industry.

Security

Many centralized exchanges hold user funds on their platforms. You may have heard about the concept of Proof of Key that was proposed by the famous crypto enthusiast Trace Mayer. He believes that everyone who holds bitcoins on centralized exchanges should transfer them to their own wallet — “not your keys, not your coins.”

As you all know, coins stored in a third-party service do not actually belong to you. For example, by storing your bitcoins on the exchange without having a private key to access or recover them in the event of theft, you expose yourself to a huge risk of being left with nothing.

You need to be prepared for the risks associated with centralized exchanges:

- They can be easily hacked, and as a result, the funds will be lost.

- Exchange owners may suddenly disappear with clients’ money.

Decentralized crypto exchange platforms are considered by some traders the real solution to these risks and issues. Here are some of the reasons why their decentralized nature makes them more secure.

- Improved confidentiality due to lack of registration or personal identification requirements.

- No need to deposit and withdraw funds to a third-party service. All transactions are conducted directly and processed through secure smart contracts.

- Lack of a single point of failure (vulnerability), control, or regulation.

In the past, decentralized cryptocurrency exchanges were very new, and users often faced various problems, with people losing money due to minor errors. Now, these problems are gone, and most established decentralized exchange platforms can be trusted. Just don’t forget to do your own research and look up reviews for any particular platform you are interested in.

Trading Pairs

One of the major concerns about decentralized platforms is the availability of rare trading pairs. However, it is hard to compare CEX vs DEX on this issue: while a centralized platform will typically have more rare coins, a decentralized one would be able to offer its users a wider variety of tokens. These days, DEXs can offer users a much bigger number of various digital assets to trade.

There’s a caveat to this, however: the two assets you exchange on a decentralized exchange must belong to the same network, like Ethereum or the Binance Smart Chain.

Liquidity

In the past, low liquidity has always been mentioned as one of the biggest downsides of decentralized services. Nowadays, however, that is not the case — most DEXs provide liquidity to their users without any constraints.

There are also DEX aggregators (like our very own DeFi Swap) that make liquidy an even smaller issue.

Fees

Although decentralized platforms are typically considered to have low transaction fees, the transaction cost of exchange on DEXs can sometimes be high as it depends on gas fees that are unique for every network. However, DEX fees are still usually lower than those of a centralized organization.

How to Choose a Cryptocurrency Exchange

No matter if you’re looking for a centralized exchange or a decentralized one, here are some of the things you should consider when choosing where to get your preferred digital asset.

Reputation

As we have already mentioned, it’s always a good idea to read some reviews online. Look for forums and trader-specific platforms — or, better yet, find some friends or simply traders you trust and ask them about their user experience on a particular platform.

Security Measures

Read up on how a particular platform manages user funds and transactions. This is especially important for centralized exchanges.

Fees

Trading fees are what most crypto traders would pay attention to. Traditional investors who are familiar with stock exchanges would be more familiar with more or less fixed fees. On crypto exchanges, however, fees often depend on things like network congestion, which can change minute by minute.

However, almost all exchanges in the crypto space still charge a flat fee for their services — you can normally see it right in the platform’s exchange widget.

Other Factors

Many other factors can influence how good an exchange is: its trading volume, liquidity, and so on. However, if you’re a beginner, don’t try to find the “perfect” exchange — just go with the one that is secure and has nice features and a user interface. As you gain experience, you will learn more about various exchanges and will be able to find the one you prefer to use.

Bottom Line

As the crypto world improves and turns into a fully functional ecosystem, crypto exchanges will continue to play a major role. Currently, coins and tokens are mainly used in investment speculation, which means that the platforms where they can be traded determine the development of the industry. Many start-ups are now developing their own options for exchanges.

The choice between centralized and decentralized exchanges is entirely up to you and your goals. If you pick a decentralized exchange, you always need a higher level of responsibility to protect your assets. In the case of centralized service, you should be prepared for hacking and loss of funds, although large sites would obviously compensate for possible damage.

Decentralization and DeFi (decentralized finance) give us a new world where there is no need to trust intermediaries, but you still need to trust yourself and take responsibility.

FAQ

What exchanges are more popular, decentralized or centralized ones?

Centralized platforms are still generally more popular than decentralized ones. They’re easier to use and thus appeal to a wider audience. Additionally, they often allow users to buy crypto with fiat.

Should I use a centralized or a decentralized crypto exchange?

This is up to you — it all depends on your individual preferences. One is not better than the other.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.