Tether is a so-called stablecoin, meaning that its price is artificially maintained on the level of value of some other real-life asset. In our case, USDT coin price is pegged to the current price of USD, hence the name. However, it not as simple as we would like it to be when talking about the price of USDT.

Does this coin need a price forecast? Let’s find out together with Changelly!

Table of Contents

- Tether Fundamental Value

- USDT Price History Analysis

- Tether Technical Analysis

- Tether (USDT) Price Prediction for 2020 & 2025

- #1. WalletInvestor USDT Price Prediction for 2020 and 2025

- #2. DigitalCoinPrice Tether Price Forecast for 2020-2026

- #3. TradingBeasts Price Prediction for USDT

- #4. CryptoRating USDT Coin Price Forecast

- Tether Price Prediction – It should be 1:1 to USD

Tether Fundamental Value

The Tether project was created to use traditional currency in the form of tokens. The developers created an altcoin based on the Bitcoin blockchain, which allowed combining the advantages of cryptocurrency and fiat money.

USDT cryptocurrency was created for the interaction of national currencies with cryptocurrencies. The platform was created on the basis of the Bitcoin blockchain with the implemented PoR (Proof of Reserves) inventory process.

Using this altcoin provides many benefits. The main ones are the speed of transfer of American currency through the Internet.

The digital dollar (USDT) differs from other cryptocurrencies in terms of physical money. But Tether created not only the ability to transform the dollar into tokens.

This is a powerful platform for working with any currency, as well as various services.

Traders do not need to recalculate their value relative to traditional money. The price of USDT is immediately understandable. It is constantly equal to the price of the American dollar. Also, considering the specified cryptocurrency, the following advantages can be distinguished:

- High conversion rate

- Full USDT Real Money

- System transparency

- The decentralization inherent in the blockchain system

- No commissions when transferring USDT between different wallets (from the exchange to the wallet and back)

- The minimum commission when converting USDT to traditional money

- USDT transfer and storage security is ensured by cryptographic encryption methods

- The user has access to his money (which he stores in USDT) around the clock 24/7

| Project name | Tether |

| Ticker | USDT |

| Asset Type | Coin |

| Network type | Blockchain |

| Curr. Price | $1.00 |

| Curr. Supply / Total Supply | 4,108,044,456 USDT / 4,207,771,504 USDT |

| ROI since launch | 0.41% |

| All-Time High / All-Time Low | $5.69 / $0.91 |

| Official Website | https://tether.to/ |

USDT Price History Analysis

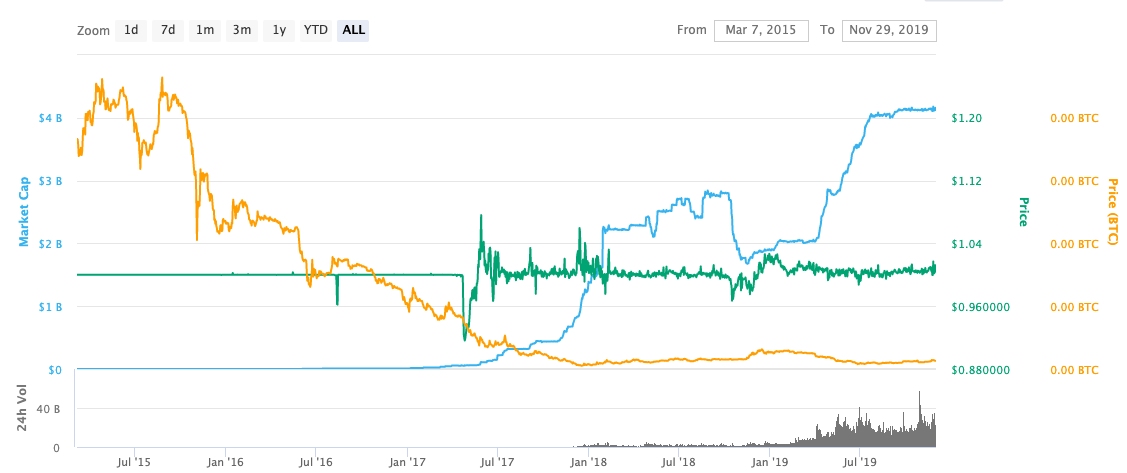

The specific look of the Tether price graph can be somewhat confusing. How can there be fluctuations in the Tether to USD ratio if USDT price is pegged to the

The most notable USDT price drop happened on April 25, 2017, when the price got to the mark of 0.91 USD. The drop was caused by the news of the international wires in Tether being rejected by the Taiwanese banks. The following market panic forced traders to sell their USDT coins and making the price of USDT much lower. At the same time, the cryptocurrency exchanges that used Tether as an alternative to USD experienced a significant increase in the price of Bitcoin and other cryptos that were traded in pairs with USDT. The Tether price connection technology doesn’t provide an algorithm that can be stable enough to fix the price of USDT in such a short term.

Tether Technical Analysis

Well, there is not actually any technical analysis expertise of USDT cryptocurrency. However, here is the aggregate rating for USDT from several traders & analysts on TradingView.

Tether (USDT) Price Prediction for 2020 & 2025

#1. WalletInvestor USDT Price Prediction for 2020 and 2025

USDT is a not so good long-term (1-year) investment. The Tether price can go up from 0.999 USD to 1.020 USD in one year. The long-term earning potential is +2.14% in one year. The Tether (USDT ) future price will be 1.039 USD. According to present data Tether (USDT) and potentially its market environment has been in a bullish cycle in the last 12 months.

#2. DigitalCoinPrice Tether Price Forecast for 2020-2026

By the end of the year, Tether coin price can go up to $1.78 USD. Tether (USDT) is profitable investment based on DCP forecasting. The price of 1 Tether (USDT) can roughly be up to $1.86 USD in 1 year time.

#3. TradingBeasts Price Prediction for USDT

The expected maximum price is $1.60654, minimum price $1.09245. The Tether price prediction for the end of the month is $1.28523.

In the next years, the price won’t change (obviously) and it will be around $1.07181.

#4. CryptoRating USDT Coin Price Forecast

If you look for a good return in 3 to 5 years, USDT might be the coin to watch closely now. Analysis of the cryptocurrency market shows that Tether price may reach $1.94 by 1st of January 2021 driven by the potential interest from large institutional investors.

Tether Price Prediction – It should be 1:1 to USD

USDT coin price will remain within the close to 1 to 1 ratio with the United States dollar for the following year. However, the coin cannot be 100% trusted even with the specific case that is was developed for. It is possible that the coin will fall a couple of times in the future hitting a mark of no less than 90 cents per coin. Various attacks or market falls can move the USDT coin price. However, the coin has shown fast recovery speed after its previous downfalls and these price shifts can only damage traders in a particular way of interrupting their current trading strategies.

Despite multiple predictions of the future fall of the dollar, Tether will still be a stable asset to store value in. The USD price volatility is not often seen as an important factor that should be accounted for in cryptocurrency trading and not without reason. The huge market volatility of the cryptocurrency industry makes it look like tiny price fluctuations.

However, the most likely driving factor of the possible rise of the cryptocurrency market is a downtrend of the traditional financial markets. If you are one of the enthusiasts that invest in crypto for a long-term gain, you should be careful with the USDT cryptocurrency. Not only is it not really a representer of your ability to immediately exchange the cryptocurrency to fiat but also the fiat it is theoretically representing is flawed in its financial positions.

Disclaimer: This article should not be considered as offering trading recommendations. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor should research multiple viewpoints and be familiar with all local regulations before committing to an investment.